The global Marine Deck Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Technology (Water Borne, Solvent Borne, Others), By Type (New Build, Professional Maintenance, Do-it-Yourself (DIY)).

Marine deck coatings are specialized coatings designed to protect and enhance the durability of ship decks and maritime structures in 2024. These coatings are applied to the decks of ships, offshore platforms, docks, and other marine infrastructure to provide corrosion protection, slip resistance, and aesthetic appeal in harsh marine environments. Marine deck coatings are subjected to extreme conditions, including exposure to saltwater, UV radiation, abrasion, and mechanical impact, making durability and performance essential considerations in their formulation. These coatings are typically formulated with epoxy, polyurethane, or acrylic resins, along with additives such as fillers, pigments, and anti-slip aggregates to meet specific performance requirements. Epoxy-based coatings offer excellent adhesion, chemical resistance, and durability, making them suitable for high-traffic areas and aggressive marine environments. Polyurethane coatings provide superior UV resistance and color retention, making them ideal for exposed decks and superstructures. Anti-slip aggregates, such as aluminum oxide or synthetic grit, are incorporated into the coating to improve traction and safety for personnel working on deck surfaces. In addition to protection against corrosion and wear, marine deck coatings also contribute to the aesthetics of maritime vessels and structures, with options available for customizable colors and finishes. With the increasing demand for marine transportation and offshore energy production, the market for marine deck coatings is poised for growth, driven by investments in new vessel construction, refurbishment projects, and infrastructure development in coastal and offshore regions around the world.

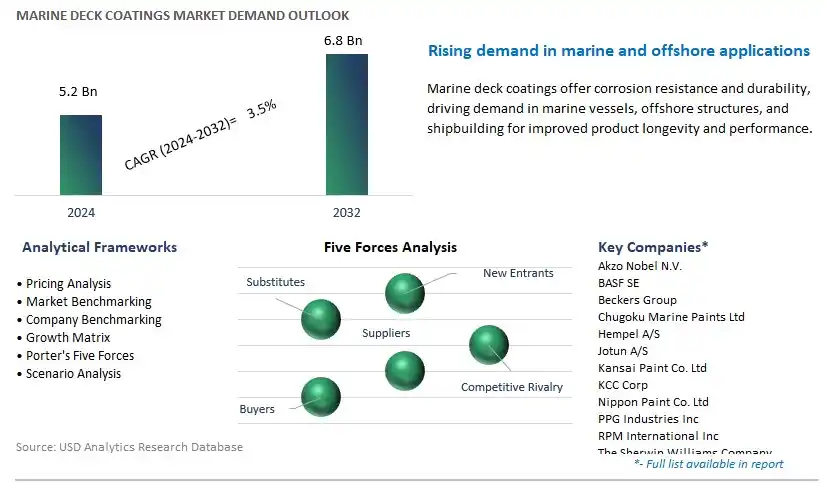

The market report analyses the leading companies in the industry including Akzo Nobel N.V. , BASF SE, Beckers Group, Chugoku Marine Paints Ltd, Hempel A/S, Jotun A/S, Kansai Paint Co. Ltd, KCC Corp, Nippon Paint Co. Ltd, PPG Industries Inc, RPM International Inc, The Sherwin Williams Company, and others.

A significant trend in the marine deck coatings market is the increasing focus on durability and safety. Marine deck coatings, designed to protect ship decks from corrosion, wear, and slipping hazards, are witnessing growing demand due to heightened emphasis on vessel longevity and crew safety. Shipowners and operators are prioritizing coatings that offer superior abrasion resistance, weathering protection, and anti-slip properties to ensure the safety of crew members and passengers, as well as to extend the lifespan of marine structures. This trend towards durable and safety-enhancing coatings drives market growth as the maritime industry seeks reliable solutions to mitigate risks and maintain operational efficiency.

A key driver fueling the marine deck coatings market is the growth in shipbuilding and refurbishment activities. With increasing global trade and maritime transport, there is a continuous demand for new vessel construction, as well as refurbishment and maintenance of existing fleets. Marine deck coatings play a crucial role in shipbuilding projects, providing corrosion protection, aesthetic appeal, and functional properties to deck surfaces. Additionally, as vessels age and undergo routine maintenance, there is a recurring need for deck coating application and renewal. This driver supports market demand for marine deck coatings as shipyards, repair facilities, and maritime operators invest in protective coatings to ensure vessel integrity and performance.

A promising opportunity for the marine deck coatings market lies in the adoption of environmentally-friendly coatings. With increasing environmental regulations and sustainability initiatives in the maritime industry, there is a growing demand for coatings that minimize environmental impact and comply with regulatory standards for VOC emissions and hazardous substances. Manufacturers can capitalize on this opportunity by developing eco-friendly deck coating formulations that utilize low-VOC resins, biodegradable additives, and sustainable raw materials. By offering environmentally-responsible coatings that meet performance requirements and regulatory compliance, suppliers can differentiate their products, attract environmentally-conscious customers, and gain a competitive edge in the market. This opportunity allows coatings manufacturers to align with industry trends towards sustainability and contribute to environmental stewardship in the maritime sector.

The largest segment within the marine deck coatings market is water-borne technology. The large revenue share is driven by the widespread adoption of water-borne coatings in marine applications. Water-borne coatings offer numerous advantages over solvent-borne counterparts, including lower VOC emissions, reduced environmental impact, and compliance with stringent regulatory standards aimed at minimizing air pollution and protecting marine ecosystems. Additionally, water-borne coatings exhibit excellent adhesion, durability, and resistance to weathering, making them well-suited for use in harsh marine environments where decks are subjected to constant exposure to saltwater, UV radiation, and abrasion. Furthermore, the shift towards sustainable and eco-friendly practices across the maritime industry has prompted shipowners and operators to prefer water-borne deck coatings as part of their efforts to reduce carbon footprint and enhance environmental sustainability. As a result, the water-borne technology segment continues to dominate the marine deck coatings market, driven by its superior performance, environmental benefits, and alignment with industry trends towards greener solutions.

The fastest-growing segment within the marine deck coatings market is professional maintenance. The market growth is driven by demand for professional services in maintaining and refurbishing deck coatings on marine vessels. As ships and offshore structures age, their deck coatings deteriorate due to exposure to harsh marine conditions, leading to corrosion, wear, and loss of protective properties. Shipowners and operators increasingly recognize the importance of proactive maintenance to extend the service life of their vessels, enhance safety, and ensure compliance with regulatory standards. Professional maintenance services offer specialized expertise, advanced equipment, and high-quality coatings tailored to the specific requirements of marine applications, providing superior performance and durability compared to DIY solutions. Moreover, outsourcing deck maintenance to professional contractors allows shipowners to minimize downtime, optimize operational efficiency, and reduce overall lifecycle costs. With the growing emphasis on asset integrity and operational reliability in the maritime industry, the demand for professional maintenance services for marine deck coatings is experiencing robust growth, positioning it as the fastest-growing segment in the market.

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel N.V.

BASF SE

Beckers Group

Chugoku Marine Paints Ltd

Hempel A/S

Jotun A/S

Kansai Paint Co. Ltd

KCC Corp

Nippon Paint Co. Ltd

PPG Industries Inc

RPM International Inc

The Sherwin Williams Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Marine Deck Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Marine Deck Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 Marine Deck Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 Marine Deck Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 Marine Deck Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 Marine Deck Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Marine Deck Coatings Industry

4.2 Key Market Trends in Marine Deck Coatings Industry

4.3 Potential Opportunities in Marine Deck Coatings Industry

4.4 Key Challenges in Marine Deck Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Marine Deck Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Marine Deck Coatings Market Outlook by Segments

7.1 Marine Deck Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

8 North America Marine Deck Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America Marine Deck Coatings Markets in 2024

8.2 North America Marine Deck Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Marine Deck Coatings Market size Outlook by Segments, 2021-2032

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

9 Europe Marine Deck Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe Marine Deck Coatings Markets in 2024

9.2 Europe Marine Deck Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Marine Deck Coatings Market Size Outlook by Segments, 2021-2032

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

10 Asia Pacific Marine Deck Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Marine Deck Coatings Markets in 2024

10.2 Asia Pacific Marine Deck Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Marine Deck Coatings Market size Outlook by Segments, 2021-2032

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

11 South America Marine Deck Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America Marine Deck Coatings Markets in 2024

11.2 South America Marine Deck Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Marine Deck Coatings Market size Outlook by Segments, 2021-2032

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

12 Middle East and Africa Marine Deck Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Marine Deck Coatings Markets in 2024

12.2 Middle East and Africa Marine Deck Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Marine Deck Coatings Market size Outlook by Segments, 2021-2032

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel N.V.

BASF SE

Beckers Group

Chugoku Marine Paints Ltd

Hempel A/S

Jotun A/S

Kansai Paint Co. Ltd

KCC Corp

Nippon Paint Co. Ltd

PPG Industries Inc

RPM International Inc

The Sherwin Williams Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Water Borne

Solvent Borne

Others

By Type

New Build

Professional Maintenance

Do-it-Yourself (DIY)

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Marine Deck Coatings Market Size is valued at $5.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.5% to reach $6.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel N.V. , BASF SE, Beckers Group, Chugoku Marine Paints Ltd, Hempel A/S, Jotun A/S, Kansai Paint Co. Ltd, KCC Corp, Nippon Paint Co. Ltd, PPG Industries Inc, RPM International Inc, The Sherwin Williams Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume