The global Oxo Alcohols Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (N-Butanol, ISO Butanol, 2-Ethylhexanol, Others), By Application (Acrylates, Glycol Ethers, Acetates, Lube Oil Additives, Resins, Solvents, Plasticizers, Others).

Oxo alcohols, also known as oxo chemicals or alkyl alcohols, are a family of organic compounds produced through the hydroformylation of olefins followed by hydrogenation. In 2024, the market for oxo alcohols remains essential as these chemicals serve as intermediate building blocks for a wide range of applications in industries such as plastics, coatings, adhesives, and lubricants. Oxo alcohols are characterized by their linear or branched alkyl chains and varying chain lengths, which impart different properties and functionalities to downstream products. Common oxo alcohols include butanol (C4), 2-ethylhexanol (2-EH), and isobutanol, each with its own unique chemical and physical properties. These alcohols are used as solvents, plasticizers, monomers, and raw materials for the synthesis of plasticizers, resins, and specialty chemicals. The demand for oxo alcohols is driven by factors such as economic growth, industrialization, and the increasing demand for polymers and chemicals in diverse end-user industries. Market trends include the development of oxo alcohols from renewable feedstocks such as biomass and bio-based sources, the optimization of production processes for improved efficiency and sustainability, and the customization of alcohol compositions and purities to meet specific application requirements and regulatory standards.

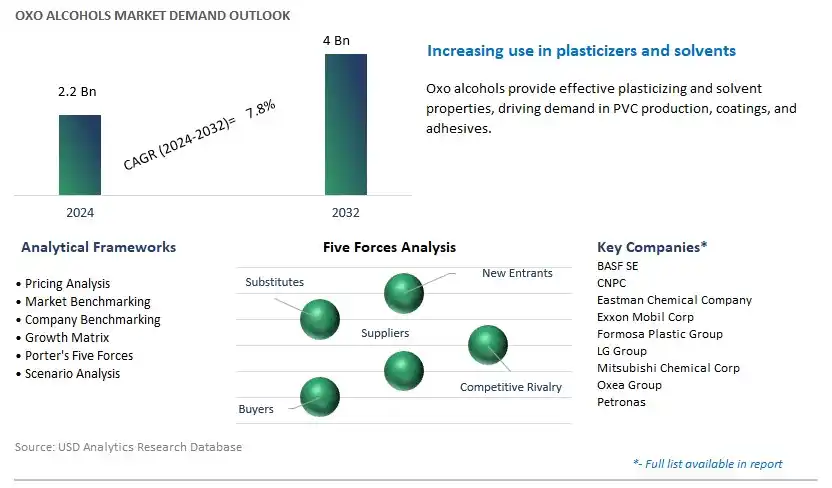

The market report analyses the leading companies in the industry including BASF SE, CNPC, Eastman Chemical Company, Exxon Mobil Corp, Formosa Plastic Group, LG Group, Mitsubishi Chemical Corp, Oxea Group, Petronas, and others.

A prominent market trend in oxo alcohols is the growing demand for bio-based variants derived from renewable feedstocks such as biomass, bioethanol, or vegetable oils. With increasing concerns about sustainability, environmental impact, and carbon footprint, there is a rising preference for bio-based alternatives to conventional oxo alcohols derived from fossil fuels. Bio-based oxo alcohols offer similar performance and functionality while offering potential environmental benefits such as reduced greenhouse gas emissions and dependence on finite resources. This trend towards bio-based oxo alcohols reflects the industry's commitment to sustainable practices and aligns with the growing demand for eco-friendly chemical solutions across various applications and industries.

A key driver for the oxo alcohols market is the expansion of end-use industries and applications that rely on these versatile chemical intermediates. Oxo alcohols serve as essential building blocks for the production of plasticizers, solvents, coatings, lubricants, and surfactants used in a wide range of industries such as automotive, construction, textiles, and consumer goods. The continued growth in these sectors, driven by factors such as population growth, urbanization, infrastructure development, and consumer demand, fuels the demand for oxo alcohols as key raw materials for manufacturing various products. As industries continue to innovate and diversify, the demand for oxo alcohols as crucial chemical intermediates is expected to remain strong, driving market growth and opportunities for suppliers.

A significant market opportunity for oxo alcohols lies in innovation in production processes and technologies to improve efficiency, reduce costs, and enhance sustainability. Manufacturers have the opportunity to invest in research and development to develop novel catalysts, reaction conditions, and feedstock options that enable the production of oxo alcohols with higher yields, purity, and environmental performance. Additionally, advancements in process intensification, energy efficiency, and waste minimization can further enhance the competitiveness of oxo alcohol production facilities. By leveraging the opportunity presented by innovation in production processes and technologies, suppliers of oxo alcohols can optimize their operations, differentiate their products, and capitalize on the growing demand for sustainable chemical solutions in the global market.

2-Ethylhexanol is the largest segment in the oxo alcohols market, primarily due to its extensive use in the production of plasticizers, which are crucial for manufacturing flexible PVC (polyvinyl chloride) products. 2-Ethylhexanol is a key raw material for the production of di-2-ethylhexyl phthalate (DEHP) and other plasticizers that are widely used in the construction, automotive, and consumer goods industries. The high demand for flexible PVC in applications such as cables, flooring, wall coverings, and medical devices drives the substantial consumption of 2-ethylhexanol. Additionally, 2-ethylhexanol is also used in the production of other chemicals, such as coatings, adhesives, and solvents, further enhancing its market demand. The versatility and critical role of 2-ethylhexanol in various industrial applications, combined with the continuous growth in sectors reliant on flexible PVC products, solidify its position as the largest segment in the oxo alcohols market. As industries continue to expand and innovate, the demand for 2-ethylhexanol is expected to remain strong, reinforcing its dominant market share.

Acrylates are the fastest-growing segment in the oxo alcohols market by application, driven by their widespread use in the production of coatings, adhesives, sealants, and textiles. Acrylates, derived from oxo alcohols, are key monomers in the formulation of acrylic polymers, which are valued for their excellent durability, weather resistance, and transparency. The growing demand for high-performance coatings in the automotive and construction industries significantly boosts the consumption of acrylates. Additionally, the expanding use of water-based acrylic adhesives in packaging, woodworking, and pressure-sensitive applications further propels this segment's growth. With the increasing focus on sustainability and the shift towards eco-friendly and low-VOC (volatile organic compounds) products, acrylates are gaining preference due to their relatively lower environmental impact compared to traditional solvent-based systems. Furthermore, the ongoing innovations in acrylic formulations to enhance properties such as flexibility, UV resistance, and adhesion are expanding the application scope of acrylates, driving their demand across various industrial sectors. As industries continue to innovate and prioritize sustainable solutions, the acrylates segment is poised for rapid growth, underscoring its importance in the oxo alcohols market.

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

CNPC

Eastman Chemical Company

Exxon Mobil Corp

Formosa Plastic Group

LG Group

Mitsubishi Chemical Corp

Oxea Group

Petronas

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Oxo Alcohols Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Oxo Alcohols Market Size Outlook, $ Million, 2021 to 2032

3.2 Oxo Alcohols Market Outlook by Type, $ Million, 2021 to 2032

3.3 Oxo Alcohols Market Outlook by Product, $ Million, 2021 to 2032

3.4 Oxo Alcohols Market Outlook by Application, $ Million, 2021 to 2032

3.5 Oxo Alcohols Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Oxo Alcohols Industry

4.2 Key Market Trends in Oxo Alcohols Industry

4.3 Potential Opportunities in Oxo Alcohols Industry

4.4 Key Challenges in Oxo Alcohols Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Oxo Alcohols Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Oxo Alcohols Market Outlook by Segments

7.1 Oxo Alcohols Market Outlook by Segments, $ Million, 2021- 2032

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

8 North America Oxo Alcohols Market Analysis and Outlook To 2032

8.1 Introduction to North America Oxo Alcohols Markets in 2024

8.2 North America Oxo Alcohols Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Oxo Alcohols Market size Outlook by Segments, 2021-2032

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

9 Europe Oxo Alcohols Market Analysis and Outlook To 2032

9.1 Introduction to Europe Oxo Alcohols Markets in 2024

9.2 Europe Oxo Alcohols Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Oxo Alcohols Market Size Outlook by Segments, 2021-2032

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

10 Asia Pacific Oxo Alcohols Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Oxo Alcohols Markets in 2024

10.2 Asia Pacific Oxo Alcohols Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Oxo Alcohols Market size Outlook by Segments, 2021-2032

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

11 South America Oxo Alcohols Market Analysis and Outlook To 2032

11.1 Introduction to South America Oxo Alcohols Markets in 2024

11.2 South America Oxo Alcohols Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Oxo Alcohols Market size Outlook by Segments, 2021-2032

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

12 Middle East and Africa Oxo Alcohols Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Oxo Alcohols Markets in 2024

12.2 Middle East and Africa Oxo Alcohols Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Oxo Alcohols Market size Outlook by Segments, 2021-2032

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

CNPC

Eastman Chemical Company

Exxon Mobil Corp

Formosa Plastic Group

LG Group

Mitsubishi Chemical Corp

Oxea Group

Petronas

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

N-Butanol

ISO Butanol

2-Ethylhexanol

Others

By Application

Acrylates

Glycol Ethers

Acetates

Lube Oil Additives

Resins

Solvents

Plasticizers

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Oxo Alcohols Market Size is valued at $2.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.8% to reach $4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, CNPC, Eastman Chemical Company, Exxon Mobil Corp, Formosa Plastic Group, LG Group, Mitsubishi Chemical Corp, Oxea Group, Petronas

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume