The global Low Foam Surfactants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Amphoteric, Cationic, Non-ionic), By End-User (Agrochemicals, Food and Dairy Process Cleaners, Detergents and Cleaning Agents, Pulp and Paper, Metal Cleaning and Metal Working Fluids, Oilfield Chemicals, Others).

In 2025, the market for low foam surfactants is witnessing significant growth, driven by their increasing demand in industrial cleaning, personal care, agrochemicals, and oilfield applications where foam control is critical. Low foam surfactants are specialty chemicals designed to reduce foam formation and stabilize foam in aqueous solutions, enhancing the efficiency of cleaning processes, pesticide formulations, and oil recovery operations. These surfactants offer advantages such as excellent wetting, dispersing, and emulsifying properties while minimizing foam production and stability. They are used in various industries for applications such as industrial cleaning, textile processing, agricultural formulations, and enhanced oil recovery (EOR) processes. Manufacturers are innovating to develop low foam surfactant formulations with tailored properties such as surface activity, solubility, and foam suppression to meet the specific requirements of end-users and address challenges encountered in different applications. Additionally, advancements in surfactant chemistry, formulation techniques, and process optimization are enabling the production of environmentally friendly and cost-effective low foam surfactants. As industries seek to improve process efficiency, reduce environmental impact, and ensure product quality, the demand for high-performance low foam surfactants is expected to growing, driving market expansion and fostering innovation in specialty chemicals and surfactant technology.

The market report analyses the leading companies in the industry including AkzoNobel N.V., BASF SE, Clariant AG, Croda International plc, Dow Inc, Evonik Industries AG, Huntsman International LLC, KAO Corp, Nufarm, Oxiteno SA, Solvay SA, Stepan Company, and others.

A prominent trend in the low foam surfactants market is the increased demand for environmentally friendly formulations. With growing awareness of environmental sustainability and regulatory pressures to reduce pollution, there is a rising preference for surfactants that produce minimal foam and have low environmental impact. Low foam surfactants are increasingly sought after in various industries such as cleaning, personal care, and industrial processes, where excessive foam can interfere with operations, waste resources, and harm the environment. This trend is driven by consumer preferences for eco-friendly products, corporate sustainability initiatives, and regulatory mandates to limit the use of harmful chemicals. Manufacturers are responding by developing innovative low foam surfactant formulations that offer effective performance while meeting stringent environmental standards, creating opportunities for growth in the market.

A significant driver propelling the low foam surfactants market is stringent regulatory standards and compliance requirements. Government regulations and industry standards mandate the use of surfactants with low foam characteristics in applications where foam control is critical, such as in industrial cleaning, food processing, and wastewater treatment. Regulatory bodies impose limits on the discharge of foam-forming substances into the environment to protect water quality, aquatic ecosystems, and public health. Compliance with these regulations drives the adoption of low foam surfactants by manufacturers seeking to meet regulatory requirements, avoid fines, and maintain a positive corporate image. Additionally, the implementation of eco-labeling schemes and green certifications further incentivizes the use of low foam surfactants, creating a competitive advantage for companies that offer environmentally friendly solutions.

An opportunity for the low foam surfactants market lies in expansion into specialized industries and niche applications. While low foam surfactants have traditionally been used in mainstream industries such as household cleaning and personal care, there are emerging opportunities in specialized sectors where foam control is critical. Industries such as food and beverage processing, pharmaceutical manufacturing, and agrochemicals require surfactants with specific performance characteristics tailored to their unique processing requirements. By developing low foam surfactant formulations optimized for specialized applications, manufacturers can address unmet needs, penetrate niche markets, and capture market share in high-value segments. Furthermore, the customization of low foam surfactants for niche applications offers opportunities for differentiation, premium pricing, and long-term partnerships with customers seeking tailored solutions for their specific foam control challenges.

Non-ionic low foam surfactants represent the largest segment in the low foam surfactants market. These surfactants do not ionize in water or aqueous solutions, which makes them highly effective in reducing surface tension without forming a lot of foam. Their widespread use is attributed to their versatility and effectiveness in various applications, including detergents, industrial cleaning agents, and personal care products. Non-ionic surfactants are known for their excellent compatibility with other types of surfactants and their ability to function well in both hard and soft water. Additionally, they are often preferred for their mildness and biodegradability, making them suitable for environmentally friendly formulations. The growth in industries such as textiles, food and beverages, and pharmaceuticals also drives the demand for non-ionic low foam surfactants, as these industries require cleaning agents that perform efficiently without excessive foaming.

The food and dairy process cleaners segment is the fastest-growing segment in the low foam surfactants market. This rapid growth is driven by the increasing global demand for processed and packaged food products, which necessitates stringent hygiene and cleanliness standards in food and dairy processing facilities. Low foam surfactants are crucial in this industry because they effectively remove fats, oils, proteins, and other residues from equipment and surfaces without leaving foam residues that could contaminate the products or hinder the cleaning process. The shift towards more automated cleaning systems, such as Clean-in-Place (CIP) systems, further boosts the demand for low foam surfactants, as these systems require surfactants that can clean efficiently without producing excessive foam. Additionally, the regulatory landscape increasingly emphasizes food safety and sanitation, prompting manufacturers to adopt high-performance, low-foaming cleaning agents that comply with safety standards and help maintain product quality. This trend is expected to continue, supported by the expanding global food and dairy industry and the rising awareness of food safety among consumers.

|

Parameter |

Details |

|

Market Size (2024) |

$18.5 Billion |

|

Market Size (2034) |

$32.5 Billion |

|

Market Growth Rate |

5.8% |

|

Segments |

By Type (Amphoteric, Cationic, Non-ionic), By End-User (Agrochemicals, Food and Dairy Process Cleaners, Detergents and Cleaning Agents, Pulp and Paper, Metal Cleaning and Metal Working Fluids, Oilfield Chemicals, Others) |

|

Study Period |

2019- 2024 and 2025-2034 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

AkzoNobel N.V., BASF SE, Clariant AG, Croda International plc, Dow Inc, Evonik Industries AG, Huntsman International LLC, KAO Corp, Nufarm, Oxiteno SA, Solvay SA, Stepan Company, and Others. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AkzoNobel N.V.

BASF SE

Clariant AG

Croda International plc

Dow Inc

Evonik Industries AG

Huntsman International LLC

KAO Corp

Nufarm

Oxiteno SA

Solvay SA

Stepan Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Low Foam Surfactants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Low Foam Surfactants Market Size Outlook, $ Million, 2021 to 2032

3.2 Low Foam Surfactants Market Outlook by Type, $ Million, 2021 to 2032

3.3 Low Foam Surfactants Market Outlook by Product, $ Million, 2021 to 2032

3.4 Low Foam Surfactants Market Outlook by Application, $ Million, 2021 to 2032

3.5 Low Foam Surfactants Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Low Foam Surfactants Industry

4.2 Key Market Trends in Low Foam Surfactants Industry

4.3 Potential Opportunities in Low Foam Surfactants Industry

4.4 Key Challenges in Low Foam Surfactants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Low Foam Surfactants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Low Foam Surfactants Market Outlook by Segments

7.1 Low Foam Surfactants Market Outlook by Segments, $ Million, 2021- 2032

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

8 North America Low Foam Surfactants Market Analysis and Outlook To 2032

8.1 Introduction to North America Low Foam Surfactants Markets in 2024

8.2 North America Low Foam Surfactants Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Low Foam Surfactants Market size Outlook by Segments, 2021-2032

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

9 Europe Low Foam Surfactants Market Analysis and Outlook To 2032

9.1 Introduction to Europe Low Foam Surfactants Markets in 2024

9.2 Europe Low Foam Surfactants Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Low Foam Surfactants Market Size Outlook by Segments, 2021-2032

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

10 Asia Pacific Low Foam Surfactants Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Low Foam Surfactants Markets in 2024

10.2 Asia Pacific Low Foam Surfactants Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Low Foam Surfactants Market size Outlook by Segments, 2021-2032

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

11 South America Low Foam Surfactants Market Analysis and Outlook To 2032

11.1 Introduction to South America Low Foam Surfactants Markets in 2024

11.2 South America Low Foam Surfactants Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Low Foam Surfactants Market size Outlook by Segments, 2021-2032

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

12 Middle East and Africa Low Foam Surfactants Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Low Foam Surfactants Markets in 2024

12.2 Middle East and Africa Low Foam Surfactants Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Low Foam Surfactants Market size Outlook by Segments, 2021-2032

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AkzoNobel N.V.

BASF SE

Clariant AG

Croda International plc

Dow Inc

Evonik Industries AG

Huntsman International LLC

KAO Corp

Nufarm

Oxiteno SA

Solvay SA

Stepan Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Amphoteric

Cationic

Non-ionic

By End-User

Agrochemicals

Food and Dairy Process Cleaners

Detergents and Cleaning Agents

Pulp and Paper

Metal Cleaning and Metal Working Fluids

Oilfield Chemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

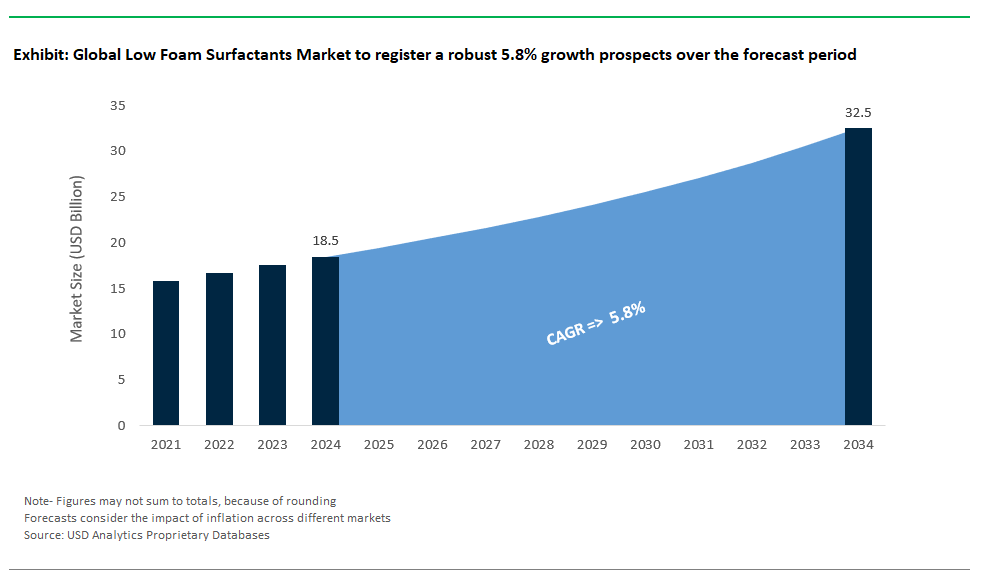

Global Low Foam Surfactants Market Size is valued at $18.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.8% to reach $32.5 Billion by 2034.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AkzoNobel N.V., BASF SE, Clariant AG, Croda International plc, Dow Inc, Evonik Industries AG, Huntsman International LLC, KAO Corp, Nufarm, Oxiteno SA, Solvay SA, Stepan Company

Base Year- 2024; Estimated Year- 2025; Historic Period- 2019-2024; Forecast period- 2025 to 2034; Currency: Revenue (USD); Volume