The global Paper and Paperboard Containers and Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Paper bags and sacks, Corrugated containers and packaging, Folding boxes and cases, Others), By End-User (Food and beverages, Industrial products, Healthcare, Others).

The market for paper and paperboard container and packaging is experiencing growth driven by the increasing demand for sustainable, recyclable, and biodegradable packaging solutions in industries such as food and beverages, retail, and e-commerce. Key trends shaping the future of the industry include innovations in paper and paperboard manufacturing processes, packaging design, and recycling technologies to meet consumer preferences for eco-friendly options, brand differentiation, and regulatory requirements for packaging waste reduction. Advanced paper and paperboard packaging offer benefits such as strength, printability, barrier properties, and versatility, making them suitable for various applications such as corrugated boxes, cartons, folding cartons, and tubes. Moreover, the integration of recycled fibers, bio-based coatings, and water-based inks enables the production of sustainable packaging solutions that minimize environmental impact and support circular economy initiatives. Additionally, the growing emphasis on e-commerce packaging, on-the-go consumption, and single-use plastics reduction drives market demand for paper and paperboard packaging that offers convenience, protection, and environmental responsibility. As brands and retailers seek to meet sustainability goals and consumer expectations, the paper and paperboard container and packaging market is poised for continued growth and innovation as a preferred choice for eco-conscious packaging across various industries.

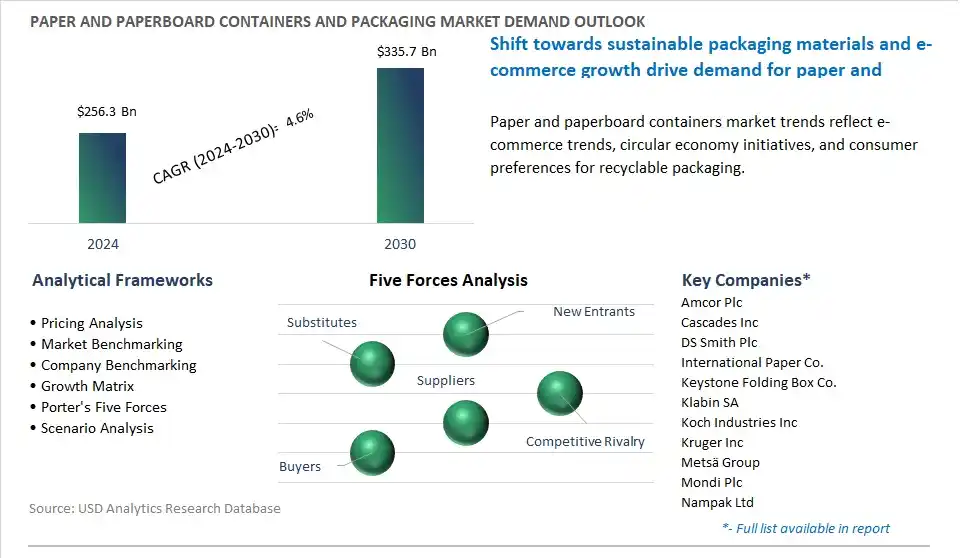

The market report analyses the leading companies in the industry including Amcor Plc, Cascades Inc, DS Smith Plc, International Paper Co., Keystone Folding Box Co., Klabin SA, Koch Industries Inc, Kruger Inc, Metsä Group, Mondi Plc, Nampak Ltd, Nippon Paper Industries Co. Ltd, Packaging Corp of America, Pactiv Evergreen Inc, Rengo Co. Ltd, Shandong Sun Holdings Group, Smurfit Kappa Group, Tetra Laval SA, WestRock Co..

A prominent trend in the paper and paperboard container and packaging market is the growing preference for sustainable packaging solutions. With heightened awareness of environmental issues and concerns over plastic pollution, there is a rising demand for packaging materials that are recyclable, biodegradable, and sourced from renewable resources. Paper and paperboard containers and packaging offer eco-friendly alternatives to traditional plastic packaging, catering to consumer preferences for environmentally responsible products. This trend is driving the adoption of paper-based packaging solutions across various industries, including food and beverage, cosmetics, healthcare, and e-commerce, shaping the future of the paper and paperboard container and packaging market.

The primary driver behind the growth of the paper and paperboard container and packaging market is the regulatory push towards plastic reduction and recycling initiatives worldwide. Governments, regulatory agencies, and industry associations are implementing policies, regulations, and incentives to reduce plastic waste, promote recycling, and encourage the use of sustainable packaging materials. This regulatory pressure creates a favorable environment for paper and paperboard packaging, as they offer recyclability, biodegradability, and compliance with environmental standards. Additionally, consumer demand for plastic-free alternatives and corporate sustainability commitments further drive the adoption of paper-based packaging solutions, stimulating market growth and innovation in the paper and paperboard container and packaging sector.

An opportunity for market growth within the paper and paperboard container and packaging sector lies in innovation in packaging design and functionality to meet the evolving needs of consumers and industries. Companies can capitalize on this opportunity by developing innovative paper-based packaging solutions that offer enhanced performance, convenience, and aesthetic appeal. This includes advancements in barrier coatings, printing technologies, structural design, and value-added features such as easy-open, resealable, and microwaveable packaging. Moreover, customization capabilities, sustainability certifications, and branding opportunities enable companies to differentiate their products and capture market share in competitive industries. By investing in research and development, collaboration with packaging designers and converters, and customer-centric product development, companies can unlock new opportunities for growth and innovation in the paper and paperboard container and packaging market.

The largest segment in the Paper and Paperboard Container and Packaging Market is the Corrugated containers and packaging segment. This dominance is primarily due to diverse factors. The corrugated containers and packaging are widely used across various industries for shipping, transportation, and storage of goods due to their strength, durability, and protective properties. Corrugated packaging consists of multiple layers of paperboard with a fluted inner layer sandwiched between two linerboards, providing excellent cushioning and stacking strength to protect products during handling and transit. Additionally, corrugated packaging is versatile and customizable, allowing for various box styles, sizes, and configurations to meet specific packaging requirements for different products and applications. In addition, corrugated containers and packaging offer cost-effectiveness compared to alternative packaging materials like plastics and metals, making them a preferred choice for many companies seeking sustainable and economical packaging solutions. Further, corrugated packaging is recyclable, renewable, and biodegradable, aligning with environmental sustainability goals and consumer preferences for eco-friendly packaging options. Over the forecast period, the combination of strength, versatility, cost-effectiveness, and sustainability positions the Corrugated containers and packaging segment as the largest and most significant segment in the Paper and Paperboard Container and Packaging Market.

The fastest-growing segment in the Paper and Paperboard Container and Packaging Market is the Food and beverages segment. The rapid growth is driven by the food and beverage industry is experiencing significant expansion globally due to population growth, urbanization, and changing consumer preferences for convenience and packaged food products. As a result, there is a growing demand for paper and paperboard packaging solutions to package various food and beverage products such as snacks, cereals, frozen foods, beverages, and fresh produce. Additionally, paper and paperboard packaging offer diverse advantages for food and beverage applications, including sustainability, recyclability, and food safety. Consumers are increasingly concerned about the environmental impact of packaging materials and prefer eco-friendly options, driving the adoption of paper-based packaging solutions. In addition, advancements in printing and coating technologies have enabled the development of high-quality, visually appealing, and functional paperboard packaging designs that enhance product visibility, branding, and shelf appeal. Further, the COVID-19 pandemic has accelerated the shift towards packaged and processed food products due to hygiene concerns and social distancing measures, further boosting the demand for paper and paperboard packaging in the food and beverage sector. Over the forecast period, the combination of industry growth, consumer trends, sustainability considerations, and technological advancements positions the Food and beverages segment as the fastest-growing segment in the Paper and Paperboard Container and Packaging Market.

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amcor Plc

Cascades Inc

DS Smith Plc

International Paper Co.

Keystone Folding Box Co.

Klabin SA

Koch Industries Inc

Kruger Inc

Metsä Group

Mondi Plc

Nampak Ltd

Nippon Paper Industries Co. Ltd

Packaging Corp of America

Pactiv Evergreen Inc

Rengo Co. Ltd

Shandong Sun Holdings Group

Smurfit Kappa Group

Tetra Laval SA

WestRock Co.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Paper and Paperboard Containers and Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Paper and Paperboard Containers and Packaging Market Size Outlook, $ Million, 2021 to 2030

3.2 Paper and Paperboard Containers and Packaging Market Outlook by Type, $ Million, 2021 to 2030

3.3 Paper and Paperboard Containers and Packaging Market Outlook by Product, $ Million, 2021 to 2030

3.4 Paper and Paperboard Containers and Packaging Market Outlook by Application, $ Million, 2021 to 2030

3.5 Paper and Paperboard Containers and Packaging Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Paper and Paperboard Containers and Packaging Industry

4.2 Key Market Trends in Paper and Paperboard Containers and Packaging Industry

4.3 Potential Opportunities in Paper and Paperboard Containers and Packaging Industry

4.4 Key Challenges in Paper and Paperboard Containers and Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Paper and Paperboard Containers and Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Paper and Paperboard Containers and Packaging Market Outlook by Segments

7.1 Paper and Paperboard Containers and Packaging Market Outlook by Segments, $ Million, 2021- 2030

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

8 North America Paper and Paperboard Containers and Packaging Market Analysis and Outlook To 2030

8.1 Introduction to North America Paper and Paperboard Containers and Packaging Markets in 2024

8.2 North America Paper and Paperboard Containers and Packaging Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Paper and Paperboard Containers and Packaging Market size Outlook by Segments, 2021-2030

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

9 Europe Paper and Paperboard Containers and Packaging Market Analysis and Outlook To 2030

9.1 Introduction to Europe Paper and Paperboard Containers and Packaging Markets in 2024

9.2 Europe Paper and Paperboard Containers and Packaging Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Paper and Paperboard Containers and Packaging Market Size Outlook by Segments, 2021-2030

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

10 Asia Pacific Paper and Paperboard Containers and Packaging Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Paper and Paperboard Containers and Packaging Markets in 2024

10.2 Asia Pacific Paper and Paperboard Containers and Packaging Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Paper and Paperboard Containers and Packaging Market size Outlook by Segments, 2021-2030

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

11 South America Paper and Paperboard Containers and Packaging Market Analysis and Outlook To 2030

11.1 Introduction to South America Paper and Paperboard Containers and Packaging Markets in 2024

11.2 South America Paper and Paperboard Containers and Packaging Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Paper and Paperboard Containers and Packaging Market size Outlook by Segments, 2021-2030

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

12 Middle East and Africa Paper and Paperboard Containers and Packaging Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Paper and Paperboard Containers and Packaging Markets in 2024

12.2 Middle East and Africa Paper and Paperboard Containers and Packaging Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Paper and Paperboard Containers and Packaging Market size Outlook by Segments, 2021-2030

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor Plc

Cascades Inc

DS Smith Plc

International Paper Co.

Keystone Folding Box Co.

Klabin SA

Koch Industries Inc

Kruger Inc

Metsä Group

Mondi Plc

Nampak Ltd

Nippon Paper Industries Co. Ltd

Packaging Corp of America

Pactiv Evergreen Inc

Rengo Co. Ltd

Shandong Sun Holdings Group

Smurfit Kappa Group

Tetra Laval SA

WestRock Co.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Paper bags and sacks

Corrugated containers and packaging

Folding boxes and cases

Others

By End-User

Food and beverages

Industrial products

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Paper and Paperboard Containers and Packaging is forecast to reach $335.7 Billion in 2030 from $256.3 Billion in 2024, registering a CAGR of 4.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor Plc, Cascades Inc, DS Smith Plc, International Paper Co., Keystone Folding Box Co., Klabin SA, Koch Industries Inc, Kruger Inc, Metsä Group, Mondi Plc, Nampak Ltd, Nippon Paper Industries Co. Ltd, Packaging Corp of America, Pactiv Evergreen Inc, Rengo Co. Ltd, Shandong Sun Holdings Group, Smurfit Kappa Group, Tetra Laval SA, WestRock Co.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume