The global Nutraceuticals Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Ingredient (Aloe vera, Amino acids, Botanical Ingredients, Cannabidiol (CBD), Carbohydrates, Carnitine, Food Color, Carotenoids, Spirulina, Collagen, Colostrum, Cultures and fermentation starters, Dairy ingredients, Emulsifiers, Enzymes, Essential oils, Fat replacers, Fats and oils, Fibers, Flavors, Fruit and vegetable products, Glucosamine / Chondroitin, Isoflavones, Juices and concentrates, Krill, Lipids / Fatty Acids, Marine ingredients, Minerals, Omega-3s, Prebiotics, Probiotics, Proteins, Sweeteners, Vitamins, Whey proteins, Others), By Product (Dietary Supplements, Functional Food, Functional Beverages), By Application (Allergy & intolerance, Animal nutrition, Bone & joint health, Cancer prevention, Children's health, Cognitive health, Diabetes, Heart health, Immune system, Infant health, Inflammation, Nutricosmetics, Personalized nutrition, Sports nutrition, Weight management & satiety, Others)

The nutraceuticals market continues to expand in 2024, driven by the growing awareness of preventive healthcare, the rising incidence of chronic diseases, and the increasing consumer interest in natural and functional ingredients for health and wellness. Nutraceuticals, comprising dietary supplements, functional foods, and beverages fortified with bioactive compounds, vitamins, minerals, and herbal extracts, offer a convenient and accessible means to promote overall health, vitality, and disease prevention. With an aging population and escalating healthcare costs, consumers are turning to nutraceuticals as proactive measures to address nutritional deficiencies, boost immunity, and support optimal health outcomes. Moreover, the beauty and personal care industry are incorporating nutraceutical ingredients into skincare and hair care formulations, harnessing their antioxidant, anti-aging, and moisturizing properties for holistic beauty solutions. Additionally, the sports and fitness sector are embracing nutraceutical supplements to enhance athletic performance, muscle recovery, and endurance, further driving market growth. As regulatory frameworks evolve, and scientific advancements continue to validate the efficacy and safety of nutraceutical ingredients, the nutraceuticals market is poised for sustained growth and innovation, with opportunities for product differentiation, market segmentation, and strategic partnerships shaping the future of the global health and wellness industry.

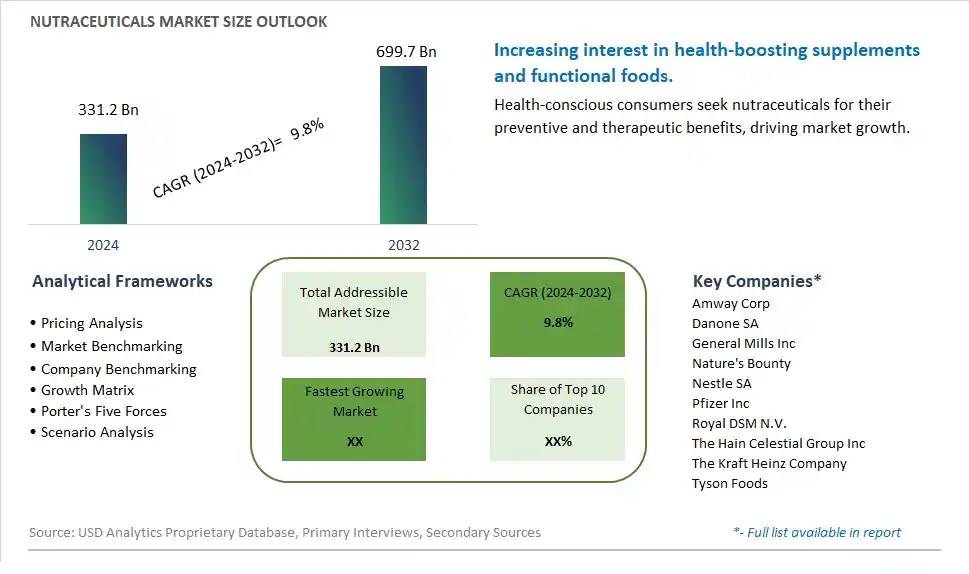

The market report analyses the leading companies in the industry including Amway Corp, Danone SA, General Mills Inc, Nature's Bounty, Nestle SA, Pfizer Inc, Royal DSM N.V., The Hain Celestial Group Inc, The Kraft Heinz Company, Tyson Foods, and Others.

One prominent trend in the nutraceuticals market is the increasing demand for health and wellness products. As consumers become more proactive about managing their health and well-being, there is a growing interest in nutraceuticals – products that offer health benefits beyond basic nutrition. Nutraceuticals encompass a wide range of dietary supplements, functional foods, and beverages that contain bioactive compounds with purported health benefits, such as vitamins, minerals, antioxidants, probiotics, and botanical extracts. This trend is driving the growth of the nutraceuticals market as consumers seek out products that support their overall health, immunity, cognitive function, and vitality.

A key driver in the nutraceuticals market is the aging population and the focus on preventive healthcare. With demographic shifts leading to a larger population of elderly individuals worldwide, there is a growing awareness of the importance of preventive health measures to maintain quality of life and longevity. Nutraceuticals play a vital role in preventive healthcare by providing targeted nutritional support for age-related health concerns such as joint health, cognitive decline, cardiovascular health, and bone health. This driver fuels market growth as older adults, as well as younger generations, increasingly incorporate nutraceuticals into their daily routines to proactively address health issues and maintain optimal well-being.

An emerging opportunity in the nutraceuticals market is innovation in functional ingredients and product formulations. With advancements in nutritional science and technology, there is immense potential to develop new nutraceutical products that offer enhanced efficacy, bioavailability, and targeted health benefits. Manufacturers can explore innovative ingredients such as bioactive peptides, marine-derived compounds, nutraceutical enzymes, and personalized nutrition solutions to address specific health concerns and consumer preferences. Additionally, there's an opportunity to create convenient and enjoyable delivery formats such as gummies, chewables, effervescents, and ready-to-drink beverages to appeal to diverse consumer demographics. By embracing innovation and addressing evolving consumer needs, nutraceutical companies can differentiate their offerings and capitalize on the growing demand for functional and preventive healthcare solutions.

Among the myriad ingredients in the nutraceuticals market, proteins emerge as the largest segment, owing to several key factors. Proteins play a fundamental role in human nutrition, serving as the building blocks for various tissues and organs, as well as being crucial components of enzymes, hormones, and immune system molecules. The widespread recognition of proteins as essential nutrients for supporting muscle growth, repair, and overall health has fueled their pervasive presence in nutraceutical products catering to diverse consumer needs, including sports nutrition, weight management, and dietary supplementation. Further, the growing consumer awareness of the importance of protein intake in promoting satiety, aiding in weight loss, and maintaining muscle mass has led to increased demand for protein-enriched functional foods, beverages, and supplements. Furthermore, the versatility of proteins in formulation allows for the development of innovative and customized nutraceutical products tailored to specific dietary preferences, lifestyles, and health goals. As the global population continues to prioritize health and wellness, the dominance of proteins as the largest segment in the nutraceuticals market is expected to persist, driving innovation and market growth in the years to come.

Within the nutraceuticals market segmented by product type, functional beverages emerge as the fastest-growing segment, propelled by several key factors. As consumers increasingly prioritize health and wellness, there is a growing demand for convenient and functional beverage options that offer nutritional benefits beyond hydration. Functional beverages, enriched with vitamins, minerals, antioxidants, and other bioactive ingredients, appeal to consumers seeking convenient solutions to support their overall health, energy levels, and immune function. The versatility of functional beverages allows for innovative formulations targeting specific health concerns, such as gut health, cognitive function, and stress reduction, catering to the diverse needs of today's health-conscious consumers. Further, the rising popularity of on-the-go consumption habits and the shift towards healthier beverage choices drive the adoption of functional beverages as an integral component of daily dietary routines. Additionally, the dynamic nature of the beverage industry fosters continuous innovation and product development, with manufacturers introducing novel ingredients and flavor profiles to enhance the efficacy and appeal of functional beverages. As functional beverages continue to gain traction among consumers seeking convenient and effective ways to support their well-being, the segment is poised for sustained growth, shaping the evolving landscape of the nutraceuticals market.

Among the diverse applications within the nutraceuticals market, weight management & satiety is the largest segment, driven by several significant factors. With the global rise in obesity rates and the increasing awareness of the importance of maintaining a healthy weight, consumers are actively seeking effective solutions to manage weight and control hunger. Nutraceutical products targeting weight management and satiety offer a holistic approach, combining nutritional ingredients with appetite-suppressing properties to support weight loss goals and promote feelings of fullness. The prevalence of sedentary lifestyles and unhealthy eating habits further underscores the demand for nutraceuticals designed to address weight-related concerns. Further, the integration of scientific research and technological advancements in product development has led to the formulation of innovative weight management solutions tailored to individual needs and preferences. As consumers continue to prioritize health and wellness, the weight management & satiety segment is poised for sustained growth, driving the expansion of the nutraceuticals market globally.

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amway Corp

Danone SA

General Mills Inc

Nature's Bounty

Nestle SA

Pfizer Inc

Royal DSM N.V.

The Hain Celestial Group Inc

The Kraft Heinz Company

Tyson Foods

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Nutraceuticals Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Nutraceuticals Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Nutraceuticals Market Share by Company, 2023

4.1.2. Product Offerings of Leading Nutraceuticals Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Nutraceuticals Market Drivers

6.2. Nutraceuticals Market Challenges

6.6. Nutraceuticals Market Opportunities

6.4. Nutraceuticals Market Trends

Chapter 7. Global Nutraceuticals Market Outlook Trends

7.1. Global Nutraceuticals Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Nutraceuticals Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Nutraceuticals Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Chapter 8. Global Nutraceuticals Regional Analysis and Outlook

8.1. Global Nutraceuticals Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Nutraceuticals Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Nutraceuticals Regional Analysis and Outlook

8.2.2. Canada Nutraceuticals Regional Analysis and Outlook

8.2.3. Mexico Nutraceuticals Regional Analysis and Outlook

8.3. Europe Nutraceuticals Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Nutraceuticals Regional Analysis and Outlook

8.3.2. France Nutraceuticals Regional Analysis and Outlook

8.3.3. United Kingdom Nutraceuticals Regional Analysis and Outlook

8.3.4. Spain Nutraceuticals Regional Analysis and Outlook

8.3.5. Italy Nutraceuticals Regional Analysis and Outlook

8.3.6. Russia Nutraceuticals Regional Analysis and Outlook

8.3.7. Rest of Europe Nutraceuticals Regional Analysis and Outlook

8.4. Asia Pacific Nutraceuticals Revenue (USD Million) by Country (2021-2032)

8.4.1. China Nutraceuticals Regional Analysis and Outlook

8.4.2. Japan Nutraceuticals Regional Analysis and Outlook

8.4.3. India Nutraceuticals Regional Analysis and Outlook

8.4.4. South Korea Nutraceuticals Regional Analysis and Outlook

8.4.5. Australia Nutraceuticals Regional Analysis and Outlook

8.4.6. South East Asia Nutraceuticals Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Nutraceuticals Regional Analysis and Outlook

8.5. South America Nutraceuticals Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Nutraceuticals Regional Analysis and Outlook

8.5.2. Argentina Nutraceuticals Regional Analysis and Outlook

8.5.3. Rest of South America Nutraceuticals Regional Analysis and Outlook

8.6. Middle East and Africa Nutraceuticals Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Nutraceuticals Regional Analysis and Outlook

8.6.2. Africa Nutraceuticals Regional Analysis and Outlook

Chapter 9. North America Nutraceuticals Analysis and Outlook

9.1. North America Nutraceuticals Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Nutraceuticals Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Nutraceuticals Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Nutraceuticals Revenue (USD Million) by Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Chapter 10. Europe Nutraceuticals Analysis and Outlook

10.1. Europe Nutraceuticals Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Nutraceuticals Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Nutraceuticals Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Nutraceuticals Revenue (USD Million) by Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Chapter 11. Asia Pacific Nutraceuticals Analysis and Outlook

11.1. Asia Pacific Nutraceuticals Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Nutraceuticals Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Nutraceuticals Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Nutraceuticals Revenue (USD Million) by Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Chapter 12. South America Nutraceuticals Analysis and Outlook

12.1. South America Nutraceuticals Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Nutraceuticals Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Nutraceuticals Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Nutraceuticals Revenue (USD Million) by Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Chapter 13. Middle East and Africa Nutraceuticals Analysis and Outlook

13.1. Middle East and Africa Nutraceuticals Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Nutraceuticals Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Nutraceuticals Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Nutraceuticals Revenue (USD Million) by Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Chapter 14. Nutraceuticals Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Amway Corp

Danone SA

General Mills Inc

Nature's Bounty

Nestle SA

Pfizer Inc

Royal DSM N.V.

The Hain Celestial Group Inc

The Kraft Heinz Company

Tyson Foods

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Nutraceuticals Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Nutraceuticals Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Nutraceuticals Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Nutraceuticals Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Nutraceuticals Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Nutraceuticals Market Share (%) By Regions (2021-2032)

Table 12 North America Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Table 15 South America Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Table 17 North America Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Table 18 North America Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Table 19 North America Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Table 26 South America Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Table 27 South America Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Table 28 South America Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Nutraceuticals Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Nutraceuticals Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Nutraceuticals Market Share (%) By Regions (2023)

Figure 6. North America Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 12. France Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 12. China Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 14. India Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Nutraceuticals Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Nutraceuticals Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Nutraceuticals Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Nutraceuticals Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Nutraceuticals Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Nutraceuticals Revenue (USD Million) By Product (2021-2032)

By Ingredient

Aloe vera

Amino acids

Botanical Ingredients

Cannabidiol (CBD)

Carbohydrates

Carnitine

Food Color

Carotenoids

Spirulina

Collagen

Colostrum

Cultures and fermentation starters

Dairy ingredients

Emulsifiers

Enzymes

Essential oils

Fat replacers

Fats and oils

Fibers

Flavors

Fruit and vegetable products

Glucosamine / Chondroitin

Isoflavones

Juices and concentrates

Krill

Lipids / Fatty Acids

Marine ingredients

Minerals

Omega-3s

Prebiotics

Probiotics

Proteins

Sweeteners

Vitamins

Whey proteins

Others

By Product

Dietary Supplements

Functional Food

Functional Beverages

By Application

Allergy & intolerance

Animal nutrition

Bone & joint health

Cancer prevention

Children's health

Cognitive health

Diabetes

Heart health

Immune system

Infant health

Inflammation

Nutricosmetics

Personalized nutrition

Sports nutrition

Weight management & satiety

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Nutraceuticals Market Size is valued at $331.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 9.8% to reach $699.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amway Corp, Danone SA, General Mills Inc, Nature's Bounty, Nestle SA, Pfizer Inc, Royal DSM N.V., The Hain Celestial Group Inc, The Kraft Heinz Company, Tyson Foods

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume