The global Metal Replacement Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By End-User (Automotive, Aerospace & Defense, Construction, Healthcare, Others), By Type (Engineering Plastics, Composites).

Metal replacement refers to the substitution of traditional metal components with alternative materials such as polymers, composites, ceramics, and advanced engineered materials in various applications. In 2024, the trend of metal replacement s to gain momentum as industries seek lightweight, cost-effective, and high-performance alternatives to conventional metal parts. Metal replacement offers several advantages, including weight reduction, corrosion resistance, design flexibility, and cost savings in material, manufacturing, and assembly processes. Polymer-based materials such as thermoplastics, thermosets, and elastomers are commonly used as substitutes for metal components in automotive, aerospace, consumer electronics, and medical devices due to their low density, moldability, and chemical resistance. Advanced composites such as carbon fiber reinforced polymers (CFRP), glass fiber reinforced polymers (GFRP), and aramid fiber composites offer exceptional strength-to-weight ratio and fatigue resistance, making them suitable for structural applications in industries such as aerospace, sports equipment, and renewable energy. Ceramics and ceramic matrix composites (CMC) are utilized in high-temperature and wear-resistant applications such as brake pads, cutting tools, and engine components due to their hardness, thermal stability, and corrosion resistance. With advancements in material science, additive manufacturing, and simulation tools, there is ongoing research into developing novel materials and manufacturing processes that offer superior performance and sustainability compared to traditional metals. Further, the adoption of metal replacement strategies supports initiatives to reduce greenhouse gas emissions, energy consumption, and resource depletion associated with metal extraction and processing. As industries to innovate and optimize material selection for specific applications, the trend of metal replacement is expected to , driving further advancements in materials science and engineering.

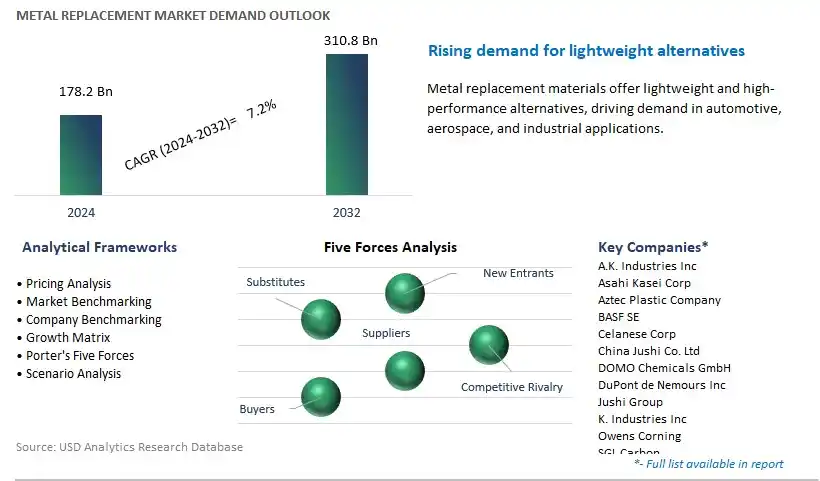

The market report analyses the leading companies in the industry including A.K. Industries Inc, Asahi Kasei Corp, Aztec Plastic Company, BASF SE, Celanese Corp, China Jushi Co. Ltd, DOMO Chemicals GmbH, DuPont de Nemours Inc, Jushi Group, K. Industries Inc, Owens Corning, SGL Carbon, Solvay S.A., Toray Industries Inc, Victrex Plc, and others.

A prominent market trend for metal replacement is the increasing demand for lightweight and cost-effective alternatives to traditional metal components across various industries such as automotive, aerospace, and consumer electronics. With a growing emphasis on fuel efficiency, sustainability, and product innovation, there's a rising need for materials that offer comparable performance to metals but with reduced weight, lower cost, and improved design flexibility. Metal replacement solutions, including engineering plastics, composites, and ceramics, are being increasingly utilized to replace metal parts in applications such as structural components, housings, and assemblies. This trend is driven by the desire to enhance product performance, reduce manufacturing costs, and address environmental concerns, leading to the widespread adoption of metal replacement materials in diverse industries.

A key market driver for metal replacement is technological advancements and material development, enabling the production of high-performance alternatives to metals with tailored properties and functionalities. As research and development efforts in materials science, polymer chemistry, and composite manufacturing continue to advance, there's a continuous evolution of metal replacement materials with enhanced strength, durability, and processability. Innovations such as carbon fiber-reinforced polymers, bio-based plastics, and additive manufacturing techniques contribute to the development of lightweight and sustainable alternatives to metals that meet the performance requirements of specific applications. The drive for continuous innovation and material advancement fuels the growth of the metal replacement market as manufacturers strive to offer solutions that outperform traditional metals in terms of performance, cost, and sustainability.

A potential opportunity for metal replacement lies in the expansion into new industries and applications beyond traditional automotive and aerospace sectors. Opportunities exist for metal replacement materials to penetrate markets such as healthcare, consumer goods, renewable energy, and construction, where there's a demand for lightweight, corrosion-resistant, and design-friendly alternatives to metals. For example, there's potential for the use of engineering plastics and composites in medical devices, packaging, renewable energy systems, and building materials for their biocompatibility, versatility, and cost-effectiveness. Additionally, metal replacement materials can be utilized in consumer electronics, appliances, and sporting goods for their aesthetic appeal, design flexibility, and durability. By exploring new applications and market segments, metal replacement material suppliers can capitalize on this opportunity to diversify their product portfolio, expand their customer base, and drive growth in the metal replacement market.

Among the types in the Metal Replacement market, composites emerge as the fastest-growing segment. Composites, which are materials made from two or more constituent materials with significantly different physical or chemical properties, offer a compelling alternative to traditional metal components in various applications across industries such as aerospace, automotive, construction, and consumer goods. Composites provide exceptional strength-to-weight ratio, corrosion resistance, and design flexibility, allowing manufacturers to produce lightweight, durable, and complex structures that outperform traditional metal counterparts. Moreover, advancements in composite manufacturing technologies, including resin infusion, filament winding, and automated lay-up processes, have significantly improved production efficiency and reduced material costs, making composites increasingly competitive with metals. Additionally, growing concerns about environmental sustainability and energy efficiency drive the adoption of composites as they offer the potential for reduced carbon footprint and energy consumption throughout the product lifecycle. As industries continue to seek innovative solutions to meet performance requirements while minimizing weight and cost, the demand for composites in the Metal Replacement market is expected to experience rapid growth, solidifying its position as the fastest-growing segment.

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

CompositesCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

A.K. Industries Inc

Asahi Kasei Corp

Aztec Plastic Company

BASF SE

Celanese Corp

China Jushi Co. Ltd

DOMO Chemicals GmbH

DuPont de Nemours Inc

Jushi Group

K. Industries Inc

Owens Corning

SGL Carbon

Solvay S.A.

Toray Industries Inc

Victrex Plc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Metal Replacement Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Metal Replacement Market Size Outlook, $ Million, 2021 to 2032

3.2 Metal Replacement Market Outlook by Type, $ Million, 2021 to 2032

3.3 Metal Replacement Market Outlook by Product, $ Million, 2021 to 2032

3.4 Metal Replacement Market Outlook by Application, $ Million, 2021 to 2032

3.5 Metal Replacement Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Metal Replacement Industry

4.2 Key Market Trends in Metal Replacement Industry

4.3 Potential Opportunities in Metal Replacement Industry

4.4 Key Challenges in Metal Replacement Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Metal Replacement Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Metal Replacement Market Outlook by Segments

7.1 Metal Replacement Market Outlook by Segments, $ Million, 2021- 2032

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

8 North America Metal Replacement Market Analysis and Outlook To 2032

8.1 Introduction to North America Metal Replacement Markets in 2024

8.2 North America Metal Replacement Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Metal Replacement Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

9 Europe Metal Replacement Market Analysis and Outlook To 2032

9.1 Introduction to Europe Metal Replacement Markets in 2024

9.2 Europe Metal Replacement Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Metal Replacement Market Size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

10 Asia Pacific Metal Replacement Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Metal Replacement Markets in 2024

10.2 Asia Pacific Metal Replacement Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Metal Replacement Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

11 South America Metal Replacement Market Analysis and Outlook To 2032

11.1 Introduction to South America Metal Replacement Markets in 2024

11.2 South America Metal Replacement Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Metal Replacement Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

12 Middle East and Africa Metal Replacement Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Metal Replacement Markets in 2024

12.2 Middle East and Africa Metal Replacement Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Metal Replacement Market size Outlook by Segments, 2021-2032

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

A.K. Industries Inc

Asahi Kasei Corp

Aztec Plastic Company

BASF SE

Celanese Corp

China Jushi Co. Ltd

DOMO Chemicals GmbH

DuPont de Nemours Inc

Jushi Group

K. Industries Inc

Owens Corning

SGL Carbon

Solvay S.A.

Toray Industries Inc

Victrex Plc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By End-User

Automotive

Aerospace & Defense

Construction

Healthcare

Others

By Type

Engineering Plastics

Composites

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Metal Replacement Market Size is valued at $178.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.2% to reach $310.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

A.K. Industries Inc, Asahi Kasei Corp, Aztec Plastic Company, BASF SE, Celanese Corp, China Jushi Co. Ltd, DOMO Chemicals GmbH, DuPont de Nemours Inc, Jushi Group, K. Industries Inc, Owens Corning, SGL Carbon, Solvay S.A., Toray Industries Inc, Victrex Plc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume