The global Pharmaceutical Contract Research and Manufacturing Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Service (CMO, CRO), By End-User (Big pharmaceuticals, Small and medium-sized pharmaceuticals, Generic pharmaceuticals, Others).

The Pharmaceutical Contract Research and Manufacturing (CRAM) Market in 2024 represents a dynamic sector within the pharmaceutical industry, offering outsourced services for drug discovery, development, and manufacturing to pharmaceutical and biotechnology companies worldwide. Pharmaceutical CRAM encompasses a broad spectrum of services including preclinical research, clinical trials, formulation development, analytical testing, and commercial-scale manufacturing, provided by contract research organizations (CROs), contract development and manufacturing organizations (CDMOs), and contract manufacturing organizations (CMOs). With increasing pressure to reduce R&D costs, accelerate time-to-market, and mitigate development risks, pharmaceutical companies leverage outsourcing partnerships to access specialized expertise, infrastructure, and resources, thus optimizing operational efficiency and focusing internal resources on core competencies. Moreover, as the pharmaceutical CRAM market evolves to address emerging trends such as personalized medicine, biologics manufacturing, and regulatory harmonization, stakeholders collaborate to foster innovation, ensure quality compliance, and drive value creation across the drug development and commercialization continuum.

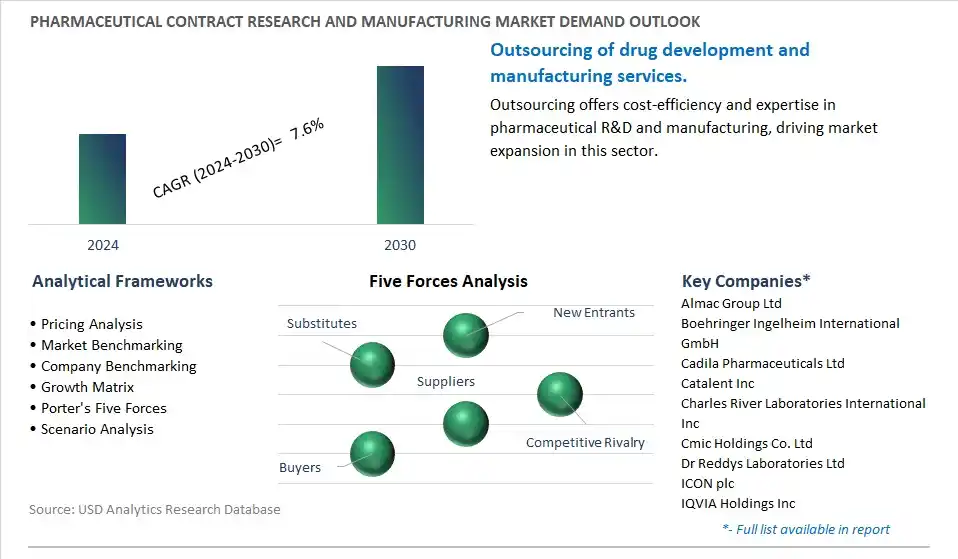

The global Pharmaceutical Contract Research and Manufacturing Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Pharmaceutical Contract Research and Manufacturing Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Pharmaceutical Contract Research and Manufacturing Industry include- Almac Group Ltd, Boehringer Ingelheim International GmbH, Cadila Pharmaceuticals Ltd, Catalent Inc, Charles River Laboratories International Inc, Cmic Holdings Co. Ltd, Dr Reddys Laboratories Ltd, ICON plc, IQVIA Holdings Inc, Laboratory Corp of America Holdings, Lonza Group Ltd, Lupin Ltd, Recipharm AB, Samsung Electronics Co. Ltd, Syneos Health Inc.

A significant trend in the Pharmaceutical Contract Research and Manufacturing Market is the increasing outsourcing of research and development (R&D) and manufacturing services by pharmaceutical companies. This trend is driven by the need for cost-effective and specialized expertise, access to advanced technologies and facilities, and flexibility in managing fluctuations in demand. Outsourcing enables pharmaceutical companies to focus on core competencies, accelerate drug development timelines, and optimize resource allocation, driving the growth of the contract research and manufacturing sector.

The primary driver fueling the Pharmaceutical Contract Research and Manufacturing Market is the rising demand for biologics, personalized medicines, and specialized therapies. Biologics and advanced therapies require specialized manufacturing processes, expertise, and facilities, driving pharmaceutical companies to seek contract research and manufacturing partners with the necessary capabilities. The increasing complexity of drug development, stringent regulatory requirements, and the need for innovative solutions further propel the demand for contract research and manufacturing services in the pharmaceutical industry.

An opportunity in the Pharmaceutical Contract Research and Manufacturing Market lies in the expansion of outsourcing to emerging markets, particularly in Asia-Pacific and Latin America. These regions offer cost advantages, a skilled workforce, supportive regulatory environments, and growing expertise in biologics and specialized therapies. Pharmaceutical companies can leverage partnerships with contract research and manufacturing organizations in emerging markets to access new talent pools, gain regional market insights, and enhance their global manufacturing and research capabilities.

Among the segments of Pharmaceutical Contract Research and Manufacturing, Contract Manufacturing Organizations (CMO) are experiencing the fastest growth. CMOs provide outsourcing services to pharmaceutical companies for the manufacturing of drug products, covering a wide range of services from formulation development to commercial-scale production. This growth can be attributed to several factors, including the increasing trend of pharmaceutical companies outsourcing manufacturing activities to focus on core competencies such as research and development (R&D) and marketing. CMOs offer flexibility, scalability, and cost-effectiveness to pharmaceutical companies by allowing them to access specialized manufacturing capabilities, state-of-the-art facilities, and regulatory expertise without significant capital investment. Additionally, the rise in the number of small and medium-sized pharmaceutical companies, as well as generic pharmaceuticals, seeking efficient and reliable manufacturing partners, has fueled the demand for CMO services. As the pharmaceutical industry continues to evolve and adapt to changing market dynamics, the role of CMOs is expected to expand further, driving continued growth in this segment.

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Almac Group Ltd

Boehringer Ingelheim International GmbH

Cadila Pharmaceuticals Ltd

Catalent Inc

Charles River Laboratories International Inc

Cmic Holdings Co. Ltd

Dr Reddys Laboratories Ltd

ICON plc

IQVIA Holdings Inc

Laboratory Corp of America Holdings

Lonza Group Ltd

Lupin Ltd

Recipharm AB

Samsung Electronics Co. Ltd

Syneos Health Inc

* List not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Pharmaceutical Contract Research and Manufacturing Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Pharmaceutical Contract Research and Manufacturing Industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Pharmaceutical Contract Research and Manufacturing Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Pharmaceutical Contract Research and Manufacturing Market Size Outlook, $ Million, 2021 to 2030

3.2 Pharmaceutical Contract Research and Manufacturing Market Outlook by Type, $ Million, 2021 to 2030

3.3 Pharmaceutical Contract Research and Manufacturing Market Outlook by Product, $ Million, 2021 to 2030

3.4 Pharmaceutical Contract Research and Manufacturing Market Outlook by Application, $ Million, 2021 to 2030

3.5 Pharmaceutical Contract Research and Manufacturing Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Pharmaceutical Contract Research and Manufacturing Industry

4.2 Key Market Trends in Pharmaceutical Contract Research and Manufacturing Industry

4.3 Potential Opportunities in Pharmaceutical Contract Research and Manufacturing Industry

4.4 Key Challenges in Pharmaceutical Contract Research and Manufacturing Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Pharmaceutical Contract Research and Manufacturing Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Pharmaceutical Contract Research and Manufacturing Market Outlook by Segments

7.1 Pharmaceutical Contract Research and Manufacturing Market Outlook by Segments, $ Million, 2021- 2030

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

8 North America Pharmaceutical Contract Research and Manufacturing Market Analysis and Outlook To 2030

8.1 Introduction to North America Pharmaceutical Contract Research and Manufacturing Markets in 2024

8.2 North America Pharmaceutical Contract Research and Manufacturing Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Pharmaceutical Contract Research and Manufacturing Market size Outlook by Segments, 2021-2030

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

9 Europe Pharmaceutical Contract Research and Manufacturing Market Analysis and Outlook To 2030

9.1 Introduction to Europe Pharmaceutical Contract Research and Manufacturing Markets in 2024

9.2 Europe Pharmaceutical Contract Research and Manufacturing Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Pharmaceutical Contract Research and Manufacturing Market Size Outlook by Segments, 2021-2030

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

10 Asia Pacific Pharmaceutical Contract Research and Manufacturing Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Pharmaceutical Contract Research and Manufacturing Markets in 2024

10.2 Asia Pacific Pharmaceutical Contract Research and Manufacturing Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Pharmaceutical Contract Research and Manufacturing Market size Outlook by Segments, 2021-2030

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

11 South America Pharmaceutical Contract Research and Manufacturing Market Analysis and Outlook To 2030

11.1 Introduction to South America Pharmaceutical Contract Research and Manufacturing Markets in 2024

11.2 South America Pharmaceutical Contract Research and Manufacturing Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Pharmaceutical Contract Research and Manufacturing Market size Outlook by Segments, 2021-2030

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

12 Middle East and Africa Pharmaceutical Contract Research and Manufacturing Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Pharmaceutical Contract Research and Manufacturing Markets in 2024

12.2 Middle East and Africa Pharmaceutical Contract Research and Manufacturing Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Pharmaceutical Contract Research and Manufacturing Market size Outlook by Segments, 2021-2030

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Almac Group Ltd

Boehringer Ingelheim International GmbH

Cadila Pharmaceuticals Ltd

Catalent Inc

Charles River Laboratories International Inc

Cmic Holdings Co. Ltd

Dr Reddys Laboratories Ltd

ICON plc

IQVIA Holdings Inc

Laboratory Corp of America Holdings

Lonza Group Ltd

Lupin Ltd

Recipharm AB

Samsung Electronics Co. Ltd

Syneos Health Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Service

CMO

CRO

By End-User

Big pharmaceuticals

Small and medium-sized pharmaceuticals

Generic pharmaceuticals

Others

The global Pharmaceutical Contract Research and Manufacturing Market is one of the lucrative growth markets, poised to register a 7.6% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Almac Group Ltd, Boehringer Ingelheim International GmbH, Cadila Pharmaceuticals Ltd, Catalent Inc, Charles River Laboratories International Inc, Cmic Holdings Co. Ltd, Dr Reddys Laboratories Ltd, ICON plc, IQVIA Holdings Inc, Laboratory Corp of America Holdings, Lonza Group Ltd, Lupin Ltd, Recipharm AB, Samsung Electronics Co. Ltd, Syneos Health Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume