The global Nutraceutical Ingredients Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Ingredient (Probiotics, Proteins and Amino Acids, Phytochemicals & Plant Extracts, Fibers & Specialty Carbohydrates, Omega-3 Fatty Acids, Vitamins, Prebiotic, Carotenoids, Minerals), By Form (Dry, Liquid), By Application (Food, Beverage, Personal Care, Animal Nutrition, Dietary Supplement).

The market for nutraceutical ingredients is witnessing robust growth driven by the increasing demand for functional and fortified food products, dietary supplements, and wellness products among consumers seeking to maintain health and prevent chronic diseases. Key trends shaping the future of this market include the rising adoption of nutraceutical ingredients such as vitamins, minerals, amino acids, probiotics, omega-3 fatty acids, and botanical extracts for their health-promoting properties and therapeutic benefits. Additionally, the growing awareness of the link between diet and health is driving market expansion, as consumers seek natural and science-backed ingredients to address specific health concerns and support overall well-being. With advancements in ingredient sourcing, extraction technologies, and formulation methods, manufacturers are developing innovative nutraceutical products with enhanced bioavailability, stability, and efficacy to meet consumer demands and regulatory requirements. Furthermore, the increasing demand for personalized nutrition and functional foods tailored to individual health goals and preferences is fueling market growth, as companies leverage data analytics and technology to offer customized solutions and targeted health benefits. As the nutraceutical industry continues to evolve and innovate, the market for nutraceutical ingredients is poised for continued growth, offering opportunities for product development, market expansion, and collaboration across the food, beverage, and healthcare sectors.

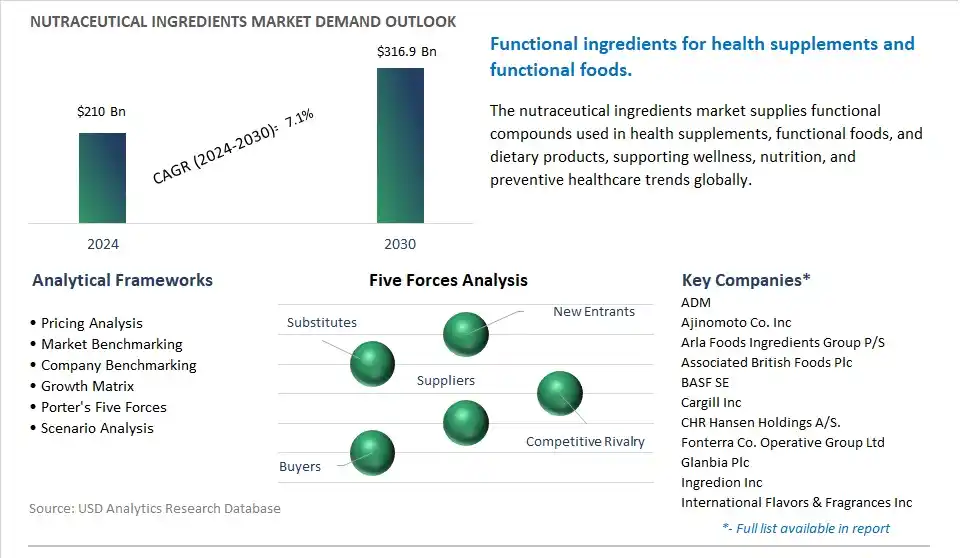

The market report analyses the leading companies in the industry including ADM, Ajinomoto Co. Inc, Arla Foods Ingredients Group P/S, Associated British Foods Plc, BASF SE, Cargill Inc, CHR Hansen Holdings A/S., Fonterra Co. Operative Group Ltd, Glanbia Plc, Ingredion Inc, International Flavors & Fragrances Inc, Kerry Groups., Koninklijke DSM N.V., Kyowa Hakko Bio Co. Ltd, Tate & Lyle PLC.

A prominent trend in the nutraceutical ingredients market is the growing consumer focus on health and wellness. As individuals become more proactive about managing their health and preventing diseases, there is an increasing demand for dietary supplements and functional foods enriched with nutraceutical ingredients. Nutraceutical ingredients, such as vitamins, minerals, antioxidants, probiotics, and botanical extracts, offer various health benefits, including immune support, heart health, digestive health, and cognitive function. Consumers are incorporating nutraceutical products into their daily routines to complement their diets and support overall well-being, driving the expansion of the nutraceutical ingredients market.

A significant driver propelling the nutraceutical ingredients market is the aging population and the prevalence of chronic health conditions. As the global population ages and life expectancy increases, there is a higher incidence of age-related health issues, such as cardiovascular diseases, diabetes, osteoporosis, and cognitive decline. Additionally, unhealthy lifestyles, poor dietary habits, and environmental factors contribute to the rise in chronic health conditions worldwide. Nutraceutical ingredients are increasingly recognized for their potential to address nutritional deficiencies, support healthy aging, and reduce the risk of chronic diseases. The growing awareness of preventive healthcare and the need for natural, non-pharmaceutical solutions drive the demand for nutraceutical ingredients as essential components of dietary supplements and functional foods, thus fueling market growth.

An opportunity for the nutraceutical ingredients market lies in innovation in personalized nutrition solutions. As consumers seek personalized approaches to health and wellness, there is a demand for customized nutraceutical products tailored to individual nutritional needs, preferences, and health goals. Advances in technology, such as genomic testing, biomarker analysis, and digital health platforms, enable personalized nutrition recommendations based on genetic profiles, lifestyle factors, and health metrics. Nutraceutical ingredient suppliers and product manufacturers can seize this opportunity by developing customizable formulations, personalized supplement blends, and targeted nutritional solutions that address specific health concerns and meet the unique requirements of diverse consumer segments. By offering personalized nutrition solutions, companies can differentiate themselves in the competitive market landscape, foster consumer loyalty, and capitalize on the growing trend towards personalized health and wellness.

The largest segment in the Nutraceutical Ingredients Market is the Proteins and Amino Acids category. Proteins and amino acids are essential nutrients required for various physiological functions in the human body, including muscle repair and growth, enzyme synthesis, hormone regulation, and immune function. As consumers become more health-conscious and seek products that support overall well-being, the demand for nutraceutical ingredients rich in proteins and amino acids has surged. Proteins and amino acids are commonly found in dietary supplements, functional foods, and beverages targeted towards fitness enthusiasts, athletes, and individuals looking to maintain a balanced diet. Further, the growing prevalence of lifestyle-related health issues such as obesity, diabetes, and cardiovascular diseases has fueled the demand for protein-rich and amino acid-enriched products, driving the growth of this segment in the Nutraceutical Ingredients Market. Additionally, advancements in food processing technologies and ingredient formulations have enabled the development of innovative protein-based products with improved taste, texture, and bioavailability, further contributing to the dominance of the Proteins and Amino Acids segment in the Nutraceutical Ingredients Market. Hence, the Proteins and Amino Acids category emerged as the largest segment in the Nutraceutical Ingredients Market, driven by their essential role in promoting health and wellness, coupled with increasing consumer awareness and product innovation.

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ADM

Ajinomoto Co. Inc

Arla Foods Ingredients Group P/S

Associated British Foods Plc

BASF SE

Cargill Inc

CHR Hansen Holdings A/S.

Fonterra Co. Operative Group Ltd

Glanbia Plc

Ingredion Inc

International Flavors & Fragrances Inc

Kerry Groups.

Koninklijke DSM N.V.

Kyowa Hakko Bio Co. Ltd

Tate & Lyle PLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Nutraceutical Ingredients Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Nutraceutical Ingredients Market Size Outlook, $ Million, 2021 to 2030

3.2 Nutraceutical Ingredients Market Outlook by Type, $ Million, 2021 to 2030

3.3 Nutraceutical Ingredients Market Outlook by Product, $ Million, 2021 to 2030

3.4 Nutraceutical Ingredients Market Outlook by Application, $ Million, 2021 to 2030

3.5 Nutraceutical Ingredients Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Nutraceutical Ingredients Industry

4.2 Key Market Trends in Nutraceutical Ingredients Industry

4.3 Potential Opportunities in Nutraceutical Ingredients Industry

4.4 Key Challenges in Nutraceutical Ingredients Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Nutraceutical Ingredients Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Nutraceutical Ingredients Market Outlook by Segments

7.1 Nutraceutical Ingredients Market Outlook by Segments, $ Million, 2021- 2030

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

8 North America Nutraceutical Ingredients Market Analysis and Outlook To 2030

8.1 Introduction to North America Nutraceutical Ingredients Markets in 2024

8.2 North America Nutraceutical Ingredients Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Nutraceutical Ingredients Market size Outlook by Segments, 2021-2030

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

9 Europe Nutraceutical Ingredients Market Analysis and Outlook To 2030

9.1 Introduction to Europe Nutraceutical Ingredients Markets in 2024

9.2 Europe Nutraceutical Ingredients Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Nutraceutical Ingredients Market Size Outlook by Segments, 2021-2030

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

10 Asia Pacific Nutraceutical Ingredients Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Nutraceutical Ingredients Markets in 2024

10.2 Asia Pacific Nutraceutical Ingredients Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Nutraceutical Ingredients Market size Outlook by Segments, 2021-2030

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

11 South America Nutraceutical Ingredients Market Analysis and Outlook To 2030

11.1 Introduction to South America Nutraceutical Ingredients Markets in 2024

11.2 South America Nutraceutical Ingredients Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Nutraceutical Ingredients Market size Outlook by Segments, 2021-2030

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

12 Middle East and Africa Nutraceutical Ingredients Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Nutraceutical Ingredients Markets in 2024

12.2 Middle East and Africa Nutraceutical Ingredients Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Nutraceutical Ingredients Market size Outlook by Segments, 2021-2030

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ADM

Ajinomoto Co. Inc

Arla Foods Ingredients Group P/S

Associated British Foods Plc

BASF SE

Cargill Inc

CHR Hansen Holdings A/S.

Fonterra Co. Operative Group Ltd

Glanbia Plc

Ingredion Inc

International Flavors & Fragrances Inc

Kerry Groups.

Koninklijke DSM N.V.

Kyowa Hakko Bio Co. Ltd

Tate & Lyle PLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Ingredient

Probiotics

Proteins and Amino Acids

Phytochemicals & Plant Extracts

Fibers & Specialty Carbohydrates

Omega-3 Fatty Acids

Vitamins

Prebiotic

Carotenoids

Minerals

By Form

Dry

Liquid

By Application

Food

Beverage

Personal Care

Animal Nutrition

Dietary Supplement

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Nutraceutical Ingredients is forecast to reach $316.9 Billion in 2030 from $210 Billion in 2024, registering a CAGR of 7.1%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ADM, Ajinomoto Co. Inc, Arla Foods Ingredients Group P/S, Associated British Foods Plc, BASF SE, Cargill Inc, CHR Hansen Holdings A/S., Fonterra Co. Operative Group Ltd, Glanbia Plc, Ingredion Inc, International Flavors & Fragrances Inc, Kerry Groups., Koninklijke DSM N.V., Kyowa Hakko Bio Co. Ltd, Tate & Lyle PLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume