The global Natural Fiber Reinforced Composites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Fiber (Wood Fiber Composites, Non-wood Fiber Composites), By Polymer (Thermosets, Thermoplastics), By End-User (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Sports, Others).

The natural fiber reinforced composites market is expected to grow significantly in 2024, driven by the increasing demand for sustainable and eco-friendly materials across various industries. Natural fiber reinforced composites, made from plant-based fibers such as flax, hemp, jute, and sisal, offer environmental benefits, including biodegradability and reduced carbon footprint, compared to synthetic fiber composites. These composites are used in automotive, construction, packaging, and consumer goods industries. The automotive sector, in particular, leverages natural fiber composites to reduce vehicle weight and improve fuel efficiency. The construction industry utilizes these materials for sustainable building solutions. Advancements in composite manufacturing technologies, coupled with the growing emphasis on sustainability and environmental regulations, are key drivers for the growth of the natural fiber reinforced composites market.

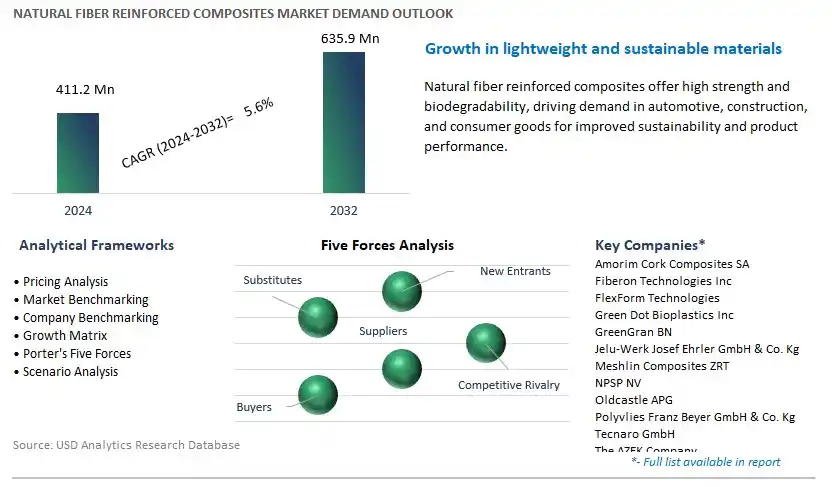

The market report analyses the leading companies in the industry including Amorim Cork Composites SA, Fiberon Technologies Inc, FlexForm Technologies, Green Dot Bioplastics Inc, GreenGran BN, Jelu-Werk Josef Ehrler GmbH & Co. Kg, Meshlin Composites ZRT, NPSP NV, Oldcastle APG, Polyvlies Franz Beyer GmbH & Co. Kg, Tecnaro GmbH, The AZEK Company, Trex Company Inc, TTS, UPM-Kymmene Oyj, and others.

A prominent trend in the natural fiber reinforced composites market is the increasing demand for sustainable and eco-friendly materials. As environmental concerns mount and regulations on carbon emissions become stricter, industries are seeking alternatives to traditional synthetic materials derived from fossil fuels. Natural fiber reinforced composites, which are composed of renewable and biodegradable fibers such as hemp, flax, jute, and kenaf embedded in a polymer matrix, offer a sustainable solution. These composites provide comparable mechanical properties to traditional materials while offering the benefits of reduced environmental footprint, lower energy consumption during production, and biodegradability at the end of their lifecycle. As consumers and industries prioritize sustainability, the demand for natural fiber reinforced composites is expected to continue to grow across various sectors including automotive, construction, aerospace, and consumer goods.

A key driver fueling the natural fiber reinforced composites market is the enforcement of stringent environmental regulations and the adoption of corporate sustainability initiatives. Governments worldwide are implementing regulations aimed at reducing carbon emissions and promoting the use of sustainable materials in manufacturing processes. Additionally, many corporations are incorporating sustainability goals into their business strategies, committing to reducing their environmental footprint and adopting green practices throughout their supply chains. Natural fiber reinforced composites offer an attractive solution for meeting these regulatory requirements and sustainability targets, as they align with the principles of circular economy and resource efficiency. The growing emphasis on environmental responsibility and corporate sustainability drives the adoption of natural fiber reinforced composites across industries, propelling market growth.

A promising opportunity for the natural fiber reinforced composites market lies in the expansion into new application areas and product segments. While natural fiber reinforced composites are already widely used in automotive interiors, construction materials, and consumer goods such as furniture and sporting goods, there is potential for further diversification and penetration into additional markets. Industries such as marine, renewable energy, and infrastructure offer untapped opportunities for the adoption of natural fiber reinforced composites in applications such as boat building, wind turbine blades, and structural components for bridges and buildings. Furthermore, advancements in composite manufacturing technologies and material formulations enable the development of innovative products with enhanced performance characteristics, opening doors to new market segments and driving continued growth and innovation in the natural fiber reinforced composites market.

Within the Natural Fiber Reinforced Composites market, the largest segment is Wood Fiber Composites. Wood fiber composites, also known as wood-plastic composites (WPC), are extensively used in various industries due to their versatility, durability, and sustainable nature. These composites combine natural wood fibers with polymer resins, resulting in materials that exhibit the aesthetic appeal of wood along with the performance benefits of plastics. Wood fiber composites find applications in decking, fencing, furniture, automotive interiors, and building materials, among others. They offer advantages such as high strength-to-weight ratio, resistance to moisture, rot, and insect damage, as well as ease of processing and recyclability. Moreover, the growing emphasis on environmental sustainability and the need for eco-friendly alternatives to traditional materials drive the demand for wood fiber composites. As industries seek to reduce their carbon footprint and comply with regulations promoting green building practices, the market for wood fiber composites continues to expand, consolidating its position as the largest segment in the Natural Fiber Reinforced Composites market.

Among the segmented polymers in the Natural Fiber Reinforced Composites market, the fastest-growing segment is Thermoplastics. Thermoplastic natural fiber composites offer significant advantages such as lightweight, recyclability, and processing flexibility, making them increasingly favored in various industries. These composites are produced by blending natural fibers with thermoplastic resins such as polypropylene (PP), polyethylene (PE), and polyethylene terephthalate (PET). Thermoplastic natural fiber composites find applications in automotive components, construction materials, consumer goods, and packaging due to their superior mechanical properties, cost-effectiveness, and sustainability. Moreover, advancements in manufacturing technologies, such as injection molding and extrusion, enable the mass production of complex shapes and intricate designs, further driving the adoption of thermoplastic natural fiber composites. With growing concerns about environmental impact and regulatory pressure to reduce reliance on conventional plastics, the demand for thermoplastic natural fiber composites is expected to witness significant growth, positioning thermoplastics segment as the fastest-growing segment in the Natural Fiber Reinforced Composites market.

Within the Natural Fiber Reinforced Composites market, the largest segment is Automotive. The automotive industry is a major consumer of natural fiber reinforced composites due to their lightweight, high strength, and environmental sustainability. Automakers are increasingly adopting natural fiber composites for interior and exterior components, such as door panels, dashboards, seat backs, and trunk liners, to reduce vehicle weight and improve fuel efficiency. Additionally, natural fiber composites offer advantages such as noise reduction, vibration damping, and thermal insulation, enhancing the overall comfort and driving experience for consumers. Moreover, stringent regulations aimed at reducing carbon emissions and promoting eco-friendly materials in the automotive sector further drive the demand for natural fiber composites. With automakers increasingly integrating sustainable materials into their manufacturing processes and the growing trend towards electric and hybrid vehicles, the demand for natural fiber reinforced composites in the automotive industry is expected to continue growing, solidifying the Automotive segment's position as the largest segment in the Natural Fiber Reinforced Composites market.

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amorim Cork Composites SA

Fiberon Technologies Inc

FlexForm Technologies

Green Dot Bioplastics Inc

GreenGran BN

Jelu-Werk Josef Ehrler GmbH & Co. Kg

Meshlin Composites ZRT

NPSP NV

Oldcastle APG

Polyvlies Franz Beyer GmbH & Co. Kg

Tecnaro GmbH

The AZEK Company

Trex Company Inc

TTS

UPM-Kymmene Oyj

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Natural Fiber Reinforced Composites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Natural Fiber Reinforced Composites Market Size Outlook, $ Million, 2021 to 2032

3.2 Natural Fiber Reinforced Composites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Natural Fiber Reinforced Composites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Natural Fiber Reinforced Composites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Natural Fiber Reinforced Composites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Natural Fiber Reinforced Composites Industry

4.2 Key Market Trends in Natural Fiber Reinforced Composites Industry

4.3 Potential Opportunities in Natural Fiber Reinforced Composites Industry

4.4 Key Challenges in Natural Fiber Reinforced Composites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Natural Fiber Reinforced Composites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Natural Fiber Reinforced Composites Market Outlook by Segments

7.1 Natural Fiber Reinforced Composites Market Outlook by Segments, $ Million, 2021- 2032

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

8 North America Natural Fiber Reinforced Composites Market Analysis and Outlook To 2032

8.1 Introduction to North America Natural Fiber Reinforced Composites Markets in 2024

8.2 North America Natural Fiber Reinforced Composites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Natural Fiber Reinforced Composites Market size Outlook by Segments, 2021-2032

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

9 Europe Natural Fiber Reinforced Composites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Natural Fiber Reinforced Composites Markets in 2024

9.2 Europe Natural Fiber Reinforced Composites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Natural Fiber Reinforced Composites Market Size Outlook by Segments, 2021-2032

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

10 Asia Pacific Natural Fiber Reinforced Composites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Natural Fiber Reinforced Composites Markets in 2024

10.2 Asia Pacific Natural Fiber Reinforced Composites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Natural Fiber Reinforced Composites Market size Outlook by Segments, 2021-2032

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

11 South America Natural Fiber Reinforced Composites Market Analysis and Outlook To 2032

11.1 Introduction to South America Natural Fiber Reinforced Composites Markets in 2024

11.2 South America Natural Fiber Reinforced Composites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Natural Fiber Reinforced Composites Market size Outlook by Segments, 2021-2032

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

12 Middle East and Africa Natural Fiber Reinforced Composites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Natural Fiber Reinforced Composites Markets in 2024

12.2 Middle East and Africa Natural Fiber Reinforced Composites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Natural Fiber Reinforced Composites Market size Outlook by Segments, 2021-2032

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amorim Cork Composites SA

Fiberon Technologies Inc

FlexForm Technologies

Green Dot Bioplastics Inc

GreenGran BN

Jelu-Werk Josef Ehrler GmbH & Co. Kg

Meshlin Composites ZRT

NPSP NV

Oldcastle APG

Polyvlies Franz Beyer GmbH & Co. Kg

Tecnaro GmbH

The AZEK Company

Trex Company Inc

TTS

UPM-Kymmene Oyj

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Fiber

Wood Fiber Composites

Non-wood Fiber Composites

-Cotton

-Flax

-Kenaf

-Hemp

-Others

By Polymer

Thermosets

Thermoplastics

-Polyethylene

-Polypropylene

-Poly Vinyl Chloride

-Others

By End-User

Aerospace

Automotive

Building and Construction

Electrical and Electronics

Sports

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Natural Fiber Reinforced Composites Market Size is valued at $411.2 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.6% to reach $635.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amorim Cork Composites SA, Fiberon Technologies Inc, FlexForm Technologies, Green Dot Bioplastics Inc, GreenGran BN, Jelu-Werk Josef Ehrler GmbH & Co. Kg, Meshlin Composites ZRT, NPSP NV, Oldcastle APG, Polyvlies Franz Beyer GmbH & Co. Kg, Tecnaro GmbH, The AZEK Company, Trex Company Inc, TTS, UPM-Kymmene Oyj

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume