The global Microcrystalline Wax Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Flexible, Hard), By Application (Cosmetics and Personal Care, Candles, Adhesives, Packaging, Rubber, Others).

The future of microcrystalline wax is influenced by several key trends reflecting its diverse applications in industries such as packaging, cosmetics, pharmaceuticals, and automotive. One significant trend is the increasing demand for microcrystalline wax as a versatile and cost-effective ingredient in various formulations, including adhesives, coatings, polishes, and lubricants. Microcrystalline wax offers unique properties such as flexibility, water resistance, and adhesion, making it suitable for enhancing product performance and durability in challenging environments. Additionally, advancements in wax refining and processing technologies are driving improvements in wax quality, purity, and consistency, enabling manufacturers to meet stringent quality standards and regulatory requirements. Moreover, there is growing interest in sustainable and renewable sources of microcrystalline wax, such as bio-based feedstocks and recycled materials, to address environmental concerns and support green initiatives in product development and manufacturing. As industries continue to prioritize performance, sustainability, and regulatory compliance, the demand for microcrystalline wax is expected to grow, driving opportunities for wax producers, formulators, and end-users to innovate and develop solutions that meet the evolving needs of the market while minimizing environmental impact.

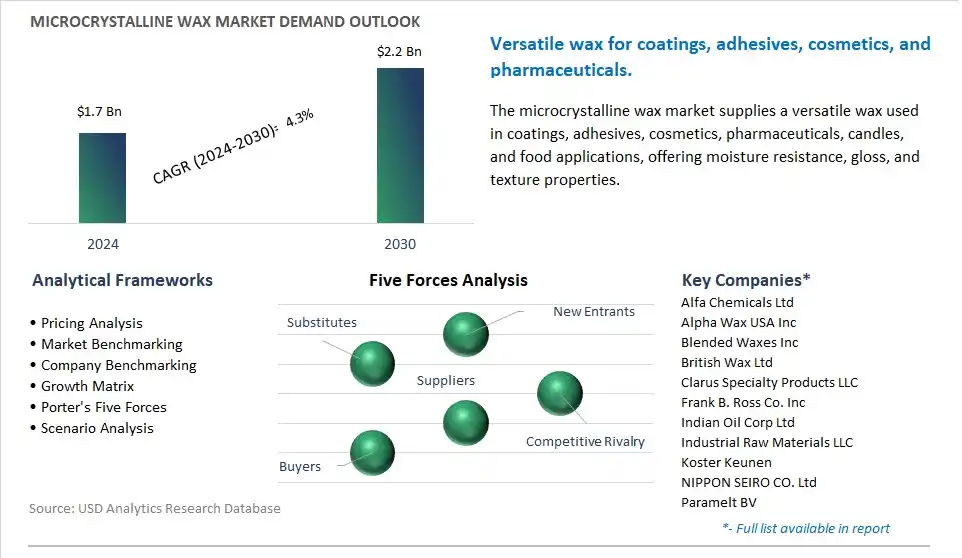

The market report analyses the leading companies in the industry including Alfa Chemicals Ltd, Alpha Wax USA Inc, Blended Waxes Inc, British Wax Ltd, Clarus Specialty Products LLC, Frank B. Ross Co. Inc, Indian Oil Corp Ltd, Industrial Raw Materials LLC, Koster Keunen, NIPPON SEIRO CO. Ltd, Paramelt BV, Sasol Ltd, Sonneborn LLC, Strahl & Pitsch Inc, The International Group Inc.

A significant trend in the Microcrystalline Wax market is the increasing demand for sustainable and bio-based wax alternatives. With growing environmental awareness and regulatory pressures, industries are seeking alternatives to traditional petroleum-based waxes. Microcrystalline wax, derived from renewable sources such as plants, animals, or recycled materials, is gaining popularity as a sustainable option. The trend towards sustainability is driving the development and adoption of bio-based microcrystalline waxes, which offer comparable performance characteristics to their petroleum-derived counterparts. Manufacturers are investing in research and development to produce bio-based microcrystalline waxes that meet the stringent requirements of various industries, including cosmetics, pharmaceuticals, food, and packaging.

A key driver propelling the Microcrystalline Wax market is its diverse range of applications across industries. Microcrystalline wax exhibits unique properties such as flexibility, adhesion, moisture resistance, and low melting point, making it suitable for a wide variety of applications. In the cosmetics industry, microcrystalline wax is used in lipsticks, creams, and lotions for its emollient and texture-enhancing properties. In the pharmaceutical industry, it serves as a base for ointments, creams, and dental products due to its inertness and stability. Additionally, microcrystalline wax finds applications in packaging, candles, adhesives, coatings, and electrical insulation. The versatility and performance of microcrystalline wax drive its demand across diverse sectors, driving market growth and investment in wax production and processing technologies.

An opportunity in the Microcrystalline Wax market lies in innovation in specialty wax formulations. While microcrystalline wax is well-established in traditional applications, there's potential for growth by developing specialty formulations tailored to specific industry needs and emerging trends. For example, there's an opportunity to formulate microcrystalline waxes with enhanced properties such as higher melting points, improved flexibility, or superior barrier properties for niche applications in cosmetics, pharmaceuticals, and food packaging. Additionally, there's an opportunity to innovate in additives and blends to customize wax formulations for specific performance requirements, such as anti-blocking agents for packaging films or rheology modifiers for personal care products. By focusing on innovation in specialty wax formulations, manufacturers can differentiate their products, address evolving market demands, and capture new growth opportunities in the Microcrystalline Wax market.

The largest segment in the Microcrystalline Wax Market is the Hard type. The market growth is driven by hard microcrystalline wax finds extensive use in various industrial applications, including adhesives, coatings, rubber compounding, candles, and packaging, due to its unique properties such as high melting point, toughness, and resistance to moisture and chemicals. These properties make hard microcrystalline wax suitable for applications requiring durability and stability, such as in the production of chewing gum bases, tire and rubber products, and corrugated cardboard coatings. Further, hard microcrystalline wax is often preferred over its flexible counterpart in applications where rigidity, strength, and thermal stability are critical, such as in hot melt adhesives and investment casting. Additionally, the versatility of hard microcrystalline wax allows it to be blended with other waxes and additives to tailor its properties to specific application requirements, further expanding its market demand. In addition, the growing industrialization and infrastructure development across various sectors, including packaging, construction, automotive, and consumer goods, drive the demand for hard microcrystalline wax as a key ingredient in manufacturing processes. Over the forecast period, the combination of its unique properties, wide-ranging industrial applications, and market demand positions the Hard type as the largest segment in the Microcrystalline Wax Market.

The fastest-growing segment in the Microcrystalline Wax Market is the Cosmetics and Personal Care sector. The cosmetics and personal care industry is experiencing significant growth globally, driven by factors such as increasing disposable incomes, changing consumer lifestyles, and a growing focus on personal grooming and wellness. Microcrystalline wax finds extensive use in cosmetics and personal care products due to its versatile properties, including emollient, thickening, and binding capabilities. Further, microcrystalline wax is a key ingredient in various cosmetic formulations such as lipsticks, lip balms, creams, lotions, mascaras, and hair care products. Its ability to impart texture, shine, and stability to these products makes it indispensable for cosmetic manufacturers. In addition, the growing consumer demand for natural and organic cosmetic products has led to increased interest in plant-based waxes, including microcrystalline wax derived from renewable sources such as palm, soy, and rice bran. Additionally, the rising awareness about the environmental impact of synthetic ingredients has prompted cosmetic companies to explore sustainable alternatives, further driving the demand for microcrystalline wax in this sector. Further, the continuous innovation and product development in the cosmetics industry, including the introduction of novel formulations and packaging designs, contribute to the growing demand for microcrystalline wax. Over the forecast period, the combination of expanding cosmetic markets, increasing consumer preferences for natural ingredients, and ongoing product innovation positions the Cosmetics and Personal Care segment as the fastest-growing in the Microcrystalline Wax Market.

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alfa Chemicals Ltd

Alpha Wax USA Inc

Blended Waxes Inc

British Wax Ltd

Clarus Specialty Products LLC

Frank B. Ross Co. Inc

Indian Oil Corp Ltd

Industrial Raw Materials LLC

Koster Keunen

NIPPON SEIRO CO. Ltd

Paramelt BV

Sasol Ltd

Sonneborn LLC

Strahl & Pitsch Inc

The International Group Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Microcrystalline Wax Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Microcrystalline Wax Market Size Outlook, $ Million, 2021 to 2030

3.2 Microcrystalline Wax Market Outlook by Type, $ Million, 2021 to 2030

3.3 Microcrystalline Wax Market Outlook by Product, $ Million, 2021 to 2030

3.4 Microcrystalline Wax Market Outlook by Application, $ Million, 2021 to 2030

3.5 Microcrystalline Wax Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Microcrystalline Wax Industry

4.2 Key Market Trends in Microcrystalline Wax Industry

4.3 Potential Opportunities in Microcrystalline Wax Industry

4.4 Key Challenges in Microcrystalline Wax Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Microcrystalline Wax Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Microcrystalline Wax Market Outlook by Segments

7.1 Microcrystalline Wax Market Outlook by Segments, $ Million, 2021- 2030

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

8 North America Microcrystalline Wax Market Analysis and Outlook To 2030

8.1 Introduction to North America Microcrystalline Wax Markets in 2024

8.2 North America Microcrystalline Wax Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Microcrystalline Wax Market size Outlook by Segments, 2021-2030

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

9 Europe Microcrystalline Wax Market Analysis and Outlook To 2030

9.1 Introduction to Europe Microcrystalline Wax Markets in 2024

9.2 Europe Microcrystalline Wax Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Microcrystalline Wax Market Size Outlook by Segments, 2021-2030

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

10 Asia Pacific Microcrystalline Wax Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Microcrystalline Wax Markets in 2024

10.2 Asia Pacific Microcrystalline Wax Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Microcrystalline Wax Market size Outlook by Segments, 2021-2030

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

11 South America Microcrystalline Wax Market Analysis and Outlook To 2030

11.1 Introduction to South America Microcrystalline Wax Markets in 2024

11.2 South America Microcrystalline Wax Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Microcrystalline Wax Market size Outlook by Segments, 2021-2030

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

12 Middle East and Africa Microcrystalline Wax Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Microcrystalline Wax Markets in 2024

12.2 Middle East and Africa Microcrystalline Wax Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Microcrystalline Wax Market size Outlook by Segments, 2021-2030

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alfa Chemicals Ltd

Alpha Wax USA Inc

Blended Waxes Inc

British Wax Ltd

Clarus Specialty Products LLC

Frank B. Ross Co. Inc

Indian Oil Corp Ltd

Industrial Raw Materials LLC

Koster Keunen

NIPPON SEIRO CO. Ltd

Paramelt BV

Sasol Ltd

Sonneborn LLC

Strahl & Pitsch Inc

The International Group Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Flexible

Hard

By Application

Cosmetics and Personal Care

Candles

Adhesives

Packaging

Rubber

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Microcrystalline Wax is forecast to reach $2.2 Billion in 2030 from $1.7 Billion in 2024, registering a CAGR of 4.3%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alfa Chemicals Ltd, Alpha Wax USA Inc, Blended Waxes Inc, British Wax Ltd, Clarus Specialty Products LLC, Frank B. Ross Co. Inc, Indian Oil Corp Ltd, Industrial Raw Materials LLC, Koster Keunen, NIPPON SEIRO CO. Ltd, Paramelt BV, Sasol Ltd, Sonneborn LLC, Strahl & Pitsch Inc, The International Group Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume