The global Network Camera Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Fixed, PTZ, Infrared), By Connection (Centralized, Decentralized), By End-User (Transportation, Public Sector, Manufacturing, Retail, IT & Telecom, Energy & Utilities, Media & Entertainment, BFSI, Healthcare, Others)

In 2024, the network camera market is witnessing rapid growth fueled by advancements in surveillance technology, increasing security concerns, and the growing demand for intelligent video analytics. Network cameras, also known as IP cameras, are equipped with built-in networking capabilities, allowing for remote monitoring, recording, and analysis of video footage over IP networks such as the internet and local area networks (LANs). With the rise of smart cities, IoT integration, and remote monitoring applications, network cameras play a critical role in enhancing public safety, traffic management, and security surveillance across various sectors, including government, commercial, and residential. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms enables network cameras to perform advanced functions such as facial recognition, object detection, and behavior analysis, providing real-time insights and actionable intelligence for security personnel and law enforcement agencies. As the market for network cameras continues to evolve, expect to see further innovations in resolution, image quality, low-light performance, and connectivity features, as well as increased adoption of cloud-based video management solutions and edge computing technologies that enhance scalability, flexibility, and interoperability in surveillance systems.

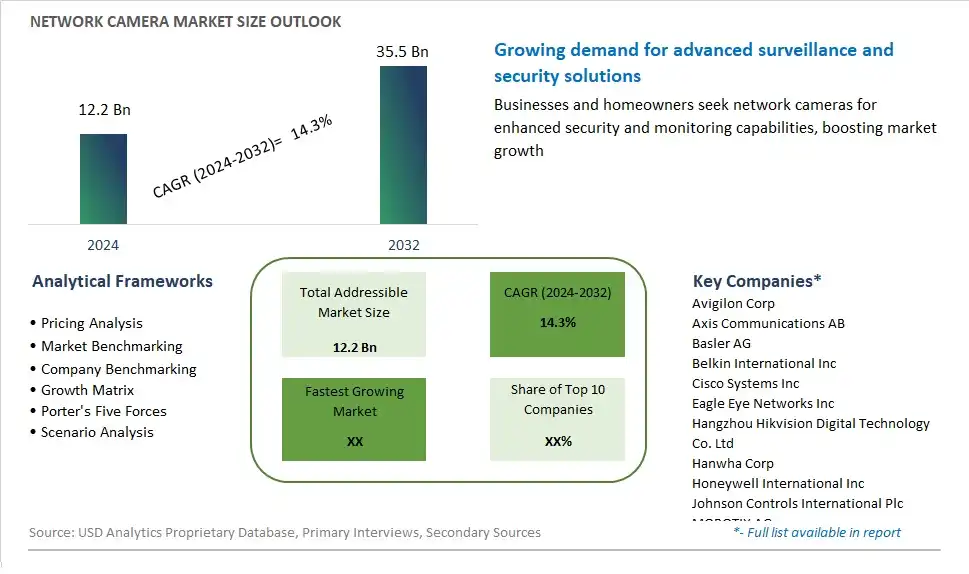

The market report analyses the leading companies in the industry including Avigilon Corp, Axis Communications AB, Basler AG, Belkin International Inc, Cisco Systems Inc, Eagle Eye Networks Inc, Hangzhou Hikvision Digital Technology Co. Ltd, Hanwha Corp, Honeywell International Inc, Johnson Controls International Plc, MOBOTIX AG, Netgear Inc, Panasonic Holdings Corp, Pelco Inc, Robert Bosch GmbH, and Others.

A significant trend in the network camera market is the shift towards digital surveillance solutions in various industries and sectors. With advancements in technology and the increasing need for real-time monitoring and security, there's a growing demand for network cameras that offer high-definition video capture, remote access, and intelligent analytics capabilities. These cameras enable organizations to enhance situational awareness, improve security protocols, and streamline surveillance operations through features such as motion detection, facial recognition, and object tracking. This trend is driven by a desire for more effective and efficient surveillance systems that leverage network connectivity and digital imaging technology to provide comprehensive monitoring and threat detection capabilities.

A key driver for the network camera market is the increasing concerns about safety and security across various industries, including commercial, industrial, governmental, and residential sectors. With rising threats such as theft, vandalism, terrorism, and public safety incidents, there's a growing need for robust surveillance solutions that can help deter criminal activities, protect assets, and ensure the safety of people and property. Network cameras offer a versatile and scalable solution for surveillance and monitoring applications, allowing organizations to deploy cameras strategically in indoor and outdoor environments, integrate with existing security systems, and access live video feeds remotely via network connectivity. This driver is reinforced by regulatory requirements, insurance mandates, and industry standards that mandate the use of surveillance systems for security and risk management purposes.

An opportunity for the network camera market lies in integration with Internet of Things (IoT) and smart city initiatives to create interconnected, intelligent surveillance ecosystems that enhance urban infrastructure and public safety. As cities and municipalities invest in smart technologies to improve efficiency, sustainability, and quality of life, there's a need for network cameras that can integrate with IoT platforms, sensors, and data analytics systems to provide real-time insights and actionable intelligence for urban planning, traffic management, crowd control, and emergency response. By leveraging network cameras as integral components of smart city infrastructure, companies can capitalize on the growing demand for interconnected surveillance solutions and contribute to the development of safer, more resilient urban environments while driving innovation and market growth in the network camera segment.

In the Network Camera market segmented by product, the Fixed Cameras category is the largest segment, owing to its widespread adoption across various surveillance applications and industries. Fixed cameras provide continuous monitoring of specific areas without the need for manual adjustment, offering a cost-effective solution for stationary surveillance requirements. These cameras are widely deployed in indoor and outdoor environments, including retail stores, office buildings, transportation hubs, and public spaces, to deter theft, vandalism, and unauthorized access. Further, advancements in technology have led to the development of high-resolution fixed cameras with enhanced features such as advanced analytics, remote monitoring capabilities, and integration with other security systems, further bolstering their utility and demand. As a result, the Fixed Cameras segment commands the largest share of the Network Camera market, reflecting its versatility, reliability, and effectiveness in meeting the surveillance needs of diverse end-users.

In the Network Camera market segmented by connection type, the Decentralized category is the fastest-growing segment, driven by the increasing demand for scalable and flexible surveillance solutions that offer enhanced reliability, resilience, and bandwidth efficiency. Decentralized network cameras operate independently, processing and storing video data locally within the camera itself, rather than relying on a centralized recording server. This decentralized approach reduces the risk of data loss due to network interruptions or server failures, ensuring continuous surveillance even in challenging environments. Further, decentralized cameras minimize bandwidth usage by transmitting only relevant video footage, optimizing network performance and reducing storage costs. As organizations seek to deploy surveillance systems that can adapt to evolving security threats and operational requirements, decentralized network cameras offer a compelling solution that combines robust performance with simplified deployment and management. Consequently, the Decentralized segment experiences rapid growth in the Network Camera market, reflecting the increasing preference for resilient and scalable surveillance architectures.

Within the Network Camera market segmented by end-users, the Retail sector is the largest segment, propelled by the imperative need for advanced surveillance solutions to mitigate theft, enhance security, and improve operational efficiency in retail environments. Retailers deploy network cameras for various purposes, including loss prevention, inventory management, crowd control, and customer behavior analysis. The integration of advanced features such as facial recognition, people counting, and heat mapping further enhances the effectiveness of network cameras in addressing retail-specific challenges. Additionally, the rise of e-commerce and omni-channel retailing has heightened the importance of surveillance in safeguarding physical stores and distribution centers against theft, vandalism, and fraud. As a result, the Retail sector commands the largest share of the Network Camera market, reflecting the critical role of surveillance technology in supporting the safety and profitability of retail businesses.

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Avigilon Corp

Axis Communications AB

Basler AG

Belkin International Inc

Cisco Systems Inc

Eagle Eye Networks Inc

Hangzhou Hikvision Digital Technology Co. Ltd

Hanwha Corp

Honeywell International Inc

Johnson Controls International Plc

MOBOTIX AG

Netgear Inc

Panasonic Holdings Corp

Pelco Inc

Robert Bosch GmbH

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Network Camera Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Network Camera Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Network Camera Market Share by Company, 2023

4.1.2. Product Offerings of Leading Network Camera Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Network Camera Market Drivers

6.2. Network Camera Market Challenges

6.6. Network Camera Market Opportunities

6.4. Network Camera Market Trends

Chapter 7. Global Network Camera Market Outlook Trends

7.1. Global Network Camera Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Network Camera Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Network Camera Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Chapter 8. Global Network Camera Regional Analysis and Outlook

8.1. Global Network Camera Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Network Camera Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Network Camera Regional Analysis and Outlook

8.2.2. Canada Network Camera Regional Analysis and Outlook

8.2.3. Mexico Network Camera Regional Analysis and Outlook

8.3. Europe Network Camera Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Network Camera Regional Analysis and Outlook

8.3.2. France Network Camera Regional Analysis and Outlook

8.3.3. United Kingdom Network Camera Regional Analysis and Outlook

8.3.4. Spain Network Camera Regional Analysis and Outlook

8.3.5. Italy Network Camera Regional Analysis and Outlook

8.3.6. Russia Network Camera Regional Analysis and Outlook

8.3.7. Rest of Europe Network Camera Regional Analysis and Outlook

8.4. Asia Pacific Network Camera Revenue (USD Million) by Country (2021-2032)

8.4.1. China Network Camera Regional Analysis and Outlook

8.4.2. Japan Network Camera Regional Analysis and Outlook

8.4.3. India Network Camera Regional Analysis and Outlook

8.4.4. South Korea Network Camera Regional Analysis and Outlook

8.4.5. Australia Network Camera Regional Analysis and Outlook

8.4.6. South East Asia Network Camera Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Network Camera Regional Analysis and Outlook

8.5. South America Network Camera Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Network Camera Regional Analysis and Outlook

8.5.2. Argentina Network Camera Regional Analysis and Outlook

8.5.3. Rest of South America Network Camera Regional Analysis and Outlook

8.6. Middle East and Africa Network Camera Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Network Camera Regional Analysis and Outlook

8.6.2. Africa Network Camera Regional Analysis and Outlook

Chapter 9. North America Network Camera Analysis and Outlook

9.1. North America Network Camera Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Network Camera Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Network Camera Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Network Camera Revenue (USD Million) by Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Chapter 10. Europe Network Camera Analysis and Outlook

10.1. Europe Network Camera Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Network Camera Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Network Camera Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Network Camera Revenue (USD Million) by Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Chapter 11. Asia Pacific Network Camera Analysis and Outlook

11.1. Asia Pacific Network Camera Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Network Camera Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Network Camera Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Network Camera Revenue (USD Million) by Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Chapter 12. South America Network Camera Analysis and Outlook

12.1. South America Network Camera Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Network Camera Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Network Camera Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Network Camera Revenue (USD Million) by Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Chapter 13. Middle East and Africa Network Camera Analysis and Outlook

13.1. Middle East and Africa Network Camera Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Network Camera Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Network Camera Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Network Camera Revenue (USD Million) by Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Chapter 14. Network Camera Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Avigilon Corp

Axis Communications AB

Basler AG

Belkin International Inc

Cisco Systems Inc

Eagle Eye Networks Inc

Hangzhou Hikvision Digital Technology Co. Ltd

Hanwha Corp

Honeywell International Inc

Johnson Controls International Plc

MOBOTIX AG

Netgear Inc

Panasonic Holdings Corp

Pelco Inc

Robert Bosch GmbH

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Network Camera Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Network Camera Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Network Camera Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Network Camera Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Network Camera Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Network Camera Market Share (%) By Regions (2021-2032)

Table 12 North America Network Camera Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Network Camera Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Network Camera Revenue (USD Million) By Country (2021-2032)

Table 15 South America Network Camera Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Network Camera Revenue (USD Million) By Region (2021-2032)

Table 17 North America Network Camera Revenue (USD Million) By Type (2021-2032)

Table 18 North America Network Camera Revenue (USD Million) By Application (2021-2032)

Table 19 North America Network Camera Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Network Camera Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Network Camera Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Network Camera Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Network Camera Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Network Camera Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Network Camera Revenue (USD Million) By Product (2021-2032)

Table 26 South America Network Camera Revenue (USD Million) By Type (2021-2032)

Table 27 South America Network Camera Revenue (USD Million) By Application (2021-2032)

Table 28 South America Network Camera Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Network Camera Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Network Camera Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Network Camera Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Network Camera Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Network Camera Market Share (%) By Regions (2023)

Figure 6. North America Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 12. France Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 12. China Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 14. India Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Network Camera Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Network Camera Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Network Camera Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Network Camera Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Network Camera Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Network Camera Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Network Camera Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Network Camera Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Network Camera Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Network Camera Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Network Camera Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Network Camera Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Network Camera Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Network Camera Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Network Camera Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Network Camera Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Network Camera Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Network Camera Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Network Camera Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Network Camera Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Network Camera Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Network Camera Revenue (USD Million) By Product (2021-2032)

By Product

Fixed

PTZ

Infrared

By Connection

Centralized

Decentralized

By End-User

Transportation

Public Sector

Manufacturing

Retail

IT & Telecom

Energy & Utilities

Media & Entertainment

BFSI

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Network Camera Market Size is valued at $12.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 14.3% to reach $35.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Avigilon Corp, Axis Communications AB, Basler AG, Belkin International Inc, Cisco Systems Inc, Eagle Eye Networks Inc, Hangzhou Hikvision Digital Technology Co. Ltd, Hanwha Corp, Honeywell International Inc, Johnson Controls International Plc, MOBOTIX AG, Netgear Inc, Panasonic Holdings Corp, Pelco Inc, Robert Bosch GmbH

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume