The global Membranes for Water and Wastewater Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Technology (Microfiltration (MF), Ultrafiltration (UF), Nanofiltration (NF), Reverse Osmosis (RO)), By End-User (Municipal, Pulp and Paper, Chemicals, Food and Beverage, Healthcare, Power, Others).

Membranes for water and wastewater treatment are integral components of modern filtration systems, playing a vital role in purifying water and removing contaminants in 2024. These membranes are engineered to selectively separate particles, microorganisms, and dissolved substances from water by size, charge, or other properties, ensuring the production of clean, potable water and the safe discharge of treated wastewater. Membrane-based processes, such as reverse osmosis (RO), nanofiltration (NF), ultrafiltration (UF), and microfiltration (MF), are widely utilized in municipal water treatment plants, industrial facilities, and decentralized water treatment systems. RO membranes are capable of removing dissolved salts, minerals, and organic compounds, making them suitable for desalination and producing high-quality drinking water. NF membranes selectively remove divalent ions, organic molecules, and certain contaminants, while UF and MF membranes effectively remove suspended solids, bacteria, and viruses from water and wastewater streams. Membrane technologies offer several advantages, including high efficiency, compact footprint, and flexibility in treating various water sources and contaminants. With growing concerns about water scarcity, population growth, and pollution, the demand for membrane-based water and wastewater treatment solutions is expected to increase, driving innovation and advancements in membrane materials, modules, and system design to meet the evolving needs of communities and industries worldwide.

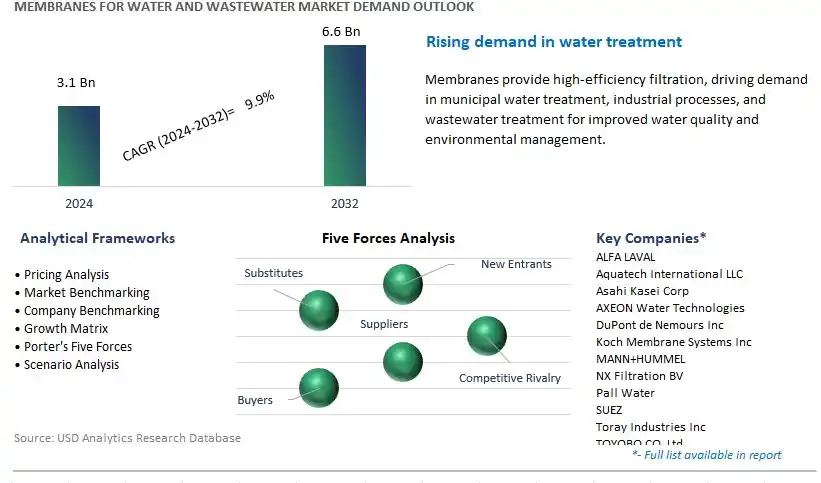

The market report analyses the leading companies in the industry including ALFA LAVAL, Aquatech International LLC, Asahi Kasei Corp, AXEON Water Technologies, DuPont de Nemours Inc, Koch Membrane Systems Inc, MANN+HUMMEL, NX Filtration BV, Pall Water, SUEZ, Toray Industries Inc, TOYOBO CO. Ltd, Veolia Environnement S.A., Vontron Technology Co. Ltd, Xylem, and others.

A significant trend in the membranes for water and wastewater market is the shift towards sustainable water management solutions. With increasing global awareness of water scarcity, pollution, and the need for sustainable resource management, there is a growing demand for membrane-based technologies to treat water and wastewater efficiently and responsibly. Membranes offer a highly effective and environmentally friendly solution for removing contaminants, pathogens, and pollutants from water sources, making them ideal for various applications including drinking water purification, industrial wastewater treatment, and water reuse. This trend towards sustainable water management drives market growth as governments, industries, and communities prioritize investments in membrane-based solutions to address water challenges and promote environmental sustainability.

A key driver fueling the membranes for water and wastewater market is the enforcement of stringent regulatory standards and water quality requirements. With increasing concerns about water pollution, health risks, and environmental degradation, regulatory authorities worldwide are imposing strict standards for water treatment and discharge. Membrane technologies, such as reverse osmosis, ultrafiltration, and microfiltration, are recognized for their ability to achieve high levels of water purity and meet regulatory requirements for safe drinking water, wastewater discharge, and environmental protection. This driver supports market demand for membranes as industries, municipalities, and utilities invest in advanced treatment systems to comply with regulatory mandates and ensure the safety and sustainability of water resources.

A promising opportunity for the membranes for water and wastewater market lies in the expansion into emerging applications and markets. As membrane technologies continue to evolve and improve, there is potential to address new challenges and penetrate untapped market segments. Membranes can be applied in innovative ways to address emerging water treatment needs such as brackish water desalination, produced water treatment in the oil and gas industry, decentralized water treatment systems for remote communities, and point-of-use filtration for residential and commercial applications. By diversifying product offerings and targeting niche markets, membrane manufacturers can capitalize on the opportunity to expand their customer base, drive market growth, and establish themselves as leaders in the rapidly evolving field of water and wastewater treatment. This opportunity allows membrane suppliers to leverage their expertise in membrane technology and engineering to develop tailored solutions that address specific customer needs and contribute to the advancement of global water sustainability goals.

The largest segment within the membranes for water and wastewater market is reverse osmosis (RO). The large revenue share can be attributed to the widespread adoption of RO technology for various water treatment applications due to its high efficiency and versatility. Reverse osmosis membranes are capable of removing a wide range of contaminants, including salts, dissolved solids, bacteria, viruses, and organic compounds, from water by applying pressure to force water molecules through a semi-permeable membrane, leaving behind impurities. RO membranes are extensively used in desalination plants for converting seawater or brackish water into potable water, as well as in industrial and municipal water treatment facilities for producing high-quality process water, drinking water, and wastewater reuse. Additionally, the growing global demand for clean water, coupled with increasing regulations on water quality and scarcity, drives the adoption of RO technology as a reliable and cost-effective solution for addressing water treatment challenges. As industries and municipalities continue to invest in upgrading and expanding their water treatment infrastructure, the demand for RO membranes is expected to remain robust, solidifying its position as the largest segment in the membranes for water and wastewater market.

The fastest-growing segment within the membranes for water and wastewater market is healthcare. The market growth is driven by demand for membrane technologies in the healthcare sector. Healthcare facilities, including hospitals, clinics, laboratories, and pharmaceutical manufacturing plants, require reliable and efficient water treatment solutions to ensure the production of high-quality water for various critical applications such as sterilization, medical equipment cleaning, pharmaceutical formulation, and patient care. Membrane technologies, including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, play a crucial role in meeting the stringent water quality standards and regulatory requirements mandated for healthcare facilities to safeguard patient health and safety. Moreover, the increasing focus on infection control, hygiene, and patient welfare further emphasizes the need for advanced water treatment solutions in healthcare settings. As the healthcare industry continues to grow globally, driven by factors such as population aging, rising healthcare expenditure, and increasing prevalence of chronic diseases, the demand for membranes for water and wastewater treatment in healthcare applications is expected to witness significant growth, positioning it as the fastest-growing segment in the market.

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ALFA LAVAL

Aquatech International LLC

Asahi Kasei Corp

AXEON Water Technologies

DuPont de Nemours Inc

Koch Membrane Systems Inc

MANN+HUMMEL

NX Filtration BV

Pall Water

SUEZ

Toray Industries Inc

TOYOBO CO. Ltd

Veolia Environnement S.A.

Vontron Technology Co. Ltd

Xylem

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Membranes for Water and Wastewater Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Membranes for Water and Wastewater Market Size Outlook, $ Million, 2021 to 2032

3.2 Membranes for Water and Wastewater Market Outlook by Type, $ Million, 2021 to 2032

3.3 Membranes for Water and Wastewater Market Outlook by Product, $ Million, 2021 to 2032

3.4 Membranes for Water and Wastewater Market Outlook by Application, $ Million, 2021 to 2032

3.5 Membranes for Water and Wastewater Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Membranes for Water and Wastewater Industry

4.2 Key Market Trends in Membranes for Water and Wastewater Industry

4.3 Potential Opportunities in Membranes for Water and Wastewater Industry

4.4 Key Challenges in Membranes for Water and Wastewater Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Membranes for Water and Wastewater Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Membranes for Water and Wastewater Market Outlook by Segments

7.1 Membranes for Water and Wastewater Market Outlook by Segments, $ Million, 2021- 2032

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

8 North America Membranes for Water and Wastewater Market Analysis and Outlook To 2032

8.1 Introduction to North America Membranes for Water and Wastewater Markets in 2024

8.2 North America Membranes for Water and Wastewater Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Membranes for Water and Wastewater Market size Outlook by Segments, 2021-2032

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

9 Europe Membranes for Water and Wastewater Market Analysis and Outlook To 2032

9.1 Introduction to Europe Membranes for Water and Wastewater Markets in 2024

9.2 Europe Membranes for Water and Wastewater Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Membranes for Water and Wastewater Market Size Outlook by Segments, 2021-2032

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

10 Asia Pacific Membranes for Water and Wastewater Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Membranes for Water and Wastewater Markets in 2024

10.2 Asia Pacific Membranes for Water and Wastewater Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Membranes for Water and Wastewater Market size Outlook by Segments, 2021-2032

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

11 South America Membranes for Water and Wastewater Market Analysis and Outlook To 2032

11.1 Introduction to South America Membranes for Water and Wastewater Markets in 2024

11.2 South America Membranes for Water and Wastewater Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Membranes for Water and Wastewater Market size Outlook by Segments, 2021-2032

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

12 Middle East and Africa Membranes for Water and Wastewater Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Membranes for Water and Wastewater Markets in 2024

12.2 Middle East and Africa Membranes for Water and Wastewater Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Membranes for Water and Wastewater Market size Outlook by Segments, 2021-2032

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ALFA LAVAL

Aquatech International LLC

Asahi Kasei Corp

AXEON Water Technologies

DuPont de Nemours Inc

Koch Membrane Systems Inc

MANN+HUMMEL

NX Filtration BV

Pall Water

SUEZ

Toray Industries Inc

TOYOBO CO. Ltd

Veolia Environnement S.A.

Vontron Technology Co. Ltd

Xylem

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Microfiltration (MF)

Ultrafiltration (UF)

Nanofiltration (NF)

Reverse Osmosis (RO)

By End-User

Municipal

Pulp and Paper

Chemicals

Food and Beverage

Healthcare

Power

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Membranes for Water and Wastewater Market Size is valued at $3.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 9.9% to reach $6.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ALFA LAVAL, Aquatech International LLC, Asahi Kasei Corp, AXEON Water Technologies, DuPont de Nemours Inc, Koch Membrane Systems Inc, MANN+HUMMEL, NX Filtration BV, Pall Water, SUEZ, Toray Industries Inc, TOYOBO CO. Ltd, Veolia Environnement S.A., Vontron Technology Co. Ltd, Xylem

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume