Non-Alcoholic RTD Beverages Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Product (Carbonated Soft Drinks, RTD Tea & Coffee, Functional Beverages, Juices, Dairy-based Beverages, Others), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Department Stores, Online, Others).

Non-alcoholic RTD beverages offer a diverse range of choices, including carbonated soft drinks, energy drinks, ready-to-drink tea and coffee, functional beverages, and flavored water, catering to various taste preferences and nutritional needs. Key drivers of market expansion include rising health consciousness, concerns over sugar intake, and a growing desire for natural, low-calorie, and functional beverage alternatives. In addition, the market benefits from the trend towards convenience and busy lifestyles, with consumers seeking convenient and portable beverage options for consumption anytime, anywhere. The market is further fueled by innovations in product formulation, packaging, and marketing strategies aimed at enhancing taste, functionality, and appeal to diverse consumer segments.

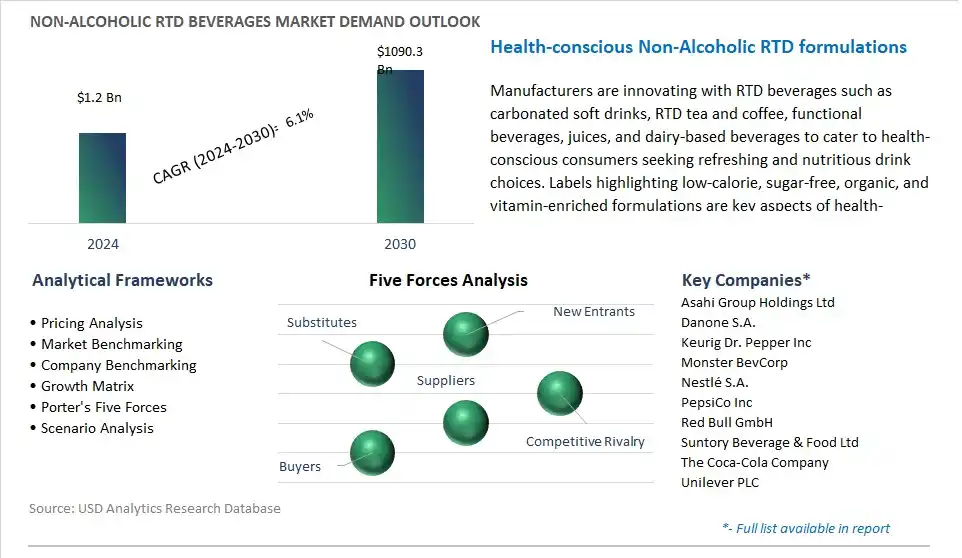

Asahi Group Holdings Ltd, Danone S.A., Keurig Dr. Pepper Inc, Monster BevCorp, Nestlé S.A., PepsiCo Inc, Red Bull GmbH, Suntory Beverage & Food Ltd, The Coca-Cola Company, Unilever PLC

The Non-Alcoholic Ready-to-Drink (RTD) Beverages companies are introducing health-conscious alternatives. Consumers are increasingly seeking non-alcoholic RTD beverages that offer nutritional benefits, natural ingredients, and functional properties such as hydration, energy boost, and wellness support. This trend encompasses a wide range of beverages including sparkling waters, flavored teas, functional drinks, plant-based milks, and sports drinks, catering to diverse consumer preferences for healthier beverage options without compromising on taste or convenience.

Non-Alcoholic RTD Beverages market is witnessing the shifting consumer preferences towards health and wellness. With a growing emphasis on lifestyle choices, nutrition, and fitness, consumers are gravitating towards beverages that align with their wellness goals, dietary restrictions, and desire for natural, clean-label products. Non-alcoholic RTD beverages offer hydration, vitamins, antioxidants, and functional ingredients such as probiotics, adaptogens, and herbal extracts, appealing to health-conscious individuals seeking convenient and refreshing beverage options.

The Non-Alcoholic RTD Beverages market presents significant opportunities driven by innovation in flavor profiles and functional ingredients. Beverage manufacturers are innovating with diverse flavor combinations, botanical extracts, superfoods, and low-sugar formulations to cater to evolving consumer tastes and preferences. In addition, the integration of functional ingredients such as CBD-infused beverages for relaxation, collagen-enriched drinks for skin health, and electrolyte-enhanced sports drinks for hydration and performance, creates new market segments and opportunities for product differentiation. Furthermore, partnerships with celebrity endorsements, wellness influencers, and brand collaborations contribute to market visibility and appeal among health-conscious consumers, driving further growth in the Non-Alcoholic RTD Beverages segment.

The RTD Tea & Coffee segment is the largest within the Non-Alcoholic RTD Beverages Market due to several key factors. RTD tea and coffee beverages offer convenience, variety, and refreshing flavors to consumers seeking on-the-go hydration and energy boosts. With busy lifestyles and increasing health consciousness, consumers prefer ready-to-drink (RTD) options that provide the flavor profiles of tea and coffee without the need for preparation. RTD tea and coffee products also cater to different preferences, including sweetened, unsweetened, flavored, and functional varieties, appealing to a wide consumer base. In addition, the trend towards premiumization, innovative packaging, and natural ingredients in RTD beverages further drives the dominance of the RTD Tea & Coffee segment in the Non-Alcoholic RTD Beverages Market.

The Online Distribution segment is the fastest-growing within the Non-Alcoholic RTD Beverages Market due to several key factors. Online platforms provide convenience, accessibility, and a wide variety of options for consumers to purchase RTD beverages from the comfort of their homes or on-the-go. With the increasing popularity of e-commerce, digitalization of shopping experiences, and the availability of mobile apps and online marketplaces, consumers have more choices and flexibility in selecting RTD beverages tailored to their preferences. In addition, online channels offer promotions, discounts, subscription services, and personalized recommendations, enhancing the overall shopping experience and attracting a growing number of consumers to purchase RTD beverages online. The convenience, variety, and digitalization of retail contribute to the rapid growth of the Online Distribution segment in the Non-Alcoholic RTD Beverages Market.

The Non-Alcoholic RTD Beverages industry encompasses diverse key stages that contribute to delivering a wide array of convenient and refreshing beverages to consumers. Ingredient sourcing involves companies like Dole Food Company, Inc. and Archer Daniels Midland Company providing fruits, sweeteners, and water purification services. Manufacturing and processing are handled by industry giants such as The Coca-Cola Company and PepsiCo, Inc., along with specialized producers like Red Bull GmbH focusing on specific beverage categories. Contract Manufacturing Organizations (CMOs) like Refresco International B.V. also play a role in manufacturing beverages for other brands. Packaging and labeling are crucial stages facilitated by suppliers such as Crown Holdings, Inc. and labeling companies like Avery Dennison Corporation, ensuring product protection, information dissemination, and brand identity.

At each stage of the value chain, value addition occurs significantly. Ingredient sourcing ensures the availability of essential raw materials for beverage production. Manufacturing and processing transform these raw materials into finished non-alcoholic RTD beverages, offering a diverse range of options to consumers. Packaging and labeling contribute to product appeal and consumer information. Distribution and logistics efficiently deliver these beverages to various retail channels, including supermarkets, convenience stores, and online retailers, providing consumers with easy access to their favorite non-alcoholic RTD beverages.

The US Non-Alcoholic RTD Beverages Market comprises products such as carbonated soft drinks, RTD tea & coffee, functional beverages, juices, dairy-based beverages, and others, distributed through hypermarkets & supermarkets, convenience stores, department stores, online platforms, and others. This market caters to consumer preferences for refreshing and healthy beverage options, offering convenience and variety in ready-to-drink formats. The market's growth is driven by factors like changing beverage consumption patterns, product innovation, and marketing strategies promoting non-alcoholic RTD beverages as alternatives to traditional sodas and alcoholic drinks.

TABLE OF CONTENTS

1 Introduction to 2024 Non-Alcoholic RTD Beverages Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Non-Alcoholic RTD Beverages Market Size Outlook, $ Million, 2021 to 2030

3.2 Non-Alcoholic RTD Beverages Market Outlook by Type, $ Million, 2021 to 2030

3.3 Non-Alcoholic RTD Beverages Market Outlook by Product, $ Million, 2021 to 2030

3.4 Non-Alcoholic RTD Beverages Market Outlook by Application, $ Million, 2021 to 2030

3.5 Non-Alcoholic RTD Beverages Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Non-Alcoholic RTD Beverages Industry

4.2 Key Market Trends in Non-Alcoholic RTD Beverages Industry

4.3 Potential Opportunities in Non-Alcoholic RTD Beverages Industry

4.4 Key Challenges in Non-Alcoholic RTD Beverages Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Non-Alcoholic RTD Beverages Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Non-Alcoholic RTD Beverages Market Outlook by Segments

7.1 Non-Alcoholic RTD Beverages Market Outlook by Segments, $ Million, 2021- 2030

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

8 North America Non-Alcoholic RTD Beverages Market Analysis and Outlook To 2030

8.1 Introduction to North America Non-Alcoholic RTD Beverages Markets in 2024

8.2 North America Non-Alcoholic RTD Beverages Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Non-Alcoholic RTD Beverages Market size Outlook by Segments, 2021-2030

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

9 Europe Non-Alcoholic RTD Beverages Market Analysis and Outlook To 2030

9.1 Introduction to Europe Non-Alcoholic RTD Beverages Markets in 2024

9.2 Europe Non-Alcoholic RTD Beverages Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Non-Alcoholic RTD Beverages Market Size Outlook by Segments, 2021-2030

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

10 Asia Pacific Non-Alcoholic RTD Beverages Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Non-Alcoholic RTD Beverages Markets in 2024

10.2 Asia Pacific Non-Alcoholic RTD Beverages Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Non-Alcoholic RTD Beverages Market size Outlook by Segments, 2021-2030

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

11 South America Non-Alcoholic RTD Beverages Market Analysis and Outlook To 2030

11.1 Introduction to South America Non-Alcoholic RTD Beverages Markets in 2024

11.2 South America Non-Alcoholic RTD Beverages Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Non-Alcoholic RTD Beverages Market size Outlook by Segments, 2021-2030

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

12 Middle East and Africa Non-Alcoholic RTD Beverages Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Non-Alcoholic RTD Beverages Markets in 2024

12.2 Middle East and Africa Non-Alcoholic RTD Beverages Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Non-Alcoholic RTD Beverages Market size Outlook by Segments, 2021-2030

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Asahi Group Holdings Ltd

Danone S.A.

Keurig Dr. Pepper Inc

Monster BevCorp

Nestlé S.A.

PepsiCo Inc

Red Bull GmbH

Suntory Beverage & Food Ltd

The Coca-Cola Company

Unilever PLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Carbonated Soft Drinks

RTD Tea & Coffee

Functional Beverages

Juices

Dairy-based Beverages

Others

By Distribution Channel

Hypermarkets & Supermarkets

Convenience Stores

Department Stores

Online

Others

Global Non-Alcoholic RTD Beverages Market is forecast to reach $1090.3 Billion in 2030 from $1.2 Billion in 2024, registering a CAGR of 6.1% | Health-conscious Non-Alcoholic RTD formulations

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Asahi Group Holdings Ltd, Danone S.A., Keurig Dr. Pepper Inc, Monster BevCorp, Nestlé S.A., PepsiCo Inc, Red Bull GmbH, Suntory Beverage & Food Ltd, The Coca-Cola Company, Unilever PLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume