The global Phase Change Thermal Interface Materials Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Conductive Type (Electrically Conductive, Non-electrically Conductive), By Binder (Paraffin, Non-paraffin (organic), Eutectic salts, Salt hydrates), By Filler (Aluminum Oxide, Boron Nitride, Aluminum Nitride, Zinc Oxide, Others), By End-User (Computers, Electrical and Electronics, Telecommunication, Automotive, Others).

The phase change thermal interface materials (PCTIMs) market experiences rapid growth in 2024, fueled by the rising demand for efficient heat dissipation solutions in electronics, automotive, and aerospace applications. PCTIMs facilitate the transfer of heat between heat-generating components and heat sinks by undergoing a phase change, ensuring optimal thermal management and preventing overheating. As electronic devices become more compact and powerful, the need for effective thermal management solutions becomes paramount to maintain performance and reliability. PCTIMs offer a promising solution by providing superior thermal conductivity and conformability, enabling efficient heat dissipation in confined spaces. Further, the increasing adoption of electric vehicles and advanced computing systems further drives the demand for PCTIMs to address the thermal challenges associated with higher power densities and operating temperatures.

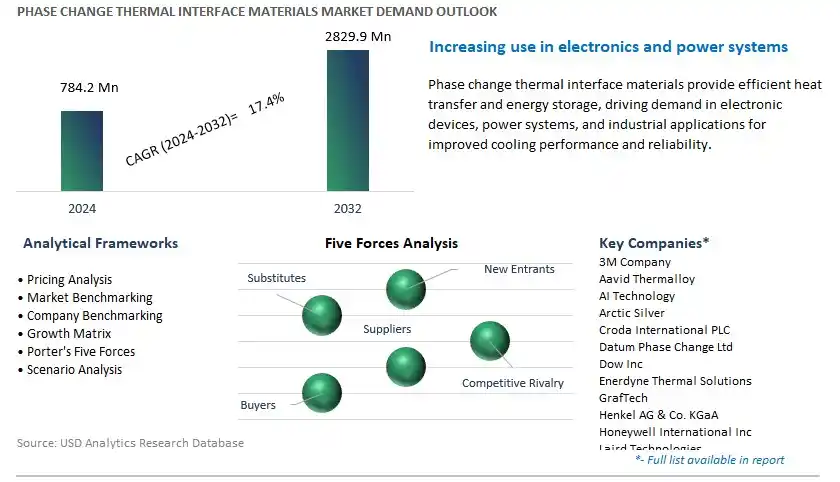

The market report analyses the leading companies in the industry including 3M Company, Aavid Thermalloy, AI Technology, Arctic Silver, Croda International PLC, Datum Phase Change Ltd, Dow Inc, Enerdyne Thermal Solutions, GrafTech, Henkel AG & Co. KGaA, Honeywell International Inc, Laird Technologies, Microtek Laboratories Inc, NuSil Technology, Parker Chomerics, Phase Change Energy Solutions Inc (PCES), Specialty Silicone Products (SSP), Stockwell Elastomerics, TCP Reliable Inc, Wakefield-Vette, and others.

One prominent market trend in the phase change thermal interface materials (PCTIMs) industry is the increasing demand for thermal management solutions in electronics, driven by the proliferation of electronic devices, the miniaturization of components, and the need for efficient heat dissipation. PCTIMs, known for their ability to efficiently transfer heat between heat-generating components and heat sinks, are gaining prominence in applications such as computer processors, LED lighting, automotive electronics, and telecommunications equipment. This trend is fueled by the rising complexity and power density of electronic devices, which require effective thermal management solutions to prevent overheating, optimize performance, and prolong component lifespan.

A key market driver for phase change thermal interface materials is advancements in electronic device performance and packaging technologies, which drive the need for efficient heat dissipation and thermal interface materials. As electronic devices become more powerful, compact, and densely packed with components, managing heat generated during operation becomes increasingly challenging. PCTIMs offer a viable solution for reducing thermal resistance and enhancing heat transfer efficiency between heat sources and heat sinks, enabling designers and manufacturers to address thermal management challenges and meet performance requirements for high-speed, high-power electronic systems.

An opportunity for market growth lies in the expansion of phase change thermal interface materials into emerging applications and industries that demand efficient thermal management solutions. Companies specializing in PCTIMs can capitalize on this opportunity by targeting sectors such as electric vehicles, renewable energy systems, 5G telecommunications infrastructure, and wearable electronics, where thermal management plays a critical role in system reliability, performance, and safety. Furthermore, developing specialized PCTIM formulations tailored to specific application requirements, such as temperature range, thermal conductivity, and mechanical properties, presents opportunities to address the diverse needs of emerging markets and establish a competitive edge in the thermal interface materials industry. By offering innovative and tailored PCTIM solutions, manufacturers can position themselves as key enablers of thermal management advancements in the rapidly evolving electronics market.

The Non-Electrically Conductive Phase Change Thermal Interface Materials segment is the largest within the Phase Change Thermal Interface Materials Market due to its wide range of applications across various industries and superior thermal management properties. Non-electrically conductive phase change thermal interface materials offer efficient heat dissipation capabilities while providing electrical insulation, making them suitable for use in electronic devices, such as laptops, smartphones, and LED lighting systems, where thermal management is crucial to ensure optimal performance and reliability. These materials form a thermally conductive interface between heat-generating components and heat sinks, facilitating the efficient transfer of heat away from sensitive electronic components. Moreover, the increasing adoption of advanced electronics with higher power densities and compact form factors drives the demand for non-electrically conductive phase change thermal interface materials, as they offer superior thermal performance and reliability compared to traditional thermal interface materials. As a result, the Non-Electrically Conductive Phase Change Thermal Interface Materials segment commands the largest share of the Phase Change Thermal Interface Materials Market, driven by its critical role in enhancing thermal management and reliability in electronic devices and systems.

The Salt Hydrates Binder segment is the fastest-growing within the Phase Change Thermal Interface Materials Market due to its unique combination of thermal properties and environmental advantages. Salt hydrates, such as sodium sulfate decahydrate and magnesium sulfate heptahydrate, offer high latent heat storage capacity and excellent thermal conductivity, making them ideal candidates for thermal management applications. Additionally, salt hydrates are non-toxic, non-corrosive, and readily available, enhancing their appeal as sustainable alternatives to traditional binders. The increasing demand for energy-efficient cooling solutions and the growing emphasis on environmental sustainability drive the adoption of salt hydrates in thermal interface materials. Moreover, advancements in material science and manufacturing technologies enable the development of salt hydrate-based thermal interface materials with improved performance and reliability, further accelerating their growth in the market. As a result, the Salt Hydrates Binder segment is poised for rapid expansion, fuelled by its superior thermal properties, environmental benefits, and growing applications in various industries requiring efficient thermal management solutions.

The Aluminum Oxide Filler segment is the largest within the Phase Change Thermal Interface Materials Market due to its widespread use in various industries and superior thermal conductivity properties. Aluminum oxide, also known as alumina, offers excellent thermal conductivity, mechanical strength, and electrical insulation properties, making it an ideal filler material for thermal interface materials. These materials are extensively used in electronic devices, such as CPUs, GPUs, and power electronics, where efficient heat dissipation is crucial to maintain optimal performance and reliability. The high thermal conductivity of aluminum oxide fillers facilitates the efficient transfer of heat between heat-generating components and heat sinks, thereby improving thermal management and preventing overheating. Moreover, the abundance and cost-effectiveness of aluminum oxide contribute to its popularity as a filler material in thermal interface materials. As a result, the Aluminum Oxide Filler segment commands the largest share of the Phase Change Thermal Interface Materials Market, driven by its exceptional thermal properties and widespread applications across various industries requiring efficient thermal management solutions.

The Automotive End-User segment is the fastest-growing within the Phase Change Thermal Interface Materials Market due to the increasing electrification and integration of advanced technologies in modern vehicles. With the rising adoption of electric vehicles (EVs), hybrid electric vehicles (HEVs), and autonomous driving systems, automotive manufacturers are facing greater challenges in thermal management. Phase change thermal interface materials play a critical role in automotive electronics, such as power electronics modules, battery packs, and LED lighting systems, by efficiently dissipating heat generated during operation. Additionally, the growing demand for enhanced safety, comfort, and performance features in vehicles drives the need for effective thermal management solutions to prevent overheating and ensure the reliability of electronic components. Moreover, stringent regulations regarding vehicle emissions and energy efficiency incentivize automotive manufacturers to invest in thermal management technologies, further fuelling the demand for phase change thermal interface materials in the automotive sector. As a result, the Automotive End-User segment is poised for rapid growth, driven by the increasing adoption of electric vehicles and the integration of advanced electronics in modern automotive systems.

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Aavid Thermalloy

AI Technology

Arctic Silver

Croda International PLC

Datum Phase Change Ltd

Dow Inc

Enerdyne Thermal Solutions

GrafTech

Henkel AG & Co. KGaA

Honeywell International Inc

Laird Technologies

Microtek Laboratories Inc

NuSil Technology

Parker Chomerics

Phase Change Energy Solutions Inc (PCES)

Specialty Silicone Products (SSP)

Stockwell Elastomerics

TCP Reliable Inc

Wakefield-Vette

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Phase Change Thermal Interface Materials Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Phase Change Thermal Interface Materials Market Size Outlook, $ Million, 2021 to 2032

3.2 Phase Change Thermal Interface Materials Market Outlook by Type, $ Million, 2021 to 2032

3.3 Phase Change Thermal Interface Materials Market Outlook by Product, $ Million, 2021 to 2032

3.4 Phase Change Thermal Interface Materials Market Outlook by Application, $ Million, 2021 to 2032

3.5 Phase Change Thermal Interface Materials Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Phase Change Thermal Interface Materials Industry

4.2 Key Market Trends in Phase Change Thermal Interface Materials Industry

4.3 Potential Opportunities in Phase Change Thermal Interface Materials Industry

4.4 Key Challenges in Phase Change Thermal Interface Materials Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Phase Change Thermal Interface Materials Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Phase Change Thermal Interface Materials Market Outlook by Segments

7.1 Phase Change Thermal Interface Materials Market Outlook by Segments, $ Million, 2021- 2032

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

8 North America Phase Change Thermal Interface Materials Market Analysis and Outlook To 2032

8.1 Introduction to North America Phase Change Thermal Interface Materials Markets in 2024

8.2 North America Phase Change Thermal Interface Materials Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Phase Change Thermal Interface Materials Market size Outlook by Segments, 2021-2032

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

9 Europe Phase Change Thermal Interface Materials Market Analysis and Outlook To 2032

9.1 Introduction to Europe Phase Change Thermal Interface Materials Markets in 2024

9.2 Europe Phase Change Thermal Interface Materials Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Phase Change Thermal Interface Materials Market Size Outlook by Segments, 2021-2032

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

10 Asia Pacific Phase Change Thermal Interface Materials Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Phase Change Thermal Interface Materials Markets in 2024

10.2 Asia Pacific Phase Change Thermal Interface Materials Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Phase Change Thermal Interface Materials Market size Outlook by Segments, 2021-2032

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

11 South America Phase Change Thermal Interface Materials Market Analysis and Outlook To 2032

11.1 Introduction to South America Phase Change Thermal Interface Materials Markets in 2024

11.2 South America Phase Change Thermal Interface Materials Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Phase Change Thermal Interface Materials Market size Outlook by Segments, 2021-2032

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

12 Middle East and Africa Phase Change Thermal Interface Materials Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Phase Change Thermal Interface Materials Markets in 2024

12.2 Middle East and Africa Phase Change Thermal Interface Materials Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Phase Change Thermal Interface Materials Market size Outlook by Segments, 2021-2032

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Aavid Thermalloy

AI Technology

Arctic Silver

Croda International PLC

Datum Phase Change Ltd

Dow Inc

Enerdyne Thermal Solutions

GrafTech

Henkel AG & Co. KGaA

Honeywell International Inc

Laird Technologies

Microtek Laboratories Inc

NuSil Technology

Parker Chomerics

Phase Change Energy Solutions Inc (PCES)

Specialty Silicone Products (SSP)

Stockwell Elastomerics

TCP Reliable Inc

Wakefield-Vette

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Conductive Type

Electrically Conductive

Non-electrically Conductive

By Binder

Paraffin

Non-paraffin (organic)

Eutectic salts

Salt hydrates

By Filler

Aluminum Oxide

Boron Nitride

Aluminum Nitride

Zinc Oxide

Others

By End-User

Computers

Electrical and Electronics

Telecommunication

Automotive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Phase Change Thermal Interface Materials Market Size is valued at $784.2 Million in 2024 and is forecast to register a growth rate (CAGR) of 17.4% to reach $2829.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Aavid Thermalloy, AI Technology, Arctic Silver, Croda International PLC, Datum Phase Change Ltd, Dow Inc, Enerdyne Thermal Solutions, GrafTech, Henkel AG & Co. KGaA, Honeywell International Inc, Laird Technologies, Microtek Laboratories Inc, NuSil Technology, Parker Chomerics, Phase Change Energy Solutions Inc (PCES), Specialty Silicone Products (SSP), Stockwell Elastomerics, TCP Reliable Inc, Wakefield-Vette

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume