The global Lower Extremity Implants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Knee, Hip, Foot & Ankle), By Biomaterial (Metallic Biomaterials, Ceramic Biomaterials, Polymeric Biomaterials, Natural Biomaterials), By End-User (Hospitals, ASCs, Clinics).

The lower extremity implants market is experiencing substantial growth, fueled by the increasing prevalence of orthopedic conditions and advancements in surgical technologies. Lower extremity implants, including hip and knee replacements, ankle implants, and femoral head implants, are critical for treating degenerative joint diseases, traumatic injuries, and congenital deformities affecting the lower limbs. The market's expansion is driven by factors such as the aging global population, rising obesity rates, and the growing demand for minimally invasive surgical techniques. Innovations in implant materials, such as the development of advanced biomaterials and 3D-printed implants, are enhancing the durability, functionality, and customization of lower extremity implants, leading to improved patient outcomes and reduced recovery times. Additionally, increasing investments in research and development, along with the expansion of healthcare infrastructure and access to orthopedic care, are supporting market growth. The trend towards personalized medicine and patient-specific implants is further propelling the market, as more tailored solutions become available. As the field of orthopedic surgery continues to evolve, the lower extremity implants market is set to grow, reflecting broader trends in advanced surgical techniques and the increasing need for effective solutions to improve mobility and quality of life for patients.

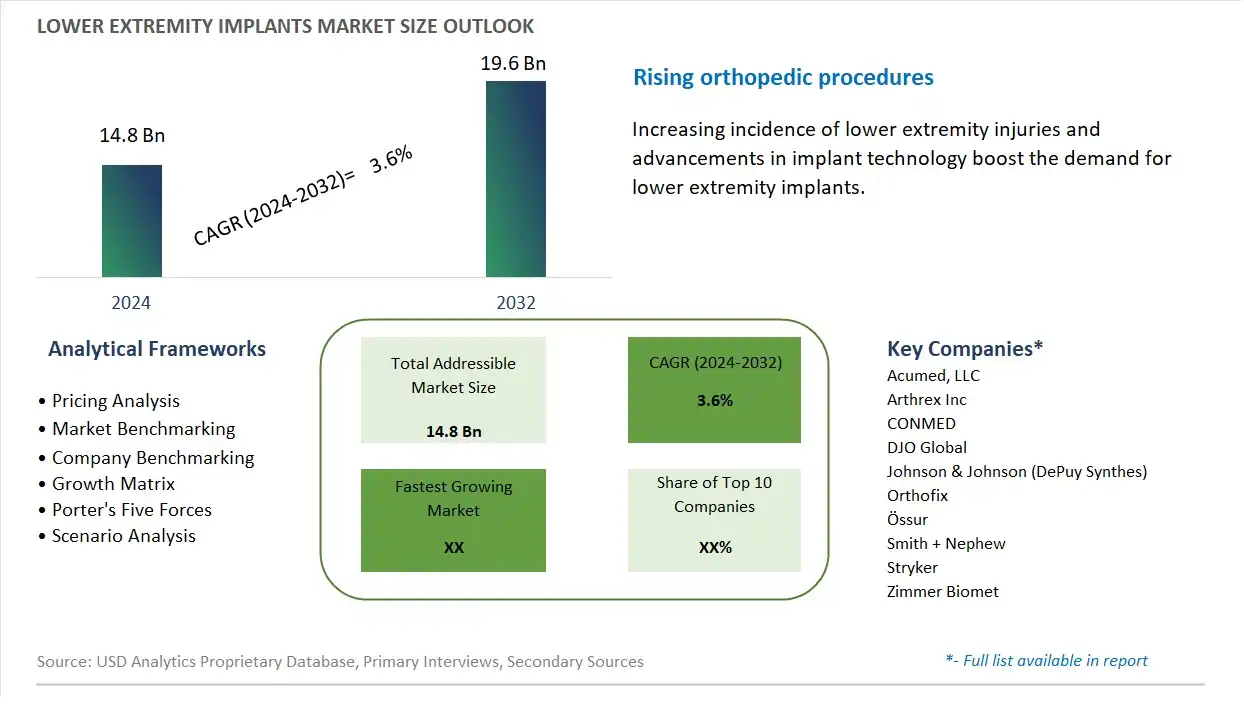

The market report analyses the leading companies in the industry including Acumed, LLC, Arthrex Inc, CONMED, DJO Global, Johnson & Johnson (DePuy Synthes), Orthofix, Össur, Smith + Nephew, Stryker, Zimmer Biomet, and others.

The Lower Extremity Implants Market is experiencing a prominent trend towards advancements in customizable and patient-specific implants. Technological innovations in 3D printing and imaging have enabled the development of implants tailored to individual anatomical and functional needs. This trend reflects a growing demand for personalized medical solutions that enhance surgical outcomes and patient comfort. Customizable implants are designed to provide a better fit, improve biomechanical function, and reduce the likelihood of complications, aligning with the broader movement towards personalized medicine and advanced orthopedic solutions.

The increasing incidence of lower extremity injuries and osteoarthritis is a significant driver for the Lower Extremity Implants Market. Factors such as an aging population, higher rates of sports-related injuries, and the prevalence of degenerative joint diseases contribute to a rising demand for surgical interventions involving lower extremity implants. These implants, which include hip, knee, and ankle replacements, are crucial for restoring mobility and function in patients with severe joint damage or injury. The growing prevalence of these conditions drives the need for effective and innovative implant solutions.

A notable opportunity for the Lower Extremity Implants Market lies in expansion into emerging markets and the development of enhanced implant materials. Emerging economies with growing healthcare infrastructure present new opportunities for market growth as access to advanced orthopedic treatments increases. Additionally, research into advanced materials such as biomaterials, smart materials, and biocompatible coatings can improve implant performance, longevity, and patient outcomes. By focusing on these opportunities, companies can tap into new markets, address unmet needs, and drive innovation in lower extremity implant technology.

In the Lower Extremity Implants Market, the Metallic Biomaterials segment is the largest. This is largely due to their established history of use and effectiveness in orthopedic implants. Metallic biomaterials, such as titanium and stainless steel, offer superior strength, durability, and biocompatibility compared to other types of biomaterials. They are well-suited for load-bearing applications, which is critical for lower extremity implants that need to withstand significant mechanical stress. Additionally, the ability of metals to be precisely engineered and manufactured to fit various implant designs further solidifies their dominance in the market. Their proven performance and the ongoing advancements in metal-based implant technologies continue to drive their leading position in the lower extremity implants sector.

In the Lower Extremity Implants Market, the Foot & Ankle segment is the fastest growing over the forecast period to 2032. This growth is driven by the increasing incidence of foot and ankle disorders, such as arthritis and sports-related injuries, which require surgical intervention. Advances in implant technology and surgical techniques specifically designed for the foot and ankle are also contributing to this growth. Additionally, the rise in the aging population and an increased focus on improving mobility and quality of life have heightened the demand for foot and ankle implants. Innovations such as minimally invasive procedures and custom-fit implants are further accelerating the segment's expansion.

In the Lower Extremity Implants Market, Hospitals represent the largest segment. This is primarily due to the comprehensive range of surgical procedures and advanced medical technologies available in hospital settings. Hospitals are equipped with specialized facilities and multidisciplinary teams that handle complex cases requiring lower extremity implants, such as joint replacements and trauma surgeries. Additionally, hospitals typically have higher patient volumes compared to Ambulatory Surgery Centers (ASCs) and clinics, contributing to their dominance in the market. The integration of advanced imaging technologies and post-operative care services in hospitals further supports their leading position in this segment.

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Acumed, LLC

Arthrex Inc

CONMED

DJO Global

Johnson & Johnson (DePuy Synthes)

Orthofix

Össur

Smith + Nephew

Stryker

Zimmer Biomet

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Lower Extremity Implants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Lower Extremity Implants Market Size Outlook, $ Million, 2021 to 2032

3.2 Lower Extremity Implants Market Outlook by Type, $ Million, 2021 to 2032

3.3 Lower Extremity Implants Market Outlook by Product, $ Million, 2021 to 2032

3.4 Lower Extremity Implants Market Outlook by Application, $ Million, 2021 to 2032

3.5 Lower Extremity Implants Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Lower Extremity Implants Industry

4.2 Key Market Trends in Lower Extremity Implants Industry

4.3 Potential Opportunities in Lower Extremity Implants Industry

4.4 Key Challenges in Lower Extremity Implants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Lower Extremity Implants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Lower Extremity Implants Market Outlook by Segments

7.1 Lower Extremity Implants Market Outlook by Segments, $ Million, 2021- 2032

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

8 North America Lower Extremity Implants Market Analysis and Outlook To 2032

8.1 Introduction to North America Lower Extremity Implants Markets in 2024

8.2 North America Lower Extremity Implants Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Lower Extremity Implants Market size Outlook by Segments, 2021-2032

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

9 Europe Lower Extremity Implants Market Analysis and Outlook To 2032

9.1 Introduction to Europe Lower Extremity Implants Markets in 2024

9.2 Europe Lower Extremity Implants Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Lower Extremity Implants Market Size Outlook by Segments, 2021-2032

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

10 Asia Pacific Lower Extremity Implants Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Lower Extremity Implants Markets in 2024

10.2 Asia Pacific Lower Extremity Implants Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Lower Extremity Implants Market size Outlook by Segments, 2021-2032

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

11 South America Lower Extremity Implants Market Analysis and Outlook To 2032

11.1 Introduction to South America Lower Extremity Implants Markets in 2024

11.2 South America Lower Extremity Implants Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Lower Extremity Implants Market size Outlook by Segments, 2021-2032

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

12 Middle East and Africa Lower Extremity Implants Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Lower Extremity Implants Markets in 2024

12.2 Middle East and Africa Lower Extremity Implants Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Lower Extremity Implants Market size Outlook by Segments, 2021-2032

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Acumed, LLC

Arthrex Inc

CONMED

DJO Global

Johnson & Johnson (DePuy Synthes)

Orthofix

Össur

Smith + Nephew

Stryker

Zimmer Biomet

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Knee

Hip

Foot & Ankle

By Biomaterial

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

By End-User

Hospitals

ASCs

Clinics

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Lower Extremity Implants Market Size is valued at $14.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.6% to reach $19.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Acumed, LLC, Arthrex Inc, CONMED, DJO Global, Johnson & Johnson (DePuy Synthes), Orthofix, Össur, Smith + Nephew, Stryker, Zimmer Biomet

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume