The market growth is driven by an increasing pharmaceutical industry's increasing focus on rare diseases and orphan drugs have spurred demand for specialized therapeutic approaches, including peptides and oligonucleotides. These molecules often play a crucial role in addressing the underlying genetic causes of rare diseases. As more research and development efforts are directed toward orphan drugs, CDMOs specializing in peptide and oligonucleotide manufacturing may see heightened demand for their services. Leading Companies focusing on Expanded Applications in Gene Therapy, Integration of Artificial Intelligence and Automation, Customization, Personalized Medicine Solutions, and others to boost market shares in the industry.

Peptides and Oligonucleotides are increasingly becoming important as Active Pharmaceutical Ingredients and playing a vital role in drug development. With increasing orphan disease niche indications, the demand for peptide and oligonucleotides is increasing rapidly. Accordingly, CDMO (contract development and manufacturing organizations) companies across the world are investing in aggressive marketing to capture the increasing market demand. In particular, innovation and technology, operational excellence, sustainability, customer centricity and service are widely marketed by CDMO companies.

A growing interest in peptides and oligonucleotides is widely observed. Research articles in PubMed feature over 400,000 peptide studies and over 180,000 oligonucleotides studies. In terms of pipeline, around 2500 peptides and oligonucleotides are in pharmaceutical pipeline. Around 70% of these are in preclinical stage and around 100 peptides and oligonucleotides are launched/commercially available.

The escalating utilization of peptides and oligonucleotides in therapeutic applications marks a pivotal shift in the landscape of medical treatments, particularly in addressing complex ailments like cancer, metabolic disorders, and genetic conditions. In cancer therapeutics, peptides have gained prominence due to their potential as targeted therapies.

Peptide-based drugs can precisely target cancer cells, minimizing adverse effects on healthy tissues. Additionally, they exhibit versatility in combating various stages and types of cancer, offering a promising avenue for personalized treatments. Oligonucleotides, on the other hand, are rapidly emerging as a transformative tool in cancer therapy by modulating gene expression, inhibiting tumor growth, and sensitizing tumors to traditional treatments like chemotherapy, enhancing their efficacy.

The growing demand for personalized medicine supports the demand for peptides and oligonucleotides. Driven by novel drug discovery, genomic research advances, personalized medicine is expanding into non-oncological indications. Leading pharmaceutical companies are emphasizing on understanding individual patient variations in drug metabolism, response, and potential side effects, allowing for the customization of dosage regimens and therapeutic strategies. Advances in high-throughput genomic sequencing technologies, Liquid biopsies, Targeted Drug Development, Immunotherapy Advancements, pharmacogenomics including optimize drug selection, dosage, and treatment regimens, minimizing adverse reactions and improving therapeutic outcomes, big data analytics, and Patient-Centric Approach drive the market outlook.

Advancements in technology are revolutionizing peptide and oligonucleotide manufacturing, opening doors to novel applications and significantly improving efficiency and scalability. Companies are opting for Implementation of advanced level of automation and digitalization for flexible, reliable, and scalable manufacturing processes.

Automated peptide synthesizers have become integral to peptide manufacturing. further, solid-phase peptide synthesis, continuous flow chemistry, modern purification techniques, such as high-performance liquid chromatography (HPLC) and preparative chromatography, advanced analytical tools, cell-free systems, advances in the synthesis of RNA and DNA, and others support the market outlook. In addition, advancements in oligonucleotide drug delivery systems also encourage the demand for large-scale peptide and oligonucleotide production.

Peptides have long been a therapeutic niche product but are becoming increasingly important in medicine as active ingredients. Peptides provide bioactivity that can mimic that of proteins, whereas oligonucleotides like DNA can be used as scaffolds to immobilize other molecules with nanoscale precision. Peptides can be used to improve the potency of therapeutic oligonucleotides by conferring tissue and attaching cell-targeting, cell-penetrating or antiviral and antibacterial properties to them. Three prominent areas where peptides are gaining strong demand include obesity, diabetes, and cancer treatments.

In addition, peptides are also in demand for cardiovascular and neurodegenerative diseases, renal failure, vaccines, antibiotics, and in drugs for rare diseases. The demand for peptide therapeutics has been increasing due to their specificity, effectiveness, and lower toxicity compared to traditional drugs. Peptide CDMOs play a pivotal role in helping pharmaceutical companies bring peptide-based drugs to market faster and more efficiently.

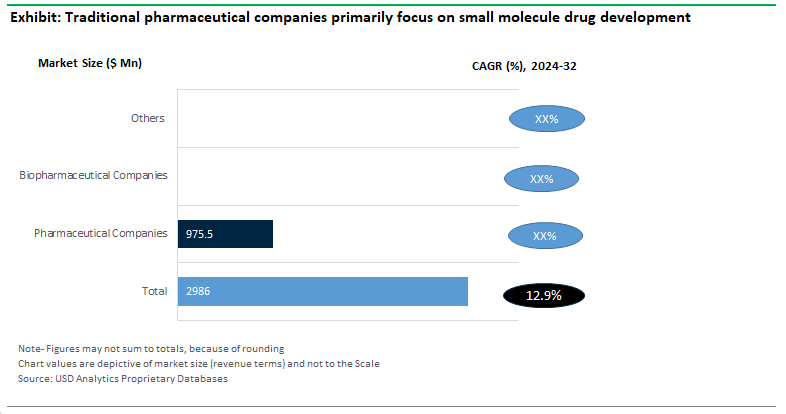

Traditional pharmaceutical companies primarily focus on small molecule drug development. Pharmaceutical CDMOs play a vital role in providing services related to chemical synthesis, formulation, and manufacturing of these small molecule drugs. Further, pharmaceutical companies involved in small molecule drug development also are exploring the use of oligonucleotides for specific applications, such as gene modulation. Further, pharmaceutical companies involved in the production of generic versions of peptide drugs and oligonucleotides also remain major consumers for CDMO Companies.

The US is the largest market for peptide and Oligonucleotide contract development and manufacturing, driven by the presence of large scale companies such as PolyPeptide Group, STA Pharmaceutical Co. Ltd., Bachem, Lonza, CMC Biopharma, and others. These companies are continuously investing in expanding their manufacturing lines and provide regulatory support for approval and marketing applications. The US remains the primary hub for pharmaceutical development outsourcing. Potential advantages of high quality, logistics, regulations, and IP rights make the market attractive for large companies. Amidst increasing number of complex and high potency compounds, CDMO companies stand out through advanced technologies and specialized expertise.

The growing emphasis on biologics, including peptides and oligonucleotides, in the pharmaceutical industry is creating opportunities for CDMOs. CDMO companies are investing in developing and manufacturing APIs for wide range of therapies that range from the treatment of wide-spread metabolic diseases like diabetes or obesity to cancer and cardiovascular or neurological disorders. In addition, ongoing research and development activities in the fields of oncology, rare diseases, and genetic disorders are driving the demand for specialized CDMO services. Further, the ability to navigate and adhere to the evolving regulatory landscape in the U.S., including FDA requirements presents robust advantages for domestic CDMOs.

The industry is fragmented in nature and is characterized by the presence of both capital-intensive global players and medium-scale local companies. Leading companies in the industry include- PolyPeptide Group, WuXi STA(Shanghai) Co.,Ltd (STA Pharmaceutical Co. Ltd.), Bachem, Creative Peptides, Aurigene Pharmaceutical Services Ltd., Merck KGaA, EUROAPI, Curia Global, Inc., CordenPharm, Sylentis, S.A., and others.

|

Stage |

Key Activities |

Key Companies |

Value Addition |

|

Discovery & Early Development |

Peptide/oligonucleotide synthesis, initial testing |

Eurofins Discovery, Bachem, GenScript |

Accelerates early research, reduces costs |

|

Process Development & Optimization |

Scale-up, process improvement |

CordenPharma, Polypeptide Group, WuXi AppTec |

Streamlines production, cost-effective scaling |

|

GMP Manufacturing |

Large-scale, compliant production |

Lonza, Bachem, Samsung Biologics, AGC Biologics |

Ensures regulatory compliance, consistent quality |

|

Quality Control & Analytical Testing |

Purity, potency, stability testing |

Almac Group, Charles River, SGS Life Sciences |

Guarantees safety, efficacy, and regulatory compliance |

|

Regulatory Support & Documentation |

Filing, compliance, documentation |

Parexel, Pharmaron, Syneos Health |

Reduces time to approval, ensures regulatory alignment |

|

Packaging & Distribution |

Secure packaging, logistics |

Sharp Packaging, PCI Pharma, Catalent |

Maintains product stability, compliant global distribution |

|

Clinical Trials & CRO Services |

Trial management, data analysis |

Covance, ICON plc, PPD (Thermo Fisher) |

Supports clinical testing, accelerates market entry |

|

Parameter |

Details |

|

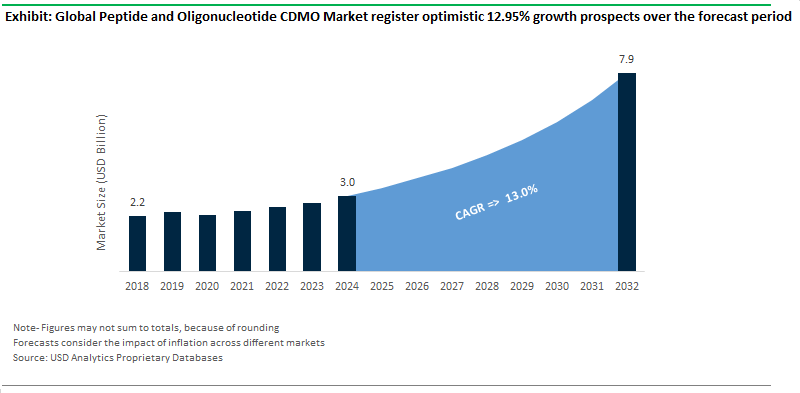

Market Size (2024) |

$2.98 Billion |

|

Market Size (2032) |

$7.91 Billion |

|

Market Growth Rate |

12.95% |

|

Largest Segment- Types |

Peptides (64.3% Market Share) |

|

Largest Growing Segment- Applications |

Pharmaceutical Companies ($97.5 Million Revenue) |

|

Potential Market |

United States ($932.7 Million Sales) |

|

Segments |

Types, Sales Channels, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

PolyPeptide Group, WuXi STA(Shanghai) Co.,Ltd (STA Pharmaceutical Co. Ltd.), Bachem, Creative Peptides, Aurigene Pharmaceutical Services Ltd., Merck KGaA, EUROAPI, Curia Global, Inc., CordenPharm, Sylentis, S.A. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Service

Applications

Countries Analyzed

Peptide and Oligonucleotide CDMO Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Peptide and Oligonucleotide CDMO Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Peptide and Oligonucleotide CDMO Market Size by Segments, 2018- 2023

Key Statistics, 2024

Peptide and Oligonucleotide CDMO Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Peptide and Oligonucleotide CDMO Types, 2018-2023

Peptide and Oligonucleotide CDMO Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Peptide and Oligonucleotide CDMO Applications, 2018-2023

7. Peptide and Oligonucleotide CDMO Market Size Outlook by Segments, 2024- 2032

Peptide and Oligonucleotide CDMO Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Peptide and Oligonucleotide CDMO Types, 2024-2032

Peptide and Oligonucleotide CDMO Market Size Outlook by Service, USD Million, 2024-2032

Growth Comparison (y-o-y) across Peptide and Oligonucleotide CDMO Services, 2024-2032

Peptide and Oligonucleotide CDMO Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Peptide and Oligonucleotide CDMO Applications, 2024-2032

8. Peptide and Oligonucleotide CDMO Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

United States Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

United States Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

10. Canada Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Canada Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Canada Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

11. Mexico Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Mexico Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Mexico Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

12. Germany Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Germany Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Germany Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

13. France Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

France Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

France Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

France Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

United Kingdom Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

United Kingdom Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

15. Spain Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Spain Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Spain Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

16. Italy Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Italy Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Italy Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

17. Benelux Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Benelux Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Benelux Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

18. Nordic Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Nordic Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Nordic Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Rest of Europe Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Rest of Europe Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

20. China Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

China Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

China Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

China Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

21. India Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

India Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

India Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

India Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

22. Japan Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Japan Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Japan Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

23. South Korea Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

South Korea Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

South Korea Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

24. Australia Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Australia Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Australia Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

25. South East Asia Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

South East Asia Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

South East Asia Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

27. Brazil Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Brazil Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Brazil Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

28. Argentina Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Argentina Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Argentina Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Rest of South America Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Rest of South America Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

United Arab Emirates Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

United Arab Emirates Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Saudi Arabia Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Saudi Arabia Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Rest of Middle East Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Rest of Middle East Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

33. South Africa Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

South Africa Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

South Africa Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Peptide and Oligonucleotide CDMO Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Peptide and Oligonucleotide CDMO Market Size Outlook by Type, 2021- 2032

Rest of Africa Peptide and Oligonucleotide CDMO Market Size Outlook by Application, 2021- 2032

Rest of Africa Peptide and Oligonucleotide CDMO Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Service

Applications

Countries Analyzed

USD Analytics forecasts the global Peptide and Oligonucleotide CDMO (contract development and manufacturing organizations) market size to increase from $2.98 Billion in 2024 to $7.91 Billion in 2032, registering a CAGR of 12.95% during the forecast period

Peptides (64.3% Market Share), Pharmaceutical Companies ($97.5 Million Revenue)

PolyPeptide Group, WuXi STA(Shanghai) Co.,Ltd (STA Pharmaceutical Co. Ltd.), Bachem, Creative Peptides, Aurigene Pharmaceutical Services Ltd., Merck KGaA, EUROAPI, Curia Global, Inc., CordenPharm, Sylentis, S.A.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume

United States ($932.7 Million Sales)