The global Livestock Transportation Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Personal, Commercial), By Application (Pig, Cattle, Sheep, Rabbit, Others)

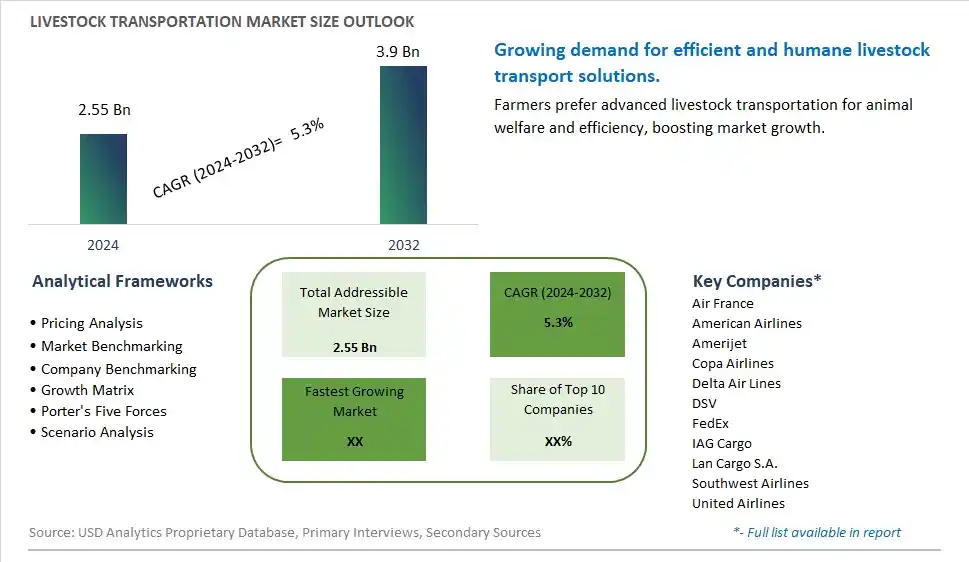

In 2024, the livestock transportation market is experiencing significant growth, driven by the need for efficient and humane transport solutions in the agriculture industry. The market benefits from advancements in transportation technologies that ensure animal welfare, reduce stress, and minimize the risk of injury during transit. Innovations in vehicle design, climate control systems, and real-time monitoring are enhancing the safety and comfort of livestock during transportation. The trend towards stringent animal welfare regulations and the increasing demand for high-quality meat products are further propelling market growth. Additionally, the rise of global trade in livestock is expanding market opportunities.

The market report analyses the leading companies in the industry including Air France, American Airlines, Amerijet, Copa Airlines, Delta Air Lines, DSV, FedEx, IAG Cargo, Lan Cargo S.A., Southwest Airlines, United Airlines, and Others.

The most prominent trend in the Livestock Transportation Market is the increasing adoption of advanced transportation solutions. To ensure the safety and well-being of livestock during transit, companies are investing in modern vehicles equipped with climate control, real-time monitoring, and automated feeding systems. This trend is driven by the need to reduce stress and mortality rates in transported animals.

A key driver in the Livestock Transportation Market is stricter animal welfare regulations. Governments and regulatory bodies are implementing more rigorous standards to ensure humane treatment of animals during transportation. Compliance with these regulations requires the use of advanced transportation technologies and practices, driving demand in the market.

One significant opportunity in the Livestock Transportation Market lies in the expansion into emerging markets. As the global demand for meat and dairy products continues to grow, there is an increasing need for efficient and humane livestock transportation solutions in developing regions. Companies that can provide reliable and compliant transportation services have the potential to capture significant market share in these emerging markets.

In the Livestock Transportation Market, the Commercial Type stands out as the largest segment. This segment encompasses the transportation of livestock for commercial purposes, including movement between farms, to processing facilities, auctions, and distribution centers. The commercial livestock transportation sector is crucial for ensuring the efficient and safe transit of animals across various stages of the supply chain. Key factors driving the growth of this segment include the expansion of industrial-scale livestock farming operations, which require reliable transportation services to move large volumes of animals over long distances. Commercial livestock transportation services are integral to maintaining the health and welfare of animals during transit, adhering to stringent regulatory standards for animal welfare, biosecurity, and food safety. Transporting livestock under optimal conditions helps minimize stress, injury, and disease transmission, ensuring that animals arrive at their destinations in good health and condition. Further, advancements in transportation technologies and practices continue to enhance the efficiency and safety of livestock transport, further supporting the growth of the commercial segment. The commercial livestock transportation market is also influenced by trends towards sustainable and ethical practices in animal agriculture, where transportation plays a critical role in demonstrating commitment to animal welfare and environmental stewardship. As the demand for livestock products grows globally, particularly in emerging markets, the need for efficient and reliable commercial livestock transportation services is expected to increase, driving further growth in this segment of the market.

The Pig segment emerges as the fastest-growing in the Livestock Transportation Market to 2032. This growth is driven by several key factors influencing the global pork industry. As consumer demand for pork products continues to rise, especially in emerging markets, there is a corresponding need to transport pigs efficiently and safely across various stages of production and distribution.Pig transportation is essential for moving pigs from breeding facilities to farms, between farms for breeding and fattening purposes, and eventually to processing plants or markets. Efficient transportation not only ensures the welfare of the animals but also plays a critical role in maintaining the quality and safety of pork products for consumers. Technological advancements in livestock transportation, including improved vehicle design, ventilation systems, and monitoring technologies, are enhancing the efficiency and safety of pig transport. These advancements help mitigate stress on animals during transit, reduce the risk of disease transmission, and comply with stringent animal welfare regulations. Further, the pig segment's growth is bolstered by increasing commercial pig farming operations that require reliable and scalable transportation solutions. Governments and regulatory bodies are also focusing on enhancing transport standards to ensure humane handling and reduce environmental impact, further driving innovation and growth in the pig transportation segment of the livestock market.

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Air France

American Airlines

Amerijet

Copa Airlines

Delta Air Lines

DSV

FedEx

IAG Cargo

Lan Cargo S.A.

Southwest Airlines

United Airlines

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Livestock Transportation Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Livestock Transportation Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Livestock Transportation Market Share by Company, 2023

4.1.2. Product Offerings of Leading Livestock Transportation Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Livestock Transportation Market Drivers

6.2. Livestock Transportation Market Challenges

6.6. Livestock Transportation Market Opportunities

6.4. Livestock Transportation Market Trends

Chapter 7. Global Livestock Transportation Market Outlook Trends

7.1. Global Livestock Transportation Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Livestock Transportation Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Livestock Transportation Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Chapter 8. Global Livestock Transportation Regional Analysis and Outlook

8.1. Global Livestock Transportation Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Livestock Transportation Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Livestock Transportation Regional Analysis and Outlook

8.2.2. Canada Livestock Transportation Regional Analysis and Outlook

8.2.3. Mexico Livestock Transportation Regional Analysis and Outlook

8.3. Europe Livestock Transportation Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Livestock Transportation Regional Analysis and Outlook

8.3.2. France Livestock Transportation Regional Analysis and Outlook

8.3.3. United Kingdom Livestock Transportation Regional Analysis and Outlook

8.3.4. Spain Livestock Transportation Regional Analysis and Outlook

8.3.5. Italy Livestock Transportation Regional Analysis and Outlook

8.3.6. Russia Livestock Transportation Regional Analysis and Outlook

8.3.7. Rest of Europe Livestock Transportation Regional Analysis and Outlook

8.4. Asia Pacific Livestock Transportation Revenue (USD Million) by Country (2021-2032)

8.4.1. China Livestock Transportation Regional Analysis and Outlook

8.4.2. Japan Livestock Transportation Regional Analysis and Outlook

8.4.3. India Livestock Transportation Regional Analysis and Outlook

8.4.4. South Korea Livestock Transportation Regional Analysis and Outlook

8.4.5. Australia Livestock Transportation Regional Analysis and Outlook

8.4.6. South East Asia Livestock Transportation Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Livestock Transportation Regional Analysis and Outlook

8.5. South America Livestock Transportation Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Livestock Transportation Regional Analysis and Outlook

8.5.2. Argentina Livestock Transportation Regional Analysis and Outlook

8.5.3. Rest of South America Livestock Transportation Regional Analysis and Outlook

8.6. Middle East and Africa Livestock Transportation Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Livestock Transportation Regional Analysis and Outlook

8.6.2. Africa Livestock Transportation Regional Analysis and Outlook

Chapter 9. North America Livestock Transportation Analysis and Outlook

9.1. North America Livestock Transportation Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Livestock Transportation Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Livestock Transportation Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Livestock Transportation Revenue (USD Million) by Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Chapter 10. Europe Livestock Transportation Analysis and Outlook

10.1. Europe Livestock Transportation Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Livestock Transportation Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Livestock Transportation Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Livestock Transportation Revenue (USD Million) by Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Chapter 11. Asia Pacific Livestock Transportation Analysis and Outlook

11.1. Asia Pacific Livestock Transportation Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Livestock Transportation Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Livestock Transportation Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Livestock Transportation Revenue (USD Million) by Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Chapter 12. South America Livestock Transportation Analysis and Outlook

12.1. South America Livestock Transportation Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Livestock Transportation Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Livestock Transportation Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Livestock Transportation Revenue (USD Million) by Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Chapter 13. Middle East and Africa Livestock Transportation Analysis and Outlook

13.1. Middle East and Africa Livestock Transportation Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Livestock Transportation Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Livestock Transportation Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Livestock Transportation Revenue (USD Million) by Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Chapter 14. Livestock Transportation Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Air France

American Airlines

Amerijet

Copa Airlines

Delta Air Lines

DSV

FedEx

IAG Cargo

Lan Cargo S.A.

Southwest Airlines

United Airlines

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Livestock Transportation Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Livestock Transportation Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Livestock Transportation Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Livestock Transportation Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Livestock Transportation Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Livestock Transportation Market Share (%) By Regions (2021-2032)

Table 12 North America Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Table 15 South America Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Table 17 North America Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Table 18 North America Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Table 19 North America Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Table 26 South America Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Table 27 South America Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Table 28 South America Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Livestock Transportation Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Livestock Transportation Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Livestock Transportation Market Share (%) By Regions (2023)

Figure 6. North America Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 12. France Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 12. China Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 14. India Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Livestock Transportation Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Livestock Transportation Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Livestock Transportation Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Livestock Transportation Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Livestock Transportation Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Livestock Transportation Revenue (USD Million) By Product (2021-2032)

By Type

Personal

Commercial

By Application

Pig

Cattle

Sheep

Rabbit

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Livestock Transportation Market Size is valued at $2.55 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $3.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Air France, American Airlines, Amerijet, Copa Airlines, Delta Air Lines, DSV, FedEx, IAG Cargo, Lan Cargo S.A., Southwest Airlines, United Airlines

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume