The global Phosphorus Fertilizers Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), Others), By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others).

The phosphorus fertilizers market is witnessing growth driven by the increasing demand for agricultural nutrients to enhance crop yields and food production. Key trends shaping the future of this industry include the development of innovative phosphorus fertilizer formulations and application technologies to improve nutrient efficiency, soil health, and environmental sustainability. Manufacturers are investing in research and innovation to create slow-release and controlled-release phosphorus fertilizers that minimize nutrient losses through leaching and runoff, reducing environmental impact and enhancing fertilizer utilization by crops. Moreover, advancements in fertilizer blending, granulation, and coating techniques are enabling the production of customized phosphorus fertilizer blends tailored to specific soil conditions, crop requirements, and agronomic practices. Additionally, digital agriculture technologies such as precision farming, soil mapping, and nutrient management software are driving the adoption of site-specific fertilizer applications and variable rate technologies, optimizing phosphorus fertilizer use efficiency and minimizing environmental footprint in agriculture. Furthermore, collaborations between fertilizer producers, agronomic researchers, and agricultural extension services are driving knowledge sharing and technology transfer to promote sustainable phosphorus management practices, address nutrient imbalances, and improve agricultural productivity and profitability for farmers worldwide.

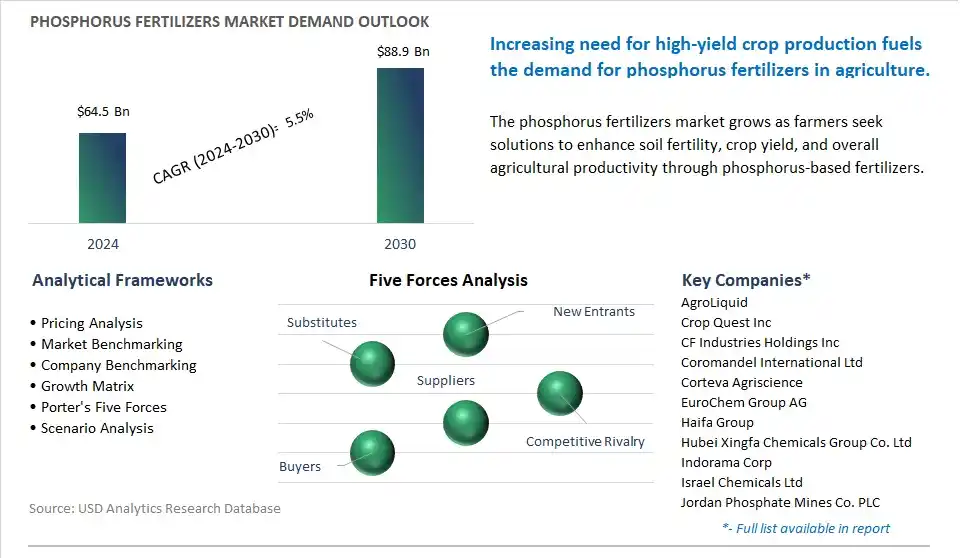

The market report analyses the leading companies in the industry including AgroLiquid, Crop Quest Inc, CF Industries Holdings Inc, Coromandel International Ltd, Corteva Agriscience, EuroChem Group AG, Haifa Group, Hubei Xingfa Chemicals Group Co. Ltd, Indorama Corp, Israel Chemicals Ltd, Jordan Phosphate Mines Co. PLC, Nutrien Ltd, OCP SA, Peptech Biosciences Ltd, PhosAgro AG, Saskatchewan, Saudi Arabian Mining Co., The Mosaic Co., Yara International ASA.

A significant trend in the phosphorus fertilizers market is the shift towards sustainable agriculture practices. With increasing awareness of environmental concerns and the need for more efficient use of resources, there's a growing preference for phosphorus fertilizers that promote sustainable soil health and minimize environmental impact. This trend is driven by the adoption of practices such as precision agriculture, soil conservation, and organic farming, which emphasize the importance of balanced nutrient management and reduced chemical inputs. As farmers seek to improve crop yields while minimizing adverse effects on soil fertility, water quality, and biodiversity, there's a rising demand for phosphorus fertilizers that offer slow-release formulations, enhanced nutrient uptake efficiency, and reduced nutrient leaching to support sustainable agricultural production systems.

A key driver behind the growth of the phosphorus fertilizers market is the rising global population and increasing demand for food and agricultural products. With population growth, urbanization, and changing dietary patterns driving demand for food, feed, and biofuel crops, there's a corresponding need to increase agricultural productivity and yield to meet growing food demand. Phosphorus fertilizers play a crucial role in supporting plant growth, root development, and reproductive processes, making them essential inputs for crop production in agriculture. As farmers strive to optimize nutrient management practices and maximize crop yields to feed a growing population, there's a continuous demand for phosphorus fertilizers to enhance soil fertility, improve crop quality, and increase agricultural productivity on a global scale.

One potential opportunity in the phosphorus fertilizers market lies in the development of enhanced efficiency fertilizers (EEFs) that improve phosphorus uptake and utilization by plants while reducing nutrient losses and environmental impact. EEFs encompass a range of fertilizer formulations and technologies designed to enhance nutrient efficiency, including controlled-release fertilizers, polymer-coated fertilizers, and nutrient stabilizers. Manufacturers can capitalize on this opportunity by investing in research and development to create innovative phosphorus fertilizer products that incorporate EEF technologies to improve nutrient availability, minimize nutrient runoff, and enhance crop nutrient use efficiency. By offering EEFs that deliver superior agronomic performance and environmental benefits, manufacturers can meet the evolving needs of farmers for sustainable phosphorus fertilizers, differentiate their products in the market, and contribute to the sustainability of global agriculture.

Diammonium phosphate (DAP) is the largest segment in the Phosphorus Fertilizers Market due to its widespread use and Diverse key advantages. DAP is a highly water-soluble fertilizer containing nitrogen and phosphorus in a highly concentrated form, making it an efficient source of nutrients for crops. Its popularity stems from its versatility, as it can be used on a wide range of crops and in various soil types and climates. Additionally, DAP's balanced nutrient composition, with nitrogen and phosphorus in a 1:1 ratio, makes it suitable for both starter and top-dressing applications, promoting healthy plant growth and maximizing yields. Further, DAP's relatively low cost compared to other phosphorus fertilizers makes it accessible to a broad range of farmers, contributing to its widespread adoption globally. With the increasing demand for high-yield crop production to feed a growing population, DAP remains the preferred choice for many farmers and agricultural industries, consolidating its position as the largest segment in the Phosphorus Fertilizers Market.

The fruits & vegetables segment is the fastest-growing segment in the Phosphorus Fertilizers Market due to its demand. There is a rising global demand for fruits and vegetables driven by increasing consumer awareness of the health benefits associated with a balanced diet rich in fresh produce. This trend is further accelerated by changing dietary preferences, urbanization, and growing disposable incomes, particularly in emerging economies. Further, fruits and vegetables have specific nutrient requirements, including phosphorus, to support their growth, flowering, and fruiting stages effectively. Phosphorus fertilizers play a crucial role in meeting these nutrient needs, promoting root development, flowering, and fruit set, thereby improving yield quantity and quality. Additionally, fruits and vegetables are often grown in intensive cultivation systems where soil fertility management is essential to sustain high yields and prevent nutrient depletion. Accordingly, there is a growing demand for phosphorus fertilizers tailored to the specific requirements of fruits and vegetables, driving the segment's rapid growth in the Phosphorus Fertilizers Market. With increasing investments in horticulture, greenhouse farming, and precision agriculture techniques aimed at enhancing fruit and vegetable production, the demand for phosphorus fertilizers in this segment is expected to continue its robust growth trajectory in the foreseeable future.

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AgroLiquid

Crop Quest Inc

CF Industries Holdings Inc

Coromandel International Ltd

Corteva Agriscience

EuroChem Group AG

Haifa Group

Hubei Xingfa Chemicals Group Co. Ltd

Indorama Corp

Israel Chemicals Ltd

Jordan Phosphate Mines Co. PLC

Nutrien Ltd

OCP SA

Peptech Biosciences Ltd

PhosAgro AG

Saskatchewan

Saudi Arabian Mining Co.

The Mosaic Co.

Yara International ASA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Phosphorus Fertilizers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Phosphorus Fertilizers Market Size Outlook, $ Million, 2021 to 2030

3.2 Phosphorus Fertilizers Market Outlook by Type, $ Million, 2021 to 2030

3.3 Phosphorus Fertilizers Market Outlook by Product, $ Million, 2021 to 2030

3.4 Phosphorus Fertilizers Market Outlook by Application, $ Million, 2021 to 2030

3.5 Phosphorus Fertilizers Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Phosphorus Fertilizers Industry

4.2 Key Market Trends in Phosphorus Fertilizers Industry

4.3 Potential Opportunities in Phosphorus Fertilizers Industry

4.4 Key Challenges in Phosphorus Fertilizers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Phosphorus Fertilizers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Phosphorus Fertilizers Market Outlook by Segments

7.1 Phosphorus Fertilizers Market Outlook by Segments, $ Million, 2021- 2030

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

8 North America Phosphorus Fertilizers Market Analysis and Outlook To 2030

8.1 Introduction to North America Phosphorus Fertilizers Markets in 2024

8.2 North America Phosphorus Fertilizers Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Phosphorus Fertilizers Market size Outlook by Segments, 2021-2030

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

9 Europe Phosphorus Fertilizers Market Analysis and Outlook To 2030

9.1 Introduction to Europe Phosphorus Fertilizers Markets in 2024

9.2 Europe Phosphorus Fertilizers Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Phosphorus Fertilizers Market Size Outlook by Segments, 2021-2030

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

10 Asia Pacific Phosphorus Fertilizers Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Phosphorus Fertilizers Markets in 2024

10.2 Asia Pacific Phosphorus Fertilizers Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Phosphorus Fertilizers Market size Outlook by Segments, 2021-2030

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

11 South America Phosphorus Fertilizers Market Analysis and Outlook To 2030

11.1 Introduction to South America Phosphorus Fertilizers Markets in 2024

11.2 South America Phosphorus Fertilizers Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Phosphorus Fertilizers Market size Outlook by Segments, 2021-2030

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

12 Middle East and Africa Phosphorus Fertilizers Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Phosphorus Fertilizers Markets in 2024

12.2 Middle East and Africa Phosphorus Fertilizers Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Phosphorus Fertilizers Market size Outlook by Segments, 2021-2030

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AgroLiquid

Crop Quest Inc

CF Industries Holdings Inc

Coromandel International Ltd

Corteva Agriscience

EuroChem Group AG

Haifa Group

Hubei Xingfa Chemicals Group Co. Ltd

Indorama Corp

Israel Chemicals Ltd

Jordan Phosphate Mines Co. PLC

Nutrien Ltd

OCP SA

Peptech Biosciences Ltd

PhosAgro AG

Saskatchewan

Saudi Arabian Mining Co.

The Mosaic Co.

Yara International ASA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Monoammonium Phosphate (MAP)

Diammonium Phosphate (DAP)

Single Superphosphate (SSP)

Triple Superphosphate (TSP)

Others

By Application

Cereals & Grains

Oilseeds & Pulses

Fruits & Vegetables

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Phosphorus Fertilizers is forecast to reach $88.9 Billion in 2030 from $64.5 Billion in 2024, registering a CAGR of 5.5%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AgroLiquid, Crop Quest Inc, CF Industries Holdings Inc, Coromandel International Ltd, Corteva Agriscience, EuroChem Group AG, Haifa Group, Hubei Xingfa Chemicals Group Co. Ltd, Indorama Corp, Israel Chemicals Ltd, Jordan Phosphate Mines Co. PLC, Nutrien Ltd, OCP SA, Peptech Biosciences Ltd, PhosAgro AG, Saskatchewan, Saudi Arabian Mining Co., The Mosaic Co., Yara International ASA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume