The global Nonylphenol Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Chemicals, Household Products, Paper & Pulp, Polymer & plastic, Textiles, Others), By Function (Surfactant, Emulsifier, Cleaning, Antioxidant, Others), By Grade (Reagent Grade, Industrial Grade).

The market for nonylphenol is experiencing steady growth driven by its wide-ranging applications in industries such as detergents, textiles, plastics, and personal care products. Key trends shaping the future of this industry include the increasing demand for nonylphenol as a surfactant, emulsifier, and chemical intermediate in various manufacturing processes, driven by its excellent wetting, dispersing, and foaming properties. Additionally, the growing emphasis on sustainable chemistry and regulatory compliance is driving market expansion, as industries seek alternatives to nonylphenol ethoxylates (NPEs) due to their environmental persistence and potential toxicity. With advancements in nonylphenol production technologies and purification methods, manufacturers are improving product quality, purity, and safety profiles to meet stringent regulatory requirements and customer specifications. Furthermore, the rising demand for nonylphenol in emerging applications such as agrochemicals, lubricants, and adhesives is fueling market growth, particularly in sectors where performance, compatibility, and cost-effectiveness are critical. As industries continue to innovate and invest in sustainable solutions, the nonylphenol market is poised for continued growth, offering opportunities for product innovation, market diversification, and collaboration across sectors.

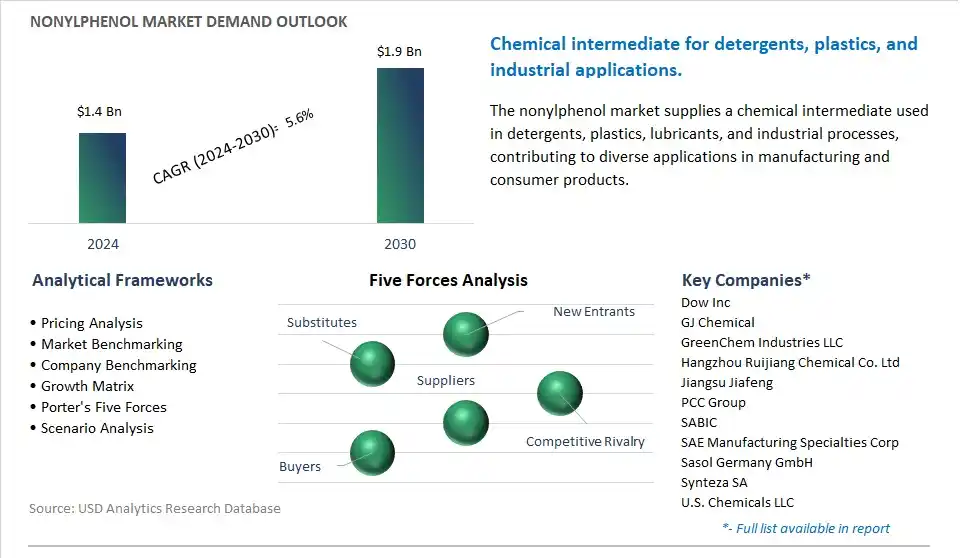

The market report analyses the leading companies in the industry including Dow Inc, GJ Chemical, GreenChem Industries LLC, Hangzhou Ruijiang Chemical Co. Ltd, Jiangsu Jiafeng, PCC Group, SABIC, SAE Manufacturing Specialties Corp, Sasol Germany GmbH, Synteza SA, U.S. Chemicals LLC, Versalis S.p.A..

A prominent trend in the nonylphenol market is the shift towards environmentally friendly alternatives. Nonylphenol, a compound used in the production of surfactants, detergents, and industrial chemicals, has raised environmental concerns due to its persistence, bioaccumulation, and toxicity to aquatic organisms. In response, there is a growing demand for safer and more sustainable alternatives to nonylphenol in various applications. Regulatory restrictions on the use of nonylphenol in certain regions and increasing consumer awareness of environmental issues are driving the adoption of eco-friendly alternatives, such as alkylphenol ethoxylates (APEs) and nonylphenol-free formulations, thus shaping market dynamics towards more sustainable solutions.

A significant driver propelling the nonylphenol market is regulatory restrictions and increasing environmental awareness. Governments worldwide are implementing regulations to restrict the use of nonylphenol and its derivatives due to their adverse environmental impacts. Additionally, environmental organizations and advocacy groups are raising awareness about the hazards associated with nonylphenol and advocating for safer chemical alternatives. The tightening of regulations and growing public concern over environmental pollution drive the demand for nonylphenol-free products and formulations, accelerating the shift towards more sustainable and environmentally friendly practices in various industries.

An opportunity for the nonylphenol market lies in the development of green surfactants and chemical alternatives. As demand for environmentally friendly solutions continues to rise, there is a growing opportunity for innovation in the development of green surfactants and chemical formulations that offer effective performance while minimizing environmental impact. Companies can invest in research and development to create nonylphenol-free surfactants and chemicals derived from renewable resources or biodegradable materials. By offering sustainable alternatives to nonylphenol-based products, manufacturers can capitalize on the growing market demand for eco-friendly solutions, meet regulatory requirements, and address consumer preferences for safer and more sustainable products.

The largest segment in the Nonylphenol Market is the Polymer & Plastic category. The market growth is driven by the widespread use of nonylphenol in the production of polymer resins and plastic materials. Nonylphenol is utilized as a key intermediate in the manufacture of various polymer-based products, including polyethylene, polypropylene, polystyrene, and PVC (polyvinyl chloride). These polymers are extensively used in diverse industries such as packaging, construction, automotive, electronics, and consumer goods manufacturing. Nonylphenol functions as a stabilizer, surfactant, and emulsifier in polymer processing, contributing to the enhancement of mechanical properties, thermal stability, and processing efficiency of plastic materials. Additionally, nonylphenol-based polymers find applications in a wide range of products, including packaging films, pipes, cables, automotive parts, and consumer goods, driving the demand for nonylphenol in the Polymer & Plastic segment of the market. Hence, the Polymer & Plastic segment is the largest in the Nonylphenol Market due to its integral role in the production of polymer-based materials used across various industries.

The fastest-growing segment in the Nonylphenol Market is the Surfactant category. Surfactants play a crucial role in various industrial and consumer applications, including detergents, cleaners, personal care products, agrochemicals, and industrial processes. Nonylphenol-based surfactants are valued for their excellent wetting, foaming, dispersing, and emulsifying properties, making them indispensable in formulations requiring effective surface tension reduction and enhanced solubility of active ingredients. With the growing demand for specialty surfactants in industries such as household cleaning, personal care, and agriculture, nonylphenol-based surfactants are experiencing increasing adoption due to their versatility, compatibility with different formulations, and cost-effectiveness. Further, nonylphenol-based surfactants are favored for their biodegradability and low toxicity compared to some alternative surfactants, aligning with the growing consumer preference for environmentally friendly and sustainable products. The versatility, performance, and eco-friendly attributes of nonylphenol-based surfactants contribute to their rapid growth in the Nonylphenol Market, particularly in the Surfactant segment.

The fastest-growing segment in the Nonylphenol Market is the Industrial Grade category. Industrial-grade nonylphenol is experiencing rapid growth due to its versatile applications across various industrial sectors. Nonylphenol serves as a key intermediate in the production of numerous chemicals, surfactants, and polymer additives used in industrial processes such as emulsion polymerization, textile manufacturing, pulp and paper production, and agrochemical formulation. Industrial-grade nonylphenol is valued for its cost-effectiveness, high purity, and consistent quality, making it a preferred choice for large-scale industrial applications where stringent specifications are not necessary. Additionally, the expanding industrial activities in emerging economies, coupled with the increasing demand for industrial chemicals and additives, are driving the growth of the industrial-grade segment in the Nonylphenol Market. The availability of industrial-grade nonylphenol in bulk quantities and its compatibility with a wide range of industrial processes contribute to its fast-paced growth in the market. Hence, the Industrial Grade segment is the fastest-growing segment in the Nonylphenol Market, fueled by its extensive use in industrial applications and the growing demand for industrial chemicals worldwide.

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Dow Inc

GJ Chemical

GreenChem Industries LLC

Hangzhou Ruijiang Chemical Co. Ltd

Jiangsu Jiafeng

PCC Group

SABIC

SAE Manufacturing Specialties Corp

Sasol Germany GmbH

Synteza SA

U.S. Chemicals LLC

Versalis S.p.A.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Nonylphenol Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Nonylphenol Market Size Outlook, $ Million, 2021 to 2030

3.2 Nonylphenol Market Outlook by Type, $ Million, 2021 to 2030

3.3 Nonylphenol Market Outlook by Product, $ Million, 2021 to 2030

3.4 Nonylphenol Market Outlook by Application, $ Million, 2021 to 2030

3.5 Nonylphenol Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Nonylphenol Industry

4.2 Key Market Trends in Nonylphenol Industry

4.3 Potential Opportunities in Nonylphenol Industry

4.4 Key Challenges in Nonylphenol Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Nonylphenol Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Nonylphenol Market Outlook by Segments

7.1 Nonylphenol Market Outlook by Segments, $ Million, 2021- 2030

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

8 North America Nonylphenol Market Analysis and Outlook To 2030

8.1 Introduction to North America Nonylphenol Markets in 2024

8.2 North America Nonylphenol Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Nonylphenol Market size Outlook by Segments, 2021-2030

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

9 Europe Nonylphenol Market Analysis and Outlook To 2030

9.1 Introduction to Europe Nonylphenol Markets in 2024

9.2 Europe Nonylphenol Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Nonylphenol Market Size Outlook by Segments, 2021-2030

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

10 Asia Pacific Nonylphenol Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Nonylphenol Markets in 2024

10.2 Asia Pacific Nonylphenol Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Nonylphenol Market size Outlook by Segments, 2021-2030

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

11 South America Nonylphenol Market Analysis and Outlook To 2030

11.1 Introduction to South America Nonylphenol Markets in 2024

11.2 South America Nonylphenol Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Nonylphenol Market size Outlook by Segments, 2021-2030

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

12 Middle East and Africa Nonylphenol Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Nonylphenol Markets in 2024

12.2 Middle East and Africa Nonylphenol Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Nonylphenol Market size Outlook by Segments, 2021-2030

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Dow Inc

GJ Chemical

GreenChem Industries LLC

Hangzhou Ruijiang Chemical Co. Ltd

Jiangsu Jiafeng

PCC Group

SABIC

SAE Manufacturing Specialties Corp

Sasol Germany GmbH

Synteza SA

U.S. Chemicals LLC

Versalis S.p.A.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Chemicals

Household Products

Paper & Pulp

Polymer & plastic

Textiles

Others

By Function

Surfactant

Emulsifier

Cleaning

Antioxidant

Others

By Grade

Reagent Grade

Industrial Grade

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Nonylphenol is forecast to reach $1.9 Billion in 2030 from $1.4 Billion in 2024, registering a CAGR of 5.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Dow Inc, GJ Chemical, GreenChem Industries LLC, Hangzhou Ruijiang Chemical Co. Ltd, Jiangsu Jiafeng, PCC Group, SABIC, SAE Manufacturing Specialties Corp, Sasol Germany GmbH, Synteza SA, U.S. Chemicals LLC, Versalis S.p.A.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume