The global Non-halogenated Flame Retardants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Aluminum Hydroxide, Magnesium Dihydroxide, Phosphorous Based, Others), By Application (Polyolefins, Epoxy resins, UPE, PVC, ETP, Rubber, Others), By End-User (Electronics, Construction, Transportation, Others).

The market for non-halogenated flame retardants is witnessing robust growth driven by regulatory restrictions on the use of halogenated flame retardants due to their environmental and health concerns, coupled with the increasing demand for fire safety solutions across various industries including electronics, construction, automotive, and textiles. Key trends shaping the future of this industry include the rising adoption of non-halogenated flame retardants as alternatives to brominated and chlorinated compounds, driven by their superior performance, low toxicity, and environmental compatibility. Additionally, the growing emphasis on sustainable and eco-friendly materials is driving market expansion, as industries seek fire protection solutions that meet stringent safety standards while minimizing environmental impact and human health risks. With advancements in flame retardant chemistry and formulation technologies, manufacturers are developing innovative products with tailored properties and functionalities to meet diverse end-use requirements and application demands. Furthermore, the increasing demand for non-halogenated flame retardants in emerging applications such as electric vehicles, renewable energy systems, and smart textiles is fueling market growth, particularly in sectors where fire safety regulations are stringent, and performance requirements are high. As industries continue to innovate and invest in sustainable solutions, the non-halogenated flame retardants market is poised for continued growth, offering opportunities for product innovation, market diversification, and collaboration across sectors.

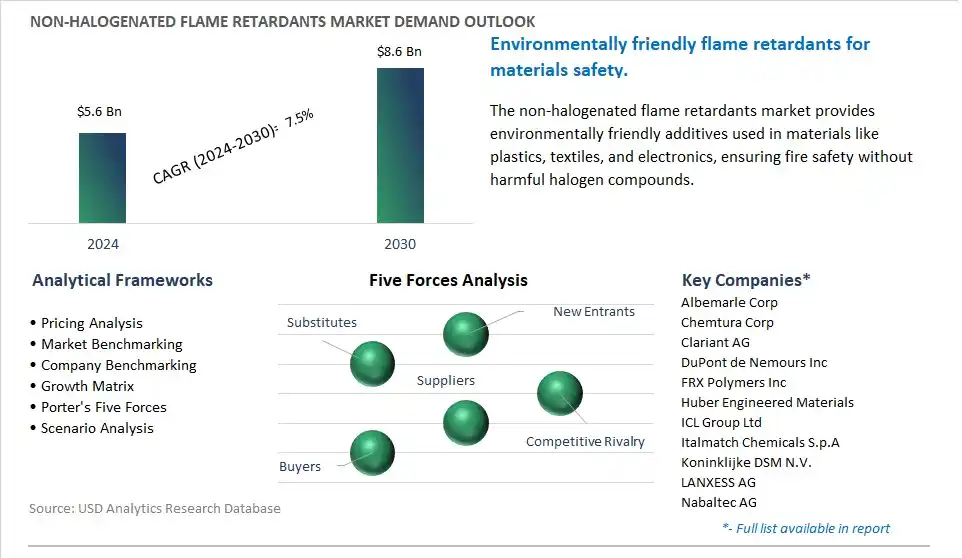

The market report analyses the leading companies in the industry including Albemarle Corp, Chemtura Corp, Clariant AG, DuPont de Nemours Inc, FRX Polymers Inc, Huber Engineered Materials, ICL Group Ltd, Italmatch Chemicals S.p.A, Koninklijke DSM N.V., LANXESS AG, Nabaltec AG, Thor Group Ltd.

A prominent trend in the non-halogenated flame retardants market is the shift towards environmentally friendly solutions. Non-halogenated flame retardants are gaining traction as alternatives to traditional halogenated flame retardants due to concerns over their environmental and health impacts, such as the release of toxic gases and persistence in the environment. Non-halogenated flame retardants offer comparable fire safety performance while being less harmful to human health and the environment. With increasing regulatory restrictions on the use of halogenated flame retardants and growing awareness of environmental sustainability, there is a rising demand for non-halogenated alternatives across various industries, driving market growth.

A significant driver propelling the non-halogenated flame retardants market is the enforcement of stringent fire safety regulations. Governments and regulatory bodies worldwide are implementing stricter fire safety standards and regulations across industries such as construction, electronics, automotive, and textiles to mitigate the risk of fire-related accidents and protect human lives and property. Non-halogenated flame retardants play a crucial role in meeting these regulatory requirements by imparting fire resistance properties to materials and products, thus ensuring compliance with safety standards. The increasing emphasis on fire safety and the enforcement of stringent regulations drive the demand for non-halogenated flame retardants, driving market expansion.

An opportunity for the non-halogenated flame retardants market lies in innovation in functional additives. Beyond their primary role in imparting fire resistance, non-halogenated flame retardants have the potential to offer additional functional properties such as thermal stability, UV resistance, and antimicrobial properties. By investing in research and development, manufacturers can innovate and develop multifunctional additives that provide enhanced performance and value-added benefits to end products. These innovative non-halogenated flame retardants can cater to diverse industry needs and applications, including building materials, electronics, transportation, and textiles, thus creating new opportunities for market growth and differentiation in a competitive landscape.

The largest segment in the Non-Halogenated Flame Retardants Market is the Aluminum Hydroxide segment. aluminum hydroxide is one of the most commonly used non-halogenated flame retardants due to its effectiveness in suppressing flames and reducing smoke emissions. It works by releasing water vapor when exposed to high temperatures, thereby cooling the surrounding area and diluting flammable gases. This mechanism helps to inhibit the spread of fire and reduce the risk of ignition in various materials and applications. Further, aluminum hydroxide is widely available and cost-effective compared to other non-halogenated flame retardants, making it a preferred choice for manufacturers seeking flame retardant solutions. Additionally, aluminum hydroxide is non-toxic and environmentally friendly, making it suitable for use in various industries, including construction, electronics, textiles, and transportation. The versatility, effectiveness, and affordability of aluminum hydroxide contribute to its dominance as the largest segment in the Non-Halogenated Flame Retardants Market.

The fastest-growing segment in the Non-Halogenated Flame Retardants Market is the Polyolefins segment. polyolefins, such as polyethylene and polypropylene, are widely used in various industries, including automotive, construction, packaging, and electronics, due to their lightweight, durability, and versatility. With the increasing demand for polyolefin-based products, there is a growing need for effective flame-retardant additives to enhance their fire safety properties. Non-halogenated flame retardants offer a viable alternative to halogenated compounds, addressing concerns related to environmental and health risks. Further, advancements in flame retardant technologies have led to the development of innovative solutions specifically tailored for polyolefin applications. These additives are designed to meet stringent fire safety standards while maintaining the mechanical and thermal properties of polyolefin materials. Additionally, regulatory initiatives and industry standards promoting the use of environmentally friendly and sustainable flame retardants further drive the demand for non-halogenated additives in polyolefin applications. The combination of increased demand for polyolefin-based products and the availability of effective non-halogenated flame retardants fuels the growth of the Polyolefins segment in the Non-Halogenated Flame Retardants Market. Hence, the Polyolefins segment is the fastest-growing segment in the Non-Halogenated Flame Retardants Market, driven by the expanding applications of polyolefin materials and the need for sustainable fire safety solutions.

The fastest-growing segment in the Non-Halogenated Flame Retardants Market is the Construction sector. The construction industry is witnessing significant expansion globally, driven by urbanization, infrastructure development, and increasing investments in residential and commercial projects. With the rise in construction activities, there is a growing demand for building materials that comply with stringent fire safety regulations and standards. Non-halogenated flame retardants offer an environmentally friendly and effective solution to enhance the fire resistance of construction materials such as insulation, foam, coatings, and plastics used in buildings. Additionally, the growing awareness of fire safety risks and the need for sustainable building practices further drive the adoption of non-halogenated flame retardants in the construction sector. Accordingly, manufacturers and suppliers in the construction industry are increasingly incorporating these additives into their products to meet fire safety requirements and address the demand for safer and more sustainable building materials. Hence, the Construction sector is the fastest-growing segment in the Non-Halogenated Flame Retardants Market, propelled by the booming construction industry's need for fire-resistant materials and regulatory compliance.

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Albemarle Corp

Chemtura Corp

Clariant AG

DuPont de Nemours Inc

FRX Polymers Inc

Huber Engineered Materials

ICL Group Ltd

Italmatch Chemicals S.p.A

Koninklijke DSM N.V.

LANXESS AG

Nabaltec AG

Thor Group Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Non-halogenated Flame Retardants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Non-halogenated Flame Retardants Market Size Outlook, $ Million, 2021 to 2030

3.2 Non-halogenated Flame Retardants Market Outlook by Type, $ Million, 2021 to 2030

3.3 Non-halogenated Flame Retardants Market Outlook by Product, $ Million, 2021 to 2030

3.4 Non-halogenated Flame Retardants Market Outlook by Application, $ Million, 2021 to 2030

3.5 Non-halogenated Flame Retardants Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Non-halogenated Flame Retardants Industry

4.2 Key Market Trends in Non-halogenated Flame Retardants Industry

4.3 Potential Opportunities in Non-halogenated Flame Retardants Industry

4.4 Key Challenges in Non-halogenated Flame Retardants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Non-halogenated Flame Retardants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Non-halogenated Flame Retardants Market Outlook by Segments

7.1 Non-halogenated Flame Retardants Market Outlook by Segments, $ Million, 2021- 2030

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

8 North America Non-halogenated Flame Retardants Market Analysis and Outlook To 2030

8.1 Introduction to North America Non-halogenated Flame Retardants Markets in 2024

8.2 North America Non-halogenated Flame Retardants Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Non-halogenated Flame Retardants Market size Outlook by Segments, 2021-2030

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

9 Europe Non-halogenated Flame Retardants Market Analysis and Outlook To 2030

9.1 Introduction to Europe Non-halogenated Flame Retardants Markets in 2024

9.2 Europe Non-halogenated Flame Retardants Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Non-halogenated Flame Retardants Market Size Outlook by Segments, 2021-2030

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

10 Asia Pacific Non-halogenated Flame Retardants Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Non-halogenated Flame Retardants Markets in 2024

10.2 Asia Pacific Non-halogenated Flame Retardants Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Non-halogenated Flame Retardants Market size Outlook by Segments, 2021-2030

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

11 South America Non-halogenated Flame Retardants Market Analysis and Outlook To 2030

11.1 Introduction to South America Non-halogenated Flame Retardants Markets in 2024

11.2 South America Non-halogenated Flame Retardants Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Non-halogenated Flame Retardants Market size Outlook by Segments, 2021-2030

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

12 Middle East and Africa Non-halogenated Flame Retardants Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Non-halogenated Flame Retardants Markets in 2024

12.2 Middle East and Africa Non-halogenated Flame Retardants Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Non-halogenated Flame Retardants Market size Outlook by Segments, 2021-2030

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Albemarle Corp

Chemtura Corp

Clariant AG

DuPont de Nemours Inc

FRX Polymers Inc

Huber Engineered Materials

ICL Group Ltd

Italmatch Chemicals S.p.A

Koninklijke DSM N.V.

LANXESS AG

Nabaltec AG

Thor Group Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Aluminum Hydroxide

Magnesium Dihydroxide

Phosphorous Based

Others

By Application

Polyolefins

Epoxy resins

UPE

PVC

ETP

Rubber

Others

By End-User

Electronics

Construction

Transportation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Non-halogenated Flame Retardants is forecast to reach $8.6 Billion in 2030 from $5.6 Billion in 2024, registering a CAGR of 7.5%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Albemarle Corp, Chemtura Corp, Clariant AG, DuPont de Nemours Inc, FRX Polymers Inc, Huber Engineered Materials, ICL Group Ltd, Italmatch Chemicals S.p.A, Koninklijke DSM N.V., LANXESS AG, Nabaltec AG, Thor Group Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume