The global Nano Paints and Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Graphene, Carbon Nanotubes, Nano-SiO2 (Silicon Dioxide), Nano Silver, Nano-TiO2 (Titanium Dioxide), Nano-ZNO), By Method (Electrospray and Electro Spinning, Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), Atomic Layer Deposition (ALD), Aerosol Coating, Self-assembly, Sol-gel), By End-User (Biomedical, Food & Packaging, Aerospace & Defense, Marine, Electronics & Optics, Automobile, Oil & Gas, Others).

Nano paints and coatings represent a category of advanced surface coatings containing nanostructured materials in 2024. These coatings offer enhanced performance characteristics, including improved durability, weather resistance, scratch resistance, and self-cleaning properties, compared to conventional coatings. Nano paints and coatings utilize nanoparticles, such as metal oxides, carbon nanotubes, and nanoclays, dispersed in a polymer matrix or solvent system to impart specific functionalities and performance enhancements. In architectural coatings, nano paints are used for exterior and interior applications to provide long-lasting protection against weathering, UV radiation, mold, and mildew. They offer excellent adhesion, color retention, and surface smoothness, resulting in aesthetically pleasing and durable finishes. In automotive coatings, nano paints are applied to vehicles to enhance their appearance, durability, and resistance to scratches, corrosion, and environmental damage. They provide a high-gloss finish, improved scratch resistance, and self-healing properties, prolonging the lifespan and maintaining the resale value of automotive vehicles. Additionally, nano coatings find applications in industrial coatings, marine coatings, and protective coatings for infrastructure, where they offer superior adhesion, chemical resistance, and barrier properties. Nano coatings are also used in specialty applications such as anti-graffiti coatings, anti-fouling coatings, and heat-resistant coatings, providing tailored solutions to specific performance requirements. With increasing demand for high-performance coatings in sectors such as construction, automotive, aerospace, and marine, nano paints and coatings are poised for growth, driven by advancements in nanomaterial synthesis, formulation technologies, and environmental regulations encouraging the use of sustainable and eco-friendly coating solutions.

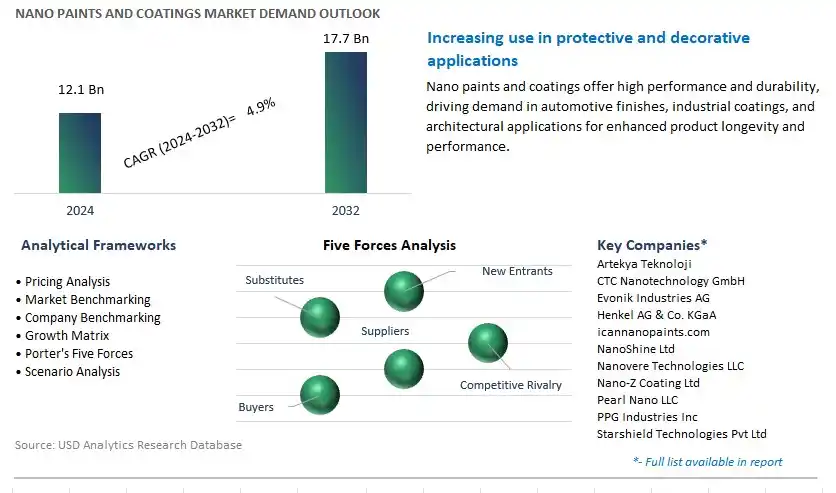

The market report analyses the leading companies in the industry including Artekya Teknoloji, CTC Nanotechnology GmbH, Evonik Industries AG, Henkel AG & Co. KGaA, icannanopaints.com, NanoShine Ltd, Nanovere Technologies LLC, Nano-Z Coating Ltd, Pearl Nano LLC, PPG Industries Inc, Starshield Technologies Pvt Ltd, and others.

A significant trend in the nano paints and coatings market is the increasing demand for sustainable and high-performance coatings. As environmental concerns and regulatory pressures intensify, there is a growing emphasis on the development of coatings that minimize environmental impact, reduce VOC emissions, and enhance durability and performance. Nano paints and coatings, which incorporate nanoparticles to improve properties such as scratch resistance, UV protection, antimicrobial properties, and corrosion resistance, are gaining traction as sustainable alternatives to conventional coatings. Industries such as automotive, construction, aerospace, and marine are increasingly adopting nano coatings to meet stringent performance requirements while adhering to sustainability goals. This trend drives market growth for nano paints and coatings as manufacturers focus on developing innovative formulations that offer superior performance, durability, and environmental sustainability.

A key driver fueling the nano paints and coatings market is advancements in nanotechnology and material science. With ongoing research and development efforts, scientists and engineers are continually exploring new nanomaterials, synthesis methods, and coating technologies to enhance the performance and functionality of coatings. Nanostructured materials, such as metal oxides, carbon nanotubes, and graphene, offer unique properties and functionalities that can be leveraged to develop coatings with enhanced properties such as self-healing, superhydrophobicity, and anti-fouling. Additionally, advancements in manufacturing techniques, such as sol-gel processing, atomic layer deposition, and electrospinning, enable precise control over coating properties and nanostructure morphology, leading to the development of tailored coatings for specific applications. This driver propels market innovation and drives the adoption of nano paints and coatings across various industries seeking advanced solutions for surface protection and functional coatings.

A promising opportunity for the nano paints and coatings market lies in customization and tailoring coatings for specific applications and industries. As industries have diverse requirements and performance criteria for coatings, there is an opportunity for coating manufacturers to develop tailored solutions that address unique challenges and meet specific needs. By collaborating with end-users and understanding their requirements, manufacturers can design nano coatings with optimized properties such as adhesion, flexibility, chemical resistance, and weatherability to suit different substrates and environmental conditions. Additionally, there is an opportunity to integrate functional additives and nanoparticles into coatings to impart additional functionalities such as antimicrobial properties, thermal insulation, or electromagnetic shielding. By offering customized nano coatings that deliver superior performance and functionality, manufacturers can differentiate their products, capture niche markets, and establish themselves as leaders in the competitive coatings industry. This opportunity allows coating manufacturers to expand their product portfolios, build strong customer relationships, and capitalize on the growing demand for tailored solutions in various industries requiring advanced coatings for surface protection and performance enhancement.

In the Nano Paints & Coatings market, the largest segment is the Nano-TiO2 (Titanium Dioxide) segment. Nano-TiO2 is one of the most extensively researched and widely used nanomaterials in the paints and coatings industry due to its exceptional optical, photocatalytic, and antimicrobial properties. TiO2 nanoparticles offer superior UV-blocking capabilities, making them ideal for exterior coatings and paints used in architectural and automotive applications to provide protection against UV radiation, weathering, and discoloration. Additionally, Nano-TiO2 nanoparticles exhibit self-cleaning properties, where they can decompose organic pollutants and inhibit microbial growth on coated surfaces, leading to enhanced durability and cleanliness. Furthermore, Nano-TiO2 nanoparticles are used as white pigments in paints and coatings formulations to impart opacity, brightness, and hiding power, enhancing the aesthetic appeal of painted surfaces. With increasing environmental awareness and regulatory pressure to reduce VOC emissions and improve indoor air quality, Nano-TiO2-based paints and coatings are favored for their low environmental impact and sustainable performance. Over the forecast period, these factors contribute to the Nano-TiO2 segment's status as the largest segment in the Nano Paints & Coatings market.

Among the segmented methods in the Nano Paints & Coatings market, the fastest-growing segment is the Sol-gel method. In particular, the Sol-gel method offers a versatile and cost-effective approach for producing nanoscale coatings with precise control over composition, structure, and thickness. Sol-gel-derived coatings are formed through the hydrolysis and condensation of metal alkoxides or metal salts in a solution, followed by gelation and drying processes to form a thin film. This method allows for the incorporation of various Nano-sized particles, such as metal oxides and nanoparticles, into the coating matrix, enhancing its mechanical, optical, and functional properties. Additionally, Sol-gel coatings exhibit excellent adhesion to various substrates, including metals, glass, ceramics, and polymers, making them suitable for a wide range of applications in industries such as automotive, aerospace, electronics, and construction. Moreover, the Sol-gel method enables the fabrication of multifunctional coatings with tailored properties, including corrosion resistance, anti-fouling, anti-reflective, and self-cleaning properties, meeting the evolving demands of end-users for high-performance and sustainable coatings solutions. Over the forecast period, these factors contribute to the Sol-gel method's status as the fastest-growing segment in the Nano Paints & Coatings market.

In the Nano Paints & Coatings market, the largest segment is the Automobile industry. the automotive sector is one of the largest consumers of paints and coatings, accounting for a significant portion of the global market demand. Nano paints and coatings offer numerous advantages for automotive applications, including enhanced durability, scratch resistance, corrosion protection, and aesthetic appeal. Nano materials such as nano-TiO2, Nano-silica, and Nano-zinc oxide are commonly used in automotive coatings to improve performance and appearance. These Nano materials help automotive coatings withstand harsh environmental conditions, UV radiation, and mechanical stress, thereby extending the lifespan of vehicles and maintaining their aesthetic appeal over time. Additionally, Nano coatings enable automakers to achieve lightweighting goals by reducing the weight of vehicles through thinner coatings while maintaining durability and corrosion resistance. Furthermore, the automotive industry's continuous innovation and adoption of advanced technologies drive the demand for high-performance Nano coatings for applications such as self-healing coatings, anti-fog coatings, and smart coatings with functional properties. Over the forecast period, these factors contribute to the Automobile segment's status as the largest segment in the Nano Paints & Coatings market.

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Artekya Teknoloji

CTC Nanotechnology GmbH

Evonik Industries AG

Henkel AG & Co. KGaA

icannanopaints.com

NanoShine Ltd

Nanovere Technologies LLC

Nano-Z Coating Ltd

Pearl Nano LLC

PPG Industries Inc

Starshield Technologies Pvt Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Nano Paints and Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Nano Paints and Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 Nano Paints and Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 Nano Paints and Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 Nano Paints and Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 Nano Paints and Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Nano Paints and Coatings Industry

4.2 Key Market Trends in Nano Paints and Coatings Industry

4.3 Potential Opportunities in Nano Paints and Coatings Industry

4.4 Key Challenges in Nano Paints and Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Nano Paints and Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Nano Paints and Coatings Market Outlook by Segments

7.1 Nano Paints and Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

8 North America Nano Paints and Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America Nano Paints and Coatings Markets in 2024

8.2 North America Nano Paints and Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Nano Paints and Coatings Market size Outlook by Segments, 2021-2032

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

9 Europe Nano Paints and Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe Nano Paints and Coatings Markets in 2024

9.2 Europe Nano Paints and Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Nano Paints and Coatings Market Size Outlook by Segments, 2021-2032

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

10 Asia Pacific Nano Paints and Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Nano Paints and Coatings Markets in 2024

10.2 Asia Pacific Nano Paints and Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Nano Paints and Coatings Market size Outlook by Segments, 2021-2032

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

11 South America Nano Paints and Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America Nano Paints and Coatings Markets in 2024

11.2 South America Nano Paints and Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Nano Paints and Coatings Market size Outlook by Segments, 2021-2032

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

12 Middle East and Africa Nano Paints and Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Nano Paints and Coatings Markets in 2024

12.2 Middle East and Africa Nano Paints and Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Nano Paints and Coatings Market size Outlook by Segments, 2021-2032

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Artekya Teknoloji

CTC Nanotechnology GmbH

Evonik Industries AG

Henkel AG & Co. KGaA

icannanopaints.com

NanoShine Ltd

Nanovere Technologies LLC

Nano-Z Coating Ltd

Pearl Nano LLC

PPG Industries Inc

Starshield Technologies Pvt Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Graphene

Carbon Nanotubes

Nano-SiO2 (Silicon Dioxide)

Nano Silver

Nano-TiO2 (Titanium Dioxide)

Nano-ZNO

By Method

Electrospray and Electro Spinning

Chemical Vapor Deposition (CVD)

Physical Vapor Deposition (PVD)

Atomic Layer Deposition (ALD)

Aerosol Coating

Self-assembly

Sol-gel

By End-User

Biomedical

Food & Packaging

Aerospace & Defense

Marine

Electronics & Optics

Automobile

Oil & Gas

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Nano Paints and Coatings Market Size is valued at $12.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $17.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Artekya Teknoloji, CTC Nanotechnology GmbH, Evonik Industries AG, Henkel AG & Co. KGaA, icannanopaints.com, NanoShine Ltd, Nanovere Technologies LLC, Nano-Z Coating Ltd, Pearl Nano LLC, PPG Industries Inc, Starshield Technologies Pvt Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume