The global Molybdenum Disulfide Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Molybdenum Disulfide (MoS2) Powder, Molybdenum Disulfide (MoS2) Crystals), By Application (Lubricants and Coatings, Semiconductor, Catalysts, Others), By End-User (Automotive, Aerospace, Electronics, Construction, Chemicals, Others).

Molybdenum disulfide (MoS2) is a versatile solid lubricant and engineering material with numerous industrial applications in 2024. It is composed of layers of molybdenum atoms sandwiched between layers of sulfur atoms, giving it a lamellar structure similar to graphite. MoS2 exhibits exceptional lubricating properties, even in extreme conditions of pressure, temperature, and vacuum, making it suitable for use in high-performance lubricants, coatings, and additives. In lubrication applications, MoS2 reduces friction and wear between moving surfaces by forming a protective film that prevents metal-to-metal contact and minimizes surface damage. It is commonly used as a dry lubricant in applications where conventional liquid lubricants are not suitable, such as high vacuum environments, extreme temperatures, and cleanroom operations. MoS2 coatings are also applied to metal surfaces to provide wear resistance, corrosion protection, and anti-seize properties in automotive, aerospace, and industrial applications. Additionally, MoS2 is used as a solid lubricant additive in greases, oils, and pastes to improve their lubricating properties and extend equipment life. With its unique combination of properties, including high temperature stability, chemical inertness, and low friction coefficient, molybdenum disulfide s to be a valuable material in various tribological applications, contributing to improved performance, efficiency, and reliability across diverse industries.

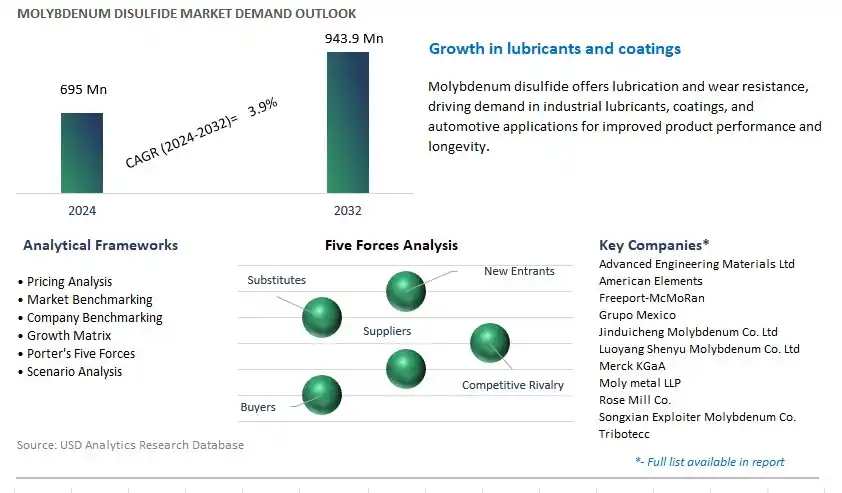

The market report analyses the leading companies in the industry including Advanced Engineering Materials Ltd, American Elements, Freeport-McMoRan, Grupo Mexico, Jinduicheng Molybdenum Co. Ltd, Luoyang Shenyu Molybdenum Co. Ltd, Merck KGaA, Moly metal LLP, Rose Mill Co., Songxian Exploiter Molybdenum Co., Tribotecc, and others.

A significant trend in the molybdenum disulfide (MoS2) market is the increasing demand for lubricants and additives. MoS2 is widely utilized as a solid lubricant due to its exceptional lubricating properties, high thermal stability, and resistance to extreme pressure conditions. With growing industrial activities, automotive production, and machinery manufacturing, there is a rising need for lubricants that can enhance equipment performance, reduce friction, and prolong component lifespan. Additionally, MoS2 is used as an additive in various lubricant formulations to improve anti-wear, anti-friction, and load-carrying capabilities, particularly in high-stress applications such as automotive engines, gearboxes, and industrial machinery. This trend towards the adoption of MoS2-based lubricants and additives drives market growth as lubricant manufacturers and end-users seek solutions to optimize equipment performance, reduce maintenance costs, and enhance operational efficiency.

A key driver fueling the molybdenum disulfide market is the growth in the automotive and industrial sectors. MoS2 finds extensive applications in automotive components, including engine parts, transmission systems, and chassis components, where it provides lubrication under high-temperature and high-load conditions to improve fuel efficiency and reduce wear. In the industrial sector, MoS2 is used in manufacturing processes, metalworking fluids, and machinery lubrication to enhance productivity, minimize downtime, and extend equipment life. With increasing vehicle production, infrastructure development, and manufacturing activities worldwide, there is a continuous demand for lubricants and additives containing MoS2 to meet the stringent performance requirements of modern automotive and industrial applications. This driver supports market expansion as automotive OEMs, lubricant manufacturers, and industrial users incorporate MoS2-based solutions into their products and processes to achieve superior performance, reliability, and sustainability.

A promising opportunity for the molybdenum disulfide market lies in the exploration of nanotechnology applications. Nanoscale MoS2 particles exhibit unique properties such as enhanced surface area, improved dispersibility, and superior lubricating performance compared to conventional micron-sized particles. This presents opportunities to develop advanced nanocomposite materials, nano-lubricants, and functional coatings with tailored properties for specific applications. Additionally, nanotechnology enables precise control over particle size, morphology, and surface chemistry, allowing for the customization of MoS2-based formulations to meet the evolving needs of diverse industries such as aerospace, electronics, and biomedical. By leveraging nanotechnology advancements, MoS2 suppliers and researchers can unlock new opportunities for innovation, product development, and market differentiation, paving the way for sustainable growth and competitiveness in the global marketplace. This opportunity allows stakeholders to collaborate and capitalize on the potential of nanoscale MoS2 materials to address emerging challenges and drive technological advancements across various sectors.

In the Molybdenum Disulfide market, the largest segment is to be the Molybdenum Disulfide (MoS2) Powder segment. MoS2 powder has a wider range of applications compared to MoS2 crystals. MoS2 powder is commonly used as a solid lubricant additive in various industries such as automotive, aerospace, machinery, and manufacturing. It provides excellent lubrication properties, reducing friction and wear between moving parts, thereby extending equipment lifespan and improving operational efficiency. Additionally, MoS2 powder finds applications in the production of lubricants, greases, coatings, and additives for plastics and composites. Its versatility and effectiveness as a lubricating agent make it a preferred choice for industries seeking to enhance their products' performance and durability. Moreover, MoS2 powder is relatively easier to handle and integrate into manufacturing processes compared to MoS2 crystals, further contributing to its larger market share. Over the forecast period, these factors drive the dominance of the Molybdenum Disulfide (MoS2) Powder segment in the market.

Among the segmented applications in the Molybdenum Disulfide market, the fastest-growing segment is the Semiconductor industry. In particular, Molybdenum Disulfide (MoS2) has emerged as a promising material for semiconductor applications due to its unique properties, such as high electron mobility, excellent thermal stability, and chemical inertness. These properties make MoS2 an attractive candidate for various semiconductor devices, including transistors, photodetectors, and sensors. As the demand for advanced semiconductor technologies continues to rise, driven by trends such as the Internet of Things (IoT), artificial intelligence (AI), and 5G telecommunications, the need for high-performance semiconductor materials like MoS2 is also increasing. Additionally, ongoing research and development efforts aimed at optimizing MoS2-based semiconductor devices for enhanced performance and functionality are further fuelling the growth of this segment. Furthermore, the expanding applications of MoS2 in emerging technologies such as flexible electronics and quantum computing are expected to drive significant demand growth in the Semiconductor segment of the Molybdenum Disulfide market in the coming years.

In the Molybdenum Disulfide market, the largest segment is the Automotive industry. Molybdenum Disulfide (MoS2) is widely used in automotive applications due to its exceptional lubricating properties. MoS2 is commonly employed as a solid lubricant additive in engine oils, greases, and coatings to reduce friction and wear between moving parts, thereby improving fuel efficiency, extending engine life, and enhancing overall vehicle performance. Additionally, MoS2 finds applications in other automotive components such as gears, bearings, and transmission systems. With the automotive industry's continuous focus on enhancing vehicle efficiency, durability, and emissions reduction, the demand for MoS2 in automotive lubricants and components remains robust. Moreover, as automotive manufacturers increasingly adopt advanced technologies such as electric and hybrid vehicles, which require high-performance lubricants and materials to meet stringent performance requirements, the demand for MoS2 is expected to further increase. Over the forecast period, these factors contribute to the Automotive industry's status as the largest segment in the Molybdenum Disulfide market.

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Advanced Engineering Materials Ltd

American Elements

Freeport-McMoRan

Grupo Mexico

Jinduicheng Molybdenum Co. Ltd

Luoyang Shenyu Molybdenum Co. Ltd

Merck KGaA

Moly metal LLP

Rose Mill Co.

Songxian Exploiter Molybdenum Co.

Tribotecc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Molybdenum Disulfide Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Molybdenum Disulfide Market Size Outlook, $ Million, 2021 to 2032

3.2 Molybdenum Disulfide Market Outlook by Type, $ Million, 2021 to 2032

3.3 Molybdenum Disulfide Market Outlook by Product, $ Million, 2021 to 2032

3.4 Molybdenum Disulfide Market Outlook by Application, $ Million, 2021 to 2032

3.5 Molybdenum Disulfide Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Molybdenum Disulfide Industry

4.2 Key Market Trends in Molybdenum Disulfide Industry

4.3 Potential Opportunities in Molybdenum Disulfide Industry

4.4 Key Challenges in Molybdenum Disulfide Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Molybdenum Disulfide Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Molybdenum Disulfide Market Outlook by Segments

7.1 Molybdenum Disulfide Market Outlook by Segments, $ Million, 2021- 2032

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

8 North America Molybdenum Disulfide Market Analysis and Outlook To 2032

8.1 Introduction to North America Molybdenum Disulfide Markets in 2024

8.2 North America Molybdenum Disulfide Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Molybdenum Disulfide Market size Outlook by Segments, 2021-2032

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

9 Europe Molybdenum Disulfide Market Analysis and Outlook To 2032

9.1 Introduction to Europe Molybdenum Disulfide Markets in 2024

9.2 Europe Molybdenum Disulfide Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Molybdenum Disulfide Market Size Outlook by Segments, 2021-2032

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

10 Asia Pacific Molybdenum Disulfide Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Molybdenum Disulfide Markets in 2024

10.2 Asia Pacific Molybdenum Disulfide Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Molybdenum Disulfide Market size Outlook by Segments, 2021-2032

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

11 South America Molybdenum Disulfide Market Analysis and Outlook To 2032

11.1 Introduction to South America Molybdenum Disulfide Markets in 2024

11.2 South America Molybdenum Disulfide Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Molybdenum Disulfide Market size Outlook by Segments, 2021-2032

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

12 Middle East and Africa Molybdenum Disulfide Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Molybdenum Disulfide Markets in 2024

12.2 Middle East and Africa Molybdenum Disulfide Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Molybdenum Disulfide Market size Outlook by Segments, 2021-2032

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Advanced Engineering Materials Ltd

American Elements

Freeport-McMoRan

Grupo Mexico

Jinduicheng Molybdenum Co. Ltd

Luoyang Shenyu Molybdenum Co. Ltd

Merck KGaA

Moly metal LLP

Rose Mill Co.

Songxian Exploiter Molybdenum Co.

Tribotecc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Molybdenum Disulfide (MoS2) Powder

Molybdenum Disulfide (MoS2) Crystals

By Application

Lubricants and Coatings

Semiconductor

Catalysts

Others

By End-User

Automotive

Aerospace

Electronics

Construction

Chemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Molybdenum Disulfide Market Size is valued at $695 Million in 2024 and is forecast to register a growth rate (CAGR) of 3.9% to reach $943.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Advanced Engineering Materials Ltd, American Elements, Freeport-McMoRan, Grupo Mexico, Jinduicheng Molybdenum Co. Ltd, Luoyang Shenyu Molybdenum Co. Ltd, Merck KGaA, Moly metal LLP, Rose Mill Co., Songxian Exploiter Molybdenum Co., Tribotecc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume