The global Nylon Resins Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Nylon 6, Nylon 6,6, Bio-based Nylon, Others), By Application (Moisture Absorbent, Chemical Resistant, Temperature Resistant, Aesthetic, Colorable, Nylon Alloys), By End-User (Automotive, Aerospace and Defense, Electrical and Electronics, Packaging and Storage, Extrusion, Textile).

Nylon resins, a type of synthetic thermoplastic polymer, are widely used in numerous industrial and consumer applications due to their excellent mechanical properties, chemical resistance, and versatility. Nylon resins belong to the polyamide family and are produced through polymerization of monomers derived from petrochemicals. They are known for their high strength-to-weight ratio, toughness, and abrasion resistance, making them suitable for applications requiring durable and lightweight materials. Nylon resins find extensive use in automotive components, electrical and electronic devices, textiles, packaging, and consumer goods. In the automotive industry, nylon resins are utilized in engine components, fuel systems, air intake manifolds, and interior parts to reduce weight, improve fuel efficiency, and enhance performance. In electrical and electronic applications, nylon resins are employed in connectors, switches, housings, and insulating materials due to their electrical insulation properties and resistance to heat and chemicals. Additionally, nylon resins are widely used in the production of fibers and textiles for apparel, carpets, industrial fabrics, and upholstery, offering durability, moisture resistance, and flexibility. Furthermore, nylon resins serve as packaging materials for food and beverage containers, films, and industrial packaging due to their barrier properties and moldability. With ongoing innovations in polymer chemistry and processing technologies, nylon resins to evolve to meet the changing demands of various industries, driving advancements in product design, performance, and sustainability.

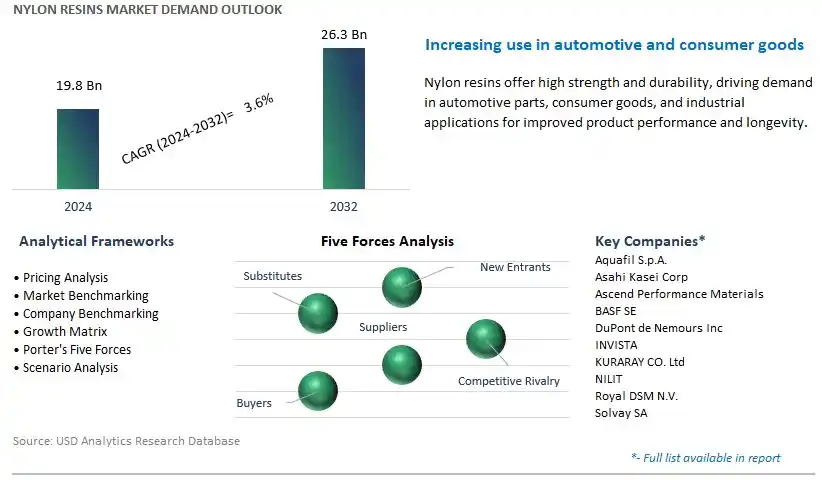

The market report analyses the leading companies in the industry including Aquafil S.p.A., Asahi Kasei Corp, Ascend Performance Materials, BASF SE, DuPont de Nemours Inc, INVISTA, KURARAY CO. Ltd, NILIT, Royal DSM N.V., Solvay SA, and others.

One significant market trend in the nylon resins industry is the growing demand for lightweight and high-performance materials across various end-use applications. Industries such as automotive, aerospace, and consumer goods are increasingly seeking advanced materials that offer a combination of strength, durability, and weight savings to enhance product performance and fuel efficiency. As a result, there is a shift towards the adoption of nylon resins, which exhibit excellent mechanical properties, chemical resistance, and processability, making them ideal for applications requiring lightweight components without compromising on structural integrity.

A primary market driver for nylon resins is the expansion of end-use industries such as automotive, electronics, packaging, and textiles, driven by economic growth, urbanization, and technological advancements. The automotive sector, in particular, is witnessing increased adoption of nylon resins for the production of lightweight components such as engine covers, intake manifolds, and fuel tanks to meet stringent fuel efficiency and emission standards. Additionally, ongoing innovations in polymer chemistry and manufacturing processes are enabling the development of advanced nylon formulations with enhanced properties such as heat resistance, flame retardancy, and recyclability, further driving the demand for nylon resins across diverse applications.

An opportunity for market growth lies in the development of sustainable nylon resins and participation in circular economy initiatives to address environmental concerns and meet evolving consumer preferences. With growing awareness of plastic pollution and the need for resource conservation, there is increasing pressure on industries to adopt sustainable practices and reduce their carbon footprint. Companies can capitalize on this opportunity by investing in the research and development of bio-based nylon resins derived from renewable sources such as biomass or recycled materials, thereby offering environmentally friendly alternatives to conventional petroleum-based nylon. Furthermore, participation in recycling programs and the establishment of closed-loop supply chains can contribute to the circularity of nylon resins, promoting resource efficiency and minimizing waste generation throughout the product lifecycle.

Within the Nylon Resins market, the largest segment is Nylon 6,6. Nylon 6,6, also known as polyamide 6,6, is a widely used engineering thermoplastic known for its excellent mechanical properties, thermal stability, and chemical resistance. It finds extensive applications in industries such as automotive, electrical and electronics, consumer goods, and textiles. Nylon 6,6 is preferred in applications requiring high strength, stiffness, and dimensional stability, making it suitable for components subjected to mechanical stress, heat, and chemical exposure. Additionally, its superior melt processability and ability to be reinforced with fillers or fibers further enhance its versatility and performance in various manufacturing processes. With the automotive industry's shift towards lightweight materials, the growing demand for durable consumer goods, and the increasing adoption of nylon resins in emerging applications such as 3D printing, Nylon 6,6 maintains its dominance as the largest segment in the Nylon Resins market.

Among the segmented applications in the Nylon Resins market, the fastest-growing segment is Nylon Alloys. Nylon alloys refer to blends or combinations of nylon resins with other polymers or additives to enhance specific properties or create novel material characteristics. These alloys offer advantages such as improved mechanical strength, impact resistance, chemical resistance, and thermal stability compared to pure nylon resins. They find applications in various industries such as automotive, aerospace, electronics, and consumer goods, where demanding performance requirements necessitate the use of advanced materials. Nylon alloys are increasingly favored for their ability to tailor material properties to meet specific application needs, such as lightweighting, structural reinforcement, and functional integration. Moreover, the continuous development of new alloy formulations and processing techniques, along with advancements in additive manufacturing technologies, is driving the adoption of nylon alloys in emerging applications such as 3D printing and lightweighting solutions. As industries seek innovative materials that offer superior performance and design flexibility, the demand for nylon alloys is expected to experience rapid growth, positioning it as the fastest-growing segment in the Nylon Resins market.

Within the Nylon Resins market, the largest segment is Automotive. Nylon resins play a pivotal role in automotive applications due to their exceptional mechanical properties, including high strength, stiffness, and impact resistance, combined with excellent chemical resistance and thermal stability. These properties make nylon resins ideal for various automotive components such as engine parts, fuel systems, electrical connectors, and interior trim components. Additionally, the automotive industry's increasing focus on lightweighting to improve fuel efficiency and reduce emissions has spurred the adoption of nylon resins as alternatives to traditional metal and other materials. Furthermore, the trend towards electric and hybrid vehicles, which require lightweight yet durable components, further drives the demand for nylon resins in the automotive sector. With the automotive industry poised for continued growth and innovation, fuelled by advancements in electric vehicle technology and autonomous driving systems, the demand for nylon resins in automotive applications is expected to remain robust, solidifying its position as the largest segment in the Nylon Resins market.

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

TextileCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aquafil S.p.A.

Asahi Kasei Corp

Ascend Performance Materials

BASF SE

DuPont de Nemours Inc

INVISTA

KURARAY CO. Ltd

NILIT

Royal DSM N.V.

Solvay SA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Nylon Resins Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Nylon Resins Market Size Outlook, $ Million, 2021 to 2032

3.2 Nylon Resins Market Outlook by Type, $ Million, 2021 to 2032

3.3 Nylon Resins Market Outlook by Product, $ Million, 2021 to 2032

3.4 Nylon Resins Market Outlook by Application, $ Million, 2021 to 2032

3.5 Nylon Resins Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Nylon Resins Industry

4.2 Key Market Trends in Nylon Resins Industry

4.3 Potential Opportunities in Nylon Resins Industry

4.4 Key Challenges in Nylon Resins Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Nylon Resins Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Nylon Resins Market Outlook by Segments

7.1 Nylon Resins Market Outlook by Segments, $ Million, 2021- 2032

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

8 North America Nylon Resins Market Analysis and Outlook To 2032

8.1 Introduction to North America Nylon Resins Markets in 2024

8.2 North America Nylon Resins Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Nylon Resins Market size Outlook by Segments, 2021-2032

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

9 Europe Nylon Resins Market Analysis and Outlook To 2032

9.1 Introduction to Europe Nylon Resins Markets in 2024

9.2 Europe Nylon Resins Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Nylon Resins Market Size Outlook by Segments, 2021-2032

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

10 Asia Pacific Nylon Resins Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Nylon Resins Markets in 2024

10.2 Asia Pacific Nylon Resins Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Nylon Resins Market size Outlook by Segments, 2021-2032

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

11 South America Nylon Resins Market Analysis and Outlook To 2032

11.1 Introduction to South America Nylon Resins Markets in 2024

11.2 South America Nylon Resins Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Nylon Resins Market size Outlook by Segments, 2021-2032

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

12 Middle East and Africa Nylon Resins Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Nylon Resins Markets in 2024

12.2 Middle East and Africa Nylon Resins Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Nylon Resins Market size Outlook by Segments, 2021-2032

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aquafil S.p.A.

Asahi Kasei Corp

Ascend Performance Materials

BASF SE

DuPont de Nemours Inc

INVISTA

KURARAY CO. Ltd

NILIT

Royal DSM N.V.

Solvay SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Nylon 6

Nylon 6,6

Bio-based Nylon

Others

By Application

Moisture Absorbent

Chemical Resistant

Temperature Resistant

Aesthetic

Colorable

Nylon Alloys

By End-User

Automotive

Aerospace and Defense

Electrical and Electronics

Packaging and Storage

Extrusion

Textile

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Nylon Resins Market Size is valued at $19.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.6% to reach $26.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aquafil S.p.A., Asahi Kasei Corp, Ascend Performance Materials, BASF SE, DuPont de Nemours Inc, INVISTA, KURARAY CO. Ltd, NILIT, Royal DSM N.V., Solvay SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume