The global Laboratory Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Molecular Biology, Cytokine and Chemokine Testing, Carbohydrate Analysis, Immunochemistry, Cell/Tissue Culture, Environmental Testing, Biochemistry, Others), By Application (Industrial, Academia, Government, Healthcare).

The laboratory chemicals market is set to expand considerably in 2024, driven by the increasing demand for chemicals in research and development across various sectors, including pharmaceuticals, biotechnology, environmental testing, and academic research. Laboratory chemicals, encompassing reagents, solvents, buffers, and standards, are essential for conducting experiments and analyses in these fields. The market growth is propelled by the rising investment in life sciences research, the development of new drugs and therapies, and the growing focus on quality control and regulatory compliance in manufacturing processes. Additionally, advancements in chemical synthesis and purification techniques are enhancing the quality and availability of laboratory chemicals. The increasing emphasis on sustainable and green chemistry practices is also influencing market dynamics, with a growing demand for environmentally friendly chemicals and solvents.

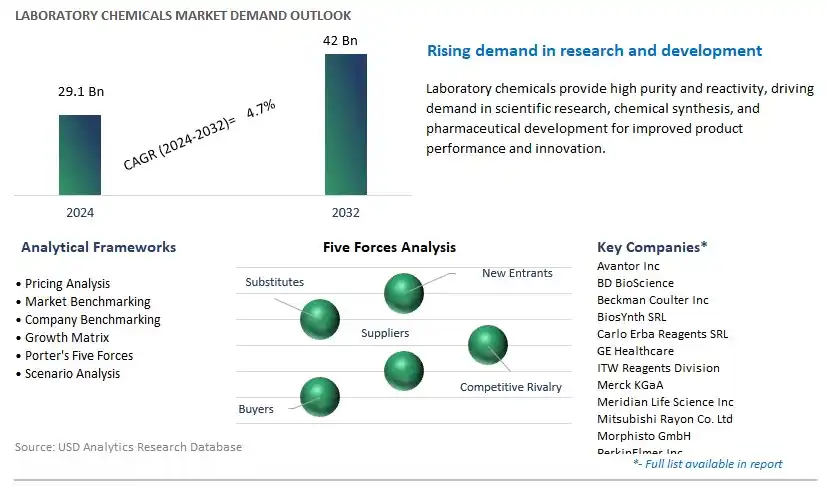

The market report analyses the leading companies in the industry including Avantor Inc, BD BioScience, Beckman Coulter Inc, BiosYnth SRL, Carlo Erba Reagents SRL, GE Healthcare, ITW Reagents Division, Merck KGaA, Meridian Life Science Inc, Mitsubishi Rayon Co. Ltd, Morphisto GmbH, PerkinElmer Inc, R&D Systems, Sigma-Aldrich Corp, UJIFILM Wako Chemicals, and others.

A significant trend in the laboratory chemicals market is the increasing demand for specialty and customized chemicals. As research and development activities in various industries such as pharmaceuticals, biotechnology, and materials science become more specialized and complex, there is a growing need for laboratory chemicals tailored to specific applications and requirements. Laboratories are seeking chemicals with high purity, precise compositions, and unique properties to support cutting-edge research, product development, and quality control processes. This trend towards specialty and customized chemicals drives market growth as manufacturers and suppliers expand their product portfolios to meet the evolving needs of laboratory customers.

A key driver fueling the laboratory chemicals market is the growth in research and development (R&D) investments across industries. Laboratories serve as hubs for innovation and scientific discovery, driving demand for a wide range of chemicals used in analytical testing, synthesis, and experimentation. With increasing emphasis on technological advancements, product innovation, and competitiveness, companies are allocating significant resources towards R&D activities to develop new products, improve existing processes, and address emerging challenges. This drives the demand for laboratory chemicals such as reagents, solvents, acids, and buffers, supporting market expansion and driving innovation in the chemical industry.

A promising opportunity for the laboratory chemicals market lies in the expansion of online distribution channels. With the proliferation of e-commerce platforms and digitalization trends, there is a shift towards online purchasing of laboratory supplies and chemicals. Laboratories increasingly prefer the convenience, transparency, and accessibility offered by online procurement channels, allowing them to compare products, access technical information, and place orders with ease. By leveraging e-commerce platforms, manufacturers and distributors can reach a wider audience, streamline order processing, and provide personalized customer experiences. Additionally, online channels enable real-time inventory management, order tracking, and data analytics, offering opportunities for efficiency gains and market insights. By embracing online distribution channels, companies can enhance their market presence, improve customer engagement, and capitalize on the growing trend towards digitalization in the laboratory chemicals market.

The largest segment within the laboratory chemicals market is biochemistry. The large revenue share is primarily due to the broad range of applications and the critical role of biochemistry in various scientific disciplines and industries. Biochemistry involves the study of chemical processes and substances occurring within living organisms, encompassing areas such as enzymology, metabolism, and protein analysis. Laboratory chemicals used in biochemistry include reagents, buffers, enzymes, and biochemical assays essential for research, diagnostics, and pharmaceutical development. Biochemical analysis is crucial in understanding biological pathways, disease mechanisms, drug interactions, and biomarker discovery, making it indispensable in fields such as medicine, biotechnology, and agriculture. Moreover, the increasing focus on personalized medicine, genomics, and proteomics drives the demand for advanced biochemical tools and techniques, further bolstering the growth of this segment. As scientific research and innovation continue to advance, biochemistry remains at the forefront of laboratory investigations, sustaining its position as the largest segment in the laboratory chemicals market.

The fastest-growing segment within the laboratory chemicals market is healthcare. In particular, the healthcare sector continually evolves with advancements in medical technology, diagnostics, and pharmaceutical research, driving the demand for a wide array of laboratory chemicals. Laboratory chemicals play a crucial role in various healthcare applications, including clinical diagnostics, drug discovery, therapeutic development, and medical device manufacturing. With the rising prevalence of chronic diseases, infectious illnesses, and genetic disorders, there is an increasing need for accurate and reliable laboratory testing to support disease diagnosis, patient monitoring, and treatment decisions. Additionally, the growing emphasis on personalized medicine and precision healthcare further fuels the demand for specialized laboratory chemicals tailored to individual patient needs. Moreover, the expansion of healthcare infrastructure, coupled with government initiatives to improve healthcare access and quality, drives investment in laboratory facilities and equipment, stimulating the demand for laboratory chemicals in healthcare settings. As healthcare systems worldwide strive to address emerging health challenges and deliver better patient outcomes, the healthcare segment is a significant driver of growth in the laboratory chemicals market.

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

HealthcareCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Avantor Inc

BD BioScience

Beckman Coulter Inc

BiosYnth SRL

Carlo Erba Reagents SRL

GE Healthcare

ITW Reagents Division

Merck KGaA

Meridian Life Science Inc

Mitsubishi Rayon Co. Ltd

Morphisto GmbH

PerkinElmer Inc

R&D Systems

Sigma-Aldrich Corp

UJIFILM Wako Chemicals

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Laboratory Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Laboratory Chemicals Market Size Outlook, $ Million, 2021 to 2032

3.2 Laboratory Chemicals Market Outlook by Type, $ Million, 2021 to 2032

3.3 Laboratory Chemicals Market Outlook by Product, $ Million, 2021 to 2032

3.4 Laboratory Chemicals Market Outlook by Application, $ Million, 2021 to 2032

3.5 Laboratory Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Laboratory Chemicals Industry

4.2 Key Market Trends in Laboratory Chemicals Industry

4.3 Potential Opportunities in Laboratory Chemicals Industry

4.4 Key Challenges in Laboratory Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Laboratory Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Laboratory Chemicals Market Outlook by Segments

7.1 Laboratory Chemicals Market Outlook by Segments, $ Million, 2021- 2032

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

8 North America Laboratory Chemicals Market Analysis and Outlook To 2032

8.1 Introduction to North America Laboratory Chemicals Markets in 2024

8.2 North America Laboratory Chemicals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Laboratory Chemicals Market size Outlook by Segments, 2021-2032

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

9 Europe Laboratory Chemicals Market Analysis and Outlook To 2032

9.1 Introduction to Europe Laboratory Chemicals Markets in 2024

9.2 Europe Laboratory Chemicals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Laboratory Chemicals Market Size Outlook by Segments, 2021-2032

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

10 Asia Pacific Laboratory Chemicals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Laboratory Chemicals Markets in 2024

10.2 Asia Pacific Laboratory Chemicals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Laboratory Chemicals Market size Outlook by Segments, 2021-2032

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

11 South America Laboratory Chemicals Market Analysis and Outlook To 2032

11.1 Introduction to South America Laboratory Chemicals Markets in 2024

11.2 South America Laboratory Chemicals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Laboratory Chemicals Market size Outlook by Segments, 2021-2032

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

12 Middle East and Africa Laboratory Chemicals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Laboratory Chemicals Markets in 2024

12.2 Middle East and Africa Laboratory Chemicals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Laboratory Chemicals Market size Outlook by Segments, 2021-2032

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Avantor Inc

BD BioScience

Beckman Coulter Inc

BiosYnth SRL

Carlo Erba Reagents SRL

GE Healthcare

ITW Reagents Division

Merck KGaA

Meridian Life Science Inc

Mitsubishi Rayon Co. Ltd

Morphisto GmbH

PerkinElmer Inc

R&D Systems

Sigma-Aldrich Corp

UJIFILM Wako Chemicals

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Molecular Biology

Cytokine and Chemokine Testing

Carbohydrate Analysis

Immunochemistry

Cell/Tissue Culture

Environmental Testing

Biochemistry

Others

By Application

Industrial

Academia

Government

Healthcare

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Laboratory Chemicals Market Size is valued at $29.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.7% to reach $42 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Avantor Inc, BD BioScience, Beckman Coulter Inc, BiosYnth SRL, Carlo Erba Reagents SRL, GE Healthcare, ITW Reagents Division, Merck KGaA, Meridian Life Science Inc, Mitsubishi Rayon Co. Ltd, Morphisto GmbH, PerkinElmer Inc, R&D Systems, Sigma-Aldrich Corp, UJIFILM Wako Chemicals

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume