The global Organic Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Primers, Topcoats, Others), By Application (Protective, Marine, Architectural, Automotive, Others).

Organic coatings play a vital role in protecting and enhancing the durability, aesthetics, and functionality of various substrates across numerous industries, including automotive, aerospace, construction, marine, and consumer goods. These coatings, formulated from organic polymers and resins, offer a versatile solution for corrosion protection, weather resistance, chemical resistance, and decorative finishes. Organic coatings encompass a wide range of formulations, including paints, varnishes, enamels, lacquers, and stains, each tailored to specific application requirements and substrate materials. In the automotive industry, organic coatings are applied to vehicle bodies, chassis, and components to provide corrosion resistance, scratch resistance, and UV protection, while also enhancing visual appeal and brand identity. In aerospace applications, organic coatings are used to protect aircraft structures from environmental degradation, including corrosion, erosion, and thermal cycling, while also reducing drag and improving aerodynamic performance. In construction, organic coatings are applied to building exteriors, facades, roofing systems, and infrastructure to enhance durability, weatherability, and energy efficiency, as well as to create decorative finishes and architectural designs. Additionally, organic coatings find applications in marine environments, where they protect ships, offshore structures, and marine equipment from corrosion, biofouling, and harsh weather conditions. Furthermore, organic coatings are used in consumer goods, such as appliances, furniture, electronics, and sporting goods, to provide surface protection, color enhancement, and tactile feel. With continuous advancements in coating technologies, formulation chemistry, and application methods, organic coatings to evolve to meet the evolving needs of various industries, contributing to the longevity, performance, and aesthetics of coated products and structures.

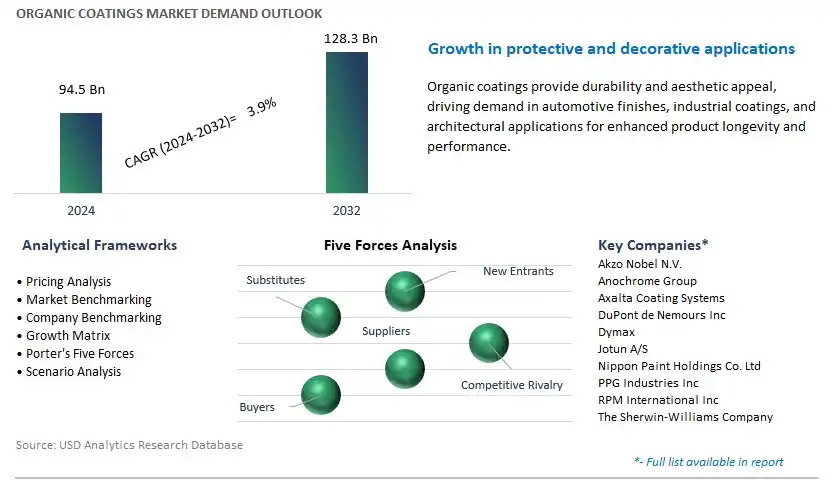

The market report analyses the leading companies in the industry including Akzo Nobel N.V., Anochrome Group, Axalta Coating Systems, DuPont de Nemours Inc, Dymax, Jotun A/S, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Company, and others.

One prominent market trend in the organic coatings industry is the rising preference for sustainable and eco-friendly coating solutions among consumers and businesses. With growing awareness of environmental issues and regulations aimed at reducing volatile organic compound (VOC) emissions, there is a shift towards organic coatings formulated with renewable raw materials and low VOC content. This trend is driven by factors such as sustainability initiatives, green building standards, and consumer demand for environmentally responsible products, prompting manufacturers to innovate and develop coatings that offer both performance and sustainability benefits.

A key market driver for organic coatings is the imposition of stringent environmental regulations and compliance requirements by government agencies and industry standards bodies. Regulatory measures aimed at reducing air pollution, minimizing toxic emissions, and promoting sustainable practices are driving the adoption of low VOC and zero VOC coatings across various sectors such as construction, automotive, and industrial manufacturing. Additionally, green building certifications such as LEED (Leadership in Energy and Environmental Design) mandate the use of environmentally friendly coatings in construction projects, creating incentives for manufacturers to invest in the development of compliant organic coating formulations.

An opportunity for market growth lies in the expansion of bio-based and natural coating technologies to meet the increasing demand for sustainable and health-conscious coating solutions. Companies can capitalize on this opportunity by leveraging biodegradable raw materials, such as plant oils, resins, and waxes, to formulate organic coatings that offer performance properties comparable to traditional synthetic coatings. Furthermore, the integration of natural additives, antimicrobial agents, and UV stabilizers into organic coating formulations enhances product functionality while aligning with consumer preferences for safe and eco-friendly coatings. By embracing bio-based and natural coating technologies, manufacturers can differentiate their products in the market, cater to the growing demand for sustainable solutions, and contribute to the advancement of environmentally responsible coating practices.

Within the Organic Coatings market, the largest segment is Topcoats. Topcoats are the final layer of organic coatings applied to surfaces to provide aesthetic appeal, weather resistance, and durability. They offer protection against environmental factors such as UV radiation, moisture, and chemical exposure, ensuring the longevity and performance of coated surfaces. Topcoats play a vital role in various industries, including automotive, aerospace, construction, and marine, where high-quality finishes are essential for enhancing product appearance and functionality. The automotive industry, in particular, represents a significant market for topcoats, with demand driven by factors such as vehicle customization, brand differentiation, and regulatory compliance regarding vehicle appearance and performance. Additionally, the construction sector relies on topcoats to protect buildings and infrastructure from weathering, corrosion, and fading, ensuring long-lasting aesthetics and structural integrity. As industries continue to prioritize surface protection, sustainability, and performance, the demand for topcoats in the Organic Coatings market is expected to remain robust, solidifying its position as the largest segment.

Among the segmented applications in the Organic Coatings market, the fastest-growing segment is Architectural. Architectural coatings are designed for use on residential, commercial, and institutional buildings to enhance aesthetics, provide protection, and improve durability. The growing construction industry, driven by urbanization, population growth, and infrastructure development, fuels the demand for architectural coatings globally. Additionally, increasing awareness of sustainable building practices and environmental regulations promoting low-VOC (volatile organic compound) coatings drive the adoption of eco-friendly organic coatings in architectural applications. Moreover, technological advancements in coating formulations, such as self-cleaning and anti-microbial properties, cater to evolving consumer preferences for high-performance and low-maintenance building finishes. As architectural design trends emphasize innovation, sustainability, and longevity, the demand for organic coatings in the architectural segment is expected to experience rapid growth, positioning it as the fastest-growing segment in the Organic Coatings market.

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel N.V.

Anochrome Group

Axalta Coating Systems

DuPont de Nemours Inc

Dymax

Jotun A/S

Nippon Paint Holdings Co. Ltd

PPG Industries Inc

RPM International Inc

The Sherwin-Williams Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Organic Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Organic Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 Organic Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 Organic Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 Organic Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 Organic Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Organic Coatings Industry

4.2 Key Market Trends in Organic Coatings Industry

4.3 Potential Opportunities in Organic Coatings Industry

4.4 Key Challenges in Organic Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Organic Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Organic Coatings Market Outlook by Segments

7.1 Organic Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

8 North America Organic Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America Organic Coatings Markets in 2024

8.2 North America Organic Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Organic Coatings Market size Outlook by Segments, 2021-2032

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

9 Europe Organic Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe Organic Coatings Markets in 2024

9.2 Europe Organic Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Organic Coatings Market Size Outlook by Segments, 2021-2032

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

10 Asia Pacific Organic Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Organic Coatings Markets in 2024

10.2 Asia Pacific Organic Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Organic Coatings Market size Outlook by Segments, 2021-2032

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

11 South America Organic Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America Organic Coatings Markets in 2024

11.2 South America Organic Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Organic Coatings Market size Outlook by Segments, 2021-2032

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

12 Middle East and Africa Organic Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Organic Coatings Markets in 2024

12.2 Middle East and Africa Organic Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Organic Coatings Market size Outlook by Segments, 2021-2032

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel N.V.

Anochrome Group

Axalta Coating Systems

DuPont de Nemours Inc

Dymax

Jotun A/S

Nippon Paint Holdings Co. Ltd

PPG Industries Inc

RPM International Inc

The Sherwin-Williams Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Primers

Topcoats

Others

By Application

Protective

Marine

Architectural

Automotive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Organic Coatings Market Size is valued at $94.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.9% to reach $128.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel N.V., Anochrome Group, Axalta Coating Systems, DuPont de Nemours Inc, Dymax, Jotun A/S, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, RPM International Inc, The Sherwin-Williams Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume