The global LED headlights Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Application (Two Wheelers, Passenger Cars, Buses, Trucks), By Distribution Channel (Online, Offline), By Sales Channel (OEM, Aftermarket).

The LED Headlights Market in 2024 is experiencing significant growth and technological advancement driven by the increasing demand for energy-efficient, durable, and high-performance lighting solutions in automotive applications. LED headlights, also known as light-emitting diode headlights, utilize semiconductor technology to produce bright and focused illumination, offering superior visibility, safety, and aesthetics compared to traditional halogen or xenon headlights. With advancements in LED chip technology, optics design, and thermal management systems, LED headlight manufacturers offer a diverse range of products that provide enhanced brightness, color temperature, and longevity for various vehicle models and designs. Moreover, the integration of features such as adaptive lighting, matrix beam technology, and dynamic control systems enhances the functionality and versatility of LED headlights, enabling improved road illumination, glare reduction, and adaptive beam patterns for different driving conditions and environments. Additionally, the energy efficiency and reliability of LED headlights contribute to reduced power consumption, longer service life, and lower maintenance costs for vehicle owners, making them a preferred choice for automotive lighting upgrades and retrofitting projects. As automakers and consumers prioritize safety, efficiency, and aesthetics in their vehicles, the LED Headlights Market remains essential, driving innovation and adoption of LED technology for creating safer, smarter, and more visually appealing automotive lighting solutions in the 21st century.

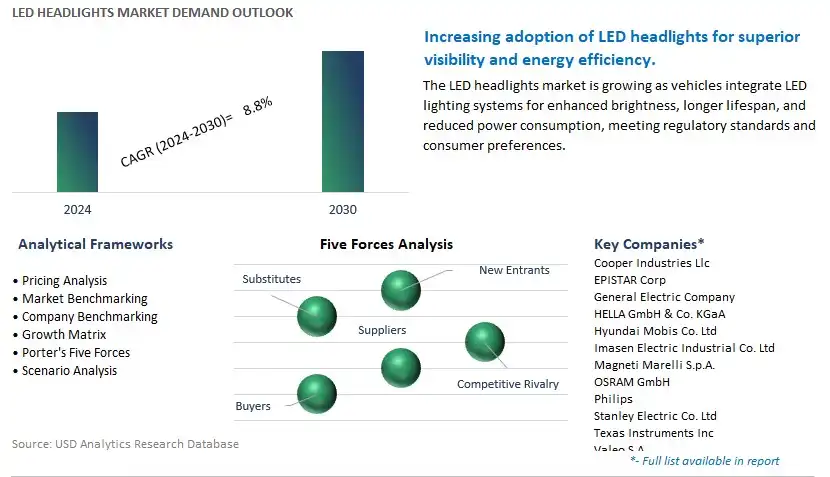

The global LED headlights market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, LED headlights Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the LED headlights Market Industry include- Cooper Industries Llc, EPISTAR Corp, General Electric Company, HELLA GmbH & Co. KGaA, Hyundai Mobis Co. Ltd, Imasen Electric Industrial Co. Ltd, Magneti Marelli S.p.A., OSRAM GmbH, Philips, Stanley Electric Co. Ltd, Texas Instruments Inc, Valeo S.A..

The most prominent trend in the LED Headlights Market is the adoption of adaptive lighting technology. As automotive manufacturers and consumers prioritize safety and visibility on the road, there is a growing demand for LED headlights equipped with adaptive features that adjust the direction and intensity of light based on driving conditions and surroundings. This trend is driven by advancements in sensor technology, image processing algorithms, and LED lighting systems, enabling headlights to automatically adjust beam patterns, brightness levels, and beam direction to optimize visibility and minimize glare for both the driver and other road users. Additionally, regulatory mandates mandating the use of adaptive lighting systems in new vehicles further accelerate the adoption of this technology. As vehicle safety standards become more stringent and consumers seek advanced safety features, the market for LED headlights with adaptive lighting capabilities is experiencing rapid growth, presenting opportunities for manufacturers to innovate and differentiate their products in the competitive automotive lighting market.

One of the primary drivers propelling the LED Headlights Market is the emphasis on vehicle safety and visibility. With increasing traffic congestion, night-time driving, and adverse weather conditions, there is a growing awareness of the importance of headlights in ensuring driver safety and visibility on the road. LED headlights offer several advantages over traditional halogen and xenon headlights, including brighter illumination, longer lifespan, and lower energy consumption. Additionally, the superior color rendering and color temperature characteristics of LED lighting provide better visibility and contrast, reducing eye strain and fatigue for drivers. As automotive manufacturers prioritize safety features and consumers demand vehicles equipped with advanced lighting systems, the demand for LED headlights continues to grow. Moreover, the rise of autonomous driving technologies further drives the need for advanced lighting solutions that enhance object detection and recognition capabilities, contributing to improved vehicle safety and accident prevention. As safety regulations and consumer preferences drive the adoption of LED headlights, manufacturers have the opportunity to capitalize on the growing demand for advanced automotive lighting solutions.

An exciting opportunity within the LED Headlights Market lies in the integration of connected and smart features into LED headlight designs. As vehicles become increasingly connected and technologically advanced, there is potential to enhance the functionality and user experience of LED headlights by incorporating smart features such as adaptive high beam assist, automatic glare reduction, and predictive lighting control. By integrating sensors, cameras, and vehicle-to-infrastructure (V2I) communication capabilities, LED headlights can interact with surrounding vehicles, road signs, and traffic signals to optimize lighting performance and enhance driver safety. Moreover, integrating connectivity features such as Wi-Fi, Bluetooth, and smartphone integration enables remote control, customization, and firmware updates for LED headlights, offering convenience and flexibility for users. Additionally, leveraging data analytics and machine learning algorithms allows LED headlights to adapt to driver preferences and driving patterns, providing personalized lighting experiences. By embracing connected and smart features, manufacturers can differentiate their LED headlights, add value for customers, and stay ahead of the competition in the rapidly evolving automotive lighting market landscape.

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Cooper Industries Llc

EPISTAR Corp

General Electric Company

HELLA GmbH & Co. KGaA

Hyundai Mobis Co. Ltd

Imasen Electric Industrial Co. Ltd

Magneti Marelli S.p.A.

OSRAM GmbH

Philips

Stanley Electric Co. Ltd

Texas Instruments Inc

Valeo S.A.

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 LED headlights Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global LED headlights Market Size Outlook, $ Million, 2021 to 2030

3.2 LED headlights Market Outlook by Type, $ Million, 2021 to 2030

3.3 LED headlights Market Outlook by Product, $ Million, 2021 to 2030

3.4 LED headlights Market Outlook by Application, $ Million, 2021 to 2030

3.5 LED headlights Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of LED headlights Industry

4.2 Key Market Trends in LED headlights Industry

4.3 Potential Opportunities in LED headlights Industry

4.4 Key Challenges in LED headlights Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global LED headlights Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global LED headlights Market Outlook by Segments

7.1 LED headlights Market Outlook by Segments, $ Million, 2021- 2030

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

8 North America LED headlights Market Analysis and Outlook To 2030

8.1 Introduction to North America LED headlights Markets in 2024

8.2 North America LED headlights Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America LED headlights Market size Outlook by Segments, 2021-2030

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

9 Europe LED headlights Market Analysis and Outlook To 2030

9.1 Introduction to Europe LED headlights Markets in 2024

9.2 Europe LED headlights Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe LED headlights Market Size Outlook by Segments, 2021-2030

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

10 Asia Pacific LED headlights Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific LED headlights Markets in 2024

10.2 Asia Pacific LED headlights Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific LED headlights Market size Outlook by Segments, 2021-2030

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

11 South America LED headlights Market Analysis and Outlook To 2030

11.1 Introduction to South America LED headlights Markets in 2024

11.2 South America LED headlights Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America LED headlights Market size Outlook by Segments, 2021-2030

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

12 Middle East and Africa LED headlights Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa LED headlights Markets in 2024

12.2 Middle East and Africa LED headlights Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa LED headlights Market size Outlook by Segments, 2021-2030

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Cooper Industries Llc

EPISTAR Corp

General Electric Company

HELLA GmbH & Co. KGaA

Hyundai Mobis Co. Ltd

Imasen Electric Industrial Co. Ltd

Magneti Marelli S.p.A.

OSRAM GmbH

Philips

Stanley Electric Co. Ltd

Texas Instruments Inc

Valeo S.A.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Two Wheelers

Passenger Cars

Buses

Trucks

By Distribution Channel

Online

Offline

By Sales Channel

OEM

Aftermarket

The global LED headlights Market is one of the lucrative growth markets, poised to register a 8.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Cooper Industries Llc, EPISTAR Corp, General Electric Company, HELLA GmbH & Co. KGaA, Hyundai Mobis Co. Ltd, Imasen Electric Industrial Co. Ltd, Magneti Marelli S.p.A., OSRAM GmbH, Philips, Stanley Electric Co. Ltd, Texas Instruments Inc, Valeo S.A.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume