The Pharmacy Benefit Management Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Service (Specialty Pharmacy Services, Mail Order Service, Drug Formulary Management, Benefit Plan Design and Consultation, Others), By Business model (Government Health Programs, Health Insurance Management, Employer-sponsored Programs), By End-User (Pharmacy Benefit Management Organization, Retail Pharmacies, Inpatient Pharmacies, Online).

In 2024, the pharmacy benefit management (PBM) market remains a critical component of the healthcare ecosystem, facilitating access to affordable prescription medications and optimizing medication therapy management for patients, employers, and healthcare payers. PBMs serve as intermediaries between health insurance plans, pharmacies, and pharmaceutical manufacturers, managing prescription drug benefits, negotiating drug prices, and implementing cost-containment strategies to ensure the effective and efficient delivery of pharmacy services. The market for pharmacy benefit management encompasses a range of services, including formulary management, pharmacy network management, drug utilization review, medication adherence programs, and specialty pharmacy services, each aimed at improving medication access, affordability, and clinical outcomes while controlling healthcare costs. Technological advancements in pharmacy benefit management focus on enhancing data analytics, predictive modeling, and artificial intelligence capabilities to identify cost-saving opportunities, predict patient medication adherence, and personalize medication therapy interventions. Moreover, the integration of digital health platforms, mobile applications, and telepharmacy services enables convenient access to medication information, medication refills, and medication counseling, empowering patients to take an active role in managing their health and medications. With the increasing focus on value-based healthcare, population health management, and patient-centered care, the market for pharmacy benefit management is poised for continued growth and innovation, offering healthcare stakeholders effective solutions for optimizing medication therapy outcomes and reducing overall healthcare costs.

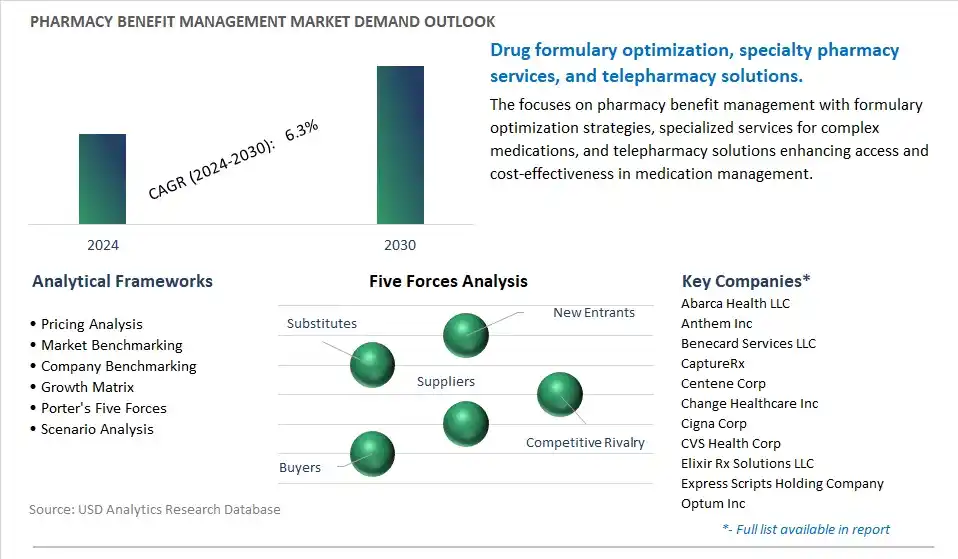

A prominent trend in the Pharmacy Benefit Management (PBM) market is the increasing integration of data analytics and artificial intelligence (AI) into PBM services. With the growing complexity of healthcare data and the need for actionable insights to optimize pharmacy benefit programs, PBMs are leveraging advanced analytics and AI algorithms to analyze vast amounts of data, identify cost-saving opportunities, and improve patient outcomes. Data-driven insights enable PBMs to develop more targeted formularies, optimize medication adherence programs, and negotiate better pricing with pharmaceutical manufacturers and pharmacies. This trend reflects a strategic shift towards data-driven decision-making and the use of technology to enhance the effectiveness and efficiency of pharmacy benefit management services.

A primary driver fueling the growth of the Pharmacy Benefit Management market is the rising healthcare costs and the demand for cost containment solutions. As healthcare expenditures continue to escalate, employers, health plans, and government agencies seek innovative strategies to manage pharmacy benefit costs while ensuring access to affordable medications for patients. PBMs play a crucial role in negotiating drug pricing, implementing cost-saving initiatives such as generic substitution and therapeutic interchange programs, and managing pharmacy networks to achieve cost containment objectives. The need to control prescription drug spending and improve healthcare affordability drives the demand for comprehensive pharmacy benefit management solutions, driving the growth of the PBM market.

An emerging opportunity in the Pharmacy Benefit Management market lies in the expansion into specialty pharmacy services. With the growing prevalence of complex and chronic diseases requiring specialized medications, there is a rising demand for specialty pharmacy services that provide personalized support, medication management, and adherence programs for patients with complex medical conditions. PBMs can capitalize on this opportunity by expanding their portfolio of specialty pharmacy services, including specialty drug distribution, patient support programs, and clinical management services. By offering integrated solutions that address the unique needs of patients requiring specialty medications, PBMs can differentiate themselves in the market, improve patient outcomes, and capture a larger share of the growing specialty pharmacy market.

Among the various services, business models, and end-users in the pharmacy benefit management (PBM) market, specialty pharmacy services for pharmacy benefit management organizations (PBMs) are experiencing rapid growth. Specialty pharmacy services cater to the unique needs of patients requiring complex, high-cost medications for chronic or rare conditions such as cancer, autoimmune diseases, and genetic disorders. PBMs play a crucial role in managing specialty pharmacy services by coordinating the distribution, administration, and reimbursement of specialty medications for patients. With the increasing prevalence of chronic diseases and the growing availability of specialty medications, there is a rising demand for comprehensive specialty pharmacy services that ensure timely access to specialized treatments while managing costs and optimizing outcomes. Moreover, as healthcare stakeholders seek to improve patient care coordination and enhance the value of specialty pharmacy interventions, PBMs are expanding their portfolio of specialty pharmacy services to include patient support programs, adherence management, and outcomes monitoring. Additionally, the shift towards value-based care models and the increasing focus on population health management further drive the demand for specialty pharmacy services among PBMs. As PBMs continue to play a pivotal role in managing specialty medications and improving patient outcomes, the market for specialty pharmacy services for PBMs is expected to witness significant growth in the pharmacy benefit management market.

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAbarca Health LLC, Anthem Inc, Benecard Services LLC, CaptureRx, Centene Corp, Change Healthcare Inc, Cigna Corp, CVS Health Corp, Elixir Rx Solutions LLC, Express Scripts Holding Company, Optum Inc, ProCare Rx, SS&C Technologies Holdings Inc

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abarca Health LLC

Anthem Inc

Benecard Services LLC

CaptureRx

Centene Corp

Change Healthcare Inc

Cigna Corp

CVS Health Corp

Elixir Rx Solutions LLC

Express Scripts Holding Company

Optum Inc

ProCare Rx

SS&C Technologies Holdings Inc

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Pharmacy Benefit Management Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Pharmacy Benefit Management Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Pharmacy Benefit Management Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Pharmacy Benefit Management Market Size Outlook, $ Million, 2021 to 2030

3.2 Pharmacy Benefit Management Market Outlook by Type, $ Million, 2021 to 2030

3.3 Pharmacy Benefit Management Market Outlook by Product, $ Million, 2021 to 2030

3.4 Pharmacy Benefit Management Market Outlook by Application, $ Million, 2021 to 2030

3.5 Pharmacy Benefit Management Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Pharmacy Benefit Management Industry

4.2 Key Market Trends in Pharmacy Benefit Management Industry

4.3 Potential Opportunities in Pharmacy Benefit Management Industry

4.4 Key Challenges in Pharmacy Benefit Management Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Pharmacy Benefit Management Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Pharmacy Benefit Management Market Outlook by Segments

7.1 Pharmacy Benefit Management Market Outlook by Segments, $ Million, 2021- 2030

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

8 North America Pharmacy Benefit Management Market Analysis and Outlook To 2030

8.1 Introduction to North America Pharmacy Benefit Management Markets in 2024

8.2 North America Pharmacy Benefit Management Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Pharmacy Benefit Management Market size Outlook by Segments, 2021-2030

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

9 Europe Pharmacy Benefit Management Market Analysis and Outlook To 2030

9.1 Introduction to Europe Pharmacy Benefit Management Markets in 2024

9.2 Europe Pharmacy Benefit Management Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Pharmacy Benefit Management Market Size Outlook by Segments, 2021-2030

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

10 Asia Pacific Pharmacy Benefit Management Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Pharmacy Benefit Management Markets in 2024

10.2 Asia Pacific Pharmacy Benefit Management Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Pharmacy Benefit Management Market size Outlook by Segments, 2021-2030

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

11 South America Pharmacy Benefit Management Market Analysis and Outlook To 2030

11.1 Introduction to South America Pharmacy Benefit Management Markets in 2024

11.2 South America Pharmacy Benefit Management Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Pharmacy Benefit Management Market size Outlook by Segments, 2021-2030

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

12 Middle East and Africa Pharmacy Benefit Management Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Pharmacy Benefit Management Markets in 2024

12.2 Middle East and Africa Pharmacy Benefit Management Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Pharmacy Benefit Management Market size Outlook by Segments, 2021-2030

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abarca Health LLC

Anthem Inc

Benecard Services LLC

CaptureRx

Centene Corp

Change Healthcare Inc

Cigna Corp

CVS Health Corp

Elixir Rx Solutions LLC

Express Scripts Holding Company

Optum Inc

ProCare Rx

SS&C Technologies Holdings Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Service

Specialty Pharmacy Services

Mail Order Service

Drug Formulary Management

Benefit Plan Design and Consultation

Others

By Business model

Government Health Programs

Health Insurance Management

Employer-sponsored Programs

By End-User

Pharmacy Benefit Management Organization

Retail Pharmacies

Inpatient Pharmacies

Online

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Pharmacy Benefit Management Market is one of the lucrative growth markets, poised to register a 6.3% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abarca Health LLC, Anthem Inc, Benecard Services LLC, CaptureRx, Centene Corp, Change Healthcare Inc, Cigna Corp, CVS Health Corp, Elixir Rx Solutions LLC, Express Scripts Holding Company, Optum Inc, ProCare Rx, SS&C Technologies Holdings Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume