The global Light Duty Vehicle Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Cars, Sports Utility Vehicle (SUVs), Pickup Trucks, Vans), By Application (Personal Use, Commercial Use, Industrial Use), By Propulsion (Gasoline, Diesel, Hybrid, Electric, Others).

The Light Duty Vehicle (LDV) Market in 2024 is witnessing significant growth and technological innovation driven by the increasing demand for fuel-efficient, technologically advanced, and environmentally friendly vehicles in both developed and emerging markets. Light duty vehicles encompass a wide range of passenger cars, sport utility vehicles (SUVs), and crossover vehicles designed for personal transportation and light commercial use, offering versatility, comfort, and convenience for everyday commuting and leisure activities. With advancements in automotive engineering, powertrain technology, and connectivity features, light duty vehicle manufacturers offer a diverse range of products that provide improved fuel economy, safety, and connectivity options for consumers. Moreover, the integration of features such as hybrid powertrains, electric propulsion systems, and advanced driver assistance systems (ADAS) enhances the performance, efficiency, and driving experience of light duty vehicles, meeting the evolving needs and preferences of modern consumers. Additionally, the expansion of mobility services, urbanization trends, and regulatory initiatives drive market adoption and investment in light duty vehicles as sustainable and intelligent transportation solutions for urban and suburban environments. As consumers prioritize convenience, safety, and environmental sustainability in their vehicle choices, the Light Duty Vehicle Market remains essential, driving innovation and transformation in the automotive industry to meet the challenges and opportunities of the 21st century.

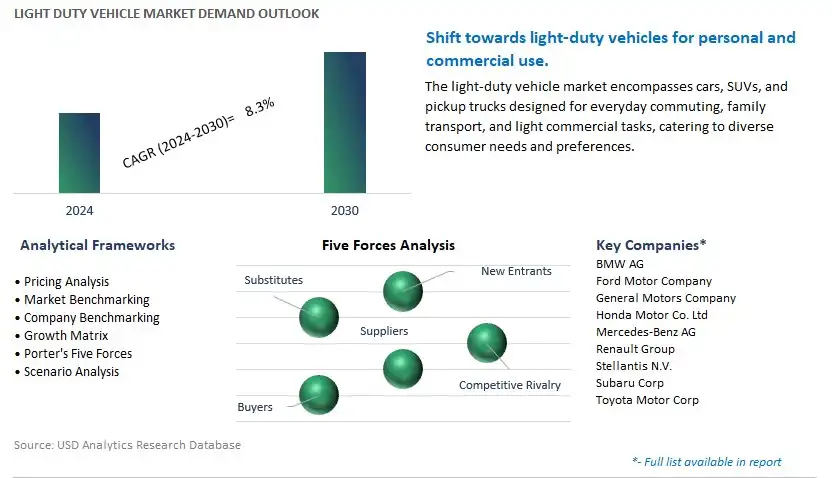

The global Light Duty Vehicle market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Light Duty Vehicle Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Light Duty Vehicle Market Industry include- BMW AG, Ford Motor Company, General Motors Company, Honda Motor Co. Ltd, Mercedes-Benz AG, Renault Group , Stellantis N.V. , Subaru Corp, Toyota Motor Corp.

The most prominent trend in the Light Duty Vehicle Market is the shift towards electric and sustainable vehicles. With increasing environmental concerns and government regulations aimed at reducing greenhouse gas emissions, there is a growing preference for light-duty vehicles powered by electric or alternative fuel sources such as hydrogen or biofuels. This trend is driven by advancements in battery technology, charging infrastructure, and the introduction of stricter emission standards that incentivize the adoption of electric and sustainable vehicles. Additionally, the lower operating costs and reduced environmental impact associated with electric and sustainable vehicles appeal to consumers and fleet operators looking to minimize their carbon footprint and operating expenses. As automotive manufacturers invest in electrification and sustainable mobility solutions, the market for electric and sustainable light-duty vehicles is experiencing significant growth, presenting opportunities for manufacturers to innovate and expand their product offerings to meet the evolving needs of consumers and fleet customers.

One of the primary drivers propelling the Light Duty Vehicle Market is consumer demand for advanced safety and convenience features. With the rise of connectivity, automation, and digitalization in vehicles, consumers expect light-duty vehicles to offer advanced safety technologies, driver assistance systems, and infotainment features that enhance the driving experience and improve overall vehicle safety. This driver is fueled by factors such as increasing urbanization, longer commute times, and the desire for comfort and convenience while traveling. Additionally, the COVID-19 pandemic has accelerated the adoption of remote work and telecommuting, leading consumers to prioritize vehicles with features such as remote start, smartphone integration, and adaptive cruise control. As automakers respond to changing consumer preferences and technological advancements, the demand for light-duty vehicles equipped with advanced safety and convenience features continues to grow. Moreover, regulatory mandates mandating the inclusion of safety technologies such as automatic emergency braking and lane-keeping assistance further drive the adoption of advanced features in light-duty vehicles. By offering vehicles with cutting-edge safety and convenience technologies, manufacturers can attract customers and gain a competitive edge in the market.

An exciting opportunity within the Light Duty Vehicle Market lies in the development of connected and autonomous vehicles (CAVs) tailored for light-duty applications. As the automotive industry moves towards autonomy and connectivity, there is potential to leverage connected and autonomous technology to enhance the capabilities of light-duty vehicles. By integrating sensors, cameras, and artificial intelligence algorithms, manufacturers can develop CAVs that offer features such as autonomous driving, remote monitoring, and predictive maintenance. Additionally, connectivity features such as vehicle-to-vehicle (V2V) communication, over-the-air (OTA) updates, and cloud-based services enable real-time data sharing, navigation assistance, and remote diagnostics. Moreover, autonomous driving technology enables light-duty vehicles to operate autonomously in specific scenarios such as highway driving or parking, improving safety, efficiency, and convenience for drivers. By embracing connected and autonomous technology, manufacturers can differentiate their light-duty vehicles, enhance the customer experience, and capitalize on the growing demand for smart and efficient transportation solutions in the light-duty vehicle segment.

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

OthersGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

BMW AG

Ford Motor Company

General Motors Company

Honda Motor Co. Ltd

Mercedes-Benz AG

Renault Group

Stellantis N.V.

Subaru Corp

Toyota Motor Corp

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Light Duty Vehicle Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Light Duty Vehicle Market Size Outlook, $ Million, 2021 to 2030

3.2 Light Duty Vehicle Market Outlook by Type, $ Million, 2021 to 2030

3.3 Light Duty Vehicle Market Outlook by Product, $ Million, 2021 to 2030

3.4 Light Duty Vehicle Market Outlook by Application, $ Million, 2021 to 2030

3.5 Light Duty Vehicle Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Light Duty Vehicle Industry

4.2 Key Market Trends in Light Duty Vehicle Industry

4.3 Potential Opportunities in Light Duty Vehicle Industry

4.4 Key Challenges in Light Duty Vehicle Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Light Duty Vehicle Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Light Duty Vehicle Market Outlook by Segments

7.1 Light Duty Vehicle Market Outlook by Segments, $ Million, 2021- 2030

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

8 North America Light Duty Vehicle Market Analysis and Outlook To 2030

8.1 Introduction to North America Light Duty Vehicle Markets in 2024

8.2 North America Light Duty Vehicle Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Light Duty Vehicle Market size Outlook by Segments, 2021-2030

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

9 Europe Light Duty Vehicle Market Analysis and Outlook To 2030

9.1 Introduction to Europe Light Duty Vehicle Markets in 2024

9.2 Europe Light Duty Vehicle Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Light Duty Vehicle Market Size Outlook by Segments, 2021-2030

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

10 Asia Pacific Light Duty Vehicle Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Light Duty Vehicle Markets in 2024

10.2 Asia Pacific Light Duty Vehicle Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Light Duty Vehicle Market size Outlook by Segments, 2021-2030

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

11 South America Light Duty Vehicle Market Analysis and Outlook To 2030

11.1 Introduction to South America Light Duty Vehicle Markets in 2024

11.2 South America Light Duty Vehicle Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Light Duty Vehicle Market size Outlook by Segments, 2021-2030

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

12 Middle East and Africa Light Duty Vehicle Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Light Duty Vehicle Markets in 2024

12.2 Middle East and Africa Light Duty Vehicle Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Light Duty Vehicle Market size Outlook by Segments, 2021-2030

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

BMW AG

Ford Motor Company

General Motors Company

Honda Motor Co. Ltd

Mercedes-Benz AG

Renault Group

Stellantis N.V.

Subaru Corp

Toyota Motor Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Cars

Sports Utility Vehicle (SUVs)

Pickup Trucks

Vans

By Application

Personal Use

Commercial Use

Industrial Use

By Propulsion

Gasoline

Diesel

Hybrid

Electric

Others

The global Light Duty Vehicle Market is one of the lucrative growth markets, poised to register a 8.3% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BMW AG, Ford Motor Company, General Motors Company, Honda Motor Co. Ltd, Mercedes-Benz AG, Renault Group , Stellantis N.V. , Subaru Corp, Toyota Motor Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume