The global Nitrite Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Calcium Nitrite, Potassium Nitrite, Sodium Nitrite, Others), By Application (Agriculture, Food and Beverages, Healthcare, Construction, Pharmaceutical, Metallurgy, Others).

Nitrite compounds play crucial roles in various industrial applications in 2024, serving as versatile chemicals with diverse functionalities. Nitrites, composed of nitrogen and oxygen atoms, are utilized across multiple sectors, including food preservation, water treatment, pharmaceuticals, and manufacturing. One of the primary applications of nitrites is in food preservation, where they act as antimicrobial agents to inhibit the growth of bacteria, particularly Clostridium botulinum, in cured meats, fish, and cheese products. Nitrites prevent spoilage and bacterial contamination, extending the shelf life of perishable food items and ensuring food safety. Further, in water treatment processes, nitrites are employed as corrosion inhibitors to protect metal pipes and equipment from rust and degradation. They form a protective film on metal surfaces, preventing corrosion and extending the service life of water distribution systems and industrial machinery. Additionally, nitrites find applications in pharmaceutical formulations as vasodilators and nitric oxide donors, contributing to the treatment of conditions such as angina, heart failure, and hypertension. Furthermore, nitrites are utilized in the manufacturing of dyes, pigments, explosives, and specialty chemicals, where they serve as intermediates in synthesis reactions or functional additives imparting specific properties to end products. With their diverse functionalities and widespread applications, nitrites to play essential roles in supporting various industrial processes and improving the quality, safety, and performance of products across multiple sectors.

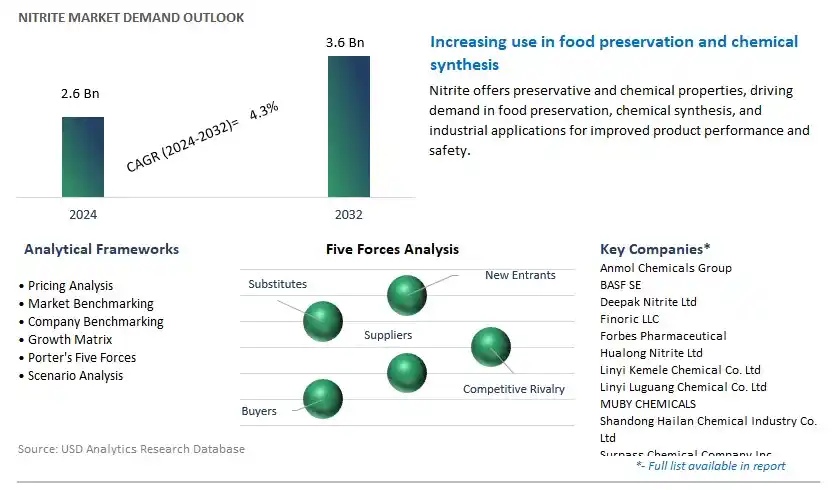

The market report analyses the leading companies in the industry including Anmol Chemicals Group, BASF SE, Deepak Nitrite Ltd, Finoric LLC, Forbes Pharmaceutical, Hualong Nitrite Ltd, Linyi Kemele Chemical Co. Ltd, Linyi Luguang Chemical Co. Ltd, MUBY CHEMICALS, Shandong Hailan Chemical Industry Co. Ltd, Surpass Chemical Company Inc, Thatcher Company, and others.

The market trend in the nitrite industry reflects a growing consumer preference for nitrite-free products, driven by health concerns and the desire for clean-label foods. This trend is catalyzed by mounting evidence linking nitrites to health risks such as cancer, prompting consumers to seek alternative preservatives and food additives. Consequently, food manufacturers are reformulating products to eliminate or reduce nitrites, leading to a rise in demand for nitrite-free alternatives across various food categories such as processed meats, cured meats, and ready-to-eat meals.

A primary market driver in the nitrite industry is the implementation of stringent regulatory guidelines governing the usage of nitrites in food products. Concerns regarding the potential health risks associated with nitrite consumption have prompted regulatory authorities to impose tighter restrictions and maximum limits on nitrite levels in processed foods. This regulatory environment is compelling food manufacturers to innovate and explore alternative preservation methods, driving investments in research and development for nitrite-free formulations and natural preservatives.

An emerging market opportunity lies in the expansion of natural nitrite alternatives within the food preservation industry. As consumer demand for clean-label and natural products continues to escalate, there is a growing need for innovative solutions that can effectively replace synthetic nitrites while maintaining product safety and shelf life. This presents an opportunity for companies to develop and commercialize natural alternatives such as plant-based preservatives, fermentation-based additives, and antimicrobial compounds derived from botanical sources. By capitalizing on this trend towards natural ingredients, businesses can carve out a competitive edge in the market while meeting the evolving preferences of health-conscious consumers.

Within the Nitrite market, the largest segment is Sodium Nitrite. Sodium nitrite is extensively used in various industries, including food preservation, pharmaceuticals, and wastewater treatment. In the food industry, sodium nitrite is primarily utilized as a curing agent for processed meats, where it helps prevent bacterial growth, enhance color retention, and impart flavor. Additionally, sodium nitrite finds applications in pharmaceutical formulations, where it serves as a vasodilator and an antidote for cyanide poisoning. Moreover, sodium nitrite is employed in wastewater treatment processes to inhibit the growth of harmful microorganisms and prevent corrosion in pipelines and equipment. Its versatility, effectiveness, and relatively low cost compared to other nitrite compounds make sodium nitrite the preferred choice for many industrial applications. With stringent regulations governing food safety, water quality, and pharmaceutical manufacturing, the demand for sodium nitrite is expected to remain robust, consolidating its position as the largest segment in the Nitrite market.

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Anmol Chemicals Group

BASF SE

Deepak Nitrite Ltd

Finoric LLC

Forbes Pharmaceutical

Hualong Nitrite Ltd

Linyi Kemele Chemical Co. Ltd

Linyi Luguang Chemical Co. Ltd

MUBY CHEMICALS

Shandong Hailan Chemical Industry Co. Ltd

Surpass Chemical Company Inc

Thatcher Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Nitrite Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Nitrite Market Size Outlook, $ Million, 2021 to 2032

3.2 Nitrite Market Outlook by Type, $ Million, 2021 to 2032

3.3 Nitrite Market Outlook by Product, $ Million, 2021 to 2032

3.4 Nitrite Market Outlook by Application, $ Million, 2021 to 2032

3.5 Nitrite Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Nitrite Industry

4.2 Key Market Trends in Nitrite Industry

4.3 Potential Opportunities in Nitrite Industry

4.4 Key Challenges in Nitrite Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Nitrite Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Nitrite Market Outlook by Segments

7.1 Nitrite Market Outlook by Segments, $ Million, 2021- 2032

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

8 North America Nitrite Market Analysis and Outlook To 2032

8.1 Introduction to North America Nitrite Markets in 2024

8.2 North America Nitrite Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Nitrite Market size Outlook by Segments, 2021-2032

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

9 Europe Nitrite Market Analysis and Outlook To 2032

9.1 Introduction to Europe Nitrite Markets in 2024

9.2 Europe Nitrite Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Nitrite Market Size Outlook by Segments, 2021-2032

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

10 Asia Pacific Nitrite Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Nitrite Markets in 2024

10.2 Asia Pacific Nitrite Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Nitrite Market size Outlook by Segments, 2021-2032

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

11 South America Nitrite Market Analysis and Outlook To 2032

11.1 Introduction to South America Nitrite Markets in 2024

11.2 South America Nitrite Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Nitrite Market size Outlook by Segments, 2021-2032

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

12 Middle East and Africa Nitrite Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Nitrite Markets in 2024

12.2 Middle East and Africa Nitrite Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Nitrite Market size Outlook by Segments, 2021-2032

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Anmol Chemicals Group

BASF SE

Deepak Nitrite Ltd

Finoric LLC

Forbes Pharmaceutical

Hualong Nitrite Ltd

Linyi Kemele Chemical Co. Ltd

Linyi Luguang Chemical Co. Ltd

MUBY CHEMICALS

Shandong Hailan Chemical Industry Co. Ltd

Surpass Chemical Company Inc

Thatcher Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Calcium Nitrite

Potassium Nitrite

Sodium Nitrite

Others

By Application

Agriculture

Food and Beverages

Healthcare

Construction

Pharmaceutical

Metallurgy

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Nitrite Market Size is valued at $2.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.3% to reach $3.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Anmol Chemicals Group, BASF SE, Deepak Nitrite Ltd, Finoric LLC, Forbes Pharmaceutical, Hualong Nitrite Ltd, Linyi Kemele Chemical Co. Ltd, Linyi Luguang Chemical Co. Ltd, MUBY CHEMICALS, Shandong Hailan Chemical Industry Co. Ltd, Surpass Chemical Company Inc, Thatcher Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume