The global Microfluidics Technology Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Material (Polymer-Based Microfluidics, Glass-Based Microfluidics, Silicon-Based Microfluidics, Others), By End-User (Hospitals, Diagnostic Centers, Academic Institutes).

Characterized by rapid innovation and diverse applications, the microfluidics technology market in 2024 is witnessing substantial growth fueled by its ability to manipulate small volumes of fluids with high precision. This technology finds extensive use across various sectors including healthcare, pharmaceuticals, biotechnology, and environmental monitoring. In healthcare, microfluidics enables rapid diagnostic testing, drug discovery, and personalized medicine, driving its adoption globally. As research intensifies and manufacturing processes evolve, the market is anticipated to witness continued expansion with a plethora of opportunities for both established companies and startups.

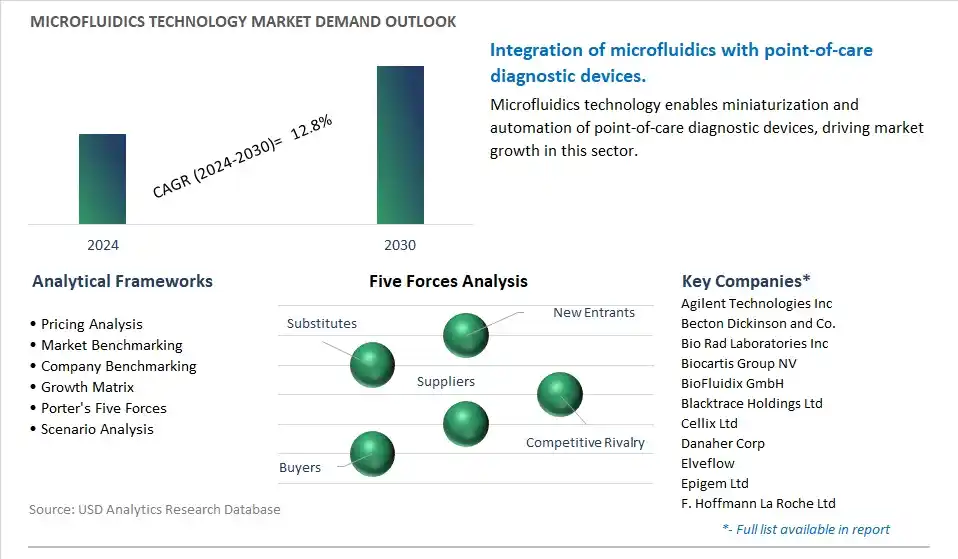

The global Microfluidics Technology Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Microfluidics Technology Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Microfluidics Technology Industry include- Agilent Technologies Inc, Becton Dickinson and Co., Bio Rad Laboratories Inc, Biocartis Group NV, BioFluidix GmbH, Blacktrace Holdings Ltd, Cellix Ltd, Danaher Corp, Elveflow, Epigem Ltd, F. Hoffmann La Roche Ltd, Fluigent SA, iBiochips, IDEX Corp, Illumina Inc, PerkinElmer Inc, QIAGEN N.V., SMC Corp, Standard BioTools Inc, Thermo Fisher Scientific Inc.

A significant trend in the microfluidics technology market is its rapid adoption in point-of-care diagnostics. Microfluidic devices, also known as lab-on-a-chip systems, enable the precise manipulation of fluids and particles at the microscale level, offering numerous advantages such as low sample volume requirements, rapid analysis times, high sensitivity, and portability. These features make microfluidic devices ideal for decentralized testing applications, allowing diagnostic tests to be performed at or near the point of care, such as doctor's offices, clinics, pharmacies, and remote settings. With the increasing demand for rapid and accurate diagnostic solutions, particularly in resource-limited and underserved regions, microfluidics technology is witnessing growing interest from healthcare providers, researchers, and diagnostic manufacturers. Microfluidic-based point-of-care devices offer the potential to improve healthcare access, reduce turnaround times for diagnostic results, and enable early detection and management of infectious diseases, chronic conditions, and emerging health threats. As advancements in microfluidics technology continue to enhance device performance, integration with digital health platforms, and multiplexing capabilities, the market for microfluidic-based point-of-care diagnostics is poised for significant growth and innovation.

A key driver for the microfluidics technology market is the increasing demand for high-throughput screening and precision medicine applications. Microfluidic platforms enable the parallel processing of multiple samples and assays in a miniaturized and automated format, offering unparalleled efficiency, scalability, and reproducibility compared to conventional laboratory techniques. These capabilities are particularly valuable in drug discovery, genomics, proteomics, and personalized medicine, where large-scale screening of compounds, biomolecules, and patient samples is essential for research, clinical trials, and diagnostic decision-making. Microfluidic-based screening assays enable rapid identification of drug candidates, biomarkers, and therapeutic targets, accelerating the drug development process and facilitating the transition towards precision medicine approaches. Additionally, microfluidic systems enable the integration of sample preparation, amplification, detection, and analysis steps into compact and versatile platforms, enabling researchers and clinicians to perform complex laboratory procedures with minimal manual intervention and sample consumption. The growing emphasis on precision medicine initiatives, coupled with advancements in microfluidics technology, fuels the adoption of microfluidic-based screening platforms across pharmaceutical companies, academic research institutions, and clinical laboratories, driving market growth and innovation in this space.

A Market Opportunity in the microfluidics technology market lies in the expansion into digital microfluidics and single-cell analysis applications. Digital microfluidics platforms utilize electric fields to manipulate discrete droplets of fluids on microelectrode arrays, enabling precise control over droplet movement, merging, splitting, and dispensing. This technology offers unique advantages such as programmable automation, reconfigurability, and compatibility with a wide range of biochemical and cellular assays. Digital microfluidics has applications in various fields, including nucleic acid analysis, protein quantification, drug screening, and single-cell manipulation. In particular, digital microfluidics platforms enable high-throughput and multiplexed analysis of single cells, facilitating detailed characterization of cellular heterogeneity, gene expression profiles, and functional responses. By leveraging digital microfluidics technology for single-cell analysis, researchers and clinicians can gain deeper insights into disease mechanisms, drug responses, and patient variability, leading to the development of more targeted and personalized therapeutic interventions. Manufacturers of microfluidics devices can capitalize on this opportunity by investing in the development of digital microfluidics platforms, expanding their product portfolios to include single-cell analysis solutions, and fostering collaborations with academic and industry partners in the fields of genomics, oncology, and regenerative medicine. By addressing the growing demand for high-throughput and single-cell analysis capabilities, companies can position themselves at the forefront of innovation in microfluidics technology and capture new opportunities in the life sciences and healthcare sectors.

Polymer-based microfluidics emerges as the fastest-growing segment within the microfluidics technology market, particularly in diagnostic centers. This growth is propelled by several factors, including the increasing demand for point-of-care diagnostic devices, the rising prevalence of chronic diseases, and the need for rapid and cost-effective diagnostic solutions. Polymer-based microfluidic devices offer numerous advantages such as low cost, ease of fabrication, and compatibility with mass production techniques, making them ideal for developing portable and disposable diagnostic platforms. Diagnostic centers utilize polymer-based microfluidics for various applications, including disease screening, monitoring, and personalized medicine. These devices enable the precise manipulation and analysis of small volumes of biological samples, allowing for rapid and accurate detection of biomarkers, pathogens, and disease indicators. Moreover, polymer-based microfluidics offer flexibility in design and functionality, allowing for the integration of multiple assay steps and detection modalities onto a single device. As diagnostic centers seek to improve accessibility to healthcare services and enhance patient outcomes through early detection and intervention, the demand for polymer-based microfluidics in this sector is expected to surge. This growth underscores the transformative potential of microfluidics technology in revolutionizing diagnostic capabilities and advancing personalized healthcare delivery.

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Agilent Technologies Inc

Becton Dickinson and Co.

Bio Rad Laboratories Inc

Biocartis Group NV

BioFluidix GmbH

Blacktrace Holdings Ltd

Cellix Ltd

Danaher Corp

Elveflow

Epigem Ltd

F. Hoffmann La Roche Ltd

Fluigent SA

iBiochips

IDEX Corp

Illumina Inc

PerkinElmer Inc

QIAGEN N.V.

SMC Corp

Standard BioTools Inc

Thermo Fisher Scientific Inc

* List not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Microfluidics Technology Market Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Microfluidics Technology Market Industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Microfluidics Technology Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Microfluidics Technology Market Size Outlook, $ Million, 2021 to 2030

3.2 Microfluidics Technology Market Outlook by Type, $ Million, 2021 to 2030

3.3 Microfluidics Technology Market Outlook by Product, $ Million, 2021 to 2030

3.4 Microfluidics Technology Market Outlook by Application, $ Million, 2021 to 2030

3.5 Microfluidics Technology Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Microfluidics Technology Industry

4.2 Key Market Trends in Microfluidics Technology Industry

4.3 Potential Opportunities in Microfluidics Technology Industry

4.4 Key Challenges in Microfluidics Technology Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Microfluidics Technology Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Microfluidics Technology Market Outlook by Segments

7.1 Microfluidics Technology Market Outlook by Segments, $ Million, 2021- 2030

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

8 North America Microfluidics Technology Market Analysis and Outlook To 2030

8.1 Introduction to North America Microfluidics Technology Markets in 2024

8.2 North America Microfluidics Technology Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Microfluidics Technology Market size Outlook by Segments, 2021-2030

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

9 Europe Microfluidics Technology Market Analysis and Outlook To 2030

9.1 Introduction to Europe Microfluidics Technology Markets in 2024

9.2 Europe Microfluidics Technology Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Microfluidics Technology Market Size Outlook by Segments, 2021-2030

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

10 Asia Pacific Microfluidics Technology Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Microfluidics Technology Markets in 2024

10.2 Asia Pacific Microfluidics Technology Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Microfluidics Technology Market size Outlook by Segments, 2021-2030

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

11 South America Microfluidics Technology Market Analysis and Outlook To 2030

11.1 Introduction to South America Microfluidics Technology Markets in 2024

11.2 South America Microfluidics Technology Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Microfluidics Technology Market size Outlook by Segments, 2021-2030

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

12 Middle East and Africa Microfluidics Technology Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Microfluidics Technology Markets in 2024

12.2 Middle East and Africa Microfluidics Technology Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Microfluidics Technology Market size Outlook by Segments, 2021-2030

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Agilent Technologies Inc

Becton Dickinson and Co.

Bio Rad Laboratories Inc

Biocartis Group NV

BioFluidix GmbH

Blacktrace Holdings Ltd

Cellix Ltd

Danaher Corp

Elveflow

Epigem Ltd

F. Hoffmann La Roche Ltd

Fluigent SA

iBiochips

IDEX Corp

Illumina Inc

PerkinElmer Inc

QIAGEN N.V.

SMC Corp

Standard BioTools Inc

Thermo Fisher Scientific Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Polymer-Based Microfluidics

Glass-Based Microfluidics

Silicon-Based Microfluidics

Others

By End-User

Hospitals

Diagnostic Centers

Academic Institutes

The global Microfluidics Technology Market is one of the lucrative growth markets, poised to register a 12.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Agilent Technologies Inc, Becton Dickinson and Co., Bio Rad Laboratories Inc, Biocartis Group NV, BioFluidix GmbH, Blacktrace Holdings Ltd, Cellix Ltd, Danaher Corp, Elveflow, Epigem Ltd, F. Hoffmann La Roche Ltd, Fluigent SA, iBiochips, IDEX Corp, Illumina Inc, PerkinElmer Inc, QIAGEN N.V., SMC Corp, Standard BioTools Inc, Thermo Fisher Scientific Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume