The global Low Alcohol Beverages Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Low alcohol beer, Low alcohol wine, Low alcohol RTD, Low alcohol cider, Low alcohol spirits), By Distribution Channel (Off-trade, On-trade)

In 2024, the market for low alcohol beverages reflects a shift in consumer preferences towards moderation, wellness, and mindful drinking. Low alcohol beverages, also known as low ABV (alcohol by volume) or non-alcoholic alternatives, offer the sensory experience of traditional alcoholic drinks with reduced alcohol content, catering to individuals seeking to limit their alcohol intake for health, social, or personal reasons. This market segment encompasses a wide range of products, including low-alcohol beer, wine, spirits, and ready-to-drink cocktails, as well as alcohol-free options such as mocktails, zero-proof spirits, and alcohol-free beer. With the rise of sober curious and wellness-conscious lifestyles, low alcohol beverages are gaining popularity as alternatives to traditional alcoholic drinks, appealing to a broad demographic of consumers. Moreover, the market is witnessing innovation in flavor profiles, packaging formats, and marketing strategies to meet the diverse needs and preferences of this growing consumer segment. In 2024, the low alcohol beverages market is poised for continued growth as consumers embrace a more balanced approach to drinking and seek out innovative, flavorful alternatives to traditional alcoholic beverages.

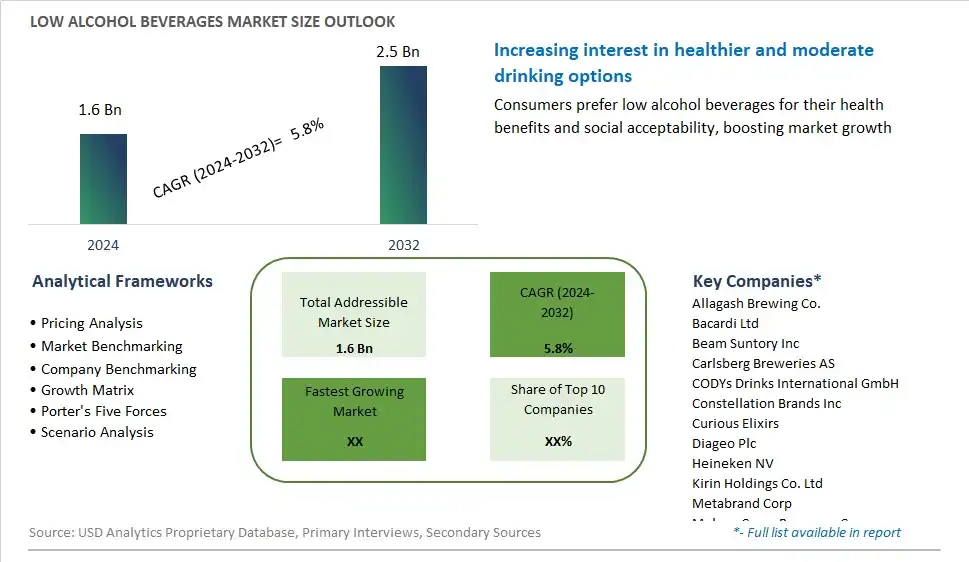

The market report analyses the leading companies in the industry including Allagash Brewing Co., Bacardi Ltd, Beam Suntory Inc, Carlsberg Breweries AS, CODYs Drinks International GmbH, Constellation Brands Inc, Curious Elixirs, Diageo Plc, Heineken NV, Kirin Holdings Co. Ltd, Metabrand Corp, Molson Coors Beverage Co., New Belgium Brewing Co. Inc, Olvi Plc, Royal Unibrew AS, Sapporo Holdings Ltd, The Boston Beer Co. Inc, and Others.

The market for low alcohol beverages is witnessing a prominent trend towards the rising demand for health-conscious choices, driven by factors such as increasing awareness of the health risks associated with excessive alcohol consumption, changing consumer lifestyles focused on wellness, and the desire for lighter and more refreshing drink options. As consumers seek to moderate their alcohol intake without sacrificing taste or social enjoyment, there is a heightened demand for low alcohol beverages known for their reduced alcohol content, fewer calories, and lighter drinking experience. This trend is fueled by the rise of mindful drinking movements, wellness-oriented lifestyles, and endorsements from health professionals advocating for moderation, driving market growth and adoption among consumers seeking balanced and responsible drinking alternatives.

A significant driver behind the market for low alcohol beverages is the shift in consumer preferences and drinking habits, driven by factors such as changing attitudes towards alcohol, generational shifts, and cultural influences shaping social norms around drinking. As younger consumers prioritize health and wellness, seek authenticity and variety in their beverage choices, and embrace moderation as part of their lifestyle, there is a growing demand for low alcohol options that offer a more balanced and mindful drinking experience. This driver is further fueled by the decline in traditional alcohol consumption, the rise of alcohol-free social gatherings and events, and the mainstream acceptance of low alcohol beverages as viable alternatives to traditional alcoholic drinks, driving market growth and consumption of low alcohol products as a reflection of evolving consumer tastes and preferences.

An opportunity exists for manufacturers of low alcohol beverages to innovate in flavor profiles and expand into new beverage categories to capitalize on the growing demand for health-conscious and flavorful drink options. By developing innovative low alcohol formulations such as craft beers, sparkling wines, mocktails, and spirits-inspired drinks with lower ABV (alcohol by volume) content, manufacturers can cater to diverse consumer preferences and occasions, offering a wide range of choices for socializing, dining, and relaxation. Moreover, exploring opportunities in premiumization, ingredient sourcing, and packaging design can enhance brand differentiation and appeal to discerning consumers seeking high-quality and indulgent low alcohol experiences. This opportunity allows manufacturers to leverage consumer interest in health-conscious living, meet evolving beverage trends, and establish themselves as leaders in the dynamic and rapidly growing market for low alcohol beverages, offering innovative and enjoyable alternatives to traditional alcoholic drinks.

Within the low alcohol beverages market, low alcohol beer is the largest segment, driven by its widespread availability, established consumer base, and growing demand for healthier drinking options. Low alcohol beer offers a lower alcohol content compared to traditional beer variants, making it a popular choice among consumers seeking to moderate their alcohol intake without compromising on taste and social enjoyment. Further, the rising health consciousness and wellness trends prompt consumers to opt for low alcohol beer as a lighter alternative to regular beer, reducing calorie intake and potential alcohol-related health risks. Additionally, the increasing variety of low alcohol beer options, including craft and non-alcoholic beer brands, caters to diverse consumer preferences and fosters innovation within the segment. Furthermore, the accessibility of low alcohol beer in supermarkets, convenience stores, and bars contributes to its dominance in the market, as consumers seek convenient and accessible options for their drinking occasions. As the demand for low alcohol beverages continues to rise, propelled by shifting consumer preferences and regulatory changes promoting responsible drinking, low alcohol beer is poised to maintain its leading position in the market.

In the low alcohol beverages market, the off-trade sector is experiencing rapid growth, driven by changing consumer behaviors, convenience, and evolving retail landscapes. Off-trade channels, including supermarkets, convenience stores, and online retailers, offer consumers the convenience of purchasing low alcohol beverages for consumption at home or on-the-go, aligning with the growing trend of at-home consumption and socializing. The COVID-19 pandemic has further accelerated the shift towards off-trade channels, as consumers prioritize safety and convenience by opting for home delivery and online shopping. Further, the increasing variety and accessibility of low alcohol beverages in off-trade outlets cater to diverse consumer preferences and lifestyles, fostering greater experimentation and brand loyalty. Additionally, promotional activities, bulk discounts, and convenient packaging options in off-trade channels incentivize consumers to explore low alcohol beverage options, contributing to the sector's rapid growth. As consumer preferences continue to evolve towards healthier and more convenient drinking choices, the off-trade sector is poised to maintain its momentum as the fastest-growing segment in the low alcohol beverages market.

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Allagash Brewing Co.

Bacardi Ltd

Beam Suntory Inc

Carlsberg Breweries AS

CODYs Drinks International GmbH

Constellation Brands Inc

Curious Elixirs

Diageo Plc

Heineken NV

Kirin Holdings Co. Ltd

Metabrand Corp

Molson Coors Beverage Co.

New Belgium Brewing Co. Inc

Olvi Plc

Royal Unibrew AS

Sapporo Holdings Ltd

The Boston Beer Co. Inc

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Low Alcohol Beverages Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Low Alcohol Beverages Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Low Alcohol Beverages Market Share by Company, 2023

4.1.2. Product Offerings of Leading Low Alcohol Beverages Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Low Alcohol Beverages Market Drivers

6.2. Low Alcohol Beverages Market Challenges

6.6. Low Alcohol Beverages Market Opportunities

6.4. Low Alcohol Beverages Market Trends

Chapter 7. Global Low Alcohol Beverages Market Outlook Trends

7.1. Global Low Alcohol Beverages Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Low Alcohol Beverages Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Low Alcohol Beverages Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Chapter 8. Global Low Alcohol Beverages Regional Analysis and Outlook

8.1. Global Low Alcohol Beverages Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Low Alcohol Beverages Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Low Alcohol Beverages Regional Analysis and Outlook

8.2.2. Canada Low Alcohol Beverages Regional Analysis and Outlook

8.2.3. Mexico Low Alcohol Beverages Regional Analysis and Outlook

8.3. Europe Low Alcohol Beverages Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Low Alcohol Beverages Regional Analysis and Outlook

8.3.2. France Low Alcohol Beverages Regional Analysis and Outlook

8.3.3. United Kingdom Low Alcohol Beverages Regional Analysis and Outlook

8.3.4. Spain Low Alcohol Beverages Regional Analysis and Outlook

8.3.5. Italy Low Alcohol Beverages Regional Analysis and Outlook

8.3.6. Russia Low Alcohol Beverages Regional Analysis and Outlook

8.3.7. Rest of Europe Low Alcohol Beverages Regional Analysis and Outlook

8.4. Asia Pacific Low Alcohol Beverages Revenue (USD Million) by Country (2021-2032)

8.4.1. China Low Alcohol Beverages Regional Analysis and Outlook

8.4.2. Japan Low Alcohol Beverages Regional Analysis and Outlook

8.4.3. India Low Alcohol Beverages Regional Analysis and Outlook

8.4.4. South Korea Low Alcohol Beverages Regional Analysis and Outlook

8.4.5. Australia Low Alcohol Beverages Regional Analysis and Outlook

8.4.6. South East Asia Low Alcohol Beverages Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Low Alcohol Beverages Regional Analysis and Outlook

8.5. South America Low Alcohol Beverages Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Low Alcohol Beverages Regional Analysis and Outlook

8.5.2. Argentina Low Alcohol Beverages Regional Analysis and Outlook

8.5.3. Rest of South America Low Alcohol Beverages Regional Analysis and Outlook

8.6. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Low Alcohol Beverages Regional Analysis and Outlook

8.6.2. Africa Low Alcohol Beverages Regional Analysis and Outlook

Chapter 9. North America Low Alcohol Beverages Analysis and Outlook

9.1. North America Low Alcohol Beverages Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Low Alcohol Beverages Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Low Alcohol Beverages Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Low Alcohol Beverages Revenue (USD Million) by Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Chapter 10. Europe Low Alcohol Beverages Analysis and Outlook

10.1. Europe Low Alcohol Beverages Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Low Alcohol Beverages Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Low Alcohol Beverages Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Low Alcohol Beverages Revenue (USD Million) by Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Chapter 11. Asia Pacific Low Alcohol Beverages Analysis and Outlook

11.1. Asia Pacific Low Alcohol Beverages Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Low Alcohol Beverages Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Low Alcohol Beverages Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Low Alcohol Beverages Revenue (USD Million) by Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Chapter 12. South America Low Alcohol Beverages Analysis and Outlook

12.1. South America Low Alcohol Beverages Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Low Alcohol Beverages Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Low Alcohol Beverages Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Low Alcohol Beverages Revenue (USD Million) by Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Chapter 13. Middle East and Africa Low Alcohol Beverages Analysis and Outlook

13.1. Middle East and Africa Low Alcohol Beverages Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) by Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Chapter 14. Low Alcohol Beverages Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Allagash Brewing Co.

Bacardi Ltd

Beam Suntory Inc

Carlsberg Breweries AS

CODYs Drinks International GmbH

Constellation Brands Inc

Curious Elixirs

Diageo Plc

Heineken NV

Kirin Holdings Co. Ltd

Metabrand Corp

Molson Coors Beverage Co.

New Belgium Brewing Co. Inc

Olvi Plc

Royal Unibrew AS

Sapporo Holdings Ltd

The Boston Beer Co. Inc

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Low Alcohol Beverages Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Low Alcohol Beverages Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Low Alcohol Beverages Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Low Alcohol Beverages Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Low Alcohol Beverages Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Low Alcohol Beverages Market Share (%) By Regions (2021-2032)

Table 12 North America Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Table 15 South America Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Table 17 North America Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Table 18 North America Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Table 19 North America Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Table 26 South America Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Table 27 South America Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Table 28 South America Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Low Alcohol Beverages Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Low Alcohol Beverages Market Share (%) By Regions (2023)

Figure 6. North America Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 12. France Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 12. China Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 14. India Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Low Alcohol Beverages Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Low Alcohol Beverages Revenue (USD Million) By Product (2021-2032)

By Product

Low alcohol beer

Low alcohol wine

Low alcohol RTD

Low alcohol cider

Low alcohol spirits

By Distribution Channel

Off-trade

On-trade

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Low Alcohol Beverages Market Size is valued at $1.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.8% to reach $2.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Allagash Brewing Co., Bacardi Ltd, Beam Suntory Inc, Carlsberg Breweries AS, CODYs Drinks International GmbH, Constellation Brands Inc, Curious Elixirs, Diageo Plc, Heineken NV, Kirin Holdings Co. Ltd, Metabrand Corp, Molson Coors Beverage Co., New Belgium Brewing Co. Inc, Olvi Plc, Royal Unibrew AS, Sapporo Holdings Ltd, The Boston Beer Co. Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume