The global Niobium Pentoxide Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Grade (Industrial Grade (purity 99.0% to 99.8%), 3N, 4N), By Application (Niobium Metal, Optical Glass, Supercapacitors, Superalloys, Ceramics, Others).

Niobium pentoxide (Nb2O5) is a versatile compound with a range of industrial applications in 2024. It is a white, odorless solid with high melting and boiling points, making it suitable for high-temperature processes and applications. Niobium pentoxide finds use in various sectors, including electronics, optics, ceramics, catalysis, and energy storage. In the electronics industry, niobium pentoxide is utilized as a dielectric material in the production of capacitors and integrated circuits. Its high dielectric constant and low leakage current make it ideal for use in high-performance electronic devices, such as smartphones, computers, and telecommunications equipment. Additionally, niobium pentoxide is employed in optical coatings for lenses, mirrors, and windows due to its high refractive index and optical transparency in the visible and infrared regions of the electromagnetic spectrum. In the ceramics industry, niobium pentoxide is used as a sintering aid and flux in the production of ceramic materials, where it promotes densification, reduces grain growth, and enhances mechanical properties. Furthermore, niobium pentoxide serves as a catalyst in chemical reactions, including oxidation, hydrogenation, and dehydrogenation processes, enabling the synthesis of fine chemicals, pharmaceuticals, and specialty materials. In energy storage applications, niobium pentoxide is investigated for use as an electrode material in lithium-ion batteries and supercapacitors, offering high energy density, fast charge-discharge rates, and long-term stability. With ongoing research and development efforts aimed at exploring new synthesis methods, applications, and functionalities, niobium pentoxide s to be a promising material for advancing technology and enabling innovations in various industrial sectors.

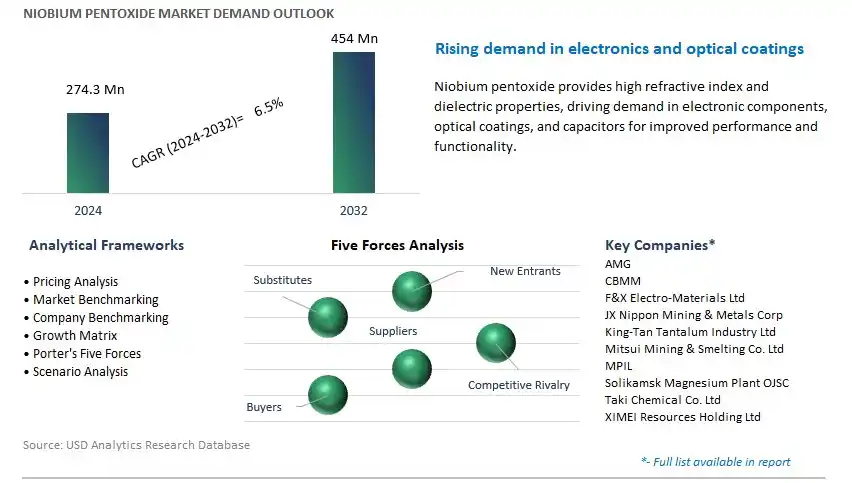

The market report analyses the leading companies in the industry including AMG, CBMM, F&X Electro-Materials Ltd, JX Nippon Mining & Metals Corp, King-Tan Tantalum Industry Ltd, Mitsui Mining & Smelting Co. Ltd, MPIL, Solikamsk Magnesium Plant OJSC, Taki Chemical Co. Ltd, XIMEI Resources Holding Ltd, and others.

A prominent trend in the niobium pentoxide market is the growing demand in high-tech industries. Niobium pentoxide, a key niobium compound, finds increasing applications in various high-technology sectors such as electronics, telecommunications, aerospace, and automotive. As these industries continue to advance, the demand for niobium pentoxide as a crucial component in capacitors, optical materials, superconductors, and catalysts is expected to rise. This trend is driven by the growing need for advanced materials that offer superior performance, reliability, and efficiency in cutting-edge technological applications.

A key driver fueling the niobium pentoxide market is the increasing adoption of niobium-based capacitors in electronics. Niobium pentoxide is a critical material used in the production of niobium capacitors, which offer several advantages over traditional tantalum capacitors, including higher capacitance, lower equivalent series resistance (ESR), and better stability at high temperatures. With the proliferation of electronic devices such as smartphones, tablets, wearables, and electric vehicles, there is a growing demand for miniaturized, high-performance capacitors that can meet the stringent requirements of modern electronics. Niobium-based capacitors are increasingly preferred for their reliability, energy efficiency, and ability to meet the demands of advanced electronic applications, thus driving the demand for niobium pentoxide.

A promising opportunity for the niobium pentoxide market lies in the expansion into energy storage and renewable energy applications. As the world transitions towards cleaner and more sustainable energy sources, there is a growing need for advanced materials that can improve the efficiency and performance of energy storage systems and renewable energy technologies. Niobium pentoxide holds promise for use in next-generation batteries, particularly in lithium-ion batteries, where it can enhance electrode performance, increase energy density, and improve cycling stability. Furthermore, niobium-based materials are being researched for their potential applications in supercapacitors, fuel cells, and hydrogen storage systems. By focusing on research and development initiatives to explore these emerging applications, companies can leverage the unique properties of niobium pentoxide to capitalize on the growing demand for energy storage solutions and renewable energy technologies, thereby unlocking new market opportunities and driving continued growth in the niobium pentoxide market.

Within the Niobium Pentoxide market, the largest segment is the Industrial Grade, which typically ranges in purity from 99.0% to 99.8%. Industrial grade niobium pentoxide serves as a crucial raw material in various industries such as steelmaking, electronics, and ceramics. Its high melting point, chemical stability, and ability to form stable compounds make it indispensable in the production of high-strength steels, superalloys, and electronic components. Additionally, industrial grade niobium pentoxide finds applications in glass manufacturing, catalysts, and optical coatings. Its relatively lower cost compared to higher purity grades makes it economically attractive for industries where ultra-high purity is not a strict requirement. As demand for niobium pentoxide continues to rise across multiple sectors, driven by infrastructure development, technological advancements, and increasing applications in emerging industries, the industrial grade segment maintains its status as the largest segment in the Niobium Pentoxide market.

Among the segmented applications in the Niobium Pentoxide market, the fastest-growing segment is Supercapacitors. Supercapacitors, also known as ultracapacitors or electrical double-layer capacitors (EDLCs), are energy storage devices that offer high power density, rapid charging and discharging capabilities, and long cycle life. Niobium pentoxide is a critical component in the electrode material of supercapacitors, where it enhances the device's capacitance and performance. The growing demand for energy storage solutions in renewable energy systems, electric vehicles, consumer electronics, and grid stabilization applications is driving the rapid adoption of supercapacitors. Additionally, advancements in nanomaterials and manufacturing processes have led to the development of high-performance niobium pentoxide-based electrodes, further fuelling the growth of this segment. With the increasing emphasis on energy efficiency, sustainability, and the electrification of transportation, the demand for supercapacitors is expected to continue growing, positioning the Supercapacitors segment as the fastest-growing segment in the Niobium Pentoxide market.

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AMG

CBMM

F&X Electro-Materials Ltd

JX Nippon Mining & Metals Corp

King-Tan Tantalum Industry Ltd

Mitsui Mining & Smelting Co. Ltd

MPIL

Solikamsk Magnesium Plant OJSC

Taki Chemical Co. Ltd

XIMEI Resources Holding Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Niobium Pentoxide Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Niobium Pentoxide Market Size Outlook, $ Million, 2021 to 2032

3.2 Niobium Pentoxide Market Outlook by Type, $ Million, 2021 to 2032

3.3 Niobium Pentoxide Market Outlook by Product, $ Million, 2021 to 2032

3.4 Niobium Pentoxide Market Outlook by Application, $ Million, 2021 to 2032

3.5 Niobium Pentoxide Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Niobium Pentoxide Industry

4.2 Key Market Trends in Niobium Pentoxide Industry

4.3 Potential Opportunities in Niobium Pentoxide Industry

4.4 Key Challenges in Niobium Pentoxide Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Niobium Pentoxide Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Niobium Pentoxide Market Outlook by Segments

7.1 Niobium Pentoxide Market Outlook by Segments, $ Million, 2021- 2032

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

8 North America Niobium Pentoxide Market Analysis and Outlook To 2032

8.1 Introduction to North America Niobium Pentoxide Markets in 2024

8.2 North America Niobium Pentoxide Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Niobium Pentoxide Market size Outlook by Segments, 2021-2032

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

9 Europe Niobium Pentoxide Market Analysis and Outlook To 2032

9.1 Introduction to Europe Niobium Pentoxide Markets in 2024

9.2 Europe Niobium Pentoxide Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Niobium Pentoxide Market Size Outlook by Segments, 2021-2032

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

10 Asia Pacific Niobium Pentoxide Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Niobium Pentoxide Markets in 2024

10.2 Asia Pacific Niobium Pentoxide Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Niobium Pentoxide Market size Outlook by Segments, 2021-2032

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

11 South America Niobium Pentoxide Market Analysis and Outlook To 2032

11.1 Introduction to South America Niobium Pentoxide Markets in 2024

11.2 South America Niobium Pentoxide Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Niobium Pentoxide Market size Outlook by Segments, 2021-2032

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

12 Middle East and Africa Niobium Pentoxide Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Niobium Pentoxide Markets in 2024

12.2 Middle East and Africa Niobium Pentoxide Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Niobium Pentoxide Market size Outlook by Segments, 2021-2032

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AMG

CBMM

F&X Electro-Materials Ltd

JX Nippon Mining & Metals Corp

King-Tan Tantalum Industry Ltd

Mitsui Mining & Smelting Co. Ltd

MPIL

Solikamsk Magnesium Plant OJSC

Taki Chemical Co. Ltd

XIMEI Resources Holding Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Grade

Industrial Grade (purity 99.0% to 99.8%)

3N

4N

By Application

Niobium Metal

Optical Glass

Supercapacitors

Superalloys

Ceramics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Niobium Pentoxide Market Size is valued at $274.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 6.5% to reach $454 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AMG, CBMM, F&X Electro-Materials Ltd, JX Nippon Mining & Metals Corp, King-Tan Tantalum Industry Ltd, Mitsui Mining & Smelting Co. Ltd, MPIL, Solikamsk Magnesium Plant OJSC, Taki Chemical Co. Ltd, XIMEI Resources Holding Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume