The global Personal Luxury Goods Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Hard luxury, Apparel, Cosmetics and perfumes, Accessories, Others), By Distribution Channel (Offline, Online)

The market for personal luxury goods in 2024 reflects a blend of timeless elegance, craftsmanship, and modern innovation as luxury brands navigate changing consumer behaviors and global trends. Personal luxury goods encompass a wide range of categories, including fashion, accessories, leather goods, jewelry, watches, and beauty products, coveted for their quality, exclusivity, and aspirational appeal. Despite economic uncertainties, luxury consumption remains resilient, driven by demand from affluent consumers, emerging markets, and a growing appetite for experiential luxury. Brands are embracing digital transformation, sustainability initiatives, and personalized experiences to engage with discerning consumers, foster brand loyalty, and adapt to shifting market dynamics. Furthermore, collaborations, limited editions, and bespoke offerings add an element of exclusivity and excitement to the personal luxury goods market, enticing collectors and connoisseurs worldwide.

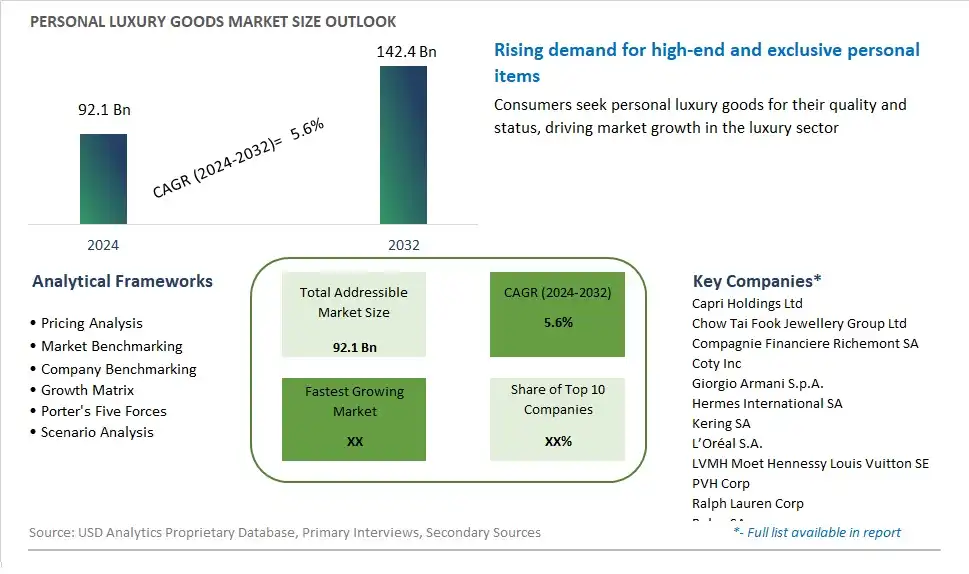

The market report analyses the leading companies in the industry including Capri Holdings Ltd, Chow Tai Fook Jewellery Group Ltd, Compagnie Financiere Richemont SA, Coty Inc, Giorgio Armani S.p.A., Hermes International SA, Kering SA, L’Oréal S.A., LVMH Moet Hennessy Louis Vuitton SE, PVH Corp, Ralph Lauren Corp, Rolex SA, Safilo Group Spa, Shiseido Co. Ltd, Swarovski AG, and Others.

One prominent trend in the personal luxury goods market is the shifting consumer preferences towards experiential luxury. While tangible luxury goods such as designer handbags, watches, and jewelry remain highly sought after, there is a growing demand for luxury experiences that offer unique and memorable moments. This trend is driven by a desire for authenticity, exclusivity, and personalization, as consumers seek to create meaningful connections and indulge in luxury experiences that enrich their lives. From bespoke travel experiences and gourmet dining to wellness retreats and immersive cultural events, luxury brands are expanding their offerings beyond physical products to cater to the evolving desires and lifestyles of affluent consumers. By embracing experiential luxury, brands can differentiate themselves in the competitive luxury market, forge deeper emotional connections with consumers, and cultivate long-term loyalty.

A key driver propelling the personal luxury goods market is the influence of millennial and Gen Z consumers. As the largest and most influential consumer segments, millennials and Gen Z are reshaping the luxury landscape with their distinct values, preferences, and purchasing behaviors. Unlike previous generations, younger consumers prioritize experiences over material possessions and seek authenticity, sustainability, and social responsibility in their luxury purchases. This driver is fueled by the rise of digital and social media platforms, which provide millennials and Gen Z with access to information, inspiration, and peer recommendations, influencing their purchasing decisions. Luxury brands that understand and cater to the preferences of these younger demographics, such as offering sustainable and ethical products, embracing digital innovation, and engaging in purpose-driven initiatives, can capitalize on this driver to drive growth and relevance in the personal luxury goods market.

An opportunity for market expansion in the personal luxury goods segment lies in the expansion into digital channels and omnichannel experiences. With the rise of e-commerce and digitalization, luxury brands have an opportunity to reach new audiences, enhance brand visibility, and drive sales through online channels. Moreover, the integration of digital technology into physical retail environments allows brands to create seamless omnichannel experiences that blur the lines between online and offline shopping. By leveraging technologies such as augmented reality, virtual reality, and artificial intelligence, luxury brands can offer immersive digital experiences that replicate the exclusivity and personalization of in-person shopping, catering to the preferences of tech-savvy consumers. Additionally, investing in digital marketing strategies, influencer collaborations, and social media engagement can help luxury brands connect with younger demographics and strengthen their digital presence, paving the way for sustainable growth and success in the evolving landscape of personal luxury goods.

Cosmetics and perfumes represent the largest segment in the personal luxury goods market. This dominance is driven by the consistent global demand for high-end beauty and fragrance products, which are often seen as accessible luxuries that provide instant gratification. The allure of premium cosmetics and perfumes lies in their association with quality, exclusivity, and status. Major brands invest heavily in marketing and packaging to create a sense of sophistication and elegance, appealing to consumers' desires for both self-expression and social recognition. The segment benefits from frequent product launches and innovations, such as limited editions and collaborations with celebrities or designers, which keep consumer interest high. Additionally, the rising trend of self-care and wellness has boosted the appeal of luxury beauty products, as individuals seek to enhance their personal grooming and pampering routines. With the continuous expansion of the affluent middle class in emerging markets and the sustained purchasing power in developed regions, cosmetics and perfumes maintain their position as the cornerstone of the personal luxury goods market.

The online distribution channel is the fastest-growing segment in the personal luxury goods market. This surge is driven by the increasing digitalization of retail and the evolving preferences of luxury consumers who seek convenience and exclusive access. E-commerce platforms offer a seamless shopping experience with the ability to browse, compare, and purchase luxury goods from anywhere in the world. High-end brands have enhanced their online presence through sophisticated websites and partnerships with luxury e-retailers, providing customers with a virtual boutique experience complete with detailed product descriptions, high-resolution images, and personalized services. The pandemic further accelerated the shift to online shopping as physical stores faced restrictions, and consumers turned to the internet to fulfill their luxury needs. Furthermore, advancements in technology, such as augmented reality for virtual try-ons and AI-driven personalized recommendations, have made online shopping more immersive and tailored. As trust in online transactions grows and digital innovations continue to evolve, the online segment is set to expand rapidly, redefining the future of luxury retail.

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Capri Holdings Ltd

Chow Tai Fook Jewellery Group Ltd

Compagnie Financiere Richemont SA

Coty Inc

Giorgio Armani S.p.A.

Hermes International SA

Kering SA

L’Oréal S.A.

LVMH Moet Hennessy Louis Vuitton SE

PVH Corp

Ralph Lauren Corp

Rolex SA

Safilo Group Spa

Shiseido Co. Ltd

Swarovski AG

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Personal Luxury Goods Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Personal Luxury Goods Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Personal Luxury Goods Market Share by Company, 2023

4.1.2. Product Offerings of Leading Personal Luxury Goods Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Personal Luxury Goods Market Drivers

6.2. Personal Luxury Goods Market Challenges

6.6. Personal Luxury Goods Market Opportunities

6.4. Personal Luxury Goods Market Trends

Chapter 7. Global Personal Luxury Goods Market Outlook Trends

7.1. Global Personal Luxury Goods Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Personal Luxury Goods Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Personal Luxury Goods Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Chapter 8. Global Personal Luxury Goods Regional Analysis and Outlook

8.1. Global Personal Luxury Goods Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Personal Luxury Goods Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Personal Luxury Goods Regional Analysis and Outlook

8.2.2. Canada Personal Luxury Goods Regional Analysis and Outlook

8.2.3. Mexico Personal Luxury Goods Regional Analysis and Outlook

8.3. Europe Personal Luxury Goods Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Personal Luxury Goods Regional Analysis and Outlook

8.3.2. France Personal Luxury Goods Regional Analysis and Outlook

8.3.3. United Kingdom Personal Luxury Goods Regional Analysis and Outlook

8.3.4. Spain Personal Luxury Goods Regional Analysis and Outlook

8.3.5. Italy Personal Luxury Goods Regional Analysis and Outlook

8.3.6. Russia Personal Luxury Goods Regional Analysis and Outlook

8.3.7. Rest of Europe Personal Luxury Goods Regional Analysis and Outlook

8.4. Asia Pacific Personal Luxury Goods Revenue (USD Million) by Country (2021-2032)

8.4.1. China Personal Luxury Goods Regional Analysis and Outlook

8.4.2. Japan Personal Luxury Goods Regional Analysis and Outlook

8.4.3. India Personal Luxury Goods Regional Analysis and Outlook

8.4.4. South Korea Personal Luxury Goods Regional Analysis and Outlook

8.4.5. Australia Personal Luxury Goods Regional Analysis and Outlook

8.4.6. South East Asia Personal Luxury Goods Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Personal Luxury Goods Regional Analysis and Outlook

8.5. South America Personal Luxury Goods Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Personal Luxury Goods Regional Analysis and Outlook

8.5.2. Argentina Personal Luxury Goods Regional Analysis and Outlook

8.5.3. Rest of South America Personal Luxury Goods Regional Analysis and Outlook

8.6. Middle East and Africa Personal Luxury Goods Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Personal Luxury Goods Regional Analysis and Outlook

8.6.2. Africa Personal Luxury Goods Regional Analysis and Outlook

Chapter 9. North America Personal Luxury Goods Analysis and Outlook

9.1. North America Personal Luxury Goods Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Personal Luxury Goods Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Personal Luxury Goods Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Personal Luxury Goods Revenue (USD Million) by Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Chapter 10. Europe Personal Luxury Goods Analysis and Outlook

10.1. Europe Personal Luxury Goods Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Personal Luxury Goods Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Personal Luxury Goods Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Personal Luxury Goods Revenue (USD Million) by Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Chapter 11. Asia Pacific Personal Luxury Goods Analysis and Outlook

11.1. Asia Pacific Personal Luxury Goods Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Personal Luxury Goods Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Personal Luxury Goods Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Personal Luxury Goods Revenue (USD Million) by Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Chapter 12. South America Personal Luxury Goods Analysis and Outlook

12.1. South America Personal Luxury Goods Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Personal Luxury Goods Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Personal Luxury Goods Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Personal Luxury Goods Revenue (USD Million) by Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Chapter 13. Middle East and Africa Personal Luxury Goods Analysis and Outlook

13.1. Middle East and Africa Personal Luxury Goods Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Personal Luxury Goods Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Personal Luxury Goods Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Personal Luxury Goods Revenue (USD Million) by Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Chapter 14. Personal Luxury Goods Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Capri Holdings Ltd

Chow Tai Fook Jewellery Group Ltd

Compagnie Financiere Richemont SA

Coty Inc

Giorgio Armani S.p.A.

Hermes International SA

Kering SA

L’Oréal S.A.

LVMH Moet Hennessy Louis Vuitton SE

PVH Corp

Ralph Lauren Corp

Rolex SA

Safilo Group Spa

Shiseido Co. Ltd

Swarovski AG

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Personal Luxury Goods Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Personal Luxury Goods Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Personal Luxury Goods Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Personal Luxury Goods Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Personal Luxury Goods Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Personal Luxury Goods Market Share (%) By Regions (2021-2032)

Table 12 North America Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Table 15 South America Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Table 17 North America Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Table 18 North America Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Table 19 North America Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Table 26 South America Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Table 27 South America Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Table 28 South America Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Personal Luxury Goods Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Personal Luxury Goods Market Share (%) By Regions (2023)

Figure 6. North America Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 12. France Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 12. China Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 14. India Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Personal Luxury Goods Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Personal Luxury Goods Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Personal Luxury Goods Revenue (USD Million) By Product (2021-2032)

By Product

Hard luxury

Apparel

Cosmetics and perfumes

Accessories

Others

By Distribution Channel

Offline

Online

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Personal Luxury Goods Market Size is valued at $92.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.6% to reach $142.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Capri Holdings Ltd, Chow Tai Fook Jewellery Group Ltd, Compagnie Financiere Richemont SA, Coty Inc, Giorgio Armani S.p.A., Hermes International SA, Kering SA, L’Oréal S.A., LVMH Moet Hennessy Louis Vuitton SE, PVH Corp, Ralph Lauren Corp, Rolex SA, Safilo Group Spa, Shiseido Co. Ltd, Swarovski AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume