The global Naphthenic Acid Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Refined Naphthenic Acid, High-purity Naphthenic Acid), By Application (Paint and Ink Driers, Wood Preservatives, Fuel and Lubricant Additives, Rubber Additives, Others).

Naphthenic acid is a type of organic compound found in petroleum crude oil and its derived products, playing a significant role in various industrial applications in 2024. It is a mixture of cyclopentane and cyclohexane carboxylic acids, typically containing branched and cyclic hydrocarbon chains. Naphthenic acids are extracted from crude oil during the refining process and can be further processed to obtain commercial-grade products with specific compositions and properties. These acids find wide application as corrosion inhibitors, emulsifiers, and additives in industries such as oil and gas production, petroleum refining, lubricants, and metalworking fluids. In the oil and gas industry, naphthenic acids are used as corrosion inhibitors to protect metal surfaces from acidic corrosion in production wells, pipelines, and refining equipment. They form a protective film on metal surfaces, preventing the formation of corrosion products and extending the service life of equipment and infrastructure. Additionally, naphthenic acids are employed as emulsifiers and surfactants in petroleum refining processes, facilitating the separation of oil-water emulsions and improving the efficiency of refining operations. In lubricants and metalworking fluids, naphthenic acids serve as additives to enhance lubricity, thermal stability, and oxidative stability, contributing to the performance and longevity of lubricated machinery and metalworking processes. With their versatile properties and beneficial effects on industrial processes, naphthenic acids to be essential components in various applications, supporting the reliability, efficiency, and sustainability of critical infrastructure and operations across multiple sectors.

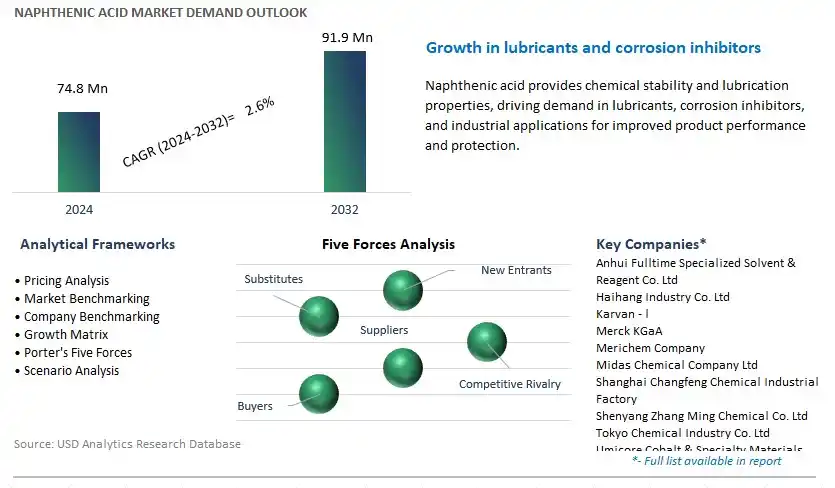

The market report analyses the leading companies in the industry including Anhui Fulltime Specialized Solvent & Reagent Co. Ltd, Haihang Industry Co. Ltd, Karvan - l, Merck KGaA, Merichem Company, Midas Chemical Company Ltd, Shanghai Changfeng Chemical Industrial Factory, Shenyang Zhang Ming Chemical Co. Ltd, Tokyo Chemical Industry Co. Ltd, Umicore Cobalt & Specialty Materials (CSM), and others.

A notable trend in the naphthenic acid market is the increasing demand for bio-based chemicals. Naphthenic acids, which are naturally occurring carboxylic acids found in petroleum, are gaining attention as feedstocks for the production of bio-based chemicals and materials. With growing environmental concerns and the need to reduce reliance on fossil fuels, there is a shift towards sustainable and renewable sources of chemicals. Naphthenic acids offer a renewable feedstock for the synthesis of a wide range of chemicals, including detergents, lubricants, corrosion inhibitors, and pharmaceuticals. This trend is driven by the desire for greener alternatives and the development of biorefinery processes that convert biomass-derived naphthenic acids into value-added products, thereby driving market growth for naphthenic acids.

A key driver fueling the naphthenic acid market is the increasing demand from end-use industries. Naphthenic acids find applications in various sectors such as oil and gas, chemicals, lubricants, rubber, and pharmaceuticals. In the oil and gas industry, naphthenic acids are used as emulsifiers in crude oil production and as additives in drilling fluids. In the chemical industry, they serve as intermediates in the synthesis of surfactants, plasticizers, and detergents. In lubricants and greases, they act as additives to improve lubricity and thermal stability. Additionally, naphthenic acids are utilized in the production of synthetic rubber and pharmaceuticals. The growing demand for these end-use products drives the consumption of naphthenic acids, making them an essential component in various industrial processes and applications.

A promising opportunity for the naphthenic acid market lies in the development of specialty chemicals and derivatives. Naphthenic acids can be chemically modified or derivatized to produce a wide range of specialty chemicals with tailored properties and functionalities. By leveraging the unique chemical structure of naphthenic acids, manufacturers can synthesize specialty chemicals such as corrosion inhibitors, surfactants, plasticizers, and antioxidants for specific industrial applications. Furthermore, the development of novel derivatives with enhanced performance characteristics and reduced environmental impact presents an opportunity to capture niche markets and create value-added products. By investing in research and development initiatives to explore new chemical pathways and applications, companies can unlock the full potential of naphthenic acids, diversify their product offerings, and capitalize on emerging market opportunities in specialty chemicals and derivatives.

Within the Naphthenic Acid market, the largest segment is Refined Naphthenic Acid. Refined naphthenic acid undergoes extensive purification processes to remove impurities and contaminants, resulting in a high-quality product with consistent properties and enhanced purity levels. This makes it suitable for a wide range of applications across industries such as chemicals, lubricants, coatings, and rubber processing. Refined naphthenic acid is valued for its excellent solubility, thermal stability, and compatibility with various materials, making it a preferred choice for formulating specialty chemicals and additives. Additionally, the stringent quality standards and regulatory requirements in end-user industries further drive the demand for refined naphthenic acid. As industries continue to prioritize product quality, performance, and environmental compliance, the demand for refined naphthenic acid is expected to remain robust, cementing its position as the largest segment in the Naphthenic Acid market.

Among the segmented applications in the Naphthenic Acid market, the fastest-growing segment is Fuel and Lubricant Additives. Naphthenic acid-based additives are increasingly being utilized in the fuel and lubricant industry to enhance the performance and functionality of petroleum-based products. Naphthenic acid additives exhibit excellent detergent, dispersant, and anti-corrosion properties, making them effective in improving fuel stability, cleanliness, and lubrication efficiency. Additionally, naphthenic acid additives help mitigate issues such as deposit formation, engine wear, and oxidation in automotive and industrial lubricants, leading to extended equipment life and improved operational reliability. With the growing demand for cleaner and more efficient fuels and lubricants, there is a rising need for advanced additive technologies like naphthenic acid-based additives. Moreover, stringent environmental regulations and evolving performance requirements in the automotive and industrial sectors further drive the adoption of naphthenic acid additives, positioning the Fuel and Lubricant Additives segment for rapid growth in the Naphthenic Acid market.

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Anhui Fulltime Specialized Solvent & Reagent Co. Ltd

Haihang Industry Co. Ltd

Karvan - l

Merck KGaA

Merichem Company

Midas Chemical Company Ltd

Shanghai Changfeng Chemical Industrial Factory

Shenyang Zhang Ming Chemical Co. Ltd

Tokyo Chemical Industry Co. Ltd

Umicore Cobalt & Specialty Materials (CSM)

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Naphthenic Acid Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Naphthenic Acid Market Size Outlook, $ Million, 2021 to 2032

3.2 Naphthenic Acid Market Outlook by Type, $ Million, 2021 to 2032

3.3 Naphthenic Acid Market Outlook by Product, $ Million, 2021 to 2032

3.4 Naphthenic Acid Market Outlook by Application, $ Million, 2021 to 2032

3.5 Naphthenic Acid Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Naphthenic Acid Industry

4.2 Key Market Trends in Naphthenic Acid Industry

4.3 Potential Opportunities in Naphthenic Acid Industry

4.4 Key Challenges in Naphthenic Acid Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Naphthenic Acid Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Naphthenic Acid Market Outlook by Segments

7.1 Naphthenic Acid Market Outlook by Segments, $ Million, 2021- 2032

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

8 North America Naphthenic Acid Market Analysis and Outlook To 2032

8.1 Introduction to North America Naphthenic Acid Markets in 2024

8.2 North America Naphthenic Acid Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Naphthenic Acid Market size Outlook by Segments, 2021-2032

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

9 Europe Naphthenic Acid Market Analysis and Outlook To 2032

9.1 Introduction to Europe Naphthenic Acid Markets in 2024

9.2 Europe Naphthenic Acid Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Naphthenic Acid Market Size Outlook by Segments, 2021-2032

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

10 Asia Pacific Naphthenic Acid Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Naphthenic Acid Markets in 2024

10.2 Asia Pacific Naphthenic Acid Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Naphthenic Acid Market size Outlook by Segments, 2021-2032

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

11 South America Naphthenic Acid Market Analysis and Outlook To 2032

11.1 Introduction to South America Naphthenic Acid Markets in 2024

11.2 South America Naphthenic Acid Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Naphthenic Acid Market size Outlook by Segments, 2021-2032

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

12 Middle East and Africa Naphthenic Acid Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Naphthenic Acid Markets in 2024

12.2 Middle East and Africa Naphthenic Acid Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Naphthenic Acid Market size Outlook by Segments, 2021-2032

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Anhui Fulltime Specialized Solvent & Reagent Co. Ltd

Haihang Industry Co. Ltd

Karvan - l

Merck KGaA

Merichem Company

Midas Chemical Company Ltd

Shanghai Changfeng Chemical Industrial Factory

Shenyang Zhang Ming Chemical Co. Ltd

Tokyo Chemical Industry Co. Ltd

Umicore Cobalt & Specialty Materials (CSM)

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Refined Naphthenic Acid

High-purity Naphthenic Acid

By Application

Paint and Ink Driers

Wood Preservatives

Fuel and Lubricant Additives

Rubber Additives

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Naphthenic Acid Market Size is valued at $74.8 Million in 2024 and is forecast to register a growth rate (CAGR) of 2.6% to reach $91.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Anhui Fulltime Specialized Solvent & Reagent Co. Ltd, Haihang Industry Co. Ltd, Karvan - l, Merck KGaA, Merichem Company, Midas Chemical Company Ltd, Shanghai Changfeng Chemical Industrial Factory, Shenyang Zhang Ming Chemical Co. Ltd, Tokyo Chemical Industry Co. Ltd, Umicore Cobalt & Specialty Materials (CSM)

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume