The Pharmaceutical Membrane Filtration Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Product (Membrane Filters, Systems, Others), By Technique (Microfiltration, Ultrafiltration, Nanofiltration, Others), By Application (Final Product Processing, Raw Material Filtration, Cell Separation, Water Purification, Air Purification), By Type (Sterile Filtration, Non-Sterile Filtration), By Scale of Operation (Manufacturing-Scale Operation, Pilot-Scale Operation, R&D-Scale Operation).

Pharmaceutical membrane filtration is a critical process used in the pharmaceutical industry for the separation, purification, and sterilization of pharmaceutical products and ingredients. In 2024, the market for pharmaceutical membrane filtration continues to expand, driven by the increasing demand for biopharmaceuticals, stringent regulatory requirements, and the adoption of advanced filtration technologies to ensure product quality and safety. Pharmaceutical membrane filtration involves the use of porous membranes, such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis membranes, to remove particulates, microorganisms, endotoxins, and other contaminants from pharmaceutical solutions and suspensions. These filtration processes are essential for the production of sterile injectable drugs, vaccines, biologics, and parenteral solutions, as well as for the purification of active pharmaceutical ingredients (APIs) and the removal of impurities during downstream processing. With advancements in membrane materials, pore size distribution, and membrane surface modifications, pharmaceutical membrane filtration offers improved efficiency, selectivity, and throughput, enabling pharmaceutical manufacturers to achieve high levels of product purity and yield while minimizing process variability and batch-to-batch variations. Moreover, the integration of single-use filtration systems, automated process control, and real-time monitoring technologies enhances operational efficiency, reduces contamination risks, and accelerates time-to-market for pharmaceutical products. As the pharmaceutical industry continues to innovate and expand, pharmaceutical membrane filtration plays a critical role in ensuring product quality, safety, and compliance with regulatory standards, thereby contributing to the development of safe and effective medicines for patients worldwide.

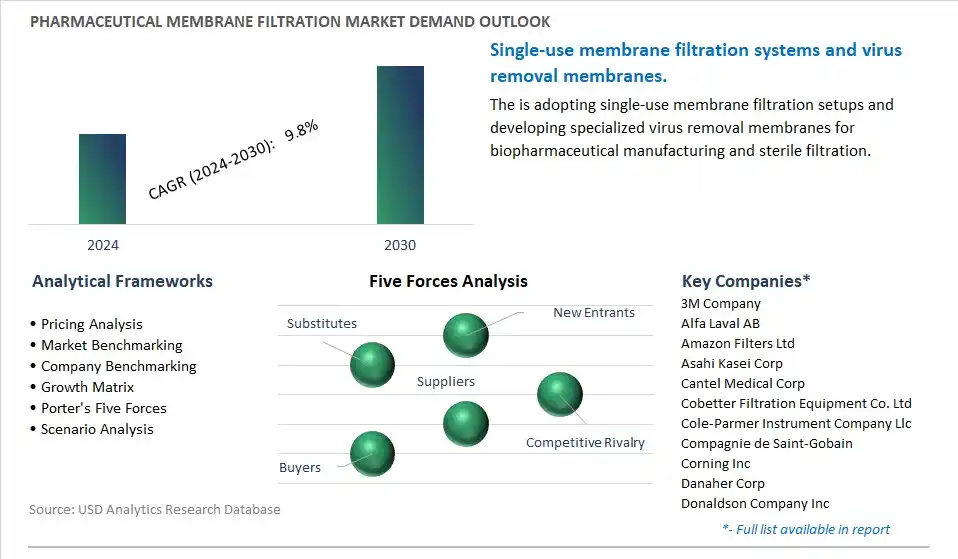

A significant market trend in pharmaceutical membrane filtration is the increasing adoption of single-use filtration systems, driven by the need for cost-effective, flexible, and scalable manufacturing solutions in pharmaceutical production. Single-use filtration technologies, such as disposable filter cartridges, capsules, and bags, offer advantages such as reduced cross-contamination risks, simplified cleaning procedures, and shorter changeover times between batches. This trend reflects a shift towards modular and disposable manufacturing platforms that enhance operational efficiency, reduce capital investment costs, and accelerate time-to-market for pharmaceutical products. The adoption of single-use filtration systems aligns with the industry's emphasis on lean manufacturing principles, process intensification, and agile production strategies, driving investments in innovative single-use filtration technologies that support biopharmaceutical manufacturing and drug formulation processes.

A primary driver fueling the growth of the pharmaceutical membrane filtration market is the stringent regulatory requirements and quality standards governing pharmaceutical manufacturing processes. With patient safety being paramount, regulatory agencies such as the FDA and EMA impose strict guidelines for the production, filtration, and purification of pharmaceutical products to ensure compliance with Good Manufacturing Practices (GMP), pharmacopeial standards, and quality assurance protocols. Moreover, the increasing complexity of biopharmaceuticals, including monoclonal antibodies, recombinant proteins, and cell-based therapies, necessitates advanced filtration technologies that can remove impurities, pathogens, and endotoxins while preserving product integrity and bioactivity. This driver underscores the critical role of membrane filtration in ensuring product quality, purity, and safety throughout the drug manufacturing lifecycle, driving investments in innovative filtration solutions that meet regulatory requirements and support the production of high-quality pharmaceutical products.

An enticing opportunity within the pharmaceutical membrane filtration market lies in the expansion into bioprocessing and continuous manufacturing applications to address the growing demand for biopharmaceuticals and advanced therapy medicinal products (ATMPs). As biologic drugs continue to gain prominence in the pharmaceutical industry, there's a need for filtration technologies that enable efficient clarification, concentration, and purification of bioprocess streams, including cell cultures, fermentation broths, and downstream processing solutions. Furthermore, the adoption of continuous manufacturing approaches, such as continuous chromatography and continuous tangential flow filtration (cTFF), presents new opportunities for membrane filtration to support continuous bioprocessing operations, reduce processing times, and enhance product consistency and yield. Collaborations between membrane filtration suppliers, biopharmaceutical manufacturers, and technology developers can drive innovation in membrane filtration solutions tailored to the specific requirements of bioprocessing and continuous manufacturing, unlocking new opportunities to improve efficiency, flexibility, and productivity in biologics production.

The fastest-growing segment in the Pharmaceutical Membrane Filtration Market is Polyethersulfone (PES) Membrane Filters within the Membrane Filters product category. This growth is driven by the increasing adoption of PES membrane filters in pharmaceutical manufacturing processes due to their excellent chemical compatibility, high flow rates, and low protein binding characteristics. PES membrane filters are widely used for sterile and non-sterile filtration applications in final product processing, raw material filtration, cell separation, water purification, and air purification. Additionally, the versatility of PES membrane filters across manufacturing-scale, pilot-scale, and R&D-scale operations contributes to their rapid growth in the Pharmaceutical Membrane Filtration Market, meeting the stringent filtration requirements of the pharmaceutical industry.

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments across3M Company, Alfa Laval AB, Amazon Filters Ltd, Asahi Kasei Corp, Cantel Medical Corp, Cobetter Filtration Equipment Co. Ltd, Cole-Parmer Instrument Company Llc, Compagnie de Saint-Gobain, Corning Inc, Danaher Corp, Donaldson Company Inc, Eaton Corp plc, GEA Group AG, Graver Technologies LLC, Koch Membrane Systems Inc, MANN+HUMMEL International GmbH & Co. KG, Meissner Filtration Products Inc, Membrane Solutions LLC, Merck KGaA, Nupore Filtration Systems, Parker-Hannifin Corp, Porvair plc, Repligen Corp, Sartorius AG, Sterlitech Corp, Synder Filtration Inc, Thermo Fisher Scientific Inc, Toyo Roshi Kaisha Ltd, W. L. Gore & Associates Inc

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Alfa Laval AB

Amazon Filters Ltd

Asahi Kasei Corp

Cantel Medical Corp

Cobetter Filtration Equipment Co. Ltd

Cole-Parmer Instrument Company Llc

Compagnie de Saint-Gobain

Corning Inc

Danaher Corp

Donaldson Company Inc

Eaton Corp plc

GEA Group AG

Graver Technologies LLC

Koch Membrane Systems Inc

MANN+HUMMEL International GmbH & Co. KG

Meissner Filtration Products Inc

Membrane Solutions LLC

Merck KGaA

Nupore Filtration Systems

Parker-Hannifin Corp

Porvair plc

Repligen Corp

Sartorius AG

Sterlitech Corp

Synder Filtration Inc

Thermo Fisher Scientific Inc

Toyo Roshi Kaisha Ltd

W. L. Gore & Associates Inc

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Pharmaceutical Membrane Filtration Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Pharmaceutical Membrane Filtration Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Pharmaceutical Membrane Filtration Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Pharmaceutical Membrane Filtration Market Size Outlook, $ Million, 2021 to 2030

3.2 Pharmaceutical Membrane Filtration Market Outlook by Type, $ Million, 2021 to 2030

3.3 Pharmaceutical Membrane Filtration Market Outlook by Product, $ Million, 2021 to 2030

3.4 Pharmaceutical Membrane Filtration Market Outlook by Application, $ Million, 2021 to 2030

3.5 Pharmaceutical Membrane Filtration Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Pharmaceutical Membrane Filtration Industry

4.2 Key Market Trends in Pharmaceutical Membrane Filtration Industry

4.3 Potential Opportunities in Pharmaceutical Membrane Filtration Industry

4.4 Key Challenges in Pharmaceutical Membrane Filtration Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Pharmaceutical Membrane Filtration Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Pharmaceutical Membrane Filtration Market Outlook by Segments

7.1 Pharmaceutical Membrane Filtration Market Outlook by Segments, $ Million, 2021- 2030

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

8 North America Pharmaceutical Membrane Filtration Market Analysis and Outlook To 2030

8.1 Introduction to North America Pharmaceutical Membrane Filtration Markets in 2024

8.2 North America Pharmaceutical Membrane Filtration Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Pharmaceutical Membrane Filtration Market size Outlook by Segments, 2021-2030

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

9 Europe Pharmaceutical Membrane Filtration Market Analysis and Outlook To 2030

9.1 Introduction to Europe Pharmaceutical Membrane Filtration Markets in 2024

9.2 Europe Pharmaceutical Membrane Filtration Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Pharmaceutical Membrane Filtration Market Size Outlook by Segments, 2021-2030

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

10 Asia Pacific Pharmaceutical Membrane Filtration Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Pharmaceutical Membrane Filtration Markets in 2024

10.2 Asia Pacific Pharmaceutical Membrane Filtration Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Pharmaceutical Membrane Filtration Market size Outlook by Segments, 2021-2030

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

11 South America Pharmaceutical Membrane Filtration Market Analysis and Outlook To 2030

11.1 Introduction to South America Pharmaceutical Membrane Filtration Markets in 2024

11.2 South America Pharmaceutical Membrane Filtration Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Pharmaceutical Membrane Filtration Market size Outlook by Segments, 2021-2030

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

12 Middle East and Africa Pharmaceutical Membrane Filtration Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Pharmaceutical Membrane Filtration Markets in 2024

12.2 Middle East and Africa Pharmaceutical Membrane Filtration Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Pharmaceutical Membrane Filtration Market size Outlook by Segments, 2021-2030

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

3M Company

Alfa Laval AB

Amazon Filters Ltd

Asahi Kasei Corp

Cantel Medical Corp

Cobetter Filtration Equipment Co. Ltd

Cole-Parmer Instrument Company Llc

Compagnie de Saint-Gobain

Corning Inc

Danaher Corp

Donaldson Company Inc

Eaton Corp plc

GEA Group AG

Graver Technologies LLC

Koch Membrane Systems Inc

MANN+HUMMEL International GmbH & Co. KG

Meissner Filtration Products Inc

Membrane Solutions LLC

Merck KGaA

Nupore Filtration Systems

Parker-Hannifin Corp

Porvair plc

Repligen Corp

Sartorius AG

Sterlitech Corp

Synder Filtration Inc

Thermo Fisher Scientific Inc

Toyo Roshi Kaisha Ltd

W. L. Gore & Associates Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Membrane Filters

-Polyethersulfone (PES) Membrane Filters

-Polyvinylidene difluoride (PVDF) Membrane Filters

-Nylon Membrane Filters

-Polytetrafluoroethylene (PTFE) Membrane Filters

-Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

-Polycarbonate Track-Etched (PCTE) Membrane Filters

-Others

Systems

-Single-Use Systems

-Reusable Systems

Others

By Technique

Microfiltration

Ultrafiltration

Nanofiltration

Others

By Application

Final Product processing

Raw Material Filtration

Cell Separation

Water Purification

Air Purification

By Type

Sterile Filtration

Non-Sterile Filtration

By Scale of Operation

Manufacturing-Scale Operation

Pilot-Scale Operation

R&D-Scale Operation

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Pharmaceutical Membrane Filtration Market is one of the lucrative growth markets, poised to register a 9.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Alfa Laval AB, Amazon Filters Ltd, Asahi Kasei Corp, Cantel Medical Corp, Cobetter Filtration Equipment Co. Ltd, Cole-Parmer Instrument Company Llc, Compagnie de Saint-Gobain, Corning Inc, Danaher Corp, Donaldson Company Inc, Eaton Corp plc, GEA Group AG, Graver Technologies LLC, Koch Membrane Systems Inc, MANN+HUMMEL International GmbH & Co. KG, Meissner Filtration Products Inc, Membrane Solutions LLC, Merck KGaA, Nupore Filtration Systems, Parker-Hannifin Corp, Porvair plc, Repligen Corp, Sartorius AG, Sterlitech Corp, Synder Filtration Inc, Thermo Fisher Scientific Inc, Toyo Roshi Kaisha Ltd, W. L. Gore & Associates Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume