The global Liquid Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Packaging (Flexible Liquid Packaging, Rigid Liquid Packaging), By End-User (Food & Beverages, Non-food, Industrial), By Resin (Polyethylene, Polypropylene, Polyethylene Terephthalate, Others), By Technique (Aseptic Liquid Packaging, Blow Molding, Form Fill Seal Technology).

The liquid packaging market s to grow steadily in 2024, driven by the increasing demand for convenient and sustainable packaging solutions in industries such as food and beverage, pharmaceuticals, personal care, and household chemicals. Liquid packaging encompasses a wide range of packaging formats including bottles, pouches, cartons, and containers designed to safely store, transport, and dispense liquid products. With consumer preferences shifting towards on-the-go consumption and eco-friendly packaging options, manufacturers are investing in innovative packaging materials and designs to meet market demands. Additionally, advancements in packaging technology, such as aseptic packaging and barrier materials, are improving product shelf life and preserving product quality. Furthermore, sustainability initiatives focusing on recyclability and the use of renewable materials are driving the adoption of eco-friendly liquid packaging solutions. Overall, the liquid packaging market is poised for further expansion, fueled by evolving consumer lifestyles, regulatory requirements, and technological innovations.

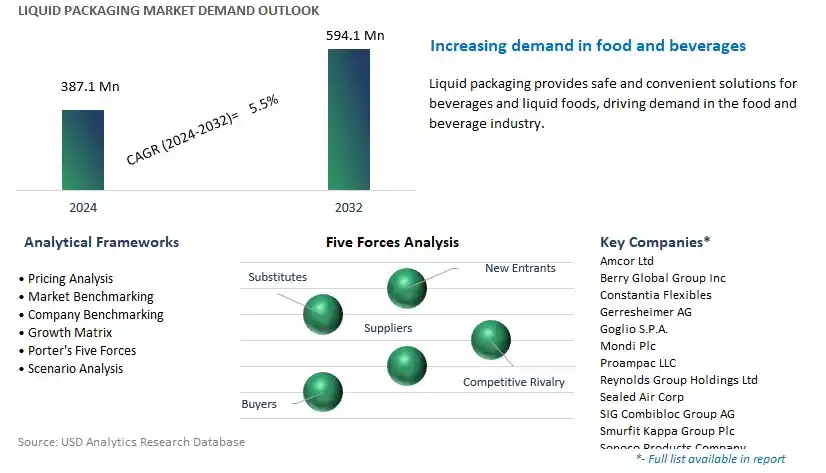

The market report analyses the leading companies in the industry including Amcor Ltd, Berry Global Group Inc, Constantia Flexibles, Gerresheimer AG, Goglio S.P.A., Mondi Plc, Proampac LLC, Reynolds Group Holdings Ltd, Sealed Air Corp, SIG Combibloc Group AG, Smurfit Kappa Group Plc, Sonoco Products Company, Tetra Laval, and others.

The liquid packaging industry is witnessing a significant trend towards sustainability, fueled by increasing consumer awareness and regulatory pressure. Companies are innovating to develop eco-friendly packaging solutions, such as recyclable materials, biodegradable options, and lightweight designs. This trend is reshaping the market landscape as brands seek to reduce their environmental footprint and meet the growing demand for sustainable packaging solutions. Additionally, consumers are increasingly prioritizing environmentally friendly products, driving the adoption of sustainable liquid packaging solutions across various industries. As a result, manufacturers are investing in research and development to create innovative packaging materials and technologies that address both sustainability concerns and functional requirements.

One of the primary drivers shaping the liquid packaging market is the evolving consumer lifestyle characterized by convenience and mobility. Busy lifestyles and changing consumption patterns have led to a surge in demand for on-the-go packaging solutions for liquid products, including beverages, personal care products, and pharmaceuticals. Consumers seek packaging formats that offer convenience, portability, and ease of use, such as single-serve pouches, resealable bottles, and pouches with dispensing caps. This shift in consumer preferences is compelling manufacturers to innovate and diversify their product offerings to cater to the growing demand for convenient liquid packaging solutions. Moreover, advancements in packaging technologies, such as barrier materials and spout closures, are further driving the development of convenient packaging formats that enhance product convenience, freshness, and shelf life.

An emerging opportunity in the liquid packaging market lies in the penetration of untapped markets, particularly in developing regions, where rising disposable incomes and urbanization are driving the demand for packaged liquid products. As consumers in these regions increasingly shift towards branded and packaged goods, there is a growing opportunity for liquid packaging manufacturers to expand their market presence and capitalize on the burgeoning consumer base. Furthermore, the rapid growth of e-commerce platforms presents a lucrative opportunity for liquid packaging companies to leverage online channels for product distribution and reach a wider audience. By optimizing packaging designs for e-commerce logistics, enhancing product visibility, and ensuring secure transportation, manufacturers can tap into the burgeoning e-commerce market and establish a competitive edge in the digital retail landscape.

Within the Liquid Packaging Market, the Flexible Liquid Packaging segment is the largest. Flexible liquid packaging refers to packaging solutions that utilize flexible materials such as plastic films, aluminum foil, and paperboard to package liquid products. The dominance of the Flexible Liquid Packaging segment can be attributed to flexibility and versatility are key advantages of flexible packaging materials, allowing them to be easily shaped, formed, and customized to accommodate a wide range of liquid products, including beverages, sauces, condiments, dairy products, pharmaceuticals, and personal care products. Flexible packaging offers various formats such as pouches, bags, sachets, and wraps, providing convenience, portability, and portion control for consumers while ensuring product freshness and shelf life. In addition, lightweight and cost-effectiveness are significant advantages of flexible packaging materials compared to rigid packaging formats such as glass bottles, metal cans, and plastic bottles. Flexible packaging materials require less material, energy, and resources to manufacture, transport, and dispose of, resulting in lower production costs, reduced transportation emissions, and minimized environmental impact. Further, innovation and sustainability are driving the adoption of flexible liquid packaging solutions in the market. Manufacturers are developing advanced flexible packaging materials with enhanced barrier properties, seal strength, and recyclability to meet the evolving needs of brand owners, retailers, and consumers for high-performance and eco-friendly packaging solutions. Moreover, the convenience and functionality of flexible liquid packaging formats such as stand-up pouches, spouted pouches, and single-serve sachets are well-suited for on-the-go lifestyles, e-commerce retailing, and emerging markets with limited access to traditional packaging formats. Additionally, the COVID-19 pandemic has accelerated the shift towards online shopping, home delivery, and contactless packaging solutions, further boosting the demand for flexible liquid packaging in the market. As consumer preferences evolve, brand owners seek innovative packaging solutions, and sustainability becomes a priority, the Flexible Liquid Packaging segment is expected to maintain its leadership position within the Liquid Packaging Market.

The Food & Beverages segment stands out as the fastest-growing segment within the liquid packaging market. In particular, the global population is increasing, leading to a rise in demand for packaged food and beverages, especially in urban areas where convenience is valued. Additionally, changing consumer preferences towards healthier and more sustainable packaging options have spurred innovation within the liquid packaging industry, driving the adoption of eco-friendly materials and packaging designs. Moreover, advancements in packaging technology have enabled manufacturers to extend the shelf life of perishable food and beverages, reducing food waste and increasing market demand. Furthermore, the COVID-19 pandemic has accelerated the shift towards e-commerce, leading to a surge in online grocery shopping, which in turn has boosted the demand for liquid packaging solutions. Over the forecast period, the Food & Beverages segment is experiencing rapid growth due to a combination of demographic trends, consumer preferences, technological advancements, and market dynamics.

The Polyethylene Terephthalate (PET) segment is the largest segment within the liquid packaging market. In particular, PET offers excellent properties such as transparency, durability, and lightweight, making it an ideal choice for packaging various liquid products ranging from beverages to personal care items. Its versatility allows for customization in terms of shapes and sizes, catering to the diverse needs of both consumers and manufacturers. Moreover, PET is highly recyclable, aligning with the growing global emphasis on sustainability and environmental consciousness. The burgeoning demand for bottled water, carbonated soft drinks, juices, and other beverages further propels the growth of the PET segment. Additionally, technological advancements in PET manufacturing processes have enhanced production efficiency and lowered costs, driving its widespread adoption across different industries. With its myriad advantages and widespread applications, the PET segment continues to dominate the liquid packaging market landscape.

The Aseptic Liquid Packaging segment is the fastest-growing segment within the liquid packaging market. Aseptic packaging technology ensures the sterility of liquid products by sterilizing both the packaging material and the product separately before filling and sealing in a sterile environment. This technique extends the shelf life of products without the need for refrigeration or preservatives, making it particularly appealing to consumers seeking convenient, healthy, and fresh products. Moreover, the rise in demand for on-the-go consumption and ready-to-drink beverages, coupled with the increasing preference for natural and minimally processed foods, has fuelled the adoption of aseptic liquid packaging. Additionally, advancements in packaging materials and machinery have improved the efficiency and cost-effectiveness of aseptic packaging processes, further driving its market growth. With its ability to preserve product quality, enhance convenience, and meet evolving consumer preferences, the Aseptic Liquid Packaging segment is poised for continued rapid expansion in the liquid packaging market.

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal TechnologyCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amcor Ltd

Berry Global Group Inc

Constantia Flexibles

Gerresheimer AG

Goglio S.P.A.

Mondi Plc

Proampac LLC

Reynolds Group Holdings Ltd

Sealed Air Corp

SIG Combibloc Group AG

Smurfit Kappa Group Plc

Sonoco Products Company

Tetra Laval

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Liquid Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Liquid Packaging Market Size Outlook, $ Million, 2021 to 2032

3.2 Liquid Packaging Market Outlook by Type, $ Million, 2021 to 2032

3.3 Liquid Packaging Market Outlook by Product, $ Million, 2021 to 2032

3.4 Liquid Packaging Market Outlook by Application, $ Million, 2021 to 2032

3.5 Liquid Packaging Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Liquid Packaging Industry

4.2 Key Market Trends in Liquid Packaging Industry

4.3 Potential Opportunities in Liquid Packaging Industry

4.4 Key Challenges in Liquid Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Liquid Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Liquid Packaging Market Outlook by Segments

7.1 Liquid Packaging Market Outlook by Segments, $ Million, 2021- 2032

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

8 North America Liquid Packaging Market Analysis and Outlook To 2032

8.1 Introduction to North America Liquid Packaging Markets in 2024

8.2 North America Liquid Packaging Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Liquid Packaging Market size Outlook by Segments, 2021-2032

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

9 Europe Liquid Packaging Market Analysis and Outlook To 2032

9.1 Introduction to Europe Liquid Packaging Markets in 2024

9.2 Europe Liquid Packaging Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Liquid Packaging Market Size Outlook by Segments, 2021-2032

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

10 Asia Pacific Liquid Packaging Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Liquid Packaging Markets in 2024

10.2 Asia Pacific Liquid Packaging Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Liquid Packaging Market size Outlook by Segments, 2021-2032

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

11 South America Liquid Packaging Market Analysis and Outlook To 2032

11.1 Introduction to South America Liquid Packaging Markets in 2024

11.2 South America Liquid Packaging Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Liquid Packaging Market size Outlook by Segments, 2021-2032

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

12 Middle East and Africa Liquid Packaging Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Liquid Packaging Markets in 2024

12.2 Middle East and Africa Liquid Packaging Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Liquid Packaging Market size Outlook by Segments, 2021-2032

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor Ltd

Berry Global Group Inc

Constantia Flexibles

Gerresheimer AG

Goglio S.P.A.

Mondi Plc

Proampac LLC

Reynolds Group Holdings Ltd

Sealed Air Corp

SIG Combibloc Group AG

Smurfit Kappa Group Plc

Sonoco Products Company

Tetra Laval

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Packaging

Flexible Liquid Packaging

-Stand-Up Pouch

-Bag-In-Box

-Films

Rigid Liquid Packaging

-Cartons

-Paperboard

-Plastics & PET bottles

-Cans

-Glass

By End-User

Food & Beverages

Non-food

Industrial

By Resin

Polyethylene

Polypropylene

Polyethylene Terephthalate

Others

By Technique

Aseptic Liquid Packaging

Blow Molding

Form Fill Seal Technology

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Liquid Packaging Market Size is valued at $387.1 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.5% to reach $594.1 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor Ltd, Berry Global Group Inc, Constantia Flexibles, Gerresheimer AG, Goglio S.P.A., Mondi Plc, Proampac LLC, Reynolds Group Holdings Ltd, Sealed Air Corp, SIG Combibloc Group AG, Smurfit Kappa Group Plc, Sonoco Products Company, Tetra Laval

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume