The global Mold Release Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Semi-permanent, Sacrificial), By Substrate (Rubber and Elastomers, Plastics and Polymers, Composites, Stones, Asphalt, and Concrete, Others), By Product (Water Based, Solvent Based), By End-User (Die Casting, Rubber and Tire, Building and Construction, Food Processing, Plastic Processing, Others).

Mold release coatings are essential materials used in manufacturing processes to facilitate the release of molded products from molds or tooling surfaces in 2024. These coatings form a thin, low-friction film between the mold and the molded part, preventing adhesion and allowing for easy removal without damaging the surface finish or integrity of the product. Mold release coatings are commonly applied to molds used in various industries, including automotive, aerospace, consumer goods, and composites manufacturing. They are used in processes such as injection molding, compression molding, rotational molding, and casting, where they ensure smooth demolding and high-quality surface finishes. Mold release coatings can be categorized based on their formulation into solvent-based, water-based, and dry film release agents. Solvent-based formulations typically contain silicone, fluoropolymer, or wax-based lubricants dissolved in organic solvents, providing excellent release properties and durability. Water-based formulations offer environmentally friendly alternatives with low VOC emissions and easy cleanup, making them suitable for use in enclosed or indoor manufacturing environments. Dry film release agents consist of solid lubricants suspended in a carrier solvent or resin, which evaporates to leave a thin film on the mold surface. With the increasing demand for high-quality molded products and the need for efficient manufacturing processes, the market for mold release coatings is expected to grow, driven by advancements in coating formulations, application techniques, and sustainability initiatives.

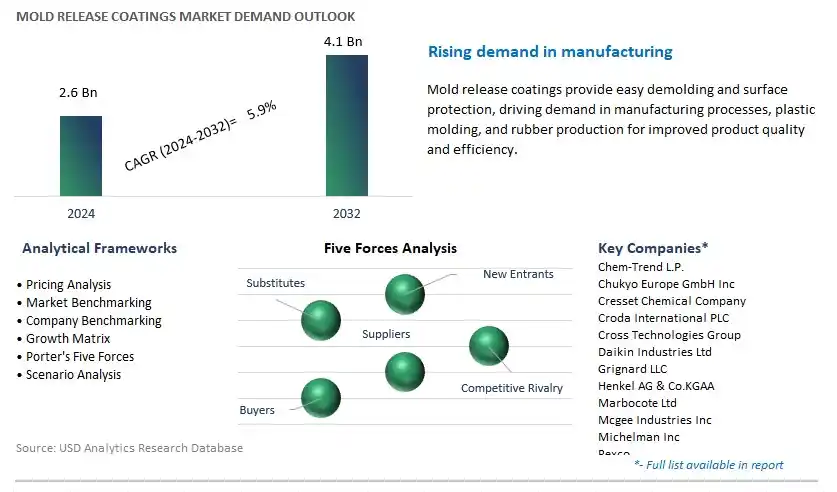

The market report analyses the leading companies in the industry including Chem-Trend L.P., Chukyo Europe GmbH Inc, Cresset Chemical Company, Croda International PLC, Cross Technologies Group, Daikin Industries Ltd, Grignard LLC, Henkel AG & Co.KGAA, Marbocote Ltd, Mcgee Industries Inc, Michelman Inc, Rexco, Shin-Etsu Chemical Co. Ltd, Wacker Chemie AG, and others.

A significant trend in the mold release coatings market is the growth in the manufacturing of composite materials. Mold release coatings play a critical role in the production of composite parts by facilitating the easy release of molded components from molds, thereby improving productivity and reducing production cycle times. With increasing demand for lightweight and high-performance materials in industries such as aerospace, automotive, and construction, there is a rising adoption of composite materials such as carbon fiber reinforced polymers (CFRP), fiberglass, and epoxy resins. As manufacturers continue to innovate and develop new composite applications, the demand for effective mold release coatings to support composite manufacturing processes is expected to grow steadily. This trend drives market expansion as mold release coating suppliers develop advanced formulations to meet the evolving needs of composite manufacturers for efficient mold release and high-quality finished products.

A key driver fueling the mold release coatings market is the rising demand for consumer goods and packaging. Mold release coatings are essential in the manufacturing of various consumer goods such as toys, appliances, electronics, and sporting goods, where injection molding, compression molding, and rotational molding processes are commonly used. Additionally, the packaging industry relies on mold release coatings for the production of plastic packaging components, containers, and bottles. With increasing consumer demand for diverse product offerings, customized packaging solutions, and sustainable packaging materials, there is a continuous need for efficient mold release coatings to enable cost-effective and high-volume production of molded plastic parts and packaging items. This driver supports market growth as mold release coating manufacturers cater to the requirements of consumer goods and packaging industries by providing reliable and high-performance solutions that enhance manufacturing efficiency and product quality.

A promising opportunity for the mold release coatings market lies in the expansion into emerging markets and applications. As industries such as renewable energy, medical devices, and 3D printing continue to grow, there is a demand for specialized mold release coatings to support innovative manufacturing processes and materials. For example, in the renewable energy sector, mold release coatings are used in the production of wind turbine blades, solar panels, and bio-based composites. Similarly, in the medical devices industry, mold release coatings are utilized in the fabrication of implants, prosthetics, and medical equipment components. By expanding into emerging markets and applications, mold release coating suppliers can diversify their customer base, capture new revenue streams, and capitalize on the opportunities presented by evolving technologies and industries. This opportunity allows mold release coating manufacturers to leverage their expertise in formulation and application technologies to address the needs of diverse markets and drive sustainable growth in the global coatings industry.

In the Mold Release Coatings market, the semi-permanent segment is the largest segment due to its superior properties and widespread applications across various industries. Semi-permanent mold release coatings offer potential advantages such as extended durability, multiple releases per application, and minimal build-up on molds, making them highly preferred in industries like automotive, aerospace, and construction. These coatings provide an efficient and cost-effective solution for releasing intricate and complex parts from molds without causing damage or imperfections, thereby enhancing production efficiency and product quality. The growing demand for lightweight materials, increased production of composite materials, and stringent quality standards in manufacturing processes are driving the adoption of semi-permanent mold release coatings. Additionally, advancements in technology leading to the development of innovative formulations with improved release properties further contribute to the dominance of the semi-permanent segment in the Mold Release Coatings market.

Among the segmented substrates in the Mold Release Coatings market, the composites segment is the fastest-growing. Composites, which typically consist of a combination of materials like fiberglass, carbon fiber, and resins, are increasingly favored in industries such as automotive, aerospace, and wind energy due to their lightweight, high strength-to-weight ratio, and corrosion-resistant properties. As the demand for composites continues to surge in these industries, the need for efficient mold release solutions becomes paramount to ensure smooth and defect-free production processes. Mold release coatings play a crucial role in facilitating the easy release of composite parts from molds, thereby enhancing manufacturing efficiency and reducing production costs. Additionally, the growing focus on sustainability and environmental regulations is prompting manufacturers to opt for mold release coatings that are environmentally friendly and comply with regulatory standards, further driving the demand for innovative solutions tailored for composite substrates. With the continuous expansion of composite applications across various industries, the composites segment is poised for rapid growth in the Mold Release Coatings market.

In the Mold Release Coatings market, the solvent-based segment is the largest segment. Solvent-based mold release coatings have been traditionally preferred in various industries due to their robust performance characteristics and wide applicability across different substrates. These coatings offer excellent adhesion to molds, ensuring effective release of parts without causing damage or defects. Additionally, solvent-based formulations often exhibit faster drying times compared to water-based alternatives, thereby increasing production efficiency and throughput. Industries such as automotive, aerospace, and construction rely heavily on solvent-based mold release coatings to achieve high-quality surface finishes and precise molding of intricate parts. While there is a growing trend towards water-based coatings due to environmental concerns and regulatory requirements, the solvent-based segment continues to maintain its prominence in the Mold Release Coatings market owing to its superior performance and versatility.

Among the segmented end-users in the Mold Release Coatings market, the fastest-growing segment is the Plastic Processing industry. This is driven by the demand for mold release coatings within this sector. Plastic processing encompasses a wide range of applications across various industries, including automotive, packaging, electronics, and consumer goods. As the demand for plastic products continues to rise globally, driven by factors such as urbanization, population growth, and technological advancements, the need for efficient mold release solutions becomes increasingly critical. Mold release coatings play a crucial role in the plastic processing industry by facilitating the easy release of molded plastic parts from molds, thereby enhancing production efficiency, reducing cycle times, and minimizing scrap rates. Additionally, as manufacturers strive to meet stringent quality standards and improve product aesthetics, the importance of reliable mold release coatings becomes more pronounced. With the continuous expansion of the plastic processing industry and the increasing adoption of advanced molding techniques, such as injection molding and thermoforming, the demand for mold release coatings is expected to experience rapid growth in this segment.

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Chem-Trend L.P.

Chukyo Europe GmbH Inc

Cresset Chemical Company

Croda International PLC

Cross Technologies Group

Daikin Industries Ltd

Grignard LLC

Henkel AG & Co.KGAA

Marbocote Ltd

Mcgee Industries Inc

Michelman Inc

Rexco

Shin-Etsu Chemical Co. Ltd

Wacker Chemie AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Mold Release Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Mold Release Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 Mold Release Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 Mold Release Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 Mold Release Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 Mold Release Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Mold Release Coatings Industry

4.2 Key Market Trends in Mold Release Coatings Industry

4.3 Potential Opportunities in Mold Release Coatings Industry

4.4 Key Challenges in Mold Release Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Mold Release Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Mold Release Coatings Market Outlook by Segments

7.1 Mold Release Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

8 North America Mold Release Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America Mold Release Coatings Markets in 2024

8.2 North America Mold Release Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Mold Release Coatings Market size Outlook by Segments, 2021-2032

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

9 Europe Mold Release Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe Mold Release Coatings Markets in 2024

9.2 Europe Mold Release Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Mold Release Coatings Market Size Outlook by Segments, 2021-2032

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

10 Asia Pacific Mold Release Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Mold Release Coatings Markets in 2024

10.2 Asia Pacific Mold Release Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Mold Release Coatings Market size Outlook by Segments, 2021-2032

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

11 South America Mold Release Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America Mold Release Coatings Markets in 2024

11.2 South America Mold Release Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Mold Release Coatings Market size Outlook by Segments, 2021-2032

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

12 Middle East and Africa Mold Release Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Mold Release Coatings Markets in 2024

12.2 Middle East and Africa Mold Release Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Mold Release Coatings Market size Outlook by Segments, 2021-2032

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Chem-Trend L.P.

Chukyo Europe GmbH Inc

Cresset Chemical Company

Croda International PLC

Cross Technologies Group

Daikin Industries Ltd

Grignard LLC

Henkel AG & Co.KGAA

Marbocote Ltd

Mcgee Industries Inc

Michelman Inc

Rexco

Shin-Etsu Chemical Co. Ltd

Wacker Chemie AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Semi-permanent

Sacrificial

By Substrate

Rubber and Elastomers

Plastics and Polymers

Composites

Stones

Asphalt

and Concrete

Others

By Product

Water Based

Solvent Based

By End-User

Die Casting

Rubber and Tire

Building and Construction

Food Processing

Plastic Processing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Mold Release Coatings Market Size is valued at $2.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.9% to reach $4.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Chem-Trend L.P., Chukyo Europe GmbH Inc, Cresset Chemical Company, Croda International PLC, Cross Technologies Group, Daikin Industries Ltd, Grignard LLC, Henkel AG & Co.KGAA, Marbocote Ltd, Mcgee Industries Inc, Michelman Inc, Rexco, Shin-Etsu Chemical Co. Ltd, Wacker Chemie AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume