The global Oxygen Barrier Materials Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (PVDC, EVOH, Polyamide, Aluminum, Others), By Type (Films, Coatings), By End-User (Food and Beverage, Pharmaceutical and Medical, Personal Care, Others).

Oxygen barrier materials represent a critical segment within the packaging industry, offering protection against oxygen permeation and extending the shelf life of packaged goods, especially in the food and beverage sector. These materials, ranging from metallized films to specialized coatings, serve as a barrier to prevent oxidation and maintain product freshness and quality. With the growing consumer demand for convenience and ready-to-eat products, the need for effective oxygen barrier materials has surged. Furthermore, stringent regulatory standards regarding food safety and preservation drive the adoption of advanced oxygen barrier solutions. The market witnesses continuous research and development efforts aimed at enhancing barrier properties while ensuring cost-effectiveness and sustainability, reflecting the dynamic nature of packaging technologies.

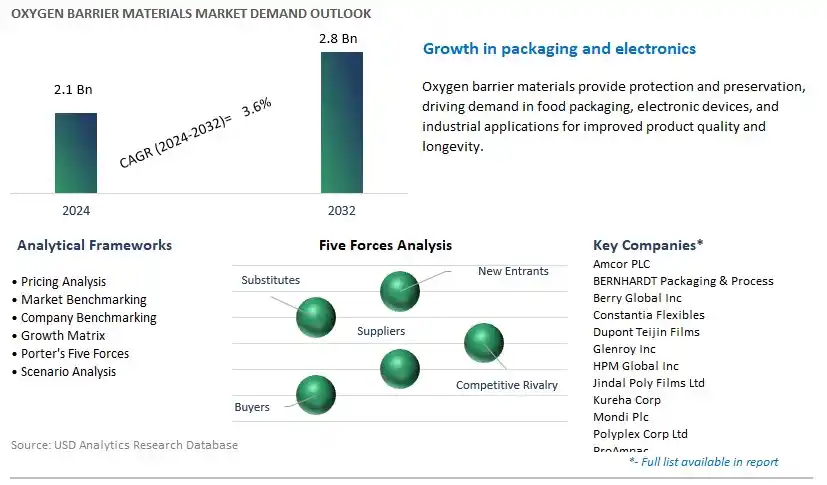

The market report analyses the leading companies in the industry including Amcor PLC, BERNHARDT Packaging & Process, Berry Global Inc, Constantia Flexibles, Dupont Teijin Films, Glenroy Inc, HPM Global Inc, Jindal Poly Films Ltd, Kureha Corp, Mondi Plc, Polyplex Corp Ltd, ProAmpac, Sealed Air, Shako Flexipack Pvt. Ltd, Sumitomo Chemical Co. Ltd, Uflex Ltd, Winpak Ltd, and others.

One prominent market trend in the oxygen barrier materials industry is the increasing demand for extended shelf life packaging solutions across various sectors such as food and beverage, pharmaceuticals, and cosmetics. Oxygen barrier materials play a critical role in preserving product freshness, flavor, and quality by preventing oxygen ingress, which can lead to oxidation, spoilage, and degradation of sensitive products. This trend is driven by consumer preferences for convenient, on-the-go products with longer shelf lives, as well as the growing importance of sustainability and reducing food waste, prompting manufacturers to adopt advanced oxygen barrier materials in packaging designs.

A key market driver for oxygen barrier materials is the growth in packaged food and beverage consumption worldwide, driven by urbanization, changing lifestyles, and increasing disposable incomes. As consumers gravitate towards convenience foods, ready-to-eat meals, and packaged beverages, there is a corresponding rise in demand for packaging materials that offer superior barrier properties to maintain product freshness and extend shelf life. Additionally, advancements in food processing and packaging technologies, coupled with innovations in barrier materials formulations, are enabling manufacturers to develop packaging solutions that meet evolving consumer preferences for convenience, portability, and product safety.

An opportunity for market growth lies in the development of high-performance barrier films and coatings tailored to specific packaging applications and performance requirements. Companies specializing in materials science and packaging technologies can capitalize on this opportunity by investing in research and innovation to enhance the barrier properties of existing materials or develop novel barrier solutions with improved oxygen resistance, moisture barrier, and aroma retention capabilities. Furthermore, the integration of multifunctional additives, nanotechnology, and bio-based materials into barrier formulations offers opportunities to enhance barrier performance while addressing sustainability concerns and regulatory requirements. By focusing on product differentiation and innovation, manufacturers can position themselves to capture market share and meet the growing demand for oxygen barrier materials in packaging applications.

Within the Oxygen Barrier Materials market, the largest segment is PVDC. PVDC is a highly effective oxygen barrier material known for its exceptional gas barrier properties, particularly against oxygen, moisture, and other gases. It is widely used in the packaging industry for food, pharmaceuticals, and other sensitive products to extend shelf life, maintain product freshness, and prevent spoilage. PVDC films offer superior oxygen barrier performance compared to other materials like EVOH (ethylene vinyl alcohol) and polyamides, making them the preferred choice for applications requiring long-term protection against oxygen ingress. The increasing demand for packaged foods, beverages, and pharmaceuticals, driven by changing consumer lifestyles, convenience, and hygiene concerns, fuels the growth of the PVDC market. Additionally, advancements in PVDC technology, such as improved heat resistance, transparency, and sustainability, further drive its adoption in flexible and rigid packaging applications. As industries continue to prioritize product quality, safety, and sustainability, the demand for PVDC as a key oxygen barrier material is expected to remain robust, solidifying its position as the largest segment in the Oxygen Barrier Materials market.

Within the Oxygen Barrier Materials market, the fastest-growing segment is Films. Films offer versatile solutions for oxygen barrier applications across various industries, including food packaging, pharmaceuticals, electronics, and agriculture. The demand for oxygen barrier films is rising rapidly due to their ability to provide superior protection against oxygen ingress, moisture transmission, and UV radiation, thereby extending the shelf life and maintaining the quality of packaged products. Moreover, advancements in film manufacturing technology, such as multilayer coextrusion and nanocomposite formulations, enable the development of high-performance oxygen barrier films with enhanced properties like transparency, flexibility, and puncture resistance. The increasing consumer demand for convenience, freshness, and sustainability drives the adoption of oxygen barrier films in flexible packaging formats like pouches, bags, and wraps. Additionally, stringent regulations and industry standards regarding food safety, shelf life extension, and environmental impact further boost the demand for oxygen barrier films. As industries continue to innovate and adapt to evolving market trends and consumer preferences, the demand for oxygen barrier films is expected to experience rapid growth, positioning films as the fastest-growing segment in the Oxygen Barrier Materials market.

Within the Oxygen Barrier Materials market, the largest segment is Food and Beverage. Oxygen barrier materials play a crucial role in preserving the quality and freshness of packaged food and beverages by preventing oxidation, spoilage, and degradation caused by exposure to oxygen. The food and beverage industry are one of the largest consumers of oxygen barrier materials, utilizing them in various packaging formats such as bottles, cans, pouches, cartons, and trays. With consumers increasingly demanding convenient, longer-lasting, and safer food products, the demand for effective oxygen barrier solutions continues to rise. Additionally, advancements in packaging technologies, such as modified atmosphere packaging (MAP) and active packaging systems, further drive the adoption of oxygen barrier materials in the food and beverage sector. Moreover, stringent regulatory requirements related to food safety, hygiene, and shelf life extension contribute to the steady demand for oxygen barrier materials in food packaging applications. As the food and beverage industry continues to innovate and respond to changing consumer preferences and regulatory standards, the demand for oxygen barrier materials in this segment is expected to remain robust, solidifying its position as the largest segment in the Oxygen Barrier Materials market.

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amcor PLC

BERNHARDT Packaging & Process

Berry Global Inc

Constantia Flexibles

Dupont Teijin Films

Glenroy Inc

HPM Global Inc

Jindal Poly Films Ltd

Kureha Corp

Mondi Plc

Polyplex Corp Ltd

ProAmpac

Sealed Air

Shako Flexipack Pvt. Ltd

Sumitomo Chemical Co. Ltd

Uflex Ltd

Winpak Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Oxygen Barrier Materials Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Oxygen Barrier Materials Market Size Outlook, $ Million, 2021 to 2032

3.2 Oxygen Barrier Materials Market Outlook by Type, $ Million, 2021 to 2032

3.3 Oxygen Barrier Materials Market Outlook by Product, $ Million, 2021 to 2032

3.4 Oxygen Barrier Materials Market Outlook by Application, $ Million, 2021 to 2032

3.5 Oxygen Barrier Materials Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Oxygen Barrier Materials Industry

4.2 Key Market Trends in Oxygen Barrier Materials Industry

4.3 Potential Opportunities in Oxygen Barrier Materials Industry

4.4 Key Challenges in Oxygen Barrier Materials Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Oxygen Barrier Materials Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Oxygen Barrier Materials Market Outlook by Segments

7.1 Oxygen Barrier Materials Market Outlook by Segments, $ Million, 2021- 2032

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

8 North America Oxygen Barrier Materials Market Analysis and Outlook To 2032

8.1 Introduction to North America Oxygen Barrier Materials Markets in 2024

8.2 North America Oxygen Barrier Materials Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Oxygen Barrier Materials Market size Outlook by Segments, 2021-2032

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

9 Europe Oxygen Barrier Materials Market Analysis and Outlook To 2032

9.1 Introduction to Europe Oxygen Barrier Materials Markets in 2024

9.2 Europe Oxygen Barrier Materials Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Oxygen Barrier Materials Market Size Outlook by Segments, 2021-2032

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

10 Asia Pacific Oxygen Barrier Materials Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Oxygen Barrier Materials Markets in 2024

10.2 Asia Pacific Oxygen Barrier Materials Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Oxygen Barrier Materials Market size Outlook by Segments, 2021-2032

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

11 South America Oxygen Barrier Materials Market Analysis and Outlook To 2032

11.1 Introduction to South America Oxygen Barrier Materials Markets in 2024

11.2 South America Oxygen Barrier Materials Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Oxygen Barrier Materials Market size Outlook by Segments, 2021-2032

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

12 Middle East and Africa Oxygen Barrier Materials Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Oxygen Barrier Materials Markets in 2024

12.2 Middle East and Africa Oxygen Barrier Materials Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Oxygen Barrier Materials Market size Outlook by Segments, 2021-2032

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor PLC

BERNHARDT Packaging & Process

Berry Global Inc

Constantia Flexibles

Dupont Teijin Films

Glenroy Inc

HPM Global Inc

Jindal Poly Films Ltd

Kureha Corp

Mondi Plc

Polyplex Corp Ltd

ProAmpac

Sealed Air

Shako Flexipack Pvt. Ltd

Sumitomo Chemical Co. Ltd

Uflex Ltd

Winpak Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

PVDC

EVOH

Polyamide

Aluminum

Others

By Type

Films

Coatings

By End-User

Food and Beverage

Pharmaceutical and Medical

Personal Care

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Oxygen Barrier Materials Market Size is valued at $2.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.6% to reach $2.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor PLC, BERNHARDT Packaging & Process, Berry Global Inc, Constantia Flexibles, Dupont Teijin Films, Glenroy Inc, HPM Global Inc, Jindal Poly Films Ltd, Kureha Corp, Mondi Plc, Polyplex Corp Ltd, ProAmpac, Sealed Air, Shako Flexipack Pvt. Ltd, Sumitomo Chemical Co. Ltd, Uflex Ltd, Winpak Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume