The global Natural Cosmetics Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Personal care, Skincare, Others), By Distribution Channel (Offline, Online)

In 2024, the natural cosmetics market is thriving as consumers seek clean, non-toxic alternatives to conventional beauty products that prioritize both health and sustainability. Natural cosmetics are formulated with plant-based ingredients, botanical extracts, and minerals, excluding synthetic chemicals, parabens, phthalates, and other potentially harmful additives commonly found in traditional cosmetics. With growing concerns about skin sensitivities, allergies, and environmental impact, consumers are gravitating towards natural cosmetics that offer safer, gentler formulations without compromising on performance or aesthetic appeal. Moreover, the rise of clean beauty standards and transparency in the beauty industry is driving demand for natural cosmetics that undergo rigorous testing, adhere to strict quality standards, and feature transparent labeling to inform and empower consumers. As the natural cosmetics market continues to evolve, expect to see further innovation in product formulations, packaging materials, and sustainable sourcing practices that cater to diverse skin types, beauty preferences, and environmental values, reflecting a growing demand for ethical and eco-conscious beauty solutions that promote both personal and planetary well-being.

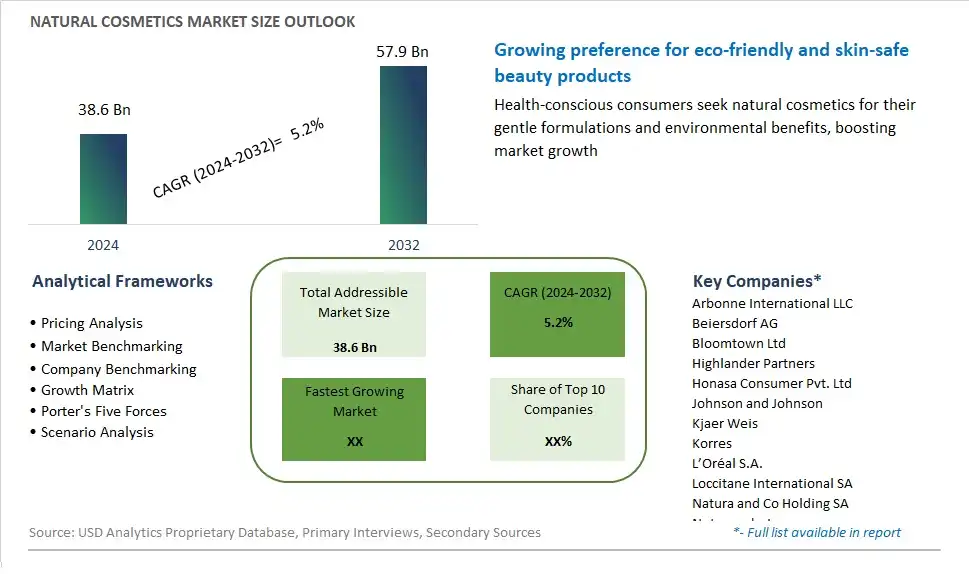

The market report analyses the leading companies in the industry including Arbonne International LLC, Beiersdorf AG, Bloomtown Ltd, Highlander Partners, Honasa Consumer Pvt. Ltd, Johnson and Johnson, Kjaer Weis, Korres, L’Oréal S.A., Loccitane International SA, Natura and Co Holding SA, Nutramarks Inc, Nuxe, Pola Orbis Holdings Inc, Tata Natural Alchemy LLC, The Clorox Co., The Estee Lauder Co. Inc, The Honest Co. Inc, Unilever PLC , Weleda Group, and Others.

A significant trend in the natural cosmetics market is the shift towards clean beauty and sustainable practices among consumers. With increasing awareness of the environmental impact of conventional cosmetics, as well as concerns about the safety of synthetic ingredients, there's a growing demand for natural and organic cosmetic products. Consumers are seeking beauty products made from ethically sourced, plant-based ingredients that are free from harsh chemicals, artificial fragrances, and animal-derived ingredients. This trend is driven by a desire for transparency in product formulations, eco-consciousness, and a holistic approach to personal care that prioritizes health, sustainability, and environmental stewardship.

A key driver for the natural cosmetics market is the rising consumer awareness and health consciousness regarding the potential risks associated with conventional cosmetics. As people become more informed about the ingredients in their personal care products and their potential impact on skin health and overall well-being, there's a growing preference for natural alternatives that are perceived as safer and gentler on the skin. This driver is reinforced by factors such as the influence of social media, beauty influencers, and wellness blogs in educating consumers about clean beauty trends and advocating for ingredient transparency. Additionally, the increasing prevalence of skin sensitivities, allergies, and dermatological concerns among consumers further drives the demand for natural cosmetics formulated with hypoallergenic and skin-friendly ingredients.

An opportunity for the natural cosmetics market lies in innovation in sustainable packaging and green formulations to meet the evolving needs and preferences of environmentally conscious consumers. Companies can capitalize on this opportunity by adopting eco-friendly packaging materials such as recycled plastics, biodegradable containers, and refillable options to minimize plastic waste and carbon footprint. Moreover, there's potential to innovate with green formulations using natural, renewable, and locally sourced ingredients that promote biodiversity, support fair trade practices, and reduce environmental impact throughout the product lifecycle. By embracing sustainability as a core value and integrating eco-friendly practices into product development, companies can differentiate themselves in the competitive natural cosmetics market, attract environmentally conscious consumers, and drive market growth while contributing to environmental conservation and social responsibility.

The skincare segment is the largest and fastest-growing segment within the natural cosmetics market, characterized by a surge in consumer demand for products that promote healthier skin without compromising on environmental sustainability. With growing awareness regarding the adverse effects of synthetic ingredients and chemicals, consumers are increasingly gravitating towards natural alternatives, driving the exponential growth of the skincare sector. Key factors propelling this growth include the rising preference for organic and plant-based formulations, coupled with a heightened focus on anti-aging solutions and holistic skincare routines. Additionally, the advent of innovative technologies and formulations in natural skincare products, such as botanical extracts, essential oils, and eco-friendly packaging, further contribute to its burgeoning popularity among health-conscious consumers. As a result, the skincare segment not only commands the largest market share but also exhibits robust growth potential, fueled by evolving consumer preferences and a shifting paradigm towards sustainable beauty practices.

Among the distribution channels in the natural cosmetics market, the online segment is the fastest-growing, propelled by the rapid digital transformation of the beauty industry and shifting consumer preferences towards convenient shopping experiences. The exponential growth of e-commerce platforms offers consumers unparalleled accessibility to a wide array of natural cosmetics, transcending geographical barriers and time constraints. Further, the online channel provides a platform for niche natural beauty brands to reach a global audience, leveraging social media, influencer marketing, and personalized recommendations to enhance brand visibility and engagement. The convenience of online shopping, coupled with the availability of detailed product information and customer reviews, fosters trust and transparency, thereby driving the preference for online purchases among discerning consumers seeking authentic and sustainable beauty solutions. As a result, the online distribution channel not only presents significant growth opportunities for natural cosmetics but also reflects the evolving landscape of the beauty industry towards digitalization and omnichannel retailing.

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arbonne International LLC

Beiersdorf AG

Bloomtown Ltd

Highlander Partners

Honasa Consumer Pvt. Ltd

Johnson and Johnson

Kjaer Weis

Korres

L’Oréal S.A.

Loccitane International SA

Natura and Co Holding SA

Nutramarks Inc

Nuxe

Pola Orbis Holdings Inc

Tata Natural Alchemy LLC

The Clorox Co.

The Estee Lauder Co. Inc

The Honest Co. Inc

Unilever PLC

Weleda Group

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Natural Cosmetics Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Natural Cosmetics Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Natural Cosmetics Market Share by Company, 2023

4.1.2. Product Offerings of Leading Natural Cosmetics Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Natural Cosmetics Market Drivers

6.2. Natural Cosmetics Market Challenges

6.6. Natural Cosmetics Market Opportunities

6.4. Natural Cosmetics Market Trends

Chapter 7. Global Natural Cosmetics Market Outlook Trends

7.1. Global Natural Cosmetics Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Natural Cosmetics Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Natural Cosmetics Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Chapter 8. Global Natural Cosmetics Regional Analysis and Outlook

8.1. Global Natural Cosmetics Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Natural Cosmetics Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Natural Cosmetics Regional Analysis and Outlook

8.2.2. Canada Natural Cosmetics Regional Analysis and Outlook

8.2.3. Mexico Natural Cosmetics Regional Analysis and Outlook

8.3. Europe Natural Cosmetics Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Natural Cosmetics Regional Analysis and Outlook

8.3.2. France Natural Cosmetics Regional Analysis and Outlook

8.3.3. United Kingdom Natural Cosmetics Regional Analysis and Outlook

8.3.4. Spain Natural Cosmetics Regional Analysis and Outlook

8.3.5. Italy Natural Cosmetics Regional Analysis and Outlook

8.3.6. Russia Natural Cosmetics Regional Analysis and Outlook

8.3.7. Rest of Europe Natural Cosmetics Regional Analysis and Outlook

8.4. Asia Pacific Natural Cosmetics Revenue (USD Million) by Country (2021-2032)

8.4.1. China Natural Cosmetics Regional Analysis and Outlook

8.4.2. Japan Natural Cosmetics Regional Analysis and Outlook

8.4.3. India Natural Cosmetics Regional Analysis and Outlook

8.4.4. South Korea Natural Cosmetics Regional Analysis and Outlook

8.4.5. Australia Natural Cosmetics Regional Analysis and Outlook

8.4.6. South East Asia Natural Cosmetics Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Natural Cosmetics Regional Analysis and Outlook

8.5. South America Natural Cosmetics Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Natural Cosmetics Regional Analysis and Outlook

8.5.2. Argentina Natural Cosmetics Regional Analysis and Outlook

8.5.3. Rest of South America Natural Cosmetics Regional Analysis and Outlook

8.6. Middle East and Africa Natural Cosmetics Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Natural Cosmetics Regional Analysis and Outlook

8.6.2. Africa Natural Cosmetics Regional Analysis and Outlook

Chapter 9. North America Natural Cosmetics Analysis and Outlook

9.1. North America Natural Cosmetics Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Natural Cosmetics Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Natural Cosmetics Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Natural Cosmetics Revenue (USD Million) by Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Chapter 10. Europe Natural Cosmetics Analysis and Outlook

10.1. Europe Natural Cosmetics Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Natural Cosmetics Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Natural Cosmetics Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Natural Cosmetics Revenue (USD Million) by Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Chapter 11. Asia Pacific Natural Cosmetics Analysis and Outlook

11.1. Asia Pacific Natural Cosmetics Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Natural Cosmetics Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Natural Cosmetics Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Natural Cosmetics Revenue (USD Million) by Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Chapter 12. South America Natural Cosmetics Analysis and Outlook

12.1. South America Natural Cosmetics Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Natural Cosmetics Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Natural Cosmetics Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Natural Cosmetics Revenue (USD Million) by Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Chapter 13. Middle East and Africa Natural Cosmetics Analysis and Outlook

13.1. Middle East and Africa Natural Cosmetics Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Natural Cosmetics Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Natural Cosmetics Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Natural Cosmetics Revenue (USD Million) by Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Chapter 14. Natural Cosmetics Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Arbonne International LLC

Beiersdorf AG

Bloomtown Ltd

Highlander Partners

Honasa Consumer Pvt. Ltd

Johnson and Johnson

Kjaer Weis

Korres

L’Oréal S.A.

Loccitane International SA

Natura and Co Holding SA

Nutramarks Inc

Nuxe

Pola Orbis Holdings Inc

Tata Natural Alchemy LLC

The Clorox Co.

The Estee Lauder Co. Inc

The Honest Co. Inc

Unilever PLC

Weleda Group

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Natural Cosmetics Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Natural Cosmetics Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Natural Cosmetics Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Natural Cosmetics Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Natural Cosmetics Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Natural Cosmetics Market Share (%) By Regions (2021-2032)

Table 12 North America Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Table 15 South America Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Table 17 North America Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Table 18 North America Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Table 19 North America Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Table 26 South America Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Table 27 South America Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Table 28 South America Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Natural Cosmetics Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Natural Cosmetics Market Share (%) By Regions (2023)

Figure 6. North America Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 12. France Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 12. China Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 14. India Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Natural Cosmetics Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Natural Cosmetics Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Natural Cosmetics Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Natural Cosmetics Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Natural Cosmetics Revenue (USD Million) By Product (2021-2032)

By Type

Personal care

Skincare

Others

By Distribution Channel

Offline

Online

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Natural Cosmetics Market Size is valued at $38.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.2% to reach $57.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arbonne International LLC, Beiersdorf AG, Bloomtown Ltd, Highlander Partners, Honasa Consumer Pvt. Ltd, Johnson and Johnson, Kjaer Weis, Korres, L’Oréal S.A., Loccitane International SA, Natura and Co Holding SA, Nutramarks Inc, Nuxe, Pola Orbis Holdings Inc, Tata Natural Alchemy LLC, The Clorox Co., The Estee Lauder Co. Inc, The Honest Co. Inc, Unilever PLC , Weleda Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume