The global Laminar Composites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Manufacturing Process (Brazing, Coextrusion, Explosive Bonding, Roll Bonding), By Application (Bimetallics, Clad Metals, Laminated Fibrous Composite, Laminated Glass), By End-User (Aerospace, Automotive, Construction, Electronics, Sports, Others).

The laminar composites market is projected to grow significantly in 2024, driven by their diverse applications across industries such as aerospace, automotive, construction, and marine. Laminar composites, consisting of multiple layers of material bonded together, offer superior strength, stiffness, and durability compared to traditional materials. These composites are particularly valued for their ability to withstand high loads and harsh environmental conditions. The aerospace and automotive sectors are major drivers of this market, leveraging laminar composites to reduce weight and improve fuel efficiency. Additionally, advancements in composite manufacturing technologies, including automated layup processes and innovative resin systems, are expanding the applications and performance characteristics of laminar composites. The increasing focus on sustainable construction materials and the growing demand for high-performance materials in infrastructure projects further propel market growth.

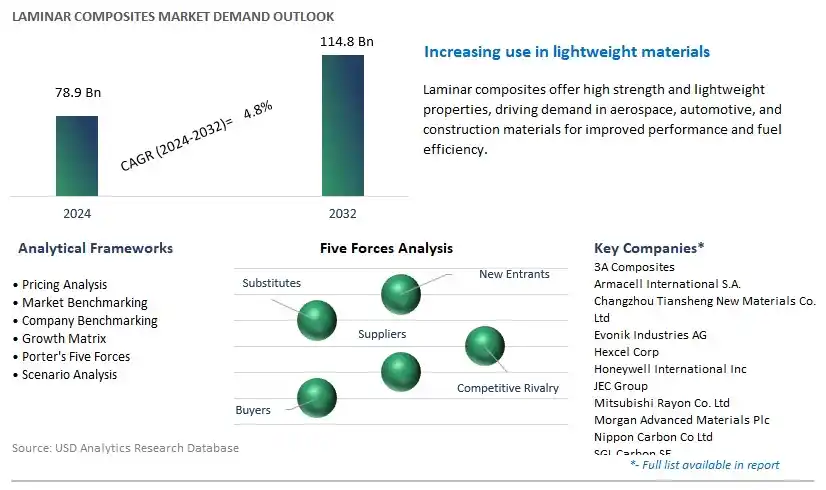

The market report analyses the leading companies in the industry including 3A Composites, Armacell International S.A., Changzhou Tiansheng New Materials Co. Ltd, Evonik Industries AG, Hexcel Corp, Honeywell International Inc, JEC Group, Mitsubishi Rayon Co. Ltd, Morgan Advanced Materials Plc, Nippon Carbon Co Ltd, SGL Carbon SE, Teijin Ltd, Toray Advanced Composites, and others.

A significant trend in the laminar composites market is the increasing demand for lightweight and high-strength materials. Laminar composites, consisting of layers of different materials bonded together, offer exceptional mechanical properties such as high strength-to-weight ratio, stiffness, and durability. These properties make laminar composites ideal for applications in aerospace, automotive, marine, and construction industries where reducing weight while maintaining structural integrity is critical. With growing emphasis on fuel efficiency, sustainability, and performance optimization, there is a rising demand for laminar composites as a preferred choice for lightweighting and structural reinforcement solutions, driving market growth and innovation.

A key driver fueling the laminar composites market is advancements in material science and manufacturing technologies. With continuous developments in composite materials, resin systems, fiber reinforcements, and production processes, manufacturers can engineer laminar composites with tailored properties and performance characteristics to meet specific application requirements. Advanced manufacturing techniques such as automated lay-up, resin infusion, and additive manufacturing enable precise control over material orientation, layer thickness, and composite architecture, resulting in optimized structural performance and cost-effective production. These technological advancements empower industries to adopt laminar composites for a wide range of applications, driving market demand and expanding opportunities for material innovation.

A promising opportunity for the laminar composites market lies in penetrating into new end-use sectors and applications. While laminar composites are widely used in aerospace, automotive, and marine industries, there are emerging opportunities in sectors such as renewable energy, infrastructure, sports and leisure, and consumer goods. For example, laminar composites are increasingly used in wind turbine blades, bridges, sporting equipment, and consumer electronics due to their lightweight, corrosion-resistant, and design flexibility properties. By identifying and targeting niche markets within these sectors, manufacturers can diversify their customer base, expand product portfolios, and capitalize on the versatility and performance advantages of laminar composites. Additionally, strategic partnerships and collaborations with industry players and research institutions can facilitate technology transfer, market penetration, and product development, accelerating growth and market penetration in new applications.

The largest segment within the laminar composites market is roll bonding. The large revenue share is primarily due to the efficiency, cost-effectiveness, and versatility of the roll bonding manufacturing process. Roll bonding involves the application of pressure and heat to bond together multiple layers of materials, typically metals or metal alloys, to form a composite structure. This process allows for the production of laminar composites with tailored properties, such as improved strength, corrosion resistance, and thermal conductivity, suitable for a wide range of applications across industries. Roll bonding is particularly favored in the manufacturing of clad metals for use in aerospace, automotive, construction, and industrial sectors. Its ability to create strong metallurgical bonds between dissimilar materials, such as aluminum and steel, expands the design possibilities and performance capabilities of laminar composites, driving its widespread adoption. Moreover, advancements in roll bonding technologies, including automation and precision control systems, further enhance the efficiency and quality of composite production, cementing roll bonding as the largest segment in the laminar composites market.

The fastest-growing segment within the laminar composites market is laminated fibrous composite. Laminated fibrous composites are increasingly being utilized in various industries, including aerospace, automotive, construction, and sports equipment, due to their exceptional strength-to-weight ratio, flexibility, and versatility. These composites are composed of layers of fibrous materials, such as carbon fiber, fiberglass, or aramid fibers, impregnated with a resin matrix and bonded together through a lamination process. The unique combination of high strength, stiffness, and lightweight properties makes laminated fibrous composites ideal for applications requiring structural integrity, impact resistance, and fatigue performance. In the aerospace sector, for example, laminated fibrous composites are used in aircraft components, including fuselages, wings, and interior panels, to reduce weight and improve fuel efficiency. Similarly, in the automotive industry, laminated fibrous composites are employed in the production of lightweight body panels and structural reinforcements to enhance vehicle performance and fuel economy. Moreover, advancements in manufacturing technologies, such as automated lay-up processes and resin infusion techniques, enable the mass production of complex composite structures at reduced costs, further driving the growth of the laminated fibrous composite segment in the laminar composites market.

The largest segment within the laminar composites market is aerospace. The large revenue share is primarily due to the unique properties and performance requirements of laminar composites in the aerospace industry. Laminar composites offer exceptional strength-to-weight ratio, durability, and corrosion resistance, making them indispensable materials for aircraft manufacturing. In the aerospace sector, laminar composites are extensively used in the production of structural components, such as fuselage panels, wings, empennages, and interior cabin parts. These composites help reduce aircraft weight, enhance fuel efficiency, and improve overall performance, crucial factors in modern aircraft design and operation. Moreover, laminar composites provide design flexibility, allowing for complex shapes and configurations to be achieved, which is essential for aerodynamic optimization and space-saving solutions in aircraft interiors. With the increasing demand for fuel-efficient aircraft, advancements in composite materials, and the rise of electric propulsion systems, the aerospace segment continues to drive significant growth in the laminar composites market. As aerospace manufacturers seek lightweight, durable, and high-performance materials to meet stringent safety and efficiency standards, laminar composites remain at the forefront of innovation and development in the aerospace industry.

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3A Composites

Armacell International S.A.

Changzhou Tiansheng New Materials Co. Ltd

Evonik Industries AG

Hexcel Corp

Honeywell International Inc

JEC Group

Mitsubishi Rayon Co. Ltd

Morgan Advanced Materials Plc

Nippon Carbon Co Ltd

SGL Carbon SE

Teijin Ltd

Toray Advanced Composites

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Laminar Composites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Laminar Composites Market Size Outlook, $ Million, 2021 to 2032

3.2 Laminar Composites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Laminar Composites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Laminar Composites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Laminar Composites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Laminar Composites Industry

4.2 Key Market Trends in Laminar Composites Industry

4.3 Potential Opportunities in Laminar Composites Industry

4.4 Key Challenges in Laminar Composites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Laminar Composites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Laminar Composites Market Outlook by Segments

7.1 Laminar Composites Market Outlook by Segments, $ Million, 2021- 2032

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

8 North America Laminar Composites Market Analysis and Outlook To 2032

8.1 Introduction to North America Laminar Composites Markets in 2024

8.2 North America Laminar Composites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Laminar Composites Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

9 Europe Laminar Composites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Laminar Composites Markets in 2024

9.2 Europe Laminar Composites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Laminar Composites Market Size Outlook by Segments, 2021-2032

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

10 Asia Pacific Laminar Composites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Laminar Composites Markets in 2024

10.2 Asia Pacific Laminar Composites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Laminar Composites Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

11 South America Laminar Composites Market Analysis and Outlook To 2032

11.1 Introduction to South America Laminar Composites Markets in 2024

11.2 South America Laminar Composites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Laminar Composites Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

12 Middle East and Africa Laminar Composites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Laminar Composites Markets in 2024

12.2 Middle East and Africa Laminar Composites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Laminar Composites Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3A Composites

Armacell International S.A.

Changzhou Tiansheng New Materials Co. Ltd

Evonik Industries AG

Hexcel Corp

Honeywell International Inc

JEC Group

Mitsubishi Rayon Co. Ltd

Morgan Advanced Materials Plc

Nippon Carbon Co Ltd

SGL Carbon SE

Teijin Ltd

Toray Advanced Composites

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Manufacturing Process

Brazing

Coextrusion

Explosive Bonding

Roll Bonding

By Application

Bimetallics

Clad Metals

Laminated Fibrous Composite

Laminated Glass

By End-User

Aerospace

Automotive

Construction

Electronics

Sports

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Laminar Composites Market Size is valued at $78.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.8% to reach $114.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3A Composites, Armacell International S.A., Changzhou Tiansheng New Materials Co. Ltd, Evonik Industries AG, Hexcel Corp, Honeywell International Inc, JEC Group, Mitsubishi Rayon Co. Ltd, Morgan Advanced Materials Plc, Nippon Carbon Co Ltd, SGL Carbon SE, Teijin Ltd, Toray Advanced Composites

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume