The global Lignin Products Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Source (Cellulosic Ethanol, Kraft Pulping, Sulfite Pulping), By Product (Lignosulfonate, Kraft Lignin, High-purity Lignin), By Application (Concrete Additive, Animal Feed, Vanillin, Dispersant, Resins, Activated Carbon, Carbon Fibers, Plastics/Polymers, Phenol and Derivatives, Others).

The future of lignin products is influenced by several key trends, including increasing demand for sustainable and renewable materials in industries such as construction, chemicals, and energy, advancements in lignin extraction and processing technologies, and growing emphasis on carbon neutrality, resource efficiency, and circular economy principles. Lignin is a complex biopolymer found in plant cell walls, primarily derived as a by-product from pulp and paper manufacturing processes, and serves as a renewable feedstock for producing a wide range of value-added products. With the rise of bio-based materials, green chemistry, and alternative energy sources, there's a growing need for lignin products that offer high purity, consistency, and functionality while reducing reliance on fossil-based materials and minimizing environmental impact. Moreover, advancements in lignin fractionation, depolymerization, and chemical modification methods are driving the development of lignin-based products such as adhesives, dispersants, antioxidants, and carbon fibers with improved performance, cost-effectiveness, and sustainability. Additionally, the integration of lignin valorization strategies, such as biorefinery concepts, co-product utilization, and waste-to-value approaches, is essential to maximize the economic and environmental benefits of lignin as a renewable resource. Collaboration between lignin producers, product developers, end-users, and policymakers is essential to drive innovation, ensure product quality, and address market demands in the lignin products industry.

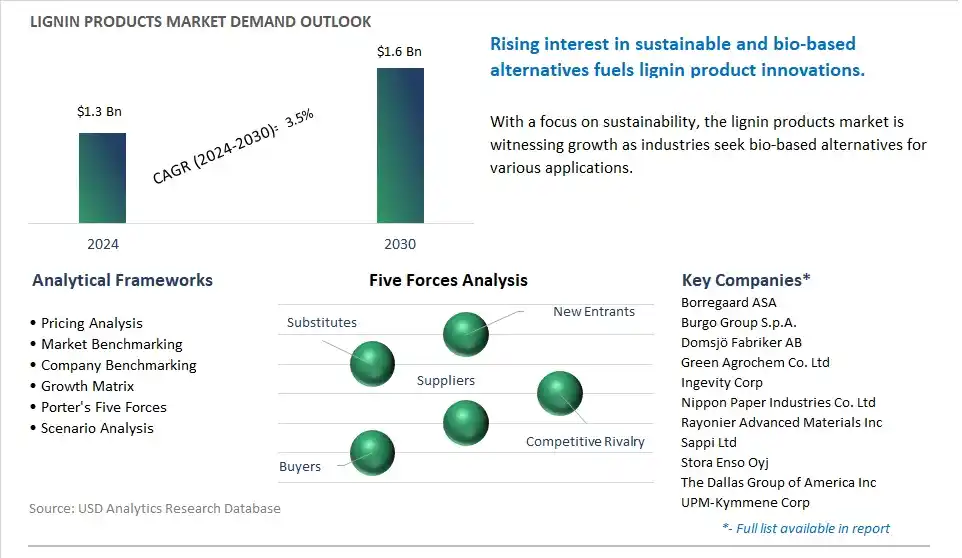

The market report analyses the leading companies in the industry including Borregaard ASA, Burgo Group S.p.A., Domsjö Fabriker AB, Green Agrochem Co. Ltd, Ingevity Corp, Nippon Paper Industries Co. Ltd, Rayonier Advanced Materials Inc, Sappi Ltd, Stora Enso Oyj, The Dallas Group of America Inc, UPM-Kymmene Corp, Wuhan East China Chemical Co. Ltd.

One prominent market trend in the lignin products industry is the increasing demand for sustainable and bio-based materials. Lignin, a natural polymer found in plant cell walls, is gaining attention as a renewable and eco-friendly alternative to traditional petroleum-based chemicals and materials. As environmental concerns grow and regulations on carbon emissions tighten, there's a rising interest in utilizing lignin-derived products in various industries, including adhesives, construction, textiles, and pharmaceuticals. This trend is driven by the desire to reduce dependency on fossil fuels, mitigate environmental impact, and transition towards a more sustainable and circular economy. Manufacturers are exploring innovative processes and applications for lignin products to meet the growing demand for sustainable materials and address the needs of environmentally conscious consumers and businesses.

A significant driver propelling the growth of the lignin products market is the shift towards a circular economy and waste valorization. Lignin, a byproduct of the paper and pulp industry, has historically been considered a low-value waste material and often burned for energy generation. However, with increasing emphasis on resource efficiency and waste reduction, there's a growing interest in valorizing lignin as a valuable raw material for the production of high-value products. By converting lignin into value-added products such as adhesives, dispersants, carbon fibers, and bio-based chemicals, manufacturers can extract maximum value from lignin-rich biomass and contribute to a more sustainable and resource-efficient economy. This driver is fueled by regulatory incentives, technological advancements, and collaborations between industry stakeholders to promote the circularity of lignocellulosic biomass and minimize waste generation throughout the supply chain.

An emerging opportunity for the lignin products market lies in the development of advanced applications and functionalities. While lignin has traditionally been used in relatively low-value applications such as animal feed additives and fuel additives, there's untapped potential for lignin-derived products in high-value sectors such as automotive, aerospace, and advanced materials. Manufacturers can capitalize on this opportunity by investing in research and development to enhance the performance, functionality, and compatibility of lignin-based products for use in specialty applications. For example, lignin-based carbon fibers could be used to manufacture lightweight and high-strength composite materials for automotive parts and aircraft components. Similarly, lignin-based additives could be incorporated into coatings, resins, and polymers to improve their mechanical properties, UV resistance, and flame retardancy. By exploring new applications and functionalities for lignin products, manufacturers can unlock new market opportunities, diversify their product portfolios, and establish themselves as key players in the emerging bio-based materials industry.

Kraft Pulping is the largest segment in the Lignin Products Market due to its widespread use in the pulp and paper industry. Kraft pulping, a chemical pulping process, involves the treatment of wood chips with a mixture of sodium hydroxide and sodium sulfide under high pressure and temperature conditions, resulting in the extraction of lignin from the wood fibers. Lignin obtained from the kraft pulping process serves as a valuable by-product, finding various applications across multiple industries, including adhesives, construction materials, and animal feed additives. The abundance of wood resources suitable for kraft pulping, coupled with the efficient extraction process, contributes to the significant production volume of lignin derived from this source. Additionally, advancements in kraft pulping technologies have led to the development of lignin products with enhanced properties, further expanding their utility and driving market growth. Accordingly, the Kraft Pulping segment maintains its dominance in the lignin products market, supported by the continued demand for sustainable and renewable raw materials in various industrial applications.

High-purity Lignin is the fastest-growing segment in the Lignin Products Market due to its increasing demand in various advanced applications, such as bioplastics, carbon fiber, and specialty chemicals. High-purity lignin is obtained through advanced extraction and purification processes, resulting in lignin with higher molecular weight and fewer impurities compared to other lignin types. This makes it particularly suitable for use in high-value applications where purity and performance are critical. The rising interest in sustainable alternatives to fossil-based materials has spurred the demand for high-purity lignin as a renewable and biodegradable substitute in industries seeking eco-friendly solutions. Further, ongoing research and development efforts aimed at enhancing the properties and functionalities of high-purity lignin further contribute to its rapid growth in the market. Accordingly, the High-purity Lignin segment is expected to continue its trajectory of rapid expansion, driven by the increasing emphasis on sustainability and the development of innovative lignin-based products across various industries.

The Plastics/Polymers segment is the fastest-growing segment in the Lignin Products Market due to its increasing utilization as a sustainable additive in polymer formulations. Lignin, a natural polymer derived from wood, offers Diverse beneficial properties, including its renewable nature, biodegradability, and compatibility with various polymer matrices. As industries worldwide strive to reduce their environmental footprint and shift towards more sustainable materials, lignin-based additives have gained significant traction in the plastics and polymers sector. These additives not only enhance the mechanical properties and processability of polymer materials but also contribute to reducing the reliance on fossil-based additives, thereby promoting a circular economy. Additionally, ongoing research and development initiatives focused on optimizing lignin extraction methods and improving its compatibility with different polymer systems further drive the growth of this segment. Accordingly, the Plastics/Polymers segment is poised to witness continued rapid expansion, driven by the growing demand for eco-friendly alternatives in the plastics industry and the increasing adoption of lignin-based additives by manufacturers seeking sustainable solutions.

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Borregaard ASA

Burgo Group S.p.A.

Domsjö Fabriker AB

Green Agrochem Co. Ltd

Ingevity Corp

Nippon Paper Industries Co. Ltd

Rayonier Advanced Materials Inc

Sappi Ltd

Stora Enso Oyj

The Dallas Group of America Inc

UPM-Kymmene Corp

Wuhan East China Chemical Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Lignin Products Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Lignin Products Market Size Outlook, $ Million, 2021 to 2030

3.2 Lignin Products Market Outlook by Type, $ Million, 2021 to 2030

3.3 Lignin Products Market Outlook by Product, $ Million, 2021 to 2030

3.4 Lignin Products Market Outlook by Application, $ Million, 2021 to 2030

3.5 Lignin Products Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Lignin Products Industry

4.2 Key Market Trends in Lignin Products Industry

4.3 Potential Opportunities in Lignin Products Industry

4.4 Key Challenges in Lignin Products Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Lignin Products Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Lignin Products Market Outlook by Segments

7.1 Lignin Products Market Outlook by Segments, $ Million, 2021- 2030

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

8 North America Lignin Products Market Analysis and Outlook To 2030

8.1 Introduction to North America Lignin Products Markets in 2024

8.2 North America Lignin Products Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Lignin Products Market size Outlook by Segments, 2021-2030

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

9 Europe Lignin Products Market Analysis and Outlook To 2030

9.1 Introduction to Europe Lignin Products Markets in 2024

9.2 Europe Lignin Products Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Lignin Products Market Size Outlook by Segments, 2021-2030

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

10 Asia Pacific Lignin Products Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Lignin Products Markets in 2024

10.2 Asia Pacific Lignin Products Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Lignin Products Market size Outlook by Segments, 2021-2030

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

11 South America Lignin Products Market Analysis and Outlook To 2030

11.1 Introduction to South America Lignin Products Markets in 2024

11.2 South America Lignin Products Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Lignin Products Market size Outlook by Segments, 2021-2030

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

12 Middle East and Africa Lignin Products Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Lignin Products Markets in 2024

12.2 Middle East and Africa Lignin Products Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Lignin Products Market size Outlook by Segments, 2021-2030

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Borregaard ASA

Burgo Group S.p.A.

Domsjö Fabriker AB

Green Agrochem Co. Ltd

Ingevity Corp

Nippon Paper Industries Co. Ltd

Rayonier Advanced Materials Inc

Sappi Ltd

Stora Enso Oyj

The Dallas Group of America Inc

UPM-Kymmene Corp

Wuhan East China Chemical Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Source

Cellulosic Ethanol

Kraft Pulping

Sulfite Pulping

By Product

Lignosulfonate

Kraft Lignin

High-purity Lignin

By Application

Concrete Additive

Animal Feed

Vanillin

Dispersant

Resins

Activated Carbon

Carbon Fibers

Plastics/Polymers

Phenol and Derivatives

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Lignin Products is forecast to reach $1.6 Billion in 2030 from $1.3 Billion in 2024, registering a CAGR of 3.5%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Borregaard ASA, Burgo Group S.p.A., Domsjö Fabriker AB, Green Agrochem Co. Ltd, Ingevity Corp, Nippon Paper Industries Co. Ltd, Rayonier Advanced Materials Inc, Sappi Ltd, Stora Enso Oyj, The Dallas Group of America Inc, UPM-Kymmene Corp, Wuhan East China Chemical Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume