The global Municipal Water Treatment Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Biocide and Disinfectant, Coagulant and Flocculant, Corrosion and Scale Inhibitor, Defoamer and Defoaming Agent, pH Adjuster and Softener, Others).

Municipal water treatment chemicals play a crucial role in ensuring the safety, quality, and compliance of drinking water supplies in urban areas in 2024. These chemicals are used in various treatment processes, including coagulation, flocculation, sedimentation, filtration, disinfection, and pH adjustment, to remove contaminants, pathogens, and impurities from raw water sources and produce potable water that meets regulatory standards and health guidelines. Municipal water treatment chemicals encompass a diverse range of products, including coagulants, flocculants, disinfectants, pH adjusters, corrosion inhibitors, and antiscalants, each tailored to address specific water quality challenges and treatment objectives. Coagulants such as aluminum sulfate (alum) and ferric chloride are used to destabilize suspended particles and organic matter, facilitating their removal through sedimentation and filtration processes. Flocculants, such as cationic polymers and polyaluminum chloride (PAC), promote the aggregation of fine particles into larger flocs, which can be easily removed by sedimentation or filtration. Disinfectants, such as chlorine, chloramines, and ozone, are added to kill or inactivate pathogens, including bacteria, viruses, and protozoa, ensuring the microbiological safety of drinking water. Additionally, pH adjusters, corrosion inhibitors, and antiscalants are employed to control water chemistry, minimize corrosion of distribution pipes, and prevent scaling in treatment equipment. With growing urbanization, population growth, and increasing awareness of waterborne diseases and contamination risks, the demand for municipal water treatment chemicals is expected to rise, driving investments in water infrastructure, treatment technologies, and chemical formulations to safeguard public health and ensure access to clean and safe drinking water for urban communities.

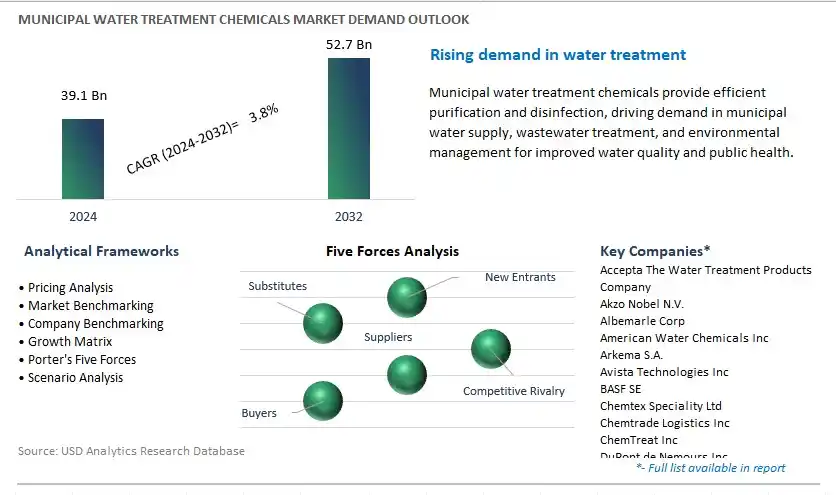

The market report analyses the leading companies in the industry including Accepta The Water Treatment Products Company, Akzo Nobel N.V. , Albemarle Corp, American Water Chemicals Inc, Arkema S.A., Avista Technologies Inc, BASF SE, Chemtex Speciality Ltd, Chemtrade Logistics Inc, ChemTreat Inc, DuPont de Nemours Inc, Ecolab Inc, Kemira Oyj, Lonza Group AG, Solenis, Solvay SA, SUEZ, Thermax Global, Veolia Environnement S.A., and others.

A significant trend in the municipal water treatment chemicals market is the increasing focus on water quality and safety. With growing population density, urbanization, and industrial activities, there is a rising concern over the contamination of municipal water supplies by pollutants such as pathogens, heavy metals, and chemical contaminants. Municipalities and water utilities are prioritizing the implementation of robust water treatment processes to ensure that drinking water meets stringent regulatory standards and is safe for consumption. This trend drives market growth as municipalities invest in advanced water treatment chemicals and technologies to effectively remove contaminants, improve water quality, and safeguard public health.

A key driver fueling the municipal water treatment chemicals market is the aging infrastructure and increasing water treatment needs. Many municipal water treatment facilities worldwide are operating with outdated infrastructure and technologies, leading to challenges in maintaining water quality and meeting regulatory requirements. As water treatment plants age, there is a need for upgrades, repairs, and modernization to enhance treatment capacity, efficiency, and reliability. Additionally, population growth, urban expansion, and changing environmental conditions are placing additional strain on existing water treatment infrastructure, necessitating investments in new treatment technologies and chemicals to address emerging contaminants and water quality challenges. This driver supports market demand for municipal water treatment chemicals as utilities and municipalities strive to upgrade and expand their treatment capabilities to meet the evolving needs of growing populations and changing environmental conditions.

A promising opportunity for the municipal water treatment chemicals market lies in the adoption of advanced treatment solutions. With advancements in water treatment technologies such as membrane filtration, advanced oxidation processes, and ion exchange, there is an opportunity to introduce innovative chemical treatments that complement these technologies and enhance overall treatment performance. Municipalities and water utilities are increasingly exploring alternative treatment methods such as chlorine dioxide, ozone, and UV disinfection to address emerging contaminants and improve treatment efficiency. This presents an opportunity for chemical suppliers to develop specialized formulations tailored to the specific needs of advanced treatment processes, such as scale and corrosion inhibitors, coagulants, and disinfectants. By offering advanced treatment chemicals that integrate seamlessly with modern water treatment technologies, suppliers can position themselves as partners in addressing complex water treatment challenges and meeting the demand for safe, clean, and sustainable drinking water. This opportunity allows chemical manufacturers to differentiate their offerings, drive innovation, and capture market share in the rapidly evolving municipal water treatment sector.

In the Municipal Water Treatment Chemicals market, the largest segment is the Coagulant and Flocculant segment. coagulants and flocculants play a critical role in the primary treatment process of municipal water treatment plants. Coagulants are chemicals that destabilize colloidal particles and organic matter in raw water, allowing them to clump together, while flocculants help aggregate these particles into larger flocs that can be easily removed through sedimentation or filtration processes. This process effectively removes suspended solids, turbidity, and other impurities from water, improving its clarity and quality. Additionally, coagulants and flocculants are versatile chemicals that can be used for treating various water sources, including surface water, groundwater, and recycled wastewater. As municipalities strive to meet stringent water quality standards and ensure the provision of safe and clean drinking water to their residents, the demand for coagulants and flocculants remains robust. Moreover, the growing urbanization, industrialization, and population growth lead to increased water pollution and the need for effective water treatment solutions, further driving the demand for coagulants and flocculants in municipal water treatment applications. Over the forecast period, these factors contribute to the Coagulant and Flocculant segment's status as the largest segment in the Municipal Water Treatment Chemicals market.

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Accepta The Water Treatment Products Company

Akzo Nobel N.V.

Albemarle Corp

American Water Chemicals Inc

Arkema S.A.

Avista Technologies Inc

BASF SE

Chemtex Speciality Ltd

Chemtrade Logistics Inc

ChemTreat Inc

DuPont de Nemours Inc

Ecolab Inc

Kemira Oyj

Lonza Group AG

Solenis

Solvay SA

SUEZ

Thermax Global

Veolia Environnement S.A.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Municipal Water Treatment Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Municipal Water Treatment Chemicals Market Size Outlook, $ Million, 2021 to 2032

3.2 Municipal Water Treatment Chemicals Market Outlook by Type, $ Million, 2021 to 2032

3.3 Municipal Water Treatment Chemicals Market Outlook by Product, $ Million, 2021 to 2032

3.4 Municipal Water Treatment Chemicals Market Outlook by Application, $ Million, 2021 to 2032

3.5 Municipal Water Treatment Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Municipal Water Treatment Chemicals Industry

4.2 Key Market Trends in Municipal Water Treatment Chemicals Industry

4.3 Potential Opportunities in Municipal Water Treatment Chemicals Industry

4.4 Key Challenges in Municipal Water Treatment Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Municipal Water Treatment Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Municipal Water Treatment Chemicals Market Outlook by Segments

7.1 Municipal Water Treatment Chemicals Market Outlook by Segments, $ Million, 2021- 2032

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

8 North America Municipal Water Treatment Chemicals Market Analysis and Outlook To 2032

8.1 Introduction to North America Municipal Water Treatment Chemicals Markets in 2024

8.2 North America Municipal Water Treatment Chemicals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Municipal Water Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

9 Europe Municipal Water Treatment Chemicals Market Analysis and Outlook To 2032

9.1 Introduction to Europe Municipal Water Treatment Chemicals Markets in 2024

9.2 Europe Municipal Water Treatment Chemicals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Municipal Water Treatment Chemicals Market Size Outlook by Segments, 2021-2032

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

10 Asia Pacific Municipal Water Treatment Chemicals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Municipal Water Treatment Chemicals Markets in 2024

10.2 Asia Pacific Municipal Water Treatment Chemicals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Municipal Water Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

11 South America Municipal Water Treatment Chemicals Market Analysis and Outlook To 2032

11.1 Introduction to South America Municipal Water Treatment Chemicals Markets in 2024

11.2 South America Municipal Water Treatment Chemicals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Municipal Water Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

12 Middle East and Africa Municipal Water Treatment Chemicals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Municipal Water Treatment Chemicals Markets in 2024

12.2 Middle East and Africa Municipal Water Treatment Chemicals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Municipal Water Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Accepta The Water Treatment Products Company

Akzo Nobel N.V.

Albemarle Corp

American Water Chemicals Inc

Arkema S.A.

Avista Technologies Inc

BASF SE

Chemtex Speciality Ltd

Chemtrade Logistics Inc

ChemTreat Inc

DuPont de Nemours Inc

Ecolab Inc

Kemira Oyj

Lonza Group AG

Solenis

Solvay SA

SUEZ

Thermax Global

Veolia Environnement S.A.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Biocide and Disinfectant

Coagulant and Flocculant

Corrosion and Scale Inhibitor

Defoamer and Defoaming Agent

pH Adjuster and Softener

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Municipal Water Treatment Chemicals Market Size is valued at $39.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.8% to reach $52.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Accepta The Water Treatment Products Company, Akzo Nobel N.V. , Albemarle Corp, American Water Chemicals Inc, Arkema S.A., Avista Technologies Inc, BASF SE, Chemtex Speciality Ltd, Chemtrade Logistics Inc, ChemTreat Inc, DuPont de Nemours Inc, Ecolab Inc, Kemira Oyj, Lonza Group AG, Solenis, Solvay SA, SUEZ, Thermax Global, Veolia Environnement S.A.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume