The Pharmaceutical Excipients Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Product (Organic Chemicals, Inorganic Chemicals), By Function (Fillers & Diluents, Suspending & Viscosity Agents, Coating Agents, Binders, Flavoring Agents & Sweeteners, Disintegrants, Colorants, Lubricants & Glidants, Preservatives, Emulsifying Agents, Others), By Formulation (Oral, Topical, Parenteral, Others), By Application (Taste Masking, Stablizers, Modified-Release, Solubility & Bioavailablity Enhancement, Others).

Pharmaceutical Excipients are inert substances added to pharmaceutical formulations to impart desired physical and chemical properties to drug products, enhance stability, and facilitate drug delivery. Excipients serve various functions, including binding, disintegration, lubrication, and taste masking, depending on the dosage form and route of administration. Common pharmaceutical excipients include fillers, binders, lubricants, preservatives, and solubilizers, which are selected based on compatibility with active pharmaceutical ingredients (APIs) and desired formulation characteristics. As pharmaceutical formulations become increasingly complex, excipient manufacturers are developing novel excipients with improved functionality, biocompatibility, and regulatory compliance. Moreover, excipient innovations address emerging trends in drug delivery, such as controlled release, targeted delivery, and biodegradability, to optimize therapeutic outcomes and patient adherence. As an integral component of drug development and formulation, pharmaceutical excipients play a critical role in ensuring the safety, efficacy, and quality of pharmaceutical products.

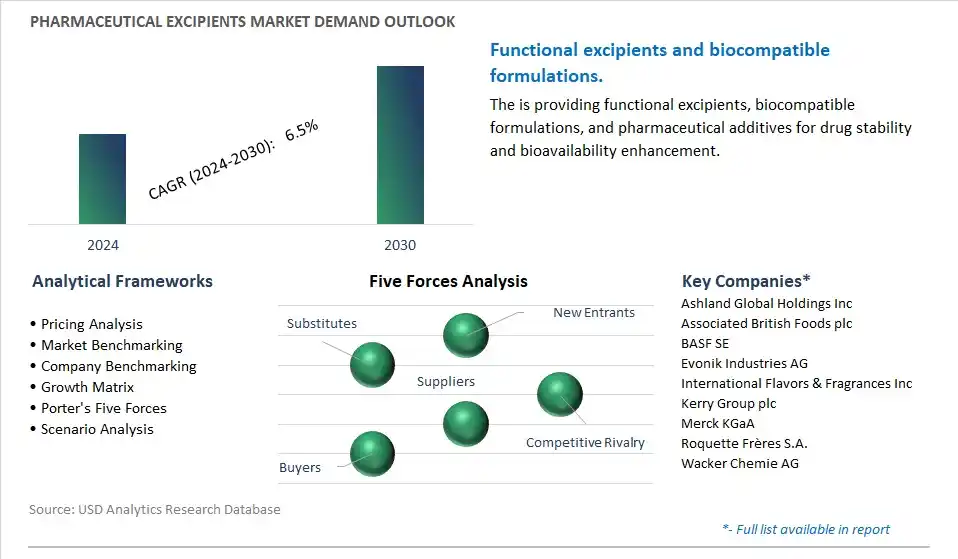

A significant trend in the pharmaceutical excipients market is the rising demand for multifunctional excipients. Pharmaceutical manufacturers are seeking excipients that not only serve as inert carriers or fillers but also offer additional functionalities such as improved drug solubility, enhanced bioavailability, controlled release, and stability enhancement. Multifunctional excipients streamline the formulation process, reduce the need for multiple excipients, and enable the development of novel dosage forms with enhanced therapeutic properties. This trend reflects a growing emphasis on excipient innovation and formulation optimization to address the challenges associated with drug development, formulation, and delivery in the pharmaceutical industry.

A key driver for the pharmaceutical excipients market is the growth in the pharmaceutical industry and drug development activities worldwide. With the increasing prevalence of chronic diseases, aging population, and healthcare advancements, there is a rising demand for new pharmaceutical products and dosage forms to meet evolving patient needs. Excipients play a critical role in drug formulation by ensuring the stability, bioavailability, and efficacy of active pharmaceutical ingredients (APIs) in various dosage forms such as tablets, capsules, injectables, and topical formulations. As pharmaceutical companies invest in research and development efforts to bring innovative therapies to market, there is a growing need for high-quality excipients that comply with regulatory standards, meet formulation requirements, and support the development of safe and effective pharmaceutical products.

An emerging opportunity within the pharmaceutical excipients market lies in the development of specialty and functional excipients. Specialty excipients are designed to address specific formulation challenges or enable unique drug delivery strategies, such as taste masking, moisture protection, or sustained release. Functional excipients offer targeted functionalities, such as improved flowability, lubrication, or disintegration properties, to enhance manufacturing processes and dosage form performance. By focusing on the development of specialty and functional excipients, manufacturers can differentiate their product offerings, cater to niche formulation needs, and add value to pharmaceutical formulations. This presents an opportunity to collaborate with pharmaceutical companies, contract development and manufacturing organizations (CDMOs), and research institutions to develop customized excipient solutions that address unmet formulation requirements and support the development of innovative pharmaceutical products with improved therapeutic outcomes.

The fastest-growing segment in the Pharmaceutical Excipients Market is Organic Chemicals, particularly Oleochemicals within the Product category. This growth is driven by the increasing demand for natural and sustainable excipients in pharmaceutical formulations. Oleochemicals, derived from natural fats and oils, are widely used as excipients due to their biodegradability, low toxicity, and compatibility with active pharmaceutical ingredients (APIs). Additionally, the rising preference for organic and plant-based excipients in oral, topical, and parenteral formulations contributes to the rapid growth of Oleochemicals in the Pharmaceutical Excipients Market.

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAshland Global Holdings Inc, Associated British Foods plc, BASF SE, Evonik Industries AG, International Flavors & Fragrances Inc, Kerry Group plc, Merck KGaA, Roquette Frères S.A., Wacker Chemie AG

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ashland Global Holdings Inc

Associated British Foods plc

BASF SE

Evonik Industries AG

International Flavors & Fragrances Inc

Kerry Group plc

Merck KGaA

Roquette Frères S.A.

Wacker Chemie AG

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Pharmaceutical Excipients Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Pharmaceutical Excipients Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Pharmaceutical Excipients Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Pharmaceutical Excipients Market Size Outlook, $ Million, 2021 to 2030

3.2 Pharmaceutical Excipients Market Outlook by Type, $ Million, 2021 to 2030

3.3 Pharmaceutical Excipients Market Outlook by Product, $ Million, 2021 to 2030

3.4 Pharmaceutical Excipients Market Outlook by Application, $ Million, 2021 to 2030

3.5 Pharmaceutical Excipients Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Pharmaceutical Excipients Industry

4.2 Key Market Trends in Pharmaceutical Excipients Industry

4.3 Potential Opportunities in Pharmaceutical Excipients Industry

4.4 Key Challenges in Pharmaceutical Excipients Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Pharmaceutical Excipients Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Pharmaceutical Excipients Market Outlook by Segments

7.1 Pharmaceutical Excipients Market Outlook by Segments, $ Million, 2021- 2030

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

8 North America Pharmaceutical Excipients Market Analysis and Outlook To 2030

8.1 Introduction to North America Pharmaceutical Excipients Markets in 2024

8.2 North America Pharmaceutical Excipients Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Pharmaceutical Excipients Market size Outlook by Segments, 2021-2030

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

9 Europe Pharmaceutical Excipients Market Analysis and Outlook To 2030

9.1 Introduction to Europe Pharmaceutical Excipients Markets in 2024

9.2 Europe Pharmaceutical Excipients Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Pharmaceutical Excipients Market Size Outlook by Segments, 2021-2030

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

10 Asia Pacific Pharmaceutical Excipients Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Pharmaceutical Excipients Markets in 2024

10.2 Asia Pacific Pharmaceutical Excipients Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Pharmaceutical Excipients Market size Outlook by Segments, 2021-2030

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

11 South America Pharmaceutical Excipients Market Analysis and Outlook To 2030

11.1 Introduction to South America Pharmaceutical Excipients Markets in 2024

11.2 South America Pharmaceutical Excipients Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Pharmaceutical Excipients Market size Outlook by Segments, 2021-2030

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

12 Middle East and Africa Pharmaceutical Excipients Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Pharmaceutical Excipients Markets in 2024

12.2 Middle East and Africa Pharmaceutical Excipients Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Pharmaceutical Excipients Market size Outlook by Segments, 2021-2030

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Ashland Global Holdings Inc

Associated British Foods plc

BASF SE

Evonik Industries AG

International Flavors & Fragrances Inc

Kerry Group plc

Merck KGaA

Roquette Frères S.A.

Wacker Chemie AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Organic Chemicals

-Oleochemicals

-Carbohydrates

-Petrochemicals

-Proteins

-Others

Inorganic Chemicals

-Calcium Phosphate

-Metal Oxides

-Halites

-Calcium Carbonate

-Calcium Sulphate

-Others

By Function

Fillers & Diluents

Suspending & Viscosity Agents

Coating Agents

Binders

Flavoring Agents & Sweeteners

Disintegrants

Colorants

Lubricants & Glidants

Preservatives

Emulsifying Agents

Others

By Formulation

Oral

Topical

Parenteral

Others

By Application

Taste Masking

Stablizers

Modified-Release

Solubility & Bioavailablity Enhancement

Others

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Pharmaceutical Excipients Market is one of the lucrative growth markets, poised to register a 6.5% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ashland Global Holdings Inc, Associated British Foods plc, BASF SE, Evonik Industries AG, International Flavors & Fragrances Inc, Kerry Group plc, Merck KGaA, Roquette Frères S.A., Wacker Chemie AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume