The global Methylene Chloride Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Paint Remover, Pharmaceuticals, Chemical Processing, Foam Manufacturing, Metal Cleaning, Others), By Type (Reagent Grade, Industrial Grade).

Methylene chloride, also known as dichloromethane, is a volatile organic compound widely used as a solvent in various industrial applications, including paint stripping, adhesive manufacturing, pharmaceutical processing, and metal cleaning. In 2024, the demand for methylene chloride s to be influenced by its unique properties and versatile applications across different industries. Methylene chloride is valued for its high solvency power, low boiling point, and relatively low toxicity compared to other chlorinated solvents. These properties make it effective for dissolving a wide range of organic materials, including resins, polymers, oils, and fats. In the paint stripping industry, methylene chloride is used in formulations for removing paint and coatings from metal, wood, and concrete surfaces. In adhesive manufacturing, it serves as a solvent for formulating contact adhesives, epoxy adhesives, and polyurethane adhesives. Further, methylene chloride finds applications in the production of pharmaceuticals and fine chemicals, where it is used as a solvent for extracting active ingredients and purifying compounds. Despite its effectiveness as a solvent, methylene chloride poses health and safety risks, including potential carcinogenicity, neurotoxicity, and environmental concerns related to its release into the atmosphere and waterways. As a result, regulatory agencies in some regions have implemented restrictions on the use of methylene chloride in consumer products and industrial processes, leading to increased scrutiny and adoption of alternative solvents and technologies. However, in industries where its unique properties are indispensable, such as aerospace, automotive, and electronics, methylene chloride s to be a valuable solvent, driving ongoing research into safer handling practices and sustainable alternatives. As industries strive to balance performance, safety, and environmental considerations, the future demand for methylene chloride may evolve in response to regulatory developments and technological advancements in solvent substitution and waste management.

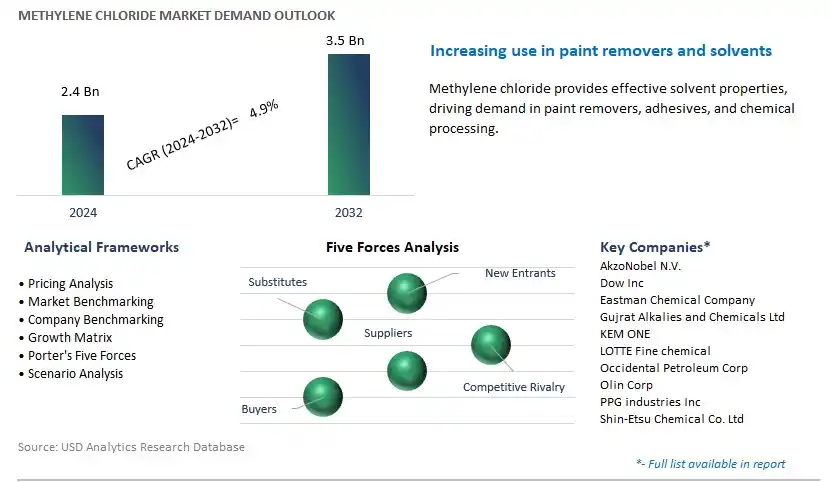

The market report analyses the leading companies in the industry including AkzoNobel N.V., Dow Inc, Eastman Chemical Company, Gujrat Alkalies and Chemicals Ltd, KEM ONE, LOTTE Fine chemical, Occidental Petroleum Corp, Olin Corp, PPG industries Inc, Shin-Etsu Chemical Co. Ltd, and others.

A prominent market trend for methylene chloride is the increasing demand for solvent alternatives across various industries such as paints and coatings, pharmaceuticals, and chemical processing. With growing concerns over health and environmental risks associated with certain volatile organic compounds (VOCs) and hazardous chemicals, there's a shift towards safer and more sustainable solvent options. Methylene chloride, commonly used as a paint stripper, degreaser, and extraction solvent, is facing scrutiny due to its potential health hazards and environmental impact. As a result, there's a trend towards replacing methylene chloride with safer alternatives such as bio-based solvents, water-based formulations, and non-toxic substitutes. This trend is driven by regulatory pressures, consumer preferences for safer products, and industry initiatives to reduce exposure to harmful chemicals, leading to the exploration of alternative solvents in various applications.

A key market driver for methylene chloride is regulatory restrictions and health concerns surrounding its use in industrial and consumer applications. Due to its classification as a potential carcinogen and neurotoxin, methylene chloride has been subject to regulatory scrutiny and restrictions in many countries. Regulatory agencies such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) have implemented regulations to limit the use of methylene chloride in certain applications and establish exposure limits to protect worker health and safety. The drive for stricter regulations and public awareness campaigns regarding the health risks associated with methylene chloride contribute to the phasing out of its use and the search for safer alternatives in various industries.

A potential opportunity for the methylene chloride market lies in the development of safer and greener solvent technologies that offer comparable performance benefits while addressing health and environmental concerns. Opportunities exist for research and innovation in solvent chemistry, process engineering, and formulation technologies to create alternative solvents that meet the stringent requirements of various applications without compromising efficiency or effectiveness. For example, there's potential for the development of bio-based solvents derived from renewable feedstocks, water-based formulations with low VOC content, and green extraction techniques that minimize environmental impact and worker exposure. By investing in R&D and collaborating with industry partners, manufacturers can capitalize on this opportunity to introduce innovative solvent solutions that meet regulatory requirements, consumer demands, and sustainability goals, driving growth in the solvent market.

The Chemical Processing application segment stands out as the largest segment in the Methylene Chloride market. Methylene Chloride, also known as dichloromethane, is widely utilized in various chemical processing applications owing to its excellent solvent properties, high solubility, and low boiling point. Within the chemical processing industry, Methylene Chloride finds extensive use as a solvent for diverse processes such as extraction, purification, and synthesis of various chemicals and intermediates. Its versatility makes it indispensable in the production of pharmaceuticals, agrochemicals, fine chemicals, and specialty polymers, where it facilitates efficient separation and purification processes. Moreover, Methylene Chloride's compatibility with a wide range of organic compounds and its ability to dissolve both polar and non-polar substances make it a preferred solvent for complex chemical reactions and processing operations. Additionally, its relatively low toxicity and favorable environmental profile compared to alternative solvents further bolster its adoption in chemical processing applications. With the continual expansion of the chemical processing industry globally and the increasing demand for specialty chemicals and pharmaceuticals, the Chemical Processing application segment is expected to maintain its leadership position in the Methylene Chloride market, presenting substantial growth opportunities for manufacturers and suppliers operating in this space.

The Industrial Grade segment is the fastest-growing segment in the Methylene Chloride market. Industrial Grade Methylene Chloride is widely utilized in various applications such as paint stripping, metal cleaning, foam manufacturing, and adhesive production, owing to its strong solvent properties and cost-effectiveness. The increasing demand for Industrial Grade Methylene Chloride is primarily attributed to its widespread use in industrial processes, including paint removal, where it serves as a highly efficient and economical solvent for stripping coatings from surfaces. Moreover, the burgeoning construction and automotive industries worldwide fuel the demand for Methylene Chloride-based paint strippers and coatings removers, driving the growth of the Industrial Grade segment. Additionally, the versatility of Industrial Grade Methylene Chloride in metal cleaning applications, where it effectively removes grease, oil, and contaminants from metal surfaces, further contributes to its rapid adoption. Furthermore, the industrial segment's growth is bolstered by the expanding manufacturing sector, particularly in emerging economies, where Methylene Chloride finds diverse applications in chemical processing and production processes. With the continual expansion of industrial activities globally and the increasing demand for cost-effective and efficient solvents, the Industrial Grade segment is poised to maintain its robust growth trajectory in the Methylene Chloride market, offering significant opportunities for market players to capitalize on evolving industrial needs and market dynamics.

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial GradeCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AkzoNobel N.V.

Dow Inc

Eastman Chemical Company

Gujrat Alkalies and Chemicals Ltd

KEM ONE

LOTTE Fine chemical

Occidental Petroleum Corp

Olin Corp

PPG industries Inc

Shin-Etsu Chemical Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Methylene Chloride Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Methylene Chloride Market Size Outlook, $ Million, 2021 to 2032

3.2 Methylene Chloride Market Outlook by Type, $ Million, 2021 to 2032

3.3 Methylene Chloride Market Outlook by Product, $ Million, 2021 to 2032

3.4 Methylene Chloride Market Outlook by Application, $ Million, 2021 to 2032

3.5 Methylene Chloride Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Methylene Chloride Industry

4.2 Key Market Trends in Methylene Chloride Industry

4.3 Potential Opportunities in Methylene Chloride Industry

4.4 Key Challenges in Methylene Chloride Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Methylene Chloride Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Methylene Chloride Market Outlook by Segments

7.1 Methylene Chloride Market Outlook by Segments, $ Million, 2021- 2032

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

8 North America Methylene Chloride Market Analysis and Outlook To 2032

8.1 Introduction to North America Methylene Chloride Markets in 2024

8.2 North America Methylene Chloride Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Methylene Chloride Market size Outlook by Segments, 2021-2032

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

9 Europe Methylene Chloride Market Analysis and Outlook To 2032

9.1 Introduction to Europe Methylene Chloride Markets in 2024

9.2 Europe Methylene Chloride Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Methylene Chloride Market Size Outlook by Segments, 2021-2032

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

10 Asia Pacific Methylene Chloride Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Methylene Chloride Markets in 2024

10.2 Asia Pacific Methylene Chloride Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Methylene Chloride Market size Outlook by Segments, 2021-2032

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

11 South America Methylene Chloride Market Analysis and Outlook To 2032

11.1 Introduction to South America Methylene Chloride Markets in 2024

11.2 South America Methylene Chloride Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Methylene Chloride Market size Outlook by Segments, 2021-2032

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

12 Middle East and Africa Methylene Chloride Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Methylene Chloride Markets in 2024

12.2 Middle East and Africa Methylene Chloride Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Methylene Chloride Market size Outlook by Segments, 2021-2032

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AkzoNobel N.V.

Dow Inc

Eastman Chemical Company

Gujrat Alkalies and Chemicals Ltd

KEM ONE

LOTTE Fine chemical

Occidental Petroleum Corp

Olin Corp

PPG industries Inc

Shin-Etsu Chemical Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Paint Remover

Pharmaceuticals

Chemical Processing

Foam Manufacturing

Metal Cleaning

Others

By Type

Reagent Grade

Industrial Grade

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Methylene Chloride Market Size is valued at $2.4 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $3.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AkzoNobel N.V., Dow Inc, Eastman Chemical Company, Gujrat Alkalies and Chemicals Ltd, KEM ONE, LOTTE Fine chemical, Occidental Petroleum Corp, Olin Corp, PPG industries Inc, Shin-Etsu Chemical Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume