The global Manganese Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Alloys, Electrolytic Manganese Dioxide, Electrolytic Manganese Metals, Others), By End-User (Industrial, Construction, Power Storage and Electricity, Others).

Manganese is an essential trace element and transition metal with diverse industrial applications in 2024. It is widely used in metallurgy, steelmaking, batteries, ceramics, electronics, and agriculture, owing to its unique properties and functionalities. Manganese is primarily employed as an alloying element in the production of steel and cast iron, where it imparts strength, hardness, and wear resistance to the final products. Manganese alloys, such as ferromanganese and silicomanganese, are used in the manufacturing of stainless steel, carbon steel, and specialty steels for construction, automotive, aerospace, and infrastructure applications. In batteries, manganese is utilized in various forms, including manganese dioxide (MnO2) and lithium manganese oxide (LiMn2O4), as cathode materials for alkaline batteries, lithium-ion batteries, and other energy storage devices. Manganese compounds find applications in ceramics as pigments, catalysts, and glazing agents, as well as in electronics as components of electronic circuits, semiconductors, and magnetic materials. In agriculture, manganese is essential for plant growth and development, serving as a micronutrient in fertilizers and soil amendments to prevent manganese deficiency in crops. With its wide-ranging applications and critical role in numerous industrial processes, manganese s to be a valuable commodity in global markets, driving economic growth, innovation, and sustainability initiatives.

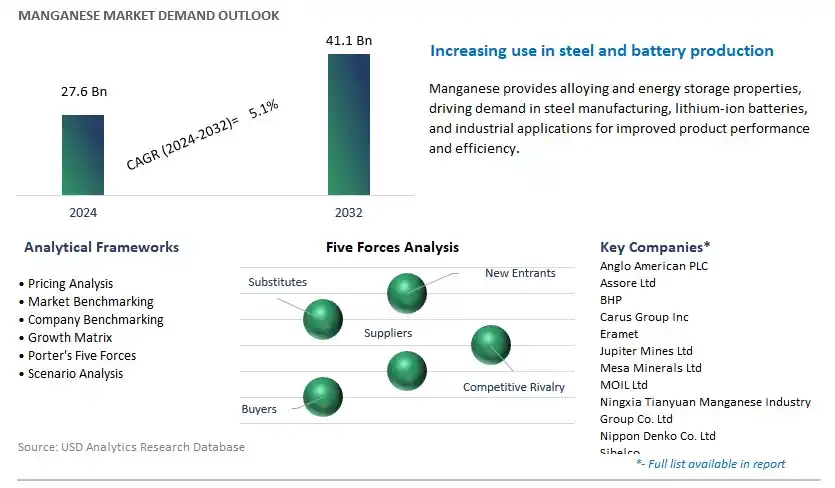

The market report analyses the leading companies in the industry including Anglo American PLC, Assore Ltd, BHP, Carus Group Inc, Eramet, Jupiter Mines Ltd, Mesa Minerals Ltd, MOIL Ltd, Ningxia Tianyuan Manganese Industry Group Co. Ltd, Nippon Denko Co. Ltd, Sibelco, Tata Steel, Vale SA, and others.

A significant trend in the manganese market is the increasing demand for battery materials. Manganese, particularly in the form of electrolytic manganese dioxide (EMD), is a key component in lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics. With the rapid growth of the electric vehicle market and the expansion of renewable energy sources, there is a rising demand for high-quality manganese products to support the production of advanced battery technologies. This trend towards electrification and energy storage solutions drives market growth as manufacturers seek reliable and cost-effective sources of manganese to meet the growing demand for batteries worldwide.

A key driver fueling the manganese market is the growth in steel production and infrastructure development. Manganese is an essential alloying element in steelmaking, imparting strength, hardness, and wear resistance to steel products. As global urbanization and industrialization continue to accelerate, there is a growing demand for steel in construction, automotive manufacturing, infrastructure projects, and machinery production. Manganese, in the form of ferromanganese and silicomanganese alloys, is widely used in steelmaking to improve the mechanical properties and performance of steel products. This driver supports market demand for manganese as steel remains a vital material in various sectors of the economy.

A promising opportunity for the manganese market lies in expansion into renewable energy and clean technologies. Manganese-based materials have potential applications in renewable energy technologies such as solar photovoltaics, wind turbines, and hydrogen fuel cells. For example, manganese compounds can be used as catalysts in water-splitting reactions for hydrogen production or as dopants in semiconductor materials for solar cells. By leveraging its unique properties and chemical versatility, manganese can play a significant role in advancing clean energy technologies and supporting the transition to a low-carbon economy. This opportunity allows manganese producers to diversify their product portfolios, access new growth markets, and contribute to sustainability efforts in the energy sector.

The largest segment within the manganese market is alloys. The large revenue share is primarily due to the extensive use of manganese alloys in various industries, ranging from steel production to manufacturing of aluminum alloys and battery materials. Manganese alloys, such as ferromanganese and silicomanganese, are essential components in the production of steel, where they act as deoxidizers, desulfurizers, and alloying agents, enhancing the strength, hardness, and corrosion resistance of steel products. Moreover, manganese alloys play a crucial role in the production of aluminum alloys, where they improve the strength and corrosion resistance of aluminum-based materials. Additionally, manganese is increasingly utilized in the manufacturing of lithium-ion batteries, particularly in the cathode materials, to enhance battery performance and stability. As industries such as automotive, construction, and electronics continue to expand, the demand for manganese alloys remains strong, solidifying the alloys segment as the largest in the manganese market.

The fastest-growing segment within the manganese market is power storage and electricity. This rapid growth is primarily driven by the increasing adoption of renewable energy sources, such as solar and wind power, and the consequent need for efficient energy storage solutions. Manganese is utilized in the production of lithium-ion batteries, specifically in the cathode materials, where it improves battery performance, stability, and energy density. As the demand for clean energy continues to rise, there is a growing focus on developing grid-scale energy storage systems to address intermittency issues associated with renewable energy generation. Lithium-ion batteries incorporating manganese-based cathodes offer a viable solution for energy storage due to their high energy density, long cycle life, and cost-effectiveness. Moreover, manganese's abundance and relatively low cost compared to other battery materials further contribute to its attractiveness in the energy storage sector. With ongoing advancements in battery technology and increasing investments in renewable energy infrastructure, the demand for manganese in power storage and electricity applications is expected to experience significant growth, positioning this segment as the fastest-growing in the manganese market.

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Anglo American PLC

Assore Ltd

BHP

Carus Group Inc

Eramet

Jupiter Mines Ltd

Mesa Minerals Ltd

MOIL Ltd

Ningxia Tianyuan Manganese Industry Group Co. Ltd

Nippon Denko Co. Ltd

Sibelco

Tata Steel

Vale SA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Manganese Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Manganese Market Size Outlook, $ Million, 2021 to 2032

3.2 Manganese Market Outlook by Type, $ Million, 2021 to 2032

3.3 Manganese Market Outlook by Product, $ Million, 2021 to 2032

3.4 Manganese Market Outlook by Application, $ Million, 2021 to 2032

3.5 Manganese Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Manganese Industry

4.2 Key Market Trends in Manganese Industry

4.3 Potential Opportunities in Manganese Industry

4.4 Key Challenges in Manganese Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Manganese Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Manganese Market Outlook by Segments

7.1 Manganese Market Outlook by Segments, $ Million, 2021- 2032

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

8 North America Manganese Market Analysis and Outlook To 2032

8.1 Introduction to North America Manganese Markets in 2024

8.2 North America Manganese Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Manganese Market size Outlook by Segments, 2021-2032

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

9 Europe Manganese Market Analysis and Outlook To 2032

9.1 Introduction to Europe Manganese Markets in 2024

9.2 Europe Manganese Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Manganese Market Size Outlook by Segments, 2021-2032

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

10 Asia Pacific Manganese Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Manganese Markets in 2024

10.2 Asia Pacific Manganese Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Manganese Market size Outlook by Segments, 2021-2032

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

11 South America Manganese Market Analysis and Outlook To 2032

11.1 Introduction to South America Manganese Markets in 2024

11.2 South America Manganese Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Manganese Market size Outlook by Segments, 2021-2032

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

12 Middle East and Africa Manganese Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Manganese Markets in 2024

12.2 Middle East and Africa Manganese Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Manganese Market size Outlook by Segments, 2021-2032

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Anglo American PLC

Assore Ltd

BHP

Carus Group Inc

Eramet

Jupiter Mines Ltd

Mesa Minerals Ltd

MOIL Ltd

Ningxia Tianyuan Manganese Industry Group Co. Ltd

Nippon Denko Co. Ltd

Sibelco

Tata Steel

Vale SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Alloys

Electrolytic Manganese Dioxide

Electrolytic Manganese Metals

Others

By End-User

Industrial

Construction

Power Storage and Electricity

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Manganese Market Size is valued at $27.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.1% to reach $41.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Anglo American PLC, Assore Ltd, BHP, Carus Group Inc, Eramet, Jupiter Mines Ltd, Mesa Minerals Ltd, MOIL Ltd, Ningxia Tianyuan Manganese Industry Group Co. Ltd, Nippon Denko Co. Ltd, Sibelco, Tata Steel, Vale SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume