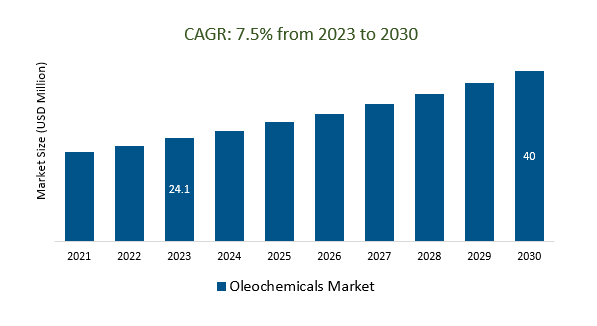

The Oleochemicals Market Size is estimated to be US 24.1 Billion in 2023. It is poised to register 7.5% growth over the forecast period from 2023 to 2030 to reach US $ 40 billion in 2030.

The market growth is driven by an increasing consumer preference for natural and organic products has led to increased use of oleochemicals in personal care, cosmetics, and food applications. Leading Companies focusing on Sustainable and Green Chemistry, Bio-Based Polymers and Materials, Personal Care and Cosmetics Industry, Industrial Applications, Carbon Neutrality Goals, Global Population Growth, and others to boost market shares in the industry.

The oleochemicals market is a rapidly expanding industry, driven by the increasing demand for sustainable and eco-friendly products. Oleochemicals, derived from natural oils and fats, find applications across various sectors, including personal care, cosmetics, household cleaning products, and food. Factors such as regulatory support, consumer awareness of environmental impact, and a shift towards bio-based alternatives are fueling market growth. Oleochemicals are used in the production of fatty acids, alcohols, esters, glycerin, and bio-based polymers. The market faces challenges related to feedstock availability and competition but is well-positioned to continue growing as industries seek greener alternatives to traditional petrochemicals.

The oleochemicals market is experiencing remarkable growth, propelled by the increasing consumer preference for natural and organic products. Oleochemicals, derived from renewable sources such as plant and animal fats, align perfectly with the rising sustainability and environmental consciousness. They are versatile ingredients, finding applications in personal care, cosmetics, food, and industrial sectors. As consumers become more discerning about the environmental impact of products, oleochemicals' status as naturally sourced, sustainable, and biodegradable compounds makes them highly sought-after in various industries.

The oleochemicals market is witnessing a notable surge in demand, particularly in pharmaceutical and nutraceutical applications. This growth is driven by the escalating preference among consumers and businesses for ingredients that are natural, sustainable, and environmentally friendly. Oleochemicals, sourced from renewable plant and animal fats, align perfectly with these criteria, making them attractive for use in the production of pharmaceuticals, dietary supplements, and functional food products.

The oleochemicals market is rapidly expanding, with the introduction of innovative industrial applications that are broadening its scope and opening new avenues for producers and manufacturers. Beyond traditional uses in personal care, cosmetics, and food, oleochemicals are finding their way into industries like lubricants, plastics, textiles, and agrochemicals, offering sustainable and biodegradable alternatives to traditional petrochemical-based products. This diversification of applications underscores the market's adaptability and growth potential, as it caters to the increasing demand for eco-friendly, bio-based solutions in numerous sectors

The Global Oleochemicals Market is analyzed across Specialty Esters, Fatty Acids, Methyl Esters, Glycerol Esters, Alkoxylates, Fatty Amines, Castor oil derivatives, and others. Specialty Esters is poised to register the fastest growth. Specialty esters are integral to the oleochemicals market, derived from natural oils and fats and valued for their versatility and eco-friendly properties. They are widely employed in personal care, cosmetics, food, pharmaceuticals, and industrial applications. Their demand is increasing as consumers and industries emphasize sustainability and natural alternatives, further establishing their significance in the oleochemicals market.

The Global Oleochemicals Market is analyzed across various applications including Personal Care and Cosmetics, Consumer Goods, Food Processing, Textiles, Paints and inks, Industrial, Healthcare and pharmaceuticals, Polymer and plastic Additives, and others. Of these Personal Care & Cosmetics held a significant market share in 2023. Oleochemicals are pivotal in the personal care and cosmetics industry, serving as natural and sustainable ingredients derived from plant and animal fats. They are essential for formulating skincare, haircare, and cosmetic products, offering emollient and texturizing properties. Oleochemicals align with the demand for eco-friendly options, meeting consumer preferences for safer and more sustainable choices in this sector.

By Type

• Specialty Esters

• Fatty Acid

• Methyl Ester

• Glycerol Esters

• Alkoxylates

• Fatty Amines

• Castor oil derivatives

• Others

By Application

• Personal Care & Cosmetics

• Consumer Goods

• Food Processing

• Textiles

• Paints & Inks

• Industrial

• Healthcare & Pharmaceuticals

• Polymer & Plastic Additives

• Others

By Region

*List not exhaustive

Oleochemicals Market Outlook 2023

1 Market Overview

1.1 Introduction

1.2 Scope/Objective of the study

1.3 Research Objective

1.3.1 Key Market Segments

1.3.2 Players Covered

1.3.3 Years Considered

2 Executive Summary

2.1 Introduction

3 Market Dynamics

3.1 Market Drivers

3.1.1 Functional Ingredients for Personal Care and Household Products

3.1.2 Oleochemicals in Pharmaceutical and Healthcare Products

3.2 Market Challenge

3.2.1 Raw Material Sourcing and Sustainability

3.2.2 Challenge2

3.3 Market Opportunity

3.3.1 Growing Consumer Demand for Natural and Green Products

3.3.2 Market Opportunity2

3.4 Market Trends

3.4.1 Technological Advancements in Oleochemical Processes

4 Market Factor Analysis

4.1 Porter’s Five Forces

4.2 Market Entropy

4.2.1 Global Oleochemicals Market Companies- Market Share Analysis

4.2.2 Products Offerings Global Oleochemicals Market

5 Post Pandemic Analysis and Outlook Scenarios

5.1.1 Scenario Analysis

5.1.2 Scenario Analysis - Low Growth Case

5.1.3 Scenario Analysis - Reference Growth Case

5.1.4 Scenario Analysis - Low Growth Case

6 Global Oleochemicals Market Trends

6.1 Global Oleochemicals Revenue (USD Million) and CAGR (%) by Type (2018-2028)

6.1.1 Specialty Esters

6.1.2 Fatty Acid

6.1.3 Methyl Ester

6.1.4 Glycerol Esters

6.1.5 Alkoxylates

6.1.6 Fatty Amines

6.1.7 Castor oil derivatives

6.1.8 Others

6.2 Global Oleochemicals Revenue (USD Million) and CAGR (%) by End-User (2018-2028)

6.2.1 Personal Care & Cosmetics

6.2.2 Consumer Goods

6.2.3 Food Processing

6.2.4 Textiles

6.2.5 Paints & Inks

6.2.6 Industrial

6.2.7 Healthcare & Pharmaceuticals

6.2.8 Polymer & Plastic Additives

6.2.9 Others

6.3 Global Oleochemicals Revenue (USD Million) and CAGR (%) by Regions (2018-2028)

7 Global Oleochemicals Market Revenue (USD Million) by Type, and Product (2018-2022)

7.1 Global Oleochemicals Revenue (USD Million) by Type (2018-2022)

7.1.1 Global Oleochemicals Revenue (USD Million), Market Share (%) by Type (2018-2022)

7.2 Global Oleochemicals Revenue (USD Million) by End-User (2018-2022)

7.2.1 Global Oleochemicals Revenue (USD Million), Market Share (%) by End-User (2018-

2022)

8 Global Oleochemicals Development Regional Status and Outlook

8.1 Global Oleochemicals Revenue (USD Million) By Regions (2018-2022)

8.2 North America Oleochemicals Revenue (USD Million) by Type, Type, and Product

(2018-2022)

8.2.1 North America Oleochemicals Revenue (USD Million) by Country (2018-2022)

8.2.2 North America Oleochemicals Revenue (USD Million) by Type (2018-2022)

8.2.3 North America Oleochemicals Revenue (USD Million) by End-User (2018-2022)

8.3 Europe Oleochemicals Revenue (USD Million), by Type, and Product (USD Million)

(2018-2022)

8.3.1 Europe Oleochemicals Revenue (USD Million), by Country (2018-2022)

8.3.2 Europe Oleochemicals Revenue (USD Million) by Type (2018-2022)

8.3.3 Europe Oleochemicals Revenue (USD Million) by End-User (2018-2022)

8.4 Asia Pacific Oleochemicals Revenue (USD Million), and Revenue (USD Million) by

Type, and Product (2018-2022)

8.4.1 Asia Pacific Oleochemicals Revenue (USD Million) by Country (2018-2022)

8.4.2 Asia Pacific Oleochemicals Revenue (USD Million) by Type (2018-2022)

8.4.3 Asia Pacific Oleochemicals Revenue (USD Million) by End-User (2018-2022)

8.5 South America Oleochemicals Revenue (USD Million), by Type, and Product (2018-

2022)

8.5.1 South America Oleochemicals Revenue (USD Million), by Country (2018-2022)

8.5.2 South America Oleochemicals Revenue (USD Million) by Type (2018-2022)

8.5.3 South America Oleochemicals Revenue (USD Million) by End-User (2018-2022)

8.6 Middle East and Africa Oleochemicals Revenue (USD Million), by Type, Type, Product,

Thickness (2018-2022)

8.6.1 Middle East and Africa Oleochemicals Revenue (USD Million) by Country (2018-2022)

8.6.2 Middle East and Africa Oleochemicals Revenue (USD Million) by Type (2018-2022)

8.6.3 Middle East and Africa Oleochemicals Revenue (USD Million) by End-User (2018-

2022)

9 Company Profiles

9.1 Vantage Specialty Chemicals, Inc.

9.2 Emery Oleochemicals

9.3 Evonik Industries AG

9.4 Wilmar International Ltd

9.5 Kao Chemicals Global

9.6 Ecogreen Oleochemicals

9.7 Corbion

9.8 Cargill, Incorporated

9.9 Oleon NV

9.10 Godrej Industries

9.11 IOI Corporation Berhad

9.12 KLK OLEO

9.13 Evyap Sabun Yag Gliserin San ve Tic A.S

9.14 JNJ Oleochemicals, Incorporated

9.15 Sakamoto Yakuhin kogyo Co., Ltd

9.16 Stephan Company

9.17 Pepmaco Manufacturing Corporation

9.18 Philippine International Dev., Inc.

10 Global Oleochemicals Market Revenue (USD Million), by Type, and Product (2023-2028)

10.1 Global Oleochemicals Revenue (USD Million) and Market Share (%) by Type (2023-

2028)

10.1.1 Global Oleochemicals Revenue (USD Million), and Market Share (%) by Type (2023-

2028)

10.2 Global Oleochemicals Revenue (USD Million) and Market Share (%) by End-User

(2023-2028)

10.2.1 Global Oleochemicals Revenue (USD Million), and Market Share (%) by End-User

(2023-2028)

11 Global Oleochemicals Development Regional Status and Outlook Forecast

11.1 Global Oleochemicals Revenue (USD Million) By Regions (2023-2028)

11.2 North America Oleochemicals Revenue (USD Million) by Type, and Product (2023-

2028)

11.2.1 North America Oleochemicals Revenue (USD) Million by Country (2023-2028)

11.2.2 North America Oleochemicals Revenue (USD Million), by Type (2023-2028)

11.2.3 North America Oleochemicals Revenue (USD Million), by End-User (2023-2028)

11.3 Europe Oleochemicals Revenue (USD Million), by Type, and Product (2023-2028)

11.3.1 Europe Oleochemicals Revenue (USD Million), by Country (2023-2028)

11.3.2 Europe Oleochemicals Revenue (USD Million), by Type (2023-2028)

11.3.3 Europe Oleochemicals Revenue (USD Million), by End-User (2023-2028)

11.4 Asia Pacific Oleochemicals Revenue (USD Million) by Type, and Product (2023-2028)

11.4.1 Asia Pacific Oleochemicals Revenue (USD Million), by Country (2023-2028)

11.4.2 Asia Pacific Oleochemicals Revenue (USD Million), by Type (2023-2028)

11.4.3 Asia Pacific Oleochemicals Revenue (USD Million), by End-User (2023-2028)

11.5 South America Oleochemicals Revenue (USD Million), by Type, and Product (2023-

2028)

11.5.1 South America Oleochemicals Revenue (USD Million), by Country (2023-2028)

11.5.2 South America Oleochemicals Revenue (USD Million), by Type (2023-2028)

11.5.3 South America Oleochemicals Revenue (USD Million), by End-User (2023-2028)

11.6 Middle East and Africa Oleochemicals Revenue (USD Million), by Type, and Product

(2023-2028)

11.6.1 Middle East and Africa Oleochemicals Revenue (USD Million), by Region (2023-2028)

11.6.2 Middle East and Africa Oleochemicals Revenue (USD Million), by Type (2023-2028)

11.6.3 Middle East and Africa Oleochemicals Revenue (USD Million), by End-User (2023-

2028)

12 Methodology and Data Source

12.1 Methodology/Research Approach

12.1.1 Research Programs/Design

12.1.2 Market Size Estimation

12.1.3 Market Breakdown and Data Triangulation

12.2 Data Source

12.2.1 Secondary Sources

12.2.2 Primary Sources

12.3 Disclaimer

Types

Applications

By Region