The Life Sciences and Analytical Reagents Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Technology (Life science, Expression and transfection, Analytical), By Application (Protein synthesis, Gene expression, DNA and RNA analysis, Drug testing).

Life sciences and analytical reagents are essential components used in various laboratory applications, including molecular biology, biochemistry, immunology, and clinical diagnostics. In 2024, these reagents continue to play a fundamental role in enabling scientific research, drug discovery, and diagnostic testing by providing high-quality, reliable, and reproducible results. Life sciences reagents encompass a wide range of products, including nucleic acid purification kits, protein assays, antibodies, enzymes, and cell culture media, tailored to specific experimental protocols and applications. Analytical reagents, such as buffers, standards, solvents, and chromatography columns, facilitate accurate and precise analysis of biological samples and chemical compounds in analytical instrumentation, including spectrophotometers, chromatography systems, and mass spectrometers. As research endeavors in life sciences and analytical chemistry continue to advance, the demand for innovative reagents that offer enhanced sensitivity, specificity, and multiplexing capability remains strong. Moreover, the integration of automation, artificial intelligence, and data analytics in laboratory workflows further optimizes reagent utilization, experimental design, and data interpretation, accelerating scientific discoveries and technological innovations that address critical challenges in healthcare, biotechnology, and environmental sustainability.

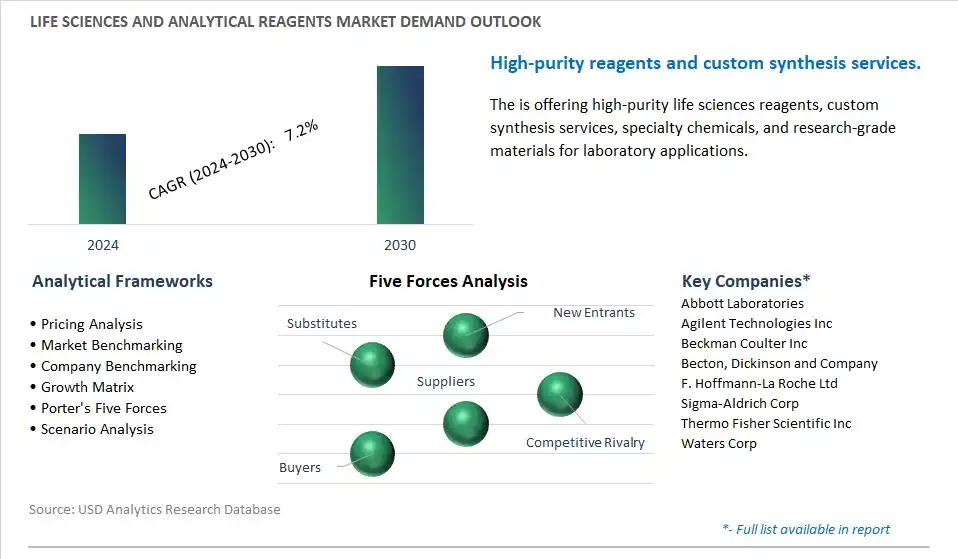

A prominent trend in the life sciences and analytical reagents market is the escalating demand for high-quality and specialized reagents. As advancements in life sciences research and analytical techniques continue to evolve, there is a growing need for reagents that offer superior purity, specificity, and performance. Researchers across various fields, including genomics, proteomics, drug discovery, and clinical diagnostics, require reagents tailored to their specific applications and experimental requirements. This trend is driving manufacturers to develop innovative reagent formulations, purification methods, and packaging formats to meet the increasingly complex demands of the scientific community and facilitate reproducible and reliable results in their experiments.

A key driver fueling the demand for life sciences and analytical reagents is the expansion of biopharmaceutical research and development (R&D). With the growing prevalence of chronic and infectious diseases, along with an aging population, there is an urgent need for innovative therapeutics and diagnostics. Biopharmaceutical companies are increasingly focusing on the development of biologics, such as monoclonal antibodies, recombinant proteins, and gene therapies, to address unmet medical needs. These endeavors require a vast array of specialized reagents for various stages of R&D, including target identification, drug screening, protein expression, purification, and characterization. As the biopharmaceutical sector continues to expand globally, the demand for high-quality reagents to support research, development, and production activities is expected to soar, driving growth in the life sciences and analytical reagents market.

A significant opportunity for players in the life sciences and analytical reagents market lies in the expansion into emerging markets and research areas. While established markets such as North America and Europe remain key revenue generators, emerging economies across Asia-Pacific, Latin America, and the Middle East present untapped potential for market expansion. Factors such as increasing government investments in scientific research, rising academic collaborations, and growing healthcare expenditure contribute to the burgeoning demand for life sciences and analytical reagents in these regions. Moreover, there is an opportunity to cater to niche research areas and applications, such as single-cell analysis, spatial omics, and synthetic biology, which are gaining prominence in the scientific community. By leveraging strategic partnerships, distribution networks, and market insights, companies can capitalize on these opportunities to broaden their customer base, drive revenue growth, and maintain a competitive edge in the dynamic life sciences reagents market.

Among the segments listed, PCR (Polymerase Chain Reaction) Reagents are experiencing the most rapid growth in the Life Sciences and Analytical Reagents Market. This growth is driven by several key factors. Firstly, PCR is a fundamental molecular biology technique used for amplifying DNA sequences, making it indispensable in various life science and analytical applications. PCR reagents, including primers, nucleotides, polymerases, and buffers, are essential components for conducting PCR experiments, enabling the detection and analysis of DNA and RNA sequences with high specificity and sensitivity. Secondly, advancements in PCR technology have led to the development of innovative reagents and kits that offer improved performance, reliability, and ease of use. These advancements include the introduction of high-fidelity polymerases, real-time PCR (qPCR) assays, multiplex PCR kits, and digital PCR platforms, which expand the capabilities and applications of PCR in fields such as genomics, diagnostics, forensics, and drug discovery. Thirdly, the increasing demand for molecular diagnostic tests, particularly in infectious disease diagnostics, oncology, and genetic testing, has driven the adoption of PCR reagents in clinical laboratories, hospitals, and research institutions worldwide. PCR-based tests for COVID-19 diagnosis, in particular, have fueled unprecedented demand for PCR reagents and consumables, highlighting the critical role of PCR technology in public health and disease surveillance efforts. Additionally, the growing emphasis on personalized medicine and precision therapeutics has further boosted the demand for PCR reagents for molecular profiling and companion diagnostic applications. With ongoing technological innovation, expanding applications, and increasing adoption in both research and clinical settings, PCR reagents are poised for sustained rapid growth in the Life Sciences and Analytical Reagents Market.

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAbbott Laboratories, Agilent Technologies Inc, Beckman Coulter Inc, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd, Sigma-Aldrich Corp, Thermo Fisher Scientific Inc, Waters Corp

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abbott Laboratories

Agilent Technologies Inc

Beckman Coulter Inc

Becton, Dickinson and Company

F. Hoffmann-La Roche Ltd

Sigma-Aldrich Corp

Thermo Fisher Scientific Inc

Waters Corp

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Life Sciences and Analytical Reagents Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Life Sciences and Analytical Reagents Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Life Sciences and Analytical Reagents Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Life Sciences and Analytical Reagents Market Size Outlook, $ Million, 2021 to 2030

3.2 Life Sciences and Analytical Reagents Market Outlook by Type, $ Million, 2021 to 2030

3.3 Life Sciences and Analytical Reagents Market Outlook by Product, $ Million, 2021 to 2030

3.4 Life Sciences and Analytical Reagents Market Outlook by Application, $ Million, 2021 to 2030

3.5 Life Sciences and Analytical Reagents Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Life Sciences and Analytical Reagents Industry

4.2 Key Market Trends in Life Sciences and Analytical Reagents Industry

4.3 Potential Opportunities in Life Sciences and Analytical Reagents Industry

4.4 Key Challenges in Life Sciences and Analytical Reagents Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Life Sciences and Analytical Reagents Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Life Sciences and Analytical Reagents Market Outlook by Segments

7.1 Life Sciences and Analytical Reagents Market Outlook by Segments, $ Million, 2021- 2030

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

8 North America Life Sciences and Analytical Reagents Market Analysis and Outlook To 2030

8.1 Introduction to North America Life Sciences and Analytical Reagents Markets in 2024

8.2 North America Life Sciences and Analytical Reagents Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Life Sciences and Analytical Reagents Market size Outlook by Segments, 2021-2030

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

9 Europe Life Sciences and Analytical Reagents Market Analysis and Outlook To 2030

9.1 Introduction to Europe Life Sciences and Analytical Reagents Markets in 2024

9.2 Europe Life Sciences and Analytical Reagents Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Life Sciences and Analytical Reagents Market Size Outlook by Segments, 2021-2030

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

10 Asia Pacific Life Sciences and Analytical Reagents Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Life Sciences and Analytical Reagents Markets in 2024

10.2 Asia Pacific Life Sciences and Analytical Reagents Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Life Sciences and Analytical Reagents Market size Outlook by Segments, 2021-2030

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

11 South America Life Sciences and Analytical Reagents Market Analysis and Outlook To 2030

11.1 Introduction to South America Life Sciences and Analytical Reagents Markets in 2024

11.2 South America Life Sciences and Analytical Reagents Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Life Sciences and Analytical Reagents Market size Outlook by Segments, 2021-2030

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

12 Middle East and Africa Life Sciences and Analytical Reagents Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Life Sciences and Analytical Reagents Markets in 2024

12.2 Middle East and Africa Life Sciences and Analytical Reagents Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Life Sciences and Analytical Reagents Market size Outlook by Segments, 2021-2030

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abbott Laboratories

Agilent Technologies Inc

Beckman Coulter Inc

Becton, Dickinson and Company

F. Hoffmann-La Roche Ltd

Sigma-Aldrich Corp

Thermo Fisher Scientific Inc

Waters Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Life science

-PCR

-Cell culture

-IVD

Expression and transfection

Analytical

-Chromatography

-Mass Spectrometry

-Electrophoresis

-Flow Cytometry

By Application

Protein synthesis

Gene expression

DNA and RNA analysis

Drug testing

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Life Sciences and Analytical Reagents Market is one of the lucrative growth markets, poised to register a 7.2% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abbott Laboratories, Agilent Technologies Inc, Beckman Coulter Inc, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd, Sigma-Aldrich Corp, Thermo Fisher Scientific Inc, Waters Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume