The global Magnesium Compounds Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Source (Seawater, Natural Brines, Others), By Product (Inorganic Chemicals, Organic Chemicals), By End-User (Agriculture, Electronics, Automotive, Aerospace, Construction, Refractory, Others).

Magnesium compounds encompass a diverse range of chemical compounds derived from magnesium, a versatile metal with numerous industrial applications in 2024. These compounds are utilized in various industries, including pharmaceuticals, agriculture, construction, automotive, and aerospace, owing to their unique properties and functionalities. Magnesium oxide (MgO), for example, is commonly used as a refractory material in the production of high-temperature insulation, fireproofing, and cement additives. Magnesium sulfate (MgSO4) finds applications in agriculture as a fertilizer and soil conditioner, as well as in pharmaceuticals and healthcare as an electrolyte replenisher and laxative. Magnesium chloride (MgCl2) is utilized in deicing agents, dust suppressants, and as a coagulant in water treatment processes. Magnesium hydroxide (Mg(OH)2) is employed as a flame retardant in plastics, cable insulation, and building materials, as well as an antacid in pharmaceuticals. With ongoing research and development efforts focused on harnessing the unique properties of magnesium compounds, their applications are expected to expanding across diverse industrial sectors, driving innovation and sustainability.

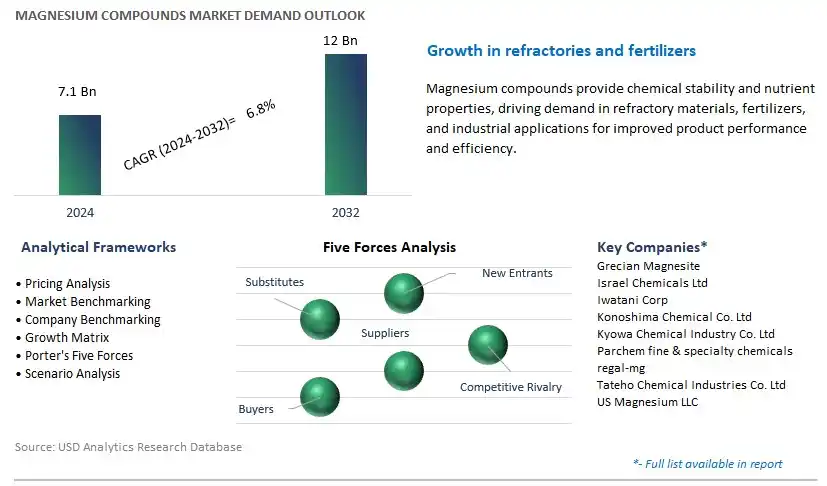

The market report analyses the leading companies in the industry including Grecian Magnesite, Israel Chemicals Ltd, Iwatani Corp, Konoshima Chemical Co. Ltd, Kyowa Chemical Industry Co. Ltd, Parchem fine & specialty chemicals, regal-mg, Tateho Chemical Industries Co. Ltd, US Magnesium LLC, and others.

A significant trend in the magnesium compounds market is the growing demand in healthcare and pharmaceutical industries. Magnesium compounds, such as magnesium oxide, magnesium sulfate, and magnesium hydroxide, are utilized in various medical applications including antacids, laxatives, dietary supplements, and medications for treating magnesium deficiency. With increasing awareness of the health benefits of magnesium and its role in maintaining cardiovascular health, muscle function, and nerve function, there is a rising demand for magnesium compounds in the healthcare sector. This trend towards preventive healthcare and wellness drives market growth as consumers seek magnesium-based products to support overall health and well-being.

A key driver fueling the magnesium compounds market is the expansion of industrial applications and technological advancements. Magnesium compounds find widespread use in industries such as agriculture, construction, water treatment, and metallurgy as additives, fertilizers, flame retardants, and corrosion inhibitors. Additionally, advancements in manufacturing processes and material science are enabling the development of innovative magnesium-based materials and formulations with enhanced properties and performance characteristics. Industries are increasingly adopting magnesium compounds to improve product quality, efficiency, and sustainability, driving market demand and fostering continuous innovation in the field.

A promising opportunity for the magnesium compounds market lies in the development of sustainable and eco-friendly products. As environmental concerns and regulatory requirements for chemical safety and sustainability continue to increase, there is growing demand for green alternatives to traditional chemical compounds. Magnesium compounds, known for their low toxicity, biodegradability, and abundance in nature, offer potential solutions for developing eco-friendly products in various sectors. By investing in research and development of eco-friendly formulations, manufacturers can capitalize on the opportunity to meet market demand for sustainable solutions while reducing environmental impact. This opportunity allows magnesium compound suppliers to differentiate their products, gain competitive advantage, and contribute to the transition towards a greener and more sustainable future.

The largest segment within the magnesium compounds market is seawater. The large revenue share is primarily due to the abundance of magnesium in seawater, making it a readily accessible and cost-effective source of magnesium compounds. Seawater contains dissolved magnesium ions, which can be extracted through various processes to produce a range of magnesium compounds, including magnesium hydroxide, magnesium chloride, and magnesium sulfate. These compounds find widespread applications in industries such as agriculture, pharmaceuticals, construction, and environmental remediation. Additionally, the use of seawater as a source of magnesium compounds aligns with sustainability goals, as it minimizes the need for intensive mining operations and reduces environmental impact. With increasing demand for magnesium compounds across diverse industries and growing emphasis on sustainable sourcing practices, the seawater segment is expected to maintain its position as the largest segment in the magnesium compounds market.

The fastest-growing segment within the magnesium compounds market is inorganic chemicals. This rapid growth can be attributed to the diverse range of applications and increasing demand for inorganic magnesium compounds across various industries. Inorganic magnesium compounds, such as magnesium oxide, magnesium hydroxide, and magnesium chloride, are extensively used in sectors including agriculture, construction, pharmaceuticals, and environmental remediation. Magnesium oxide, for example, serves as a refractory material in the steel industry, a pH regulator in wastewater treatment, and a supplement in animal feed. Magnesium hydroxide finds applications as a flame retardant in plastics and rubber, an antacid in pharmaceuticals, and a neutralizer in acid mine drainage. The versatility and functionality of inorganic magnesium compounds make them indispensable in numerous industrial processes and products. Moreover, the growing emphasis on environmental sustainability and regulatory requirements regarding hazardous chemicals drive the demand for eco-friendly alternatives, further boosting the growth of inorganic magnesium compounds in the market. As industries continue to seek efficient and environmentally responsible solutions, the demand for inorganic magnesium compounds is expected to continue expanding, solidifying its position as the fastest-growing segment in the magnesium compounds market.

The largest segment within the magnesium compounds market is construction. The large revenue share is primarily due to the widespread use of magnesium compounds in various construction applications, ranging from building materials to infrastructure projects. Magnesium compounds, such as magnesium oxide, magnesium hydroxide, and magnesium chloride, are integral components of construction materials due to their fire resistance, thermal stability, and binding properties. In the construction industry, magnesium oxide is commonly used as a binder in the production of magnesium oxide boards, insulation materials, and cementitious products. Magnesium hydroxide finds applications as a flame retardant in construction materials such as insulation foams, plastics, and coatings. Additionally, magnesium chloride is utilized as a dust suppressant for roads, soil stabilizer for construction sites, and additive for concrete admixtures. As the construction sector experiences growth driven by urbanization, infrastructure development, and sustainable building practices, the demand for magnesium compounds in construction applications is expected to remain robust, solidifying construction as the largest segment in the magnesium compounds market.

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Grecian Magnesite

Israel Chemicals Ltd

Iwatani Corp

Konoshima Chemical Co. Ltd

Kyowa Chemical Industry Co. Ltd

Parchem fine & specialty chemicals

regal-mg

Tateho Chemical Industries Co. Ltd

US Magnesium LLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Magnesium Compounds Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Magnesium Compounds Market Size Outlook, $ Million, 2021 to 2032

3.2 Magnesium Compounds Market Outlook by Type, $ Million, 2021 to 2032

3.3 Magnesium Compounds Market Outlook by Product, $ Million, 2021 to 2032

3.4 Magnesium Compounds Market Outlook by Application, $ Million, 2021 to 2032

3.5 Magnesium Compounds Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Magnesium Compounds Industry

4.2 Key Market Trends in Magnesium Compounds Industry

4.3 Potential Opportunities in Magnesium Compounds Industry

4.4 Key Challenges in Magnesium Compounds Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Magnesium Compounds Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Magnesium Compounds Market Outlook by Segments

7.1 Magnesium Compounds Market Outlook by Segments, $ Million, 2021- 2032

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

8 North America Magnesium Compounds Market Analysis and Outlook To 2032

8.1 Introduction to North America Magnesium Compounds Markets in 2024

8.2 North America Magnesium Compounds Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Magnesium Compounds Market size Outlook by Segments, 2021-2032

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

9 Europe Magnesium Compounds Market Analysis and Outlook To 2032

9.1 Introduction to Europe Magnesium Compounds Markets in 2024

9.2 Europe Magnesium Compounds Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Magnesium Compounds Market Size Outlook by Segments, 2021-2032

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

10 Asia Pacific Magnesium Compounds Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Magnesium Compounds Markets in 2024

10.2 Asia Pacific Magnesium Compounds Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Magnesium Compounds Market size Outlook by Segments, 2021-2032

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

11 South America Magnesium Compounds Market Analysis and Outlook To 2032

11.1 Introduction to South America Magnesium Compounds Markets in 2024

11.2 South America Magnesium Compounds Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Magnesium Compounds Market size Outlook by Segments, 2021-2032

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

12 Middle East and Africa Magnesium Compounds Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Magnesium Compounds Markets in 2024

12.2 Middle East and Africa Magnesium Compounds Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Magnesium Compounds Market size Outlook by Segments, 2021-2032

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Grecian Magnesite

Israel Chemicals Ltd

Iwatani Corp

Konoshima Chemical Co. Ltd

Kyowa Chemical Industry Co. Ltd

Parchem fine & specialty chemicals

regal-mg

Tateho Chemical Industries Co. Ltd

US Magnesium LLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Source

Seawater

Natural Brines

Others

By Product

Inorganic Chemicals

Organic Chemicals

By End-User

Agriculture

Electronics

Automotive

Aerospace

Construction

Refractory

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Magnesium Compounds Market Size is valued at $7.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.8% to reach $12 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Grecian Magnesite, Israel Chemicals Ltd, Iwatani Corp, Konoshima Chemical Co. Ltd, Kyowa Chemical Industry Co. Ltd, Parchem fine & specialty chemicals, regal-mg, Tateho Chemical Industries Co. Ltd, US Magnesium LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume