The global Magnesium Hydroxide Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Form (Slurry, Powder, Others), By Application (Wastewater Treatment, Flue-Gas Desulphurisation, Flame Retardant, Pharmaceutical, Food Additive, Others).

Magnesium hydroxide, also known as milk of magnesia, is a versatile inorganic compound with various industrial and pharmaceutical applications in 2024. It is obtained through the precipitation of magnesium salts, such as magnesium chloride or magnesium sulfate, with alkali compounds like sodium hydroxide or lime. Magnesium hydroxide is widely used as an antacid to neutralize excess stomach acid and alleviate symptoms of indigestion, heartburn, and acid reflux. In pharmaceutical formulations, it serves as a laxative to relieve constipation and as a component in oral suspensions and topical ointments. Additionally, magnesium hydroxide finds applications in environmental and industrial processes, such as wastewater treatment, flue gas desulfurization, and flame retardancy. In wastewater treatment, it is utilized as a neutralizing agent to adjust pH levels and remove heavy metals from effluents. In flue gas desulfurization, magnesium hydroxide reacts with sulfur dioxide to form magnesium sulfate, reducing emissions of harmful air pollutants. In flame retardant applications, magnesium hydroxide acts as a smoke suppressant and char-forming agent in plastics, cables, textiles, and construction materials. With its diverse range of applications and environmentally friendly properties, magnesium hydroxide s to be a valuable ingredient in various industrial processes, supporting health, safety, and sustainability initiatives.

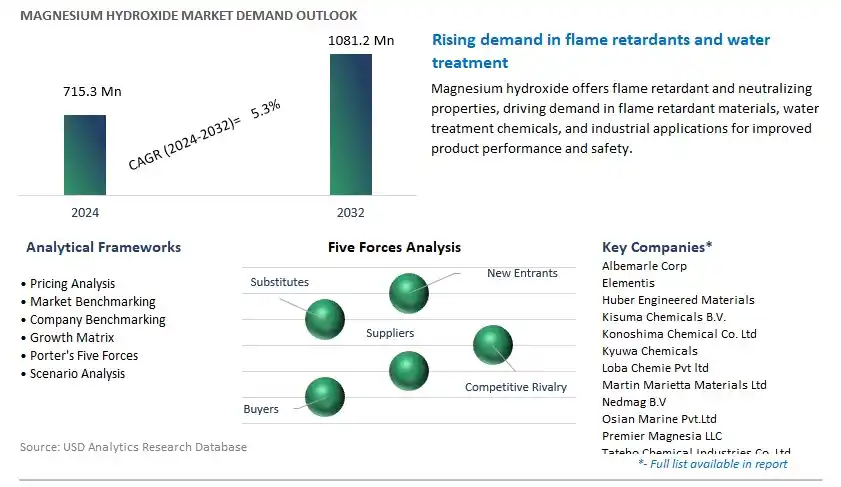

The market report analyses the leading companies in the industry including Albemarle Corp, Elementis, Huber Engineered Materials, Kisuma Chemicals B.V., Konoshima Chemical Co. Ltd, Kyuwa Chemicals, Loba Chemie Pvt ltd, Martin Marietta Materials Ltd, Nedmag B.V, Osian Marine Pvt.Ltd, Premier Magnesia LLC, Tateho Chemical Industries Co. Ltd, Timab Magnesium SAS, Ube Material Industries Ltd, Xinyang Mineral Group, and others.

A significant trend in the magnesium hydroxide market is the increasing demand in environmental remediation. Magnesium hydroxide, with its alkaline properties and ability to neutralize acidic pollutants, is widely used in wastewater treatment, flue gas desulfurization, and soil remediation applications. With growing concerns about water and air pollution, stringent regulations, and the need for sustainable waste management practices, there is a rising demand for magnesium hydroxide as an effective and environmentally-friendly solution for neutralizing acidic waste streams and controlling emissions. This trend towards environmental sustainability drives market growth as industries prioritize compliance with regulatory standards and invest in pollution control technologies.

A key driver fueling the magnesium hydroxide market is the expansion of industrial applications and technological advancements. Magnesium hydroxide finds diverse applications in industries such as flame retardants, pharmaceuticals, cosmetics, and construction materials. Additionally, advancements in manufacturing processes and material science have led to the development of innovative magnesium hydroxide products with improved purity, particle size distribution, and surface modification properties. Industries are increasingly adopting magnesium hydroxide as a safer and more cost-effective alternative to traditional flame retardants and chemical additives, driving market demand and fostering continuous innovation in product development and application technologies.

A promising opportunity for the magnesium hydroxide market lies in adoption in sustainable building materials. Magnesium hydroxide, known for its fire-retardant properties and low toxicity, offers potential applications in eco-friendly construction materials such as MgO boards, insulation panels, and decorative coatings. With growing emphasis on green building practices, energy efficiency, and fire safety regulations, there is a rising demand for building materials that provide superior fire resistance while minimizing environmental impact. By promoting magnesium hydroxide as a sustainable flame retardant additive in construction materials, manufacturers can capitalize on the opportunity to meet market demand for eco-friendly solutions and contribute to the development of sustainable building practices. This opportunity allows magnesium hydroxide suppliers to expand their product portfolios, access new market segments, and drive innovation in the construction industry.

The largest segment within the magnesium hydroxide market is powder. The large revenue share is primarily due to the versatility and ease of handling offered by powdered magnesium hydroxide. Powdered magnesium hydroxide is widely utilized across various industries for applications such as flame retardants, wastewater treatment, pharmaceuticals, and environmental remediation. In flame retardant applications, magnesium hydroxide powder acts as an effective and environmentally friendly additive, inhibiting the spread of fire by releasing water vapor and absorbing heat during combustion. Additionally, powdered magnesium hydroxide is commonly used as a neutralizing agent in wastewater treatment processes to control pH levels and remove heavy metals. Its fine particle size and dispersibility make it suitable for incorporation into pharmaceutical formulations for antacid medications and oral hygiene products. As industries prioritize safety, sustainability, and regulatory compliance, the demand for powdered magnesium hydroxide is expected to continue growing, solidifying its position as the largest segment in the magnesium hydroxide market.

The fastest-growing segment within the magnesium hydroxide market is flame retardant. This rapid growth is primarily driven by stringent regulations and increasing awareness regarding fire safety across various industries. Magnesium hydroxide acts as an efficient flame retardant by releasing water vapor and absorbing heat when exposed to fire, thereby suppressing the combustion process and preventing the spread of flames. As concerns about fire hazards continue to escalate, particularly in sectors such as construction, automotive, and electronics, there is a growing demand for safer and more environmentally friendly flame-retardant solutions. Magnesium hydroxide offers a non-toxic and halogen-free alternative to traditional flame retardants, making it increasingly favored by manufacturers seeking to meet stringent safety standards and regulatory requirements. Moreover, the versatility of magnesium hydroxide allows it to be incorporated into a wide range of materials, including plastics, textiles, and coatings, further expanding its application scope in flame retardant formulations. As industries prioritize fire safety and sustainability, the demand for magnesium hydroxide as a flame retardant is expected to experience continued growth, solidifying its position as the fastest-growing segment in the magnesium hydroxide market.

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Albemarle Corp

Elementis

Huber Engineered Materials

Kisuma Chemicals B.V.

Konoshima Chemical Co. Ltd

Kyuwa Chemicals

Loba Chemie Pvt ltd

Martin Marietta Materials Ltd

Nedmag B.V

Osian Marine Pvt.Ltd

Premier Magnesia LLC

Tateho Chemical Industries Co. Ltd

Timab Magnesium SAS

Ube Material Industries Ltd

Xinyang Mineral Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Magnesium Hydroxide Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Magnesium Hydroxide Market Size Outlook, $ Million, 2021 to 2032

3.2 Magnesium Hydroxide Market Outlook by Type, $ Million, 2021 to 2032

3.3 Magnesium Hydroxide Market Outlook by Product, $ Million, 2021 to 2032

3.4 Magnesium Hydroxide Market Outlook by Application, $ Million, 2021 to 2032

3.5 Magnesium Hydroxide Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Magnesium Hydroxide Industry

4.2 Key Market Trends in Magnesium Hydroxide Industry

4.3 Potential Opportunities in Magnesium Hydroxide Industry

4.4 Key Challenges in Magnesium Hydroxide Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Magnesium Hydroxide Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Magnesium Hydroxide Market Outlook by Segments

7.1 Magnesium Hydroxide Market Outlook by Segments, $ Million, 2021- 2032

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

8 North America Magnesium Hydroxide Market Analysis and Outlook To 2032

8.1 Introduction to North America Magnesium Hydroxide Markets in 2024

8.2 North America Magnesium Hydroxide Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Magnesium Hydroxide Market size Outlook by Segments, 2021-2032

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

9 Europe Magnesium Hydroxide Market Analysis and Outlook To 2032

9.1 Introduction to Europe Magnesium Hydroxide Markets in 2024

9.2 Europe Magnesium Hydroxide Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Magnesium Hydroxide Market Size Outlook by Segments, 2021-2032

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

10 Asia Pacific Magnesium Hydroxide Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Magnesium Hydroxide Markets in 2024

10.2 Asia Pacific Magnesium Hydroxide Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Magnesium Hydroxide Market size Outlook by Segments, 2021-2032

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

11 South America Magnesium Hydroxide Market Analysis and Outlook To 2032

11.1 Introduction to South America Magnesium Hydroxide Markets in 2024

11.2 South America Magnesium Hydroxide Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Magnesium Hydroxide Market size Outlook by Segments, 2021-2032

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

12 Middle East and Africa Magnesium Hydroxide Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Magnesium Hydroxide Markets in 2024

12.2 Middle East and Africa Magnesium Hydroxide Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Magnesium Hydroxide Market size Outlook by Segments, 2021-2032

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Albemarle Corp

Elementis

Huber Engineered Materials

Kisuma Chemicals B.V.

Konoshima Chemical Co. Ltd

Kyuwa Chemicals

Loba Chemie Pvt ltd

Martin Marietta Materials Ltd

Nedmag B.V

Osian Marine Pvt.Ltd

Premier Magnesia LLC

Tateho Chemical Industries Co. Ltd

Timab Magnesium SAS

Ube Material Industries Ltd

Xinyang Mineral Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Form

Slurry

Powder

Others

By Application

Wastewater Treatment

Flue-Gas Desulphurisation

Flame Retardant

Pharmaceutical

Food Additive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Magnesium Hydroxide Market Size is valued at $715.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $1081.2 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Albemarle Corp, Elementis, Huber Engineered Materials, Kisuma Chemicals B.V., Konoshima Chemical Co. Ltd, Kyuwa Chemicals, Loba Chemie Pvt ltd, Martin Marietta Materials Ltd, Nedmag B.V, Osian Marine Pvt.Ltd, Premier Magnesia LLC, Tateho Chemical Industries Co. Ltd, Timab Magnesium SAS, Ube Material Industries Ltd, Xinyang Mineral Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume