The global Metal Matrix Composites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Matrix type (Aluminum MMC, Copper MMC, Magnesium MMC, Super Alloys MMC, Others), By Reinforcement (Continuous, Discontinuous, Particles ), By Production Technology (Liquid Metal Infiltration, Powder Metallurgy, Casting, Deposition techniques ), By Reinforcement Material (Alumina, Silicon Carbide, Carbon Fiber, Others), By End-User (Automotive & Transportation, Aerospace & Defense, Electrical & Electronics, Industrial, Others).

Metal matrix composites (MMCs) represent a class of advanced materials composed of a metal matrix reinforced with high-performance fibers, particles, or whiskers in 2024. These composites offer a unique combination of properties, including high strength, stiffness, thermal conductivity, and wear resistance, making them suitable for a wide range of demanding applications across aerospace, automotive, defense, and industrial sectors. The metal matrix, typically composed of aluminum, magnesium, titanium, or their alloys, provides the structural framework, while the reinforcing materials, such as silicon carbide (SiC), alumina (Al2O3), carbon fibers, or boron nitride (BN), enhance specific properties to meet application requirements. MMCs find applications in aerospace components, such as aircraft engine components, rocket nozzles, and structural panels, where lightweight materials with high strength and thermal stability are essential for performance and fuel efficiency. In the automotive industry, MMCs are used in brake rotors, pistons, and suspension components to reduce weight, improve fuel economy, and enhance durability. In industrial applications, MMCs are employed in machinery components, bearings, and tooling inserts for enhanced wear resistance and extended service life. With ongoing research and development efforts focused on optimizing material compositions, manufacturing processes, and cost-effective production methods, the market for metal matrix composites is poised for growth, driven by increasing demand for lightweight, high-performance materials in advanced engineering applications.

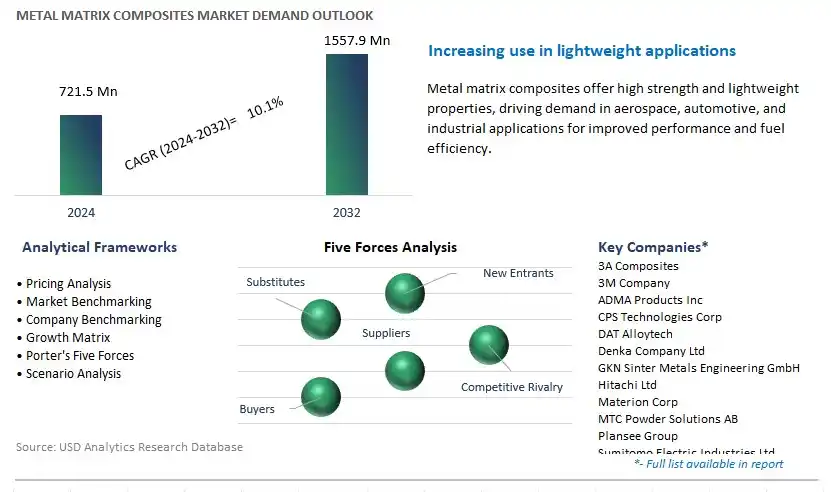

The market report analyses the leading companies in the industry including 3A Composites, 3M Company, ADMA Products Inc, CPS Technologies Corp, DAT Alloytech, Denka Company Ltd, GKN Sinter Metals Engineering GmbH, Hitachi Ltd, Materion Corp, MTC Powder Solutions AB, Plansee Group, Sumitomo Electric Industries Ltd, Thermal Transfer Composites LLC, TISICS Ltd, and others.

A significant trend in the metal matrix composites market is the growing demand for lightweight and high-performance materials. Metal matrix composites (MMCs) offer superior mechanical properties, including high strength-to-weight ratio, excellent thermal conductivity, and enhanced wear resistance, making them ideal for applications requiring lightweight yet durable components. With increasing emphasis on fuel efficiency, sustainability, and performance optimization across industries such as automotive, aerospace, and electronics, there is a rising adoption of MMCs to replace traditional materials like steel and aluminum. This trend towards lightweighting and performance enhancement drives market growth as manufacturers seek innovative solutions to meet stringent performance requirements and achieve competitive advantages in their respective markets.

A key driver fueling the metal matrix composites market is advancements in material science and manufacturing technologies. With continuous research and development efforts, there are significant advancements in MMC formulations, processing techniques, and reinforcement materials, enabling the production of MMCs with tailored properties and improved performance characteristics. Advanced manufacturing technologies such as powder metallurgy, infiltration methods, and additive manufacturing facilitate the production of complex-shaped MMC components with precise microstructures and enhanced mechanical properties. Additionally, advancements in nanotechnology and fiber reinforcement techniques contribute to the development of next-generation MMCs with exceptional strength, toughness, and fatigue resistance. This driver supports market growth as manufacturers leverage technological innovations to expand the application range and performance capabilities of metal matrix composites in various industries.

A promising opportunity for the metal matrix composites market lies in the expansion into emerging applications and industries. As MMC technology matures and gains wider acceptance, there is potential to penetrate new market segments and applications beyond traditional aerospace and automotive sectors. Emerging industries such as renewable energy, medical devices, and sporting goods offer promising opportunities for MMC adoption due to their unique performance requirements and demand for lightweight and durable materials. Additionally, MMCs can find applications in infrastructure, defense, marine, and electronics industries, where performance optimization, corrosion resistance, and durability are paramount. By diversifying into emerging applications and industries, MMC manufacturers can unlock new revenue streams, broaden their customer base, and capitalize on the versatility and performance advantages of metal matrix composites. This opportunity allows MMC suppliers to position themselves as innovative solution providers and drive market expansion into new frontiers of technology and applications.

The largest segment within the metal matrix composites (MMC) market is aluminum MMC. The large revenue share is primarily due to the widespread use of aluminum matrix composites across various industries for their exceptional combination of properties. Aluminum MMCs offer a unique blend of high strength, lightweight, and excellent thermal and electrical conductivity, making them highly desirable for applications where these attributes are critical. Industries such as aerospace, automotive, defense, and electronics extensively utilize aluminum MMCs for components requiring lightweight yet robust materials, such as aircraft structures, automotive engine parts, electronic packaging, and sporting equipment. Moreover, the versatility of aluminum MMCs allows for customization through the incorporation of different reinforcement materials, such as silicon carbide (SiC) or alumina (Al2O3), to further enhance specific properties like hardness, wear resistance, and thermal stability. As industries continue to prioritize lightweighting initiatives, coupled with the demand for high-performance materials that can withstand extreme conditions, the aluminum MMC segment maintains its position as the largest segment in the metal matrix composites market.

The fastest-growing segment within the metal matrix composites (MMC) market is continuous reinforcement. This growth is driven by the increasing adoption of continuous reinforcement materials in various industrial applications. Continuous reinforcement, such as continuous fibers or wires, offers superior mechanical properties compared to discontinuous or particle reinforcements. Continuous fibers provide excellent strength, stiffness, and fatigue resistance, making them ideal for applications requiring high-performance materials, such as aerospace, automotive, and sporting goods. Additionally, continuous reinforcement allows for better load transfer between the matrix and the reinforcement phase, resulting in enhanced structural integrity and durability of MMC components. Industries are increasingly turning to continuous reinforcement MMCs to meet stringent performance requirements while reducing weight and improving fuel efficiency in automotive and aerospace applications. Moreover, advancements in manufacturing technologies, such as automated fiber placement and filament winding, have made it more feasible to produce complex shapes and structures using continuous reinforcement MMCs, further driving their adoption across industries. As a result, the continuous reinforcement segment is experiencing rapid growth within the MMC market.

The largest segment within the metal matrix composites (MMC) market is powder metallurgy. The large revenue share is primarily due to the versatility, efficiency, and widespread applicability of powder metallurgy techniques in manufacturing MMCs. Powder metallurgy involves the consolidation of metal powders and reinforcement materials through processes such as hot pressing, hot isostatic pressing (HIP), and sintering, among others. This method allows for precise control over the composition, distribution, and orientation of reinforcement materials within the metal matrix, resulting in MMCs with tailored properties to meet specific application requirements. Powder metallurgy offers potential advantages, including the ability to produce complex shapes, uniform dispersion of reinforcements, and the incorporation of a wide range of reinforcement materials, such as ceramics, carbides, and fibers. Additionally, powder metallurgy techniques are highly scalable and cost-effective, making them suitable for both small-scale and large-scale production of MMC components across various industries, including automotive, aerospace, electronics, and machinery. As industries continue to seek lightweight, high-performance materials with superior mechanical and thermal properties, powder metallurgy remains the preferred production technology for manufacturing MMCs, thus establishing itself as the largest segment in the market.

The fastest-growing segment within the metal matrix composites (MMC) market is carbon fiber reinforcement. This rapid growth can be attributed to the unique combination of properties offered by carbon fibers, making them highly desirable for various high-performance applications. Carbon fibers exhibit exceptional strength-to-weight ratio, high stiffness, low thermal expansion, and excellent corrosion resistance, making them ideal reinforcement materials for enhancing the mechanical and thermal properties of metal matrices. As industries such as aerospace, automotive, and defense increasingly demand lightweight materials with superior mechanical performance, carbon fiber-reinforced MMCs have emerged as an attractive solution. These composites offer significant weight savings without compromising on structural integrity or durability, enabling the development of lighter, more fuel-efficient vehicles, aircraft, and components. Additionally, advancements in carbon fiber manufacturing technologies have led to improved production efficiency, reduced costs, and expanded application possibilities, further driving the growth of this segment in the MMC market. As industries continue to prioritize lightweighting and performance optimization, the demand for carbon fiber-reinforced MMCs is expected to escalate, solidifying its position as the fastest-growing segment in the market.

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3A Composites

3M Company

ADMA Products Inc

CPS Technologies Corp

DAT Alloytech

Denka Company Ltd

GKN Sinter Metals Engineering GmbH

Hitachi Ltd

Materion Corp

MTC Powder Solutions AB

Plansee Group

Sumitomo Electric Industries Ltd

Thermal Transfer Composites LLC

TISICS Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Metal Matrix Composites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Metal Matrix Composites Market Size Outlook, $ Million, 2021 to 2032

3.2 Metal Matrix Composites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Metal Matrix Composites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Metal Matrix Composites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Metal Matrix Composites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Metal Matrix Composites Industry

4.2 Key Market Trends in Metal Matrix Composites Industry

4.3 Potential Opportunities in Metal Matrix Composites Industry

4.4 Key Challenges in Metal Matrix Composites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Metal Matrix Composites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Metal Matrix Composites Market Outlook by Segments

7.1 Metal Matrix Composites Market Outlook by Segments, $ Million, 2021- 2032

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

8 North America Metal Matrix Composites Market Analysis and Outlook To 2032

8.1 Introduction to North America Metal Matrix Composites Markets in 2024

8.2 North America Metal Matrix Composites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Metal Matrix Composites Market size Outlook by Segments, 2021-2032

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

9 Europe Metal Matrix Composites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Metal Matrix Composites Markets in 2024

9.2 Europe Metal Matrix Composites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Metal Matrix Composites Market Size Outlook by Segments, 2021-2032

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

10 Asia Pacific Metal Matrix Composites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Metal Matrix Composites Markets in 2024

10.2 Asia Pacific Metal Matrix Composites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Metal Matrix Composites Market size Outlook by Segments, 2021-2032

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

11 South America Metal Matrix Composites Market Analysis and Outlook To 2032

11.1 Introduction to South America Metal Matrix Composites Markets in 2024

11.2 South America Metal Matrix Composites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Metal Matrix Composites Market size Outlook by Segments, 2021-2032

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

12 Middle East and Africa Metal Matrix Composites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Metal Matrix Composites Markets in 2024

12.2 Middle East and Africa Metal Matrix Composites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Metal Matrix Composites Market size Outlook by Segments, 2021-2032

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3A Composites

3M Company

ADMA Products Inc

CPS Technologies Corp

DAT Alloytech

Denka Company Ltd

GKN Sinter Metals Engineering GmbH

Hitachi Ltd

Materion Corp

MTC Powder Solutions AB

Plansee Group

Sumitomo Electric Industries Ltd

Thermal Transfer Composites LLC

TISICS Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Matrix type

Aluminum MMC

Copper MMC

Magnesium MMC

Super Alloys MMC

Others

By Reinforcement type

Continuous

Discontinuous

Particles

By Production Technology

Liquid Metal Infiltration

Powder Metallurgy

Casting

Deposition techniques

By Reinforcement Material

Alumina

Silicon Carbide

Carbon Fiber

Others

By End-User

Automotive & Transportation

Aerospace & Defense

Electrical & Electronics

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Metal Matrix Composites Market Size is valued at $721.5 Million in 2024 and is forecast to register a growth rate (CAGR) of 10.1% to reach $1557.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3A Composites, 3M Company, ADMA Products Inc, CPS Technologies Corp, DAT Alloytech, Denka Company Ltd, GKN Sinter Metals Engineering GmbH, Hitachi Ltd, Materion Corp, MTC Powder Solutions AB, Plansee Group, Sumitomo Electric Industries Ltd, Thermal Transfer Composites LLC, TISICS Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume